Tata Motors Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tata Motors Bundle

What is included in the product

Tailored analysis for Tata Motors' portfolio, examining each business unit's position within the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, allowing easy stakeholder sharing and analysis of Tata Motors' portfolio.

What You See Is What You Get

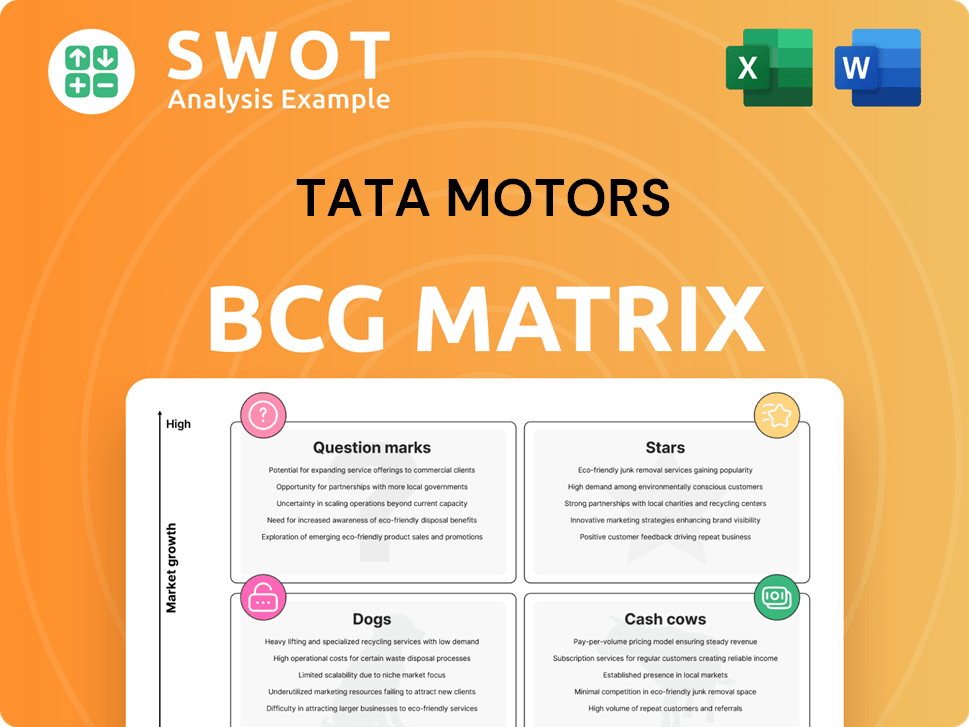

Tata Motors BCG Matrix

The preview showcases the complete Tata Motors BCG Matrix you'll receive instantly upon purchase. This is the final, fully-formatted document, ready for strategic decision-making without any alterations needed. Experience the same professional layout and data analysis in the downloadable file.

BCG Matrix Template

Tata Motors operates in a dynamic automotive market. Analyzing its diverse portfolio, including cars and trucks, is key. This BCG Matrix helps dissect product performance and investment strategies. Identify Stars, Cash Cows, Dogs, and Question Marks within its offerings. Strategic insights await within a comprehensive report. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Tata Motors' EV portfolio, including Nexon EV, Tiago EV, Punch EV, and Curvv EV, shines as a Star in its BCG Matrix. These EVs benefit from India's rising EV demand, with Tata holding a 70% market share in the passenger EV segment in 2024. Continued investment in technology and expansion, like the recent launch of the Curvv EV, are crucial for maintaining this position. The company reported a 48% increase in EV sales in FY24, highlighting the growth potential.

Jaguar Land Rover (JLR) is a Star for Tata Motors. JLR significantly boosts Tata Motors' revenue and EBITDA. It thrives in the high-growth premium vehicle market. Electrification and new models, like the Range Rover Electric, will help JLR maintain its strong position. In Fiscal Year 2024, JLR's revenue reached £29 billion.

Tata Motors' SUVs, like the Nexon and Punch, are rising stars in India. The SUV segment's high growth, fueled by competitive pricing, and feature-rich offerings, is a key driver. In 2024, Tata's SUV sales grew significantly, reflecting this trend. Continued focus on design and safety is essential.

Commercial Vehicle Passenger Carriers

The commercial vehicle passenger carrier segment is a "Star" for Tata Motors, demonstrating robust growth. This is supported by increasing public transportation needs and thriving tourism. As of Q3 FY24, the CV business of Tata Motors reported a revenue of ₹15,000 crore, with a strong focus on passenger vehicles. Strategic investments in this area are vital.

- Strong revenue growth in CV segment.

- Increased demand in public transport and tourism.

- Strategic investments to support growth.

- Passenger vehicles contribute to revenue.

Strategic Acquisitions & Partnerships

Tata Motors' strategic acquisitions, notably Jaguar Land Rover (JLR) in 2008, propelled it into the premium vehicle market, significantly broadening its product portfolio. Collaborations, particularly in electric vehicle (EV) technology, boost its competitiveness in the rapidly evolving automotive sector. These partnerships and acquisitions have been pivotal in driving revenue growth. Successfully capitalizing on these strengths is vital for Tata Motors to sustain its Star status within the BCG Matrix.

- JLR's revenue in FY24 was £29.0 billion, a 22% increase year-over-year.

- Tata Motors' EV sales grew by 48% in FY24.

- Partnerships include collaborations with companies like Siemens for manufacturing.

- The company aims to increase EV sales to 25% of its total sales by 2025.

Tata Motors' EVs and JLR represent Stars due to high growth and market share. The company's SUV segment also shines, boosted by India's rising demand. These segments drive significant revenue growth. The CV passenger carrier segment is also a star, supported by public transport.

| Segment | Status | Key Factor |

|---|---|---|

| EVs (Nexon, Tiago, Punch, Curvv) | Star | 70% market share in India in 2024, 48% sales growth in FY24 |

| Jaguar Land Rover (JLR) | Star | FY24 Revenue: £29.0 billion (22% YoY increase) |

| SUVs (Nexon, Punch) | Rising Star | High growth in the SUV segment due to competitive pricing |

| Commercial Vehicles (CV) | Star | Revenue ₹15,000 crore in Q3 FY24, focus on passenger vehicles |

Cash Cows

Tata Motors dominates India's commercial vehicle market. Trucks are a steady revenue source, vital for logistics. In FY24, CV sales volume was up, reflecting market demand. Efficiency and cost focus solidify its Cash Cow status. Tata Motors' CV segment reported a revenue of ₹78,878.14 crore in FY24.

Medium & Heavy Commercial Vehicles (MH&ICV) are a substantial part of Tata Motors' commercial vehicle sales. In 2024, MH&ICV sales volume showed steady growth. These vehicles are vital for various industries. Fuel efficiency and durability are key to maintaining their Cash Cow status.

Tata Motors is a cash cow due to its robust presence in the Indian automotive market. Strategic initiatives like new models and powertrain changes boost revenue. The focus on electric vehicles is a key driver of domestic PV sales. In 2024, Tata Motors held a significant market share in the PV segment. They are making significant strides with EVs.

Total Domestic Sales

Tata Motors demonstrates a robust position in the Indian domestic market. The company aims to enhance customer experiences, technology, and brand leadership. Strategic investments in infrastructure can boost efficiency. This approach is critical for maintaining strong cash flow.

- Domestic sales growth in FY24: 6% increase.

- Investment in R&D: ₹3,000 crore in FY24.

- Market share in passenger vehicles (FY24): 13.5%.

- Target for EV sales by 2025: 25%.

Cost Optimization

Tata Motors' cost optimization strategy, vital for its Cash Cow status, involves vertical integration within the Tata Group, like leveraging Tata Steel and component suppliers. This integration streamlines the supply chain, reducing costs and improving efficiency. The company focuses on economies of scale, ensuring quality while minimizing expenses. This approach is critical for maintaining profitability.

- In FY24, Tata Motors' overall cost reduction initiatives saved ₹2,500 crore.

- Vertical integration contributes to a 5-7% cost advantage in raw materials.

- Efficiency improvements have led to a 10% reduction in manufacturing cycle times.

- Tata Motors aims for an additional 3% cost reduction through supply chain optimization by the end of FY25.

Tata Motors' cash cows, like commercial vehicles, deliver consistent revenue. The company's strong market share supports its status. Cost optimization and strategic initiatives further enhance profitability, a crucial factor for cash flow. Domestic sales grew by 6% in FY24, and R&D investments totaled ₹3,000 crore.

| Key Metric | FY24 Data | Impact |

|---|---|---|

| CV Revenue | ₹78,878.14 crore | Supports Cash Cow Status |

| Domestic PV Market Share | 13.5% | Boosts Revenue |

| Cost Savings | ₹2,500 crore | Increases Profitability |

Dogs

The Tata Nano, a "dog" in the BCG matrix, was discontinued due to poor market performance. Despite its initial promise as an affordable car, it struggled with negative perceptions and low sales. In 2024, there were no plans for revival, with the focus on more successful models. The Nano's failure is a clear example of how product perception affects market outcomes.

Tata Motors' passenger vehicles face tough competition in some export markets. These markets, with low growth and market share, are considered "dogs." For instance, in 2024, exports to Nepal and Bangladesh have been stagnant. Focusing on high-growth markets is key for improvement.

In Tata Motors' BCG Matrix, gasoline vehicles are in the "Dog" quadrant. The automotive sector is changing, with trends like connected and autonomous cars emerging. Gasoline vehicles face low growth in the current market, with a small market share. Turnaround plans are often costly and may not succeed. In 2024, sales of gasoline vehicles are decreasing due to the growing popularity of electric vehicles (EVs) and hybrid models.

Low-margin variants

Low-margin variants of Tata Motors, such as certain entry-level models, might not be as profitable. These "Dogs" could be consuming resources that could be better used elsewhere. Reallocating resources towards higher-margin products is a strategic move.

- In Q3 FY24, Tata Motors' Passenger Vehicles segment saw a revenue increase of 11%, indicating a shift towards potentially more profitable models.

- The company's focus on electric vehicles (EVs) also suggests a move away from low-margin internal combustion engine (ICE) variants.

- Tata Motors aims to improve profitability through cost optimization and a focus on premium offerings.

Struggling JLR Models

Within Tata Motors' BCG Matrix, some Jaguar Land Rover (JLR) models are classified as "Dogs." These models experience low growth and market share, indicating underperformance within the broader JLR portfolio. Divestment should be considered for these specific models to optimize resource allocation. This strategic move aims to improve overall profitability and focus on more successful ventures.

- Models like the Jaguar XE and XF have faced declining sales.

- Market share for these models has decreased in key regions.

- Divestment could free up capital for high-growth areas.

- In 2024, JLR's overall sales showed mixed results.

Several Tata Motors models are categorized as "Dogs" in its BCG Matrix due to low growth and market share.

These include discontinued models like the Tata Nano and certain export market ventures. In 2024, gasoline vehicles also fall into this category, with decreasing sales. Divestment is considered for underperforming Jaguar Land Rover models.

The company is shifting focus towards more profitable models and electric vehicles to improve overall financial performance and optimize resource allocation.

| Category | Examples | Key Issue |

|---|---|---|

| Passenger Vehicles | Tata Nano, Gasoline variants | Low Sales, Negative Perception, Declining market share |

| Export Markets | Nepal, Bangladesh | Stagnant Exports |

| JLR Models | Jaguar XE, XF | Underperformance, Divestment consideration |

Question Marks

Tata Motors is strategically investing in hydrogen-powered vehicles, a move aligned with the growing global focus on sustainability. The demand for these vehicles is increasing; in 2024, the global hydrogen vehicle market was valued at approximately $2.5 billion. Given the growth potential, Tata Motors is likely positioning these vehicles as "Stars" in its BCG matrix, driving further investment.

Tata Motors' passenger vehicles in foreign markets are categorized as "Question Marks" in the BCG Matrix. These vehicles face stiff competition from luxury brands. The goal is to encourage market adoption. In 2024, Tata Motors' international sales were a small fraction of its total revenue. The strategic options are to invest for growth or divest.

Tata Motors is expanding in electric commercial vehicles, but its position is still evolving. These vehicles need to gain market share rapidly. In 2024, Tata Motors aimed to increase its EV sales by 40% . The marketing strategy focuses on accelerating market adoption.

Flex-Fuel Powertrain Vehicles

Tata Motors is investing more in research and development, particularly in flex-fuel powertrains. These vehicles are positioned in growing markets, but their market share is currently low. To avoid becoming "dogs" in the BCG matrix, these products must rapidly increase their market share. As of 2024, Tata Motors has allocated a significant portion of its R&D budget to flex-fuel technology.

- Focus on growing markets with low market share.

- Invest in research and development of flex-fuel powertrains.

- Aim to quickly increase market share to avoid becoming "dogs".

- Allocate a significant portion of R&D budget to flex-fuel tech.

New EV Models (Sierra EV, Harrier EV, Curvv EV)

Tata Motors' new EV models, such as the Sierra EV, Harrier EV, and Curvv EV, fit into the "Question Mark" quadrant of the BCG Matrix. These models are in growing markets but currently have a low market share. The strategic options for these question marks involve significant investment to increase market share or potential divestiture.

- EV sales in India are projected to reach 1.5 million units by 2028.

- Tata Motors aims to capture a significant portion of the growing EV market.

- The success of these models depends on strategic investments and market penetration.

Tata Motors' new EVs are "Question Marks." They're in growing markets with low shares. Strategic investments are key for EV growth or potential divestiture.

| Aspect | Details |

|---|---|

| Market Focus | Growing EV market |

| Market Share | Low |

| Strategic Action | Investment or divestiture |

BCG Matrix Data Sources

Tata Motors' BCG Matrix uses annual reports, sales data, and market analysis. Industry publications, and financial forecasts provide extra details.