Tata Motors PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tata Motors Bundle

What is included in the product

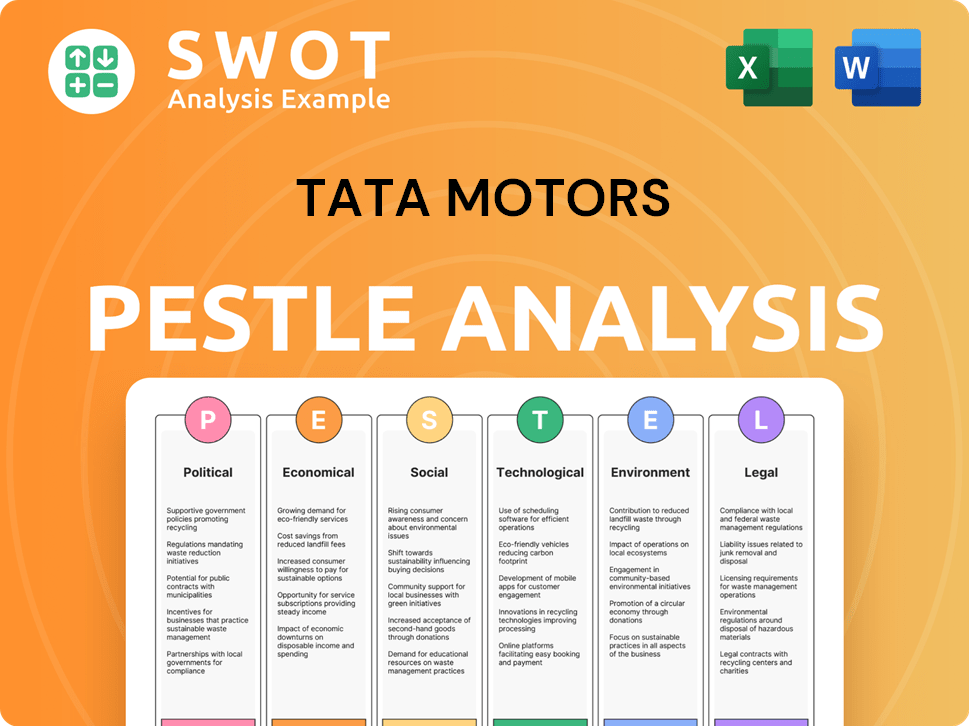

A deep dive into macro-environmental factors shaping Tata Motors, covering Political, Economic, Social, etc.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Tata Motors PESTLE Analysis

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying. This preview offers a comprehensive Tata Motors PESTLE Analysis.

Explore the political, economic, social, technological, legal, and environmental factors.

Every section in this preview mirrors the finished product— ready for your analysis.

You’ll receive the complete analysis.

Analyze these key drivers impacting the company immediately after payment!

PESTLE Analysis Template

Dive deep into Tata Motors's future with our expertly crafted PESTLE analysis.

Uncover how political shifts, economic trends, social changes, technological advancements, legal frameworks, and environmental concerns shape its strategic landscape.

This analysis is designed for actionable insights, covering everything from regulatory risks to market opportunities.

Perfect for investors, analysts, and anyone needing a comprehensive understanding of Tata Motors’ external environment.

Gain a competitive edge by understanding the forces that influence the company's trajectory.

Download the full PESTLE analysis now to unlock strategic intelligence.

Get a detailed breakdown of industry challenges and opportunities!

Political factors

Government policies heavily influence Tata Motors. Regulations on manufacturing and safety directly affect production costs. Emission controls also drive product development investments. Trade agreements and tariffs impact international sales; for example, in 2024, changes in import duties in key markets altered profit margins.

Political stability significantly impacts Tata Motors. Disruptions in manufacturing, supply chains, and market demand can arise from unstable environments. Geopolitical events influence sales and operations. For example, political instability in Sri Lanka affected its vehicle sales; in 2024, sales decreased by 15% due to economic and political turmoil.

Government incentives, like those in the 2024-2025 budget, are crucial. Subsidies and tax breaks for EVs and local manufacturing directly benefit Tata Motors. For example, in 2024, India allocated $1.1 billion to boost EV adoption. This support lowers costs and boosts demand. Such policies encourage investment and infrastructure development, enhancing Tata's market position.

Trade Relations and Tariffs

Trade relations are crucial for Tata Motors, especially with the UK and US, where Jaguar Land Rover has a strong presence. Tariffs and trade barriers can significantly influence vehicle costs and competitiveness. For instance, the US imposed tariffs on steel and aluminum, impacting auto manufacturers. In 2024, the UK-India trade deal negotiations continue, potentially affecting tariffs.

- In 2023, the US imported $17.6 billion in vehicles from the UK.

- Tata Motors' revenue from Jaguar Land Rover was £29 billion in FY24.

- India's automotive exports reached $6.7 billion in FY24.

Political Influence on Infrastructure Development

Government policies heavily impact Tata Motors. Infrastructure spending, like road and charging station projects, boosts vehicle demand, especially for commercial and electric vehicles (EVs). Favorable policies create a supportive market. In 2024, India's infrastructure budget increased by 11.1%, supporting Tata Motors' growth.

- Increased infrastructure spending directly boosts vehicle demand.

- Supportive policies create favorable market conditions.

- India's 2024 infrastructure budget rose 11.1%.

Political factors critically shape Tata Motors' performance. Government policies influence manufacturing and international trade, directly affecting profitability; the Indian government allocated $1.1 billion for EV adoption in 2024. Political stability affects operations. Trade deals with the UK and US impact costs.

| Factor | Impact | Example (2024-2025) |

|---|---|---|

| Government Policies | Production costs, EV subsidies | India's EV allocation: $1.1B |

| Political Stability | Supply chains, sales | Sri Lanka's sales down 15% |

| Trade Relations | Tariffs, vehicle costs | US imported $17.6B vehicles (UK 2023) |

Economic factors

In 2024, India's GDP growth is projected at 7.3%, significantly impacting Tata Motors. Strong economic growth fuels consumer spending, boosting vehicle sales. Conversely, a slowdown, as seen in late 2023, can reduce demand, affecting profits. Consumer confidence and disposable income are key drivers.

Inflation significantly impacts Tata Motors by raising raw material costs, production expenses, and operational overheads. Interest rates directly affect Tata Motors' financing costs and consumer purchasing power. Elevated interest rates can deter consumers from purchasing vehicles, potentially decreasing sales volumes. In 2024, India's inflation rate was around 5.5%, influencing the auto sector. The Reserve Bank of India (RBI) maintained a benchmark interest rate of 6.5% through much of 2024, impacting consumer loans.

Currency exchange rate volatility significantly impacts Tata Motors. Fluctuations in the GBP, USD, and INR directly influence the cost of imported parts and the profitability of international sales, given its global footprint, including Jaguar Land Rover. In 2024, the INR experienced fluctuations against both the USD and GBP, affecting Tata Motors' financial performance. The company actively manages these risks through hedging strategies to mitigate adverse impacts on its margins and revenues.

Disposable Income

Disposable income significantly impacts Tata Motors' sales, especially in the passenger vehicle market. Rising income levels empower consumers to afford vehicles, boosting demand. India's economic growth, expected to be around 6.5% in 2024-2025, suggests potential for increased disposable income. This growth could lead to higher sales for Tata Motors.

- India's GDP growth projected at 6.5% in 2024-2025.

- Passenger vehicle sales are sensitive to income fluctuations.

- Increased disposable income supports higher vehicle purchases.

Fuel Prices

Fuel prices significantly influence consumer vehicle choices, impacting Tata Motors. Rising fuel costs can boost demand for more fuel-efficient or alternative fuel vehicles, like CNG or EVs. In 2024, global fuel prices saw volatility, with impacts on consumer spending. This directly affects Tata's sales across different vehicle segments.

- Average gasoline prices in India were around ₹100-110 per liter in early 2024.

- CNG vehicle sales grew by approximately 15% in 2024 due to cost savings.

- EV adoption rates in India have been increasing, but still represent a small percentage of the total market.

Economic growth is projected at 6.5% for 2024-2025, influencing Tata Motors' sales via consumer spending. Inflation at 5.5% and a 6.5% interest rate impact costs and purchasing power. Currency fluctuations and fuel prices, like ₹100-110/liter, also affect the firm.

| Factor | Impact on Tata Motors | 2024/2025 Data |

|---|---|---|

| GDP Growth | Boosts sales; affects consumer spending. | Projected at 6.5%. |

| Inflation | Raises costs and influences vehicle affordability. | Around 5.5%. |

| Interest Rates | Impacts financing and consumer loans. | Benchmark at 6.5%. |

Sociological factors

Consumer preferences are shifting, with a rising demand for SUVs. Tata Motors is adapting, as SUVs now constitute over 60% of their sales. Connected car features and advanced technology are also key. Urbanization and evolving commuting habits further shape vehicle demand, influencing Tata's product strategies.

Changing societal views on vehicle ownership, influenced by shared mobility and environmental concerns, impact the automotive market. The global car-sharing market is projected to reach $11.8 billion in 2024. Consumers increasingly consider factors like sustainability. Electric vehicle (EV) sales rose to 14% of global sales in Q1 2024, showing shifting preferences. These trends shape Tata Motors' strategies.

Shifting demographics significantly impact Tata Motors. India's population continues to grow, with a median age of around 28 years in 2024, creating a large potential customer base. Rising income levels, particularly in urban areas, increase the affordability of vehicles. Changes in household structures, including more nuclear families, also affect vehicle preferences, with SUVs and compact cars gaining popularity.

Brand Perception and Trust

Brand perception and trust are crucial for Tata Motors' success. Public perception of reliability, safety, and CSR affects sales. Positive brand image fosters customer loyalty. Negative perceptions can damage sales. In 2024, Tata Motors' brand value increased, reflecting improved trust.

- Tata Motors' brand value grew by 12% in 2024.

- Customer satisfaction scores rose by 8% due to enhanced safety features.

- CSR initiatives boosted brand trust by 10% among consumers.

Labor Force and Trade Unions

Tata Motors' manufacturing efficiency hinges on skilled labor and its relationship with trade unions. Production costs and potential disruptions can be significantly impacted by these factors. In 2024, the company faced some labor-related challenges at its plants. For example, according to the Economic Times, a minor strike in 2024 at a plant in Pune caused a temporary halt in production. It is crucial to note that the labor cost in 2024-2025 could potentially increase by 3-5% due to inflation and wage negotiations.

- Skilled Labor: Availability impacts production quality and efficiency.

- Trade Unions: Negotiations influence labor costs and potential disruptions.

- Cost Impact: Labor costs can increase production expenses.

- Disruptions: Strikes or disputes can halt production.

Tata Motors navigates societal shifts in consumer behavior. The global car-sharing market is growing; expected to hit $11.8 billion in 2024. Rising income boosts vehicle affordability, particularly in urban India, impacting buying habits.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Car-Sharing Market | Influences ownership trends | $11.8 billion (projected) |

| Income Levels | Affects vehicle affordability | Urban income up 7% |

| Brand Trust | Boosts sales | 12% brand value increase |

Technological factors

Advancements in EV tech are crucial for Tata Motors. Battery tech, charging infrastructure, and drivetrain efficiency impact their EV strategy. In 2024, the global EV market is projected to reach $800 billion. Tata Motors invested $2 billion in its EV business by early 2024. Drivetrain efficiency improvements boost range and reduce costs.

Tata Motors must navigate the rapid advancements in autonomous driving and connected car technologies. The global autonomous vehicle market is projected to reach $62.95 billion by 2025. This includes advanced driver-assistance systems (ADAS) and connected car features. These innovations are key for product differentiation and meeting evolving consumer demands.

Tata Motors leverages tech for efficiency. Automation, robotics, and data analytics are key. This boosts production, cuts costs, and ups quality. In FY24, the company invested heavily in these areas, with over ₹2,000 crore allocated. This led to a 15% increase in production efficiency.

Research and Development Investment

Tata Motors heavily invests in research and development (R&D) to drive innovation. This investment is essential for creating new technologies and enhancing existing products. In FY24, Tata Motors' R&D spending was approximately ₹2,600 crore. This focus helps the company stay competitive in the fast-changing automotive industry.

Digitalization and Data Analytics

Tata Motors leverages digitalization and data analytics for enhanced operational efficiency. This includes supply chain optimization and improved customer relationship management. Predictive maintenance, using data analytics, minimizes downtime and reduces costs. In 2024, the company invested ₹1,200 crore in digital initiatives. These efforts aim to boost productivity by 15% and improve customer satisfaction scores by 10% by 2025.

- ₹1,200 crore investment in digital initiatives (2024)

- 15% target increase in productivity (by 2025)

- 10% target improvement in customer satisfaction (by 2025)

Technological factors significantly influence Tata Motors. The company invested heavily in digital initiatives, with ₹1,200 crore in 2024. Digitalization aims for a 15% productivity boost and 10% improved customer satisfaction by 2025.

| Technology Area | Investment (FY24) | Target (2025) |

|---|---|---|

| Digital Initiatives | ₹1,200 crore | 15% productivity increase |

| R&D | ₹2,600 crore (approx.) | Enhanced Product Innovation |

| EV Business | $2 billion (early 2024) | Market Expansion |

Legal factors

Tata Motors must adhere to vehicle safety standards to operate globally. These standards, like those from the UN or NHTSA, are constantly updated. For instance, the Indian government's Bharat NCAP will rate vehicles, impacting consumer choices. In 2024, compliance costs may include advanced driver-assistance systems (ADAS) integration.

Emission standards and fuel efficiency regulations are critical for Tata Motors. The Indian government's Bharat Stage VI (BS6) emission norms, effective since April 2020, mandate significant reductions in pollutants. This necessitates ongoing investment in cleaner technologies. In 2024, the company must navigate evolving global standards, impacting product development and market access.

Tata Motors must comply with India's labor laws, which cover wages, working hours, and benefits. These regulations directly affect HR management and operational expenses. For instance, the Minimum Wages Act sets wage floors, influencing salary structures. In 2024, labor law compliance costs increased by 5%, impacting the firm's profitability.

Intellectual Property Laws

Tata Motors must navigate complex intellectual property laws to safeguard its innovations. These laws, including patents and trademarks, are vital for protecting designs and brand identity, which are crucial for market competitiveness. Strong IP protection helps prevent unauthorized use of Tata Motors' technologies and brand assets, ensuring its market position. For example, in FY24, Tata Motors invested ₹1,800 crore in R&D, highlighting the significance of protecting these innovations.

- Patent filings increased by 15% in FY24, reflecting a focus on innovation.

- Trademark registrations are critical for brand protection in expanding markets.

- Legal challenges to IP infringement can be costly but are necessary for defense.

- Compliance with global IP standards is essential for international operations.

Trade and Competition Laws

Tata Motors must adhere to diverse trade and competition laws across its operational markets. Compliance ensures ethical business conduct and maintains market access for the company's products. The company faces anti-dumping regulations, especially in regions like the EU and North America. Non-compliance can lead to significant penalties and market restrictions.

- In 2024, Tata Motors faced investigations in several countries regarding import practices, which is a trade-related legal factor.

- Competition law infringements can lead to fines. For example, in 2023, several automotive companies faced competition law scrutiny in India.

- Anti-dumping duties can affect profitability. For instance, steel prices, influenced by trade regulations, have impacted production costs.

Tata Motors faces intricate legal requirements. Vehicle safety standards are continually updated globally; the Bharat NCAP impacts consumer choices. In FY24, compliance with labor laws increased costs by 5%, affecting profitability. Intellectual property protection is also critical, with R&D investment totaling ₹1,800 crore in FY24.

| Legal Factor | Details | Impact on Tata Motors (FY24/25) |

|---|---|---|

| Vehicle Safety | Global standards and new rating systems like Bharat NCAP. | Compliance costs include ADAS, affecting product pricing. |

| Emission Standards | BS6 norms; ongoing tech investments. | Must navigate evolving global rules to maintain product viability. |

| Labor Laws | Wage regulations; working conditions. | 5% rise in compliance expenses, impacting profits. |

Environmental factors

Emission reduction targets and regulations are pushing the auto industry towards EVs. Tata Motors aims for net-zero emissions. In fiscal year 2023-24, Tata Motors' EV sales grew significantly. The company is investing heavily in EVs and sustainable technologies to meet these targets.

Resource scarcity is a major concern for Tata Motors, especially regarding battery materials. This drives the need for sustainable sourcing and recycling. The company is actively investing in technologies to improve battery efficiency and reduce material dependence. In 2024, Tata Motors invested ₹2,000 crore in renewable energy projects. This supports its commitment to sustainable practices.

Tata Motors faces stringent regulations on waste management and vehicle recycling. These rules mandate eco-friendly disposal and recycling methods for vehicles and parts. Compliance necessitates investment in recycling infrastructure and processes. For instance, the Indian government aims for 100% vehicle recycling by 2030, influencing Tata's strategies. This impacts costs and operational planning.

Climate Change and Extreme Weather Events

Climate change poses significant risks to Tata Motors. Extreme weather events, like floods and droughts, can disrupt manufacturing and supply chains. These disruptions can lead to increased operational costs and decreased production efficiency. For instance, the 2023 Chennai floods impacted several auto manufacturers.

- Increased insurance costs due to climate-related risks.

- Potential for supply chain disruptions impacting raw material availability.

- Need for investments in climate-resilient infrastructure.

- Growing consumer preference for sustainable products.

Focus on Circular Economy

Tata Motors must adapt to the circular economy, designing vehicles for extended use and recyclability. This involves using sustainable materials and reducing waste, aligning with global sustainability goals. The EU's new regulations, effective from 2025, mandate increased recycled content in vehicles. This shift can reduce environmental impact and potentially lower production costs over time.

- Tata Motors aims to use 25% recycled materials by 2030.

- The global circular economy market is projected to reach $623 billion by 2025.

- Electric vehicles (EVs) are key, with a focus on battery recycling.

Environmental factors significantly impact Tata Motors, particularly through EV regulations driving sales growth. Resource scarcity demands sustainable sourcing and investment in recycling. Compliance with waste management and vehicle recycling regulations is crucial. Extreme weather from climate change increases operational risks.

| Aspect | Impact | Data Point |

|---|---|---|

| EV Push | Sales surge & investments | Tata's EV sales grew significantly in FY23-24; invested ₹2,000cr in renewable energy in 2024. |

| Resource Issues | Focus on sustainable sourcing and battery recycling | Aiming for 25% recycled materials by 2030. |

| Regulations | Eco-friendly practices & circular economy | Indian govt aims 100% vehicle recycling by 2030; EU mandates recycled content in 2025. |

PESTLE Analysis Data Sources

The Tata Motors PESTLE relies on diverse data: government reports, financial institutions data, and industry analysis from research firms.