Tata Steel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tata Steel Bundle

What is included in the product

Tailored analysis for Tata Steel's product portfolio, identifying investment, hold, or divest strategies.

Printable summary optimized for A4 and mobile PDFs of the Tata Steel BCG Matrix provides convenient data access.

Delivered as Shown

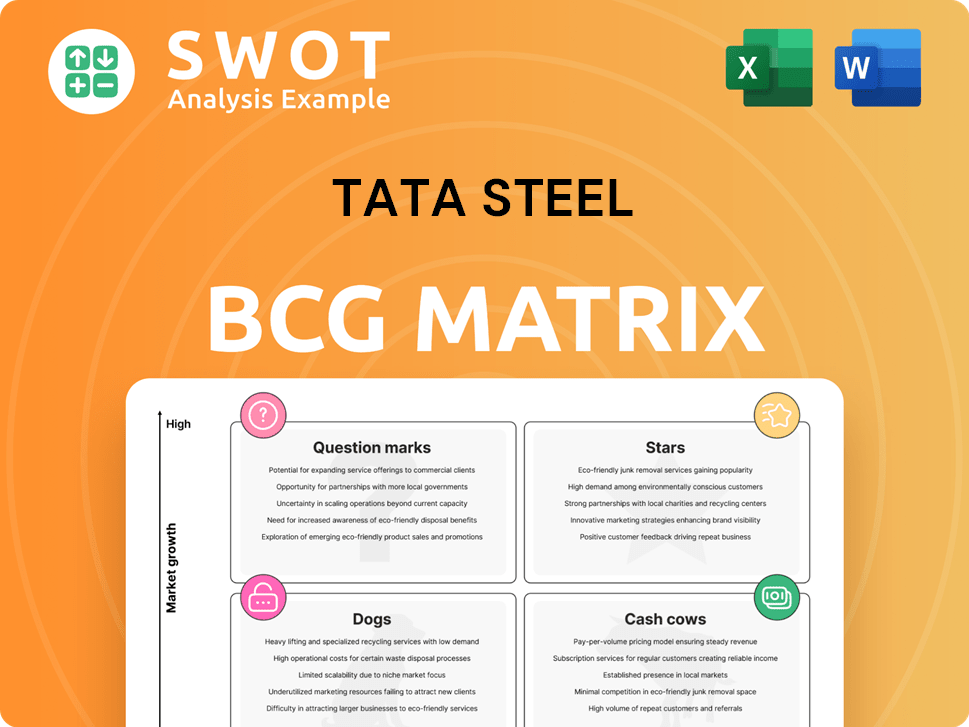

Tata Steel BCG Matrix

The Tata Steel BCG Matrix you see now is the full document you'll receive after purchase. It offers a comprehensive view of Tata Steel's business units. Ready for use, it's designed for immediate strategic application.

BCG Matrix Template

Tata Steel's BCG Matrix reveals a fascinating landscape of products. Some are shining "Stars," poised for continued growth. Others are reliable "Cash Cows," generating steady profits. Identifying "Question Marks" that need strategic attention is crucial. And the "Dogs" demand careful evaluation to prevent resource drain.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Hot-rolled steel is a key product for Tata Steel, vital for construction and heavy industries, indicating significant growth potential. The hot-rolled steel coil market is expanding, making it a Star due to high market share. India's largest blast furnace at Kalinganagar increases production capacity, strengthening its Star status. In 2024, Tata Steel's hot-rolled coil production reached 12 million tons, a 7% increase.

Cold-rolled steel is vital for the automotive and appliance sectors, thanks to its excellent surface and strength. Tata Steel's concentration on value-added areas and its rising automotive market share position it as a Star. The Jamshedpur CRM Complex has been key to Tata Steel's growth, with automotive market share up. In 2024, Tata Steel's automotive steel sales increased by 12%, reflecting its Star status.

Tata Steel's Automotive & Special Products (A&SP) vertical is a "Star" in the BCG Matrix, fueled by strong performance and innovation. The company localized high-strength grade hot-rolled CP780, a first for an Indian mill. This focus on high-margin products contributed to significant deliveries, boosting its market presence. In FY24, A&SP delivered 1.72 million tons, highlighting its growth.

Tata Tiscon (Retail Brand)

Tata Tiscon, the retail brand of Tata Steel, shines as a Star in its BCG Matrix. The brand achieved its best-ever annual deliveries, highlighting its robust market performance. This strong performance boosts Tata Steel's revenue and extends its market presence, capitalizing on the growing construction sector demand.

- Best-ever annual deliveries showcase strong market presence.

- Retail success contributes significantly to Tata Steel's revenue.

- Aligns with increasing demand in the construction sector.

- A key driver for Tata Steel's growth strategy.

Kalinganagar Plant

The Kalinganagar plant is a "Star" in Tata Steel's BCG Matrix, fueled by a new blast furnace. This plant significantly boosts Tata Steel's growth and market position with its increasing output. Production ramp-up enhances cost efficiency and output.

- In 2024, Kalinganagar's capacity expansion is a key growth driver.

- Operational efficiency improvements are ongoing.

- Production increases are expected to be substantial.

- It's contributing significantly to overall revenue.

Tata Steel's Stars include hot-rolled, cold-rolled steel, and automotive products, showing strong market presence. The Kalinganagar plant's expansion boosts its output and revenue significantly. Tata Tiscon's record deliveries highlight retail success.

| Product | 2024 Production/Sales | Market Impact |

|---|---|---|

| Hot-Rolled Steel | 12M tons (+7%) | Key for construction and heavy industries |

| Automotive Steel | +12% Sales Growth | Focus on value-added products |

| A&SP Deliveries | 1.72M tons | First high-strength grade CP780 |

Cash Cows

Tata Steel's Indian operations, centered around the Jamshedpur plant, are a Cash Cow. This is due to its established market position and reliable cash flow. The plant's captive mines provide raw material security. In 2024, Tata Steel India's revenue was approximately $28 billion, reflecting its stable production and customer base.

Flat products, such as hot-rolled and cold-rolled coils, form a substantial part of Tata Steel's offerings. These products serve sectors like automotive and construction. In 2024, flat products represented a major portion of Tata Steel's revenue, approximately 60%. They generate consistent revenue due to established markets.

Long steel products, including wire rods and rebars, are a consistent revenue source for Tata Steel. They support infrastructure development, ensuring steady demand. In 2024, Tata Steel's long products segment saw a 10% revenue increase. This stable demand makes them cash cows. They are vital for railroads and construction.

Global Wires Business (Tata Wiron)

Tata Wiron, a global leader in steel wire manufacturing, is a Cash Cow within Tata Steel's portfolio. It boasts a substantial market share in India and Thailand, providing a stable revenue stream. The business thrives on its established brand and diverse product range, supporting various sectors.

- In FY2024, Tata Steel's wire business contributed significantly to overall revenue.

- Tata Wiron's strong presence in the automotive and infrastructure sectors ensures consistent demand.

- The company's diverse product portfolio helps to mitigate risks and capitalize on different market opportunities.

- Tata Wiron benefits from operational efficiencies and cost management strategies.

Bearings

Tata Steel's bearings business, serving agriculture and engineering, is a Cash Cow. This segment benefits from established distribution and consistent demand. Bearings provide a steady revenue stream and maintain a strong market presence. In 2024, the bearings market showed stable growth, with Tata Steel's revenue from this segment being around $50 million.

- Mature Market: Stable and well-established.

- Consistent Demand: Products are essential for various applications.

- Steady Revenue: Contributes positively to overall financials.

- Market Presence: Maintains a strong position.

Cash Cows within Tata Steel’s portfolio generate substantial cash flow, essential for funding other business units. These segments have a strong market position and stable demand. Key examples include Tata Steel's Indian operations and Tata Wiron. They ensure consistent financial performance.

| Business Segment | Key Characteristics | 2024 Revenue (approx.) |

|---|---|---|

| Tata Steel India | Established Market Position, Captive Mines | $28 billion |

| Flat Products | Automotive and Construction sectors, Consistent demand | 60% of Revenue |

| Tata Wiron | Global Leader, Strong Market Share | Significant contribution |

Dogs

Tata Steel's UK operations struggle with weak demand and high costs, fitting the Dog quadrant. In 2024, the UK steel sector faced challenges, with production declines. Restructuring is underway to reduce losses amid market shifts. The shift to scrap-based production aims to cut costs. The company reported a loss of £489 million in the first half of FY24.

Tata Steel is reevaluating its new materials ventures, streamlining its portfolio. Ventures lacking long-term scalability are being phased out. These ventures, akin to "Dogs" in the BCG Matrix, face limited growth potential. The company now prioritizes ventures with higher scalability, potentially reducing goals that cannot expand. In 2024, Tata Steel's focus is on profitable, scalable segments.

Tata Steel's operations dependent on short-term subsidies face uncertainty. The UK government prioritizes long-term job creation over short-term financial aid. Such operations are classified as Dogs in the BCG Matrix. The government aims to boost long-term UK capabilities through strategic investments. In 2024, Tata Steel's UK operations reported a loss of £284 million.

Bhushan Steel Limited (Acquisition Challenges)

The Bhushan Steel acquisition by Tata Steel faced integration hurdles, potentially positioning it as a "Dog" in the BCG matrix due to initial profitability impacts. Challenges included integrating operations and managing debt, which could strain resources. Effective post-acquisition strategies are vital to improve performance. In 2024, Tata Steel reported a net loss, underscoring the need for careful management.

- Acquisition cost: ₹35,200 crore.

- Debt: High debt levels post-acquisition.

- Net loss (2024): Tata Steel reported a net loss.

- Integration challenges: Operational and cultural differences.

Specific Product Lines Facing High Import Competition

Certain Tata Steel product lines are struggling due to high import competition, especially from China. These offerings, facing low growth and market share, fit the "Dogs" category in the BCG matrix. The influx of cheaper imports can depress domestic prices, hurting profitability. For example, in 2024, Chinese steel imports surged, pressuring Indian steelmakers.

- Product lines with low growth potential and low market share.

- High import competition, particularly from China.

- Potential for declining profitability due to price pressures.

- Strategic decisions needed: divest, liquidate, or reposition.

Tata Steel's Dogs include UK operations and ventures with limited growth. They struggle with losses, high costs, and intense competition. Strategic moves like restructuring and focusing on profitable segments are crucial. The 2024 net loss reflects the tough environment.

| Category | Details | 2024 Data |

|---|---|---|

| UK Operations | Weak demand, high costs | £284M loss in H1 FY24 |

| New Materials | Phasing out ventures | Focus on scalable segments |

| Bhushan Steel | Integration hurdles | Net loss reported |

Question Marks

Neelachal Ispat Nigam Limited (NINL) is categorized as a Question Mark in Tata Steel's BCG Matrix. Acquired in 2022, NINL has low market share but holds growth potential. Tata Steel plans to boost NINL's capacity, requiring significant investment. In 2023, NINL's crude steel production was 0.6 million tonnes.

Tata Steel's push into African and Southeast Asian markets is a strategic move. These regions boast high growth potential, crucial for expansion. However, success demands substantial investment. Strategic alliances are vital; in 2024, Tata Steel's revenue was $30.7 billion.

Tata Steel's green steel initiatives are a question mark in its BCG Matrix. Investments in sustainable practices are ongoing, with a focus on low-carbon steelmaking in Europe. The market for green steel is nascent, requiring significant upfront investment. In 2024, Tata Steel allocated substantial capital toward decarbonization projects.

New Materials Business (Scalable Ventures)

Ventures in Tata Steel's new materials business, deemed "Question Marks" in the BCG matrix, show scalability potential. These ventures need more investment and development to prove their market worth and growth prospects. Tata Steel is currently reassessing these new material ventures, focusing on those with long-term scalability. This strategic shift aims to allocate resources effectively and foster future growth within the company's portfolio. In 2024, Tata Steel's capital expenditure was ₹16,000 crore, a portion of which is allocated to these ventures.

- Strategic Re-evaluation: Tata Steel is actively assessing its new materials ventures.

- Investment Focus: The company is concentrating on ventures with long-term scalability.

- BCG Matrix: These ventures are classified as "Question Marks," needing investment.

- Financial Data: Tata Steel's 2024 capital expenditure was ₹16,000 crore.

Services and Solutions

Tata Steel's move into services and solutions represents a Question Mark in its BCG Matrix. These new ventures need significant investment to establish a foothold in the market. Success hinges on how effectively Tata Steel penetrates these markets and gains customer acceptance. The company must prove the value proposition of these services to ensure growth. This strategic direction aims to diversify revenue streams beyond core steel production.

- Investment in new areas is crucial for market presence.

- Effective market penetration and customer adoption are key success factors.

- The value proposition of services must be clearly demonstrated.

- This strategy aims to diversify revenue beyond steel.

Tata Steel's investments in new materials are classified as "Question Marks". These ventures require substantial financial backing and strategic development for success. The focus is on long-term scalability to ensure profitable growth. In 2024, capital expenditure was ₹16,000 crore.

| Aspect | Details | 2024 Data |

|---|---|---|

| Classification | "Question Marks" in BCG Matrix | |

| Strategy | Long-term scalability focus | |

| Investment | Required for market entry | ₹16,000 crore CAPEX |

BCG Matrix Data Sources

The Tata Steel BCG Matrix uses data from financial filings, market reports, and industry benchmarks, complemented by expert opinions.