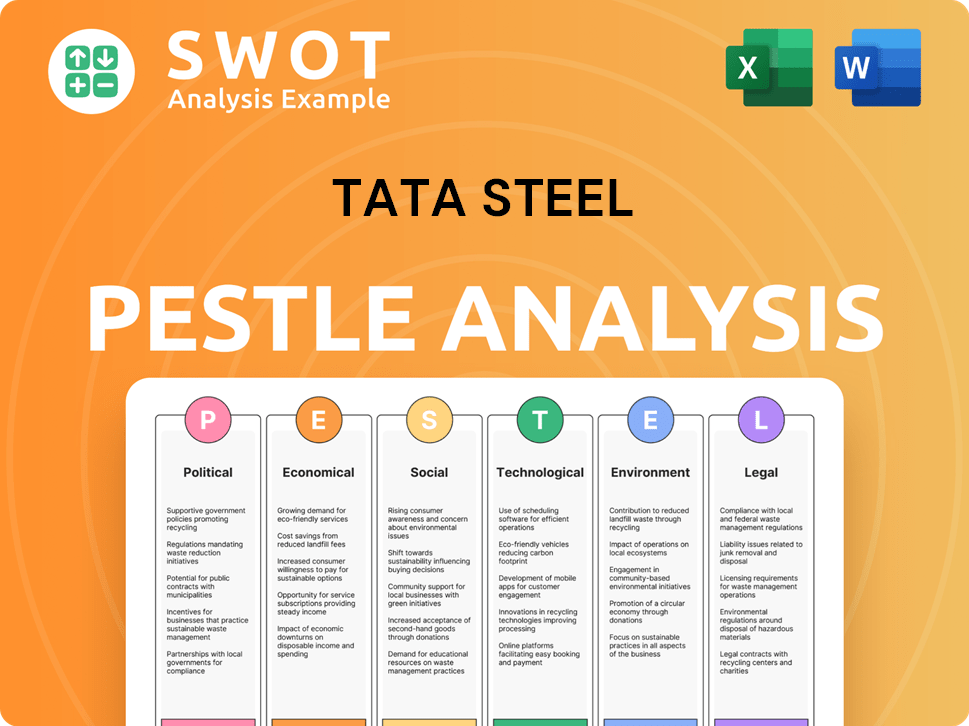

Tata Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tata Steel Bundle

What is included in the product

Unveils how external forces impact Tata Steel. Each point includes data and trend insights for reliable evaluations.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Tata Steel PESTLE Analysis

The preview reveals Tata Steel's PESTLE Analysis content and structure. What you see here is the fully formatted, finished document. It’s ready to download immediately after purchase. No changes or hidden sections are included.

PESTLE Analysis Template

Navigate the complexities surrounding Tata Steel with our focused PESTLE analysis. Explore the political, economic, social, technological, legal, and environmental forces impacting the company. Uncover key drivers affecting market dynamics, opportunities, and threats. Identify critical insights essential for strategic planning and risk management. Download the full PESTLE analysis now for complete, actionable intelligence!

Political factors

Government policies are crucial for Tata Steel. US Section 232 tariffs on steel imports affect global trade. Trade agreement changes and protectionism influence steel costs. In 2024, India's steel production reached 140 million tonnes. These factors impact Tata Steel's market competitiveness.

Geopolitical instability poses significant risks to Tata Steel. Conflicts can disrupt supply chains and raise raw material costs. For example, the Russia-Ukraine war impacted steel prices globally in 2022-2023. This year, geopolitical events continue affecting the global steel market. These factors influence Tata Steel's financial performance.

Government support, like incentives for green initiatives and infrastructure development, is crucial. Policies promoting sustainable steel production and large-scale construction projects boost demand. In 2024, India's infrastructure spending rose, supporting steel demand. Tata Steel benefits from such policies.

Political Stability in Operating Regions

Political stability is crucial for Tata Steel's operations. Stable regions offer predictable regulations, reducing risks and supporting long-term investments. Political instability can disrupt supply chains and increase operational costs. For instance, India's stable government has supported infrastructure projects, benefiting Tata Steel. Conversely, instability in some regions could lead to project delays.

- India's GDP growth in 2024-2025 is projected around 6.5-7%.

- Tata Steel's revenue from India in FY24 was approximately $20 billion.

- Political risks, such as policy changes, can impact profitability.

Industrial Policy and the Steel Sector

Industrial policies significantly impact the steel sector, a cornerstone of national economies. Governments globally often enact measures to bolster domestic steel production. These policies can affect Tata Steel's strategic planning, influencing its investments and market positioning.

- In 2024, the EU implemented Carbon Border Adjustment Mechanism (CBAM), impacting steel imports.

- India's government has a "Make in India" initiative, supporting domestic steel manufacturers.

- China's overcapacity in steel production is a persistent global concern.

Political factors heavily influence Tata Steel's operations. Government policies like tariffs and incentives significantly impact trade and demand; for example, in 2024, India's steel production hit 140 million tonnes. Geopolitical instability poses risks, affecting supply chains. Stable regions foster investment, whereas unstable ones increase operational costs.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Government Policies | Affects trade, demand, and costs | India's steel production: 140 MT in 2024 |

| Geopolitical Instability | Disrupts supply chains, raises costs | Projected India's GDP growth: 6.5-7% |

| Industrial Policies | Impacts strategic planning | Tata Steel's India revenue (FY24): $20B |

Economic factors

The global economic climate directly impacts Tata Steel's performance. Steel demand is tightly linked to construction, automotive, and manufacturing. In 2024, global economic uncertainties, like inflation and geopolitical tensions, affected steel consumption. For instance, in Q1 2024, global steel demand growth was slower than anticipated, around 1.5%.

Tata Steel's profitability is significantly impacted by the volatility of raw materials like iron ore and coal, alongside energy expenses. In 2024, iron ore prices fluctuated, affecting production costs. Geopolitical events and supply chain issues can intensify price swings. For instance, a 10% rise in coal prices could decrease profit margins.

As a global entity, Tata Steel navigates the complexities of currency exchange rates, which significantly affect its financial outcomes. Fluctuations in these rates directly influence both import and export costs, thereby impacting profitability. For instance, a stronger rupee against the pound could make UK exports more expensive. Currency volatility can also affect the translation of earnings from various international operations. In 2024, Tata Steel's international exposure highlights the need for effective hedging strategies to manage these risks.

Interest Rates and Financing Costs

Interest rates significantly impact Tata Steel's investment plans, especially for capital-intensive projects. Rising interest rates increase borrowing costs, which can delay or reduce investments in areas like green steel technology. In Q3 FY24, Tata Steel's net debt decreased, but interest expenses remained a concern.

- Interest rates influence the feasibility of large projects.

- Higher rates can curb investments in new plants.

- Tata Steel's debt management is crucial.

- Financial performance is affected by interest rate volatility.

Market Overcapacity and Steel Prices

Global steel overcapacity presents a significant challenge. This overcapacity, especially from China, intensifies competition and puts downward pressure on steel prices. Tata Steel's revenue and profit margins are directly affected by these price fluctuations. The World Steel Association reported a global crude steel production of 1.85 billion metric tons in 2023.

- China's steel production in 2023 reached approximately 1.0 billion metric tons.

- Steel prices have been volatile, with fluctuations impacting profitability.

- Tata Steel's financial performance is sensitive to global steel market dynamics.

Economic factors deeply influence Tata Steel. Global demand, tied to sectors like construction and automotive, faced slowdowns. Raw material costs, including iron ore, affect profits; a rise impacts margins. Currency fluctuations, especially exchange rate changes, also significantly influence outcomes.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Global Demand | Affects sales volume | Q1 2024: 1.5% global steel demand growth |

| Raw Materials | Influences production costs | Iron ore prices fluctuated in 2024; coal price up 10% decreases margins |

| Currency Exchange | Impacts import/export costs | Rupee vs. Pound fluctuations affecting UK exports in 2024 |

Sociological factors

Tata Steel's sociological landscape is shaped by workforce dynamics. Labor trends, including the availability of skilled workers, are important. Positive labor relations and addressing workforce needs are crucial for operational stability. In 2024, the company's focus on upskilling is evident.

Tata Steel's social license to operate depends on its community relationships. Community development programs and social responsibility efforts are key. Addressing local issues improves public image and ensures smooth operations. In FY2023-24, Tata Steel invested ₹460.12 Cr in CSR initiatives. This included healthcare, education, and sustainable livelihood projects.

Consumer preferences are shifting towards sustainable products, impacting steel demand. Tata Steel's green steel initiatives address this trend. In 2024, the global green building materials market was valued at $367.3 billion, growing annually. This growth shows consumers' preference for eco-friendly options. Tata Steel's focus on reducing its environmental impact aligns with this demand, potentially boosting sales.

Demographic Shifts and Urbanization

Demographic shifts and rapid urbanization, especially in India, are key drivers for steel demand. Tata Steel benefits from this, with construction and infrastructure projects needing steel. India's urban population is forecast to reach 675 million by 2036, boosting steel consumption. This growth creates significant market expansion opportunities for Tata Steel.

- India's steel demand is projected to grow by 7-8% in 2024-2025.

- Urbanization rate in India is expected to increase to 40% by 2030.

- Tata Steel's domestic sales volume reached 18.35 million tons in FY24.

Health and Safety Standards

Societal expectations and regulations for health and safety are critical for Tata Steel's operations. Prioritizing employee well-being and complying with safety standards are essential for maintaining a positive reputation. The company must invest in robust safety protocols and training programs to mitigate risks. In 2024, Tata Steel reported a Lost Time Injury Frequency Rate (LTIFR) of 0.13, showcasing its commitment to safety.

- 2024 LTIFR: 0.13

- Focus on safety protocols

- Employee well-being is key

Tata Steel faces sociological factors influencing operations. Skilled labor availability and labor relations are vital for stability, emphasizing upskilling initiatives. Community development investments, like the ₹460.12 Cr in FY2023-24 for CSR, boost its image. Consumer demand for green steel aligns with sustainability efforts, driving eco-friendly product demand and mitigating risks through robust safety protocols.

| Sociological Aspect | Impact | Data |

|---|---|---|

| Labor Trends | Affects operational stability. | Focus on upskilling, addressing workforce needs. |

| Community Relations | Improves public image and ensures smooth operations. | ₹460.12 Cr CSR in FY2023-24. |

| Consumer Preference | Drives demand for eco-friendly products. | Green building market: $367.3B in 2024. |

Technological factors

Tata Steel is embracing automation, digitalization, and data analytics in its steel production. These tech advancements are boosting efficiency and product quality. For instance, in FY24, Tata Steel invested ₹7,000 crore in technology upgrades. This tech-driven approach also helps reduce the environmental footprint.

Technological advancements are reshaping steel production. Green steel technologies, like hydrogen-based direct reduction, are crucial. Tata Steel invests heavily in these to cut emissions. In 2024, Tata Steel's R&D budget was approximately £300 million, with a significant portion dedicated to green initiatives.

Digital transformation is key for Tata Steel. Implementing digital solutions, AI, and IoT can optimize processes. This boosts supply chain visibility and operational efficiency. For instance, in 2024, Tata Steel invested ₹8,000 crore in digital initiatives.

Innovation in Product Development

Tata Steel's focus on technological advancement is crucial. Investing in R&D allows for the development of innovative steel products. This strategy directly addresses the needs of automotive and aerospace industries. This provides a competitive edge for Tata Steel in the market. In 2024, Tata Steel allocated ₹1,500 crore to R&D.

- R&D spending increased by 12% in FY24.

- Focus on lightweight steel for electric vehicles.

- Development of high-strength steel for construction.

Energy Efficiency Technologies

Energy efficiency technologies are critical for Tata Steel to cut expenses and lessen its environmental footprint. The company must adopt energy-efficient methods and look into renewable energy sources to stay competitive. In 2024, Tata Steel invested significantly in technologies to reduce energy consumption by 10% in its key plants. This aligns with their goal to lower carbon emissions by 25% by 2030.

- Investment in advanced sensors and AI for real-time energy monitoring.

- Implementation of heat recovery systems to reuse waste heat.

- Adoption of electric arc furnaces for steelmaking.

- Exploration of hydrogen-based steelmaking technologies.

Tata Steel boosts production via automation, digitalization, and data analytics, investing heavily in technology upgrades. Green steel technologies, backed by significant R&D, cut emissions, with FY24 R&D spend increasing by 12%. Digital transformation enhances supply chain and operational efficiency.

| Technology Area | Investment (2024) | Impact |

|---|---|---|

| Digital Initiatives | ₹8,000 crore | Optimized processes, AI & IoT, boosting efficiency. |

| Technology Upgrades | ₹7,000 crore | Boosted efficiency, improved product quality, reduce environmental footprint |

| R&D | ₹1,500 crore/£300 million | Innovative steel products and green initiatives for cutting-edge advantage. |

Legal factors

Tata Steel faces stringent environmental regulations globally, particularly concerning emissions, waste, and pollution. Increased regulatory scrutiny and carbon pricing could raise production costs. The company invested approximately ₹2,700 crores in environmental sustainability during FY24. Compliance necessitates significant investments in cleaner technologies to meet evolving standards.

International trade laws, encompassing anti-dumping measures, are crucial for Tata Steel's export strategies and can lead to trade disputes. Changes in trade policies and tariffs can significantly impede international trade operations. In 2024, the World Trade Organization (WTO) reported a 1.5% increase in global trade restrictions. This impacts Tata Steel's ability to compete effectively in global markets.

Tata Steel faces legal obligations tied to labor laws across its global operations. These regulations dictate working conditions, employee rights, and industrial relations. Compliance is crucial, with potential penalties including fines or legal action for non-compliance. For example, in India, the labor law compliance costs for companies can range from 10% to 15% of the payroll.

Health and Safety Regulations

Tata Steel must adhere to stringent health and safety regulations to protect its workforce. This includes providing necessary safety equipment and training. Compliance is crucial to prevent workplace accidents and ensure operational continuity. Non-compliance can lead to significant fines and reputational damage. In 2024, Tata Steel invested ₹1,200 crore in safety and environment initiatives.

- Investment in safety initiatives reached ₹1,200 crore in 2024.

- Focus on reducing workplace accidents and improving employee well-being.

- Ensuring compliance with global safety standards.

Competition Law and Anti-Trust Regulations

Tata Steel must comply with competition laws to avoid anti-competitive practices. These regulations aim to ensure fair market competition and prevent monopolies. In 2024, the Competition Commission of India (CCI) has actively scrutinized the steel sector. This scrutiny includes investigations into pricing and market dominance.

- CCI imposed penalties on steel companies for anti-competitive practices in 2023.

- Tata Steel's market share in India was approximately 20% in 2024.

- The European Commission has also investigated steel companies for potential antitrust violations.

Tata Steel navigates global legal landscapes, facing labor law mandates dictating employee rights and industrial relations. Investments in safety are critical, with ₹1,200 crore spent in 2024 on safety. Compliance with competition laws and anti-trust regulations, particularly from CCI, shapes the steel market dynamics.

| Legal Aspect | Key Focus | Financial Impact (2024) |

|---|---|---|

| Labor Laws | Compliance across global operations. | Labor compliance costs are 10-15% of payroll in India. |

| Safety Regulations | Protecting the workforce through compliance. | ₹1,200 crore investment in safety initiatives. |

| Competition Laws | Fair market practices, anti-trust scrutiny. | CCI scrutinized pricing & market share (20% in India). |

Environmental factors

The steel industry is a major source of carbon emissions, and Tata Steel is no exception. The company is under growing pressure to cut its carbon footprint. In 2024, the steel sector accounted for roughly 7-9% of global CO2 emissions. This necessitates investment in green technologies.

Tata Steel faces environmental challenges due to resource depletion and raw material sourcing. The company relies heavily on iron ore and coal, making sustainable sourcing crucial. In 2024, the company reported significant investments in sustainable mining practices. Recycling initiatives are vital for reducing environmental impact and ensuring long-term operational viability. The price of iron ore in Q1 2024 was around $120-$130 per tonne.

Steel production is water-intensive. Tata Steel must reduce water usage to lower its environmental footprint. In 2024, Tata Steel's water consumption was approximately 140 million cubic meters. They aim for a 10% reduction by 2025 through recycling and efficiency improvements.

Waste Generation and Management

Tata Steel's operations produce diverse waste streams, necessitating diligent management. In FY2023, the company reported processing approximately 12 million tons of slag, a byproduct of steelmaking. Effective waste management includes recycling efforts, such as utilizing slag in construction. Regulatory compliance is critical, with potential penalties for non-compliance impacting financial performance.

- Slag recycling: 90% utilization rate in FY2023.

- Waste reduction target: 10% reduction in waste to landfill by 2025.

- Compliance cost: ₹500 million in FY2023 for waste management.

- Byproduct revenue: ₹200 million from slag sales in FY2023.

Air Quality and Pollution Control

Emissions from Tata Steel plants are a key environmental concern, potentially impacting local air quality. The company must adhere to stringent pollution control measures. Tata Steel invests significantly in emission reduction technologies. For example, the company's Jamshedpur plant has implemented advanced dust collection systems.

- Tata Steel has allocated approximately ₹1,500 crore (around $180 million USD) for environmental protection measures in FY2023-24.

- The company aims to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 30% by 2030 from a 2021-22 baseline.

Environmental factors significantly impact Tata Steel, given the steel industry's carbon intensity, representing 7-9% of global CO2 emissions in 2024. Sustainable sourcing is crucial because of dependence on raw materials such as iron ore; Q1 2024 saw prices around $120-$130 per tonne. Water usage, with roughly 140 million cubic meters in 2024, and waste management (12 million tons of slag in FY2023) are also major areas.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Carbon Emissions | High | ₹1,500 crore (approx. $180 million USD) investment in FY2023-24 for environmental protection. Aim for 30% reduction by 2030. |

| Resource Depletion | Moderate | Sustainable mining investments ongoing; iron ore prices around $120-$130/tonne in Q1 2024. |

| Water Usage | Moderate | Consumption ~140 million cubic meters in 2024, aiming for 10% reduction by 2025. |

| Waste Management | High | 90% slag utilization rate in FY2023, 10% waste to landfill reduction target by 2025; Compliance cost of ₹500 million in FY2023. |

PESTLE Analysis Data Sources

This PESTLE uses global databases, industry reports, and government sources for current political, economic, social, technological, legal, and environmental insights.