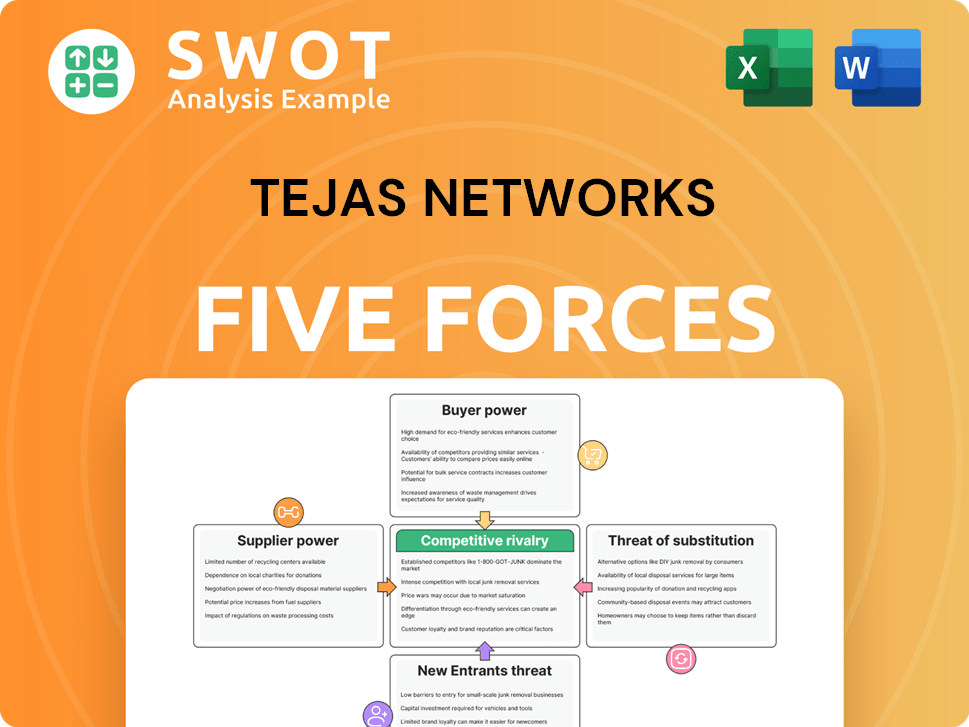

Tejas Networks Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tejas Networks Bundle

What is included in the product

Analyzes Tejas Networks' competitive landscape, evaluating threats and opportunities.

Easily visualize strategic pressure with a dynamic spider/radar chart for competitive analysis.

What You See Is What You Get

Tejas Networks Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis for Tejas Networks. The document you're viewing is identical to the one you will receive upon purchase, offering a detailed examination.

Porter's Five Forces Analysis Template

Tejas Networks faces moderate rivalry due to competitive landscape. Buyer power is notable, driven by telecom operators' influence. Supplier power is somewhat concentrated. The threat of new entrants is moderate. Substitute products pose a limited threat.

Unlock key insights into Tejas Networks’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Tejas Networks faces moderate supplier concentration. The company likely sources components from a limited number of specialized suppliers, potentially increasing their bargaining power. This is especially true for critical, proprietary components. The availability of alternative suppliers is crucial; if few exist, suppliers can exert more control.

Tejas Networks relies heavily on suppliers for specialized components crucial to its networking products. If these inputs are unique or hard to find, suppliers gain leverage. Tejas's product differentiation, or how unique its tech is, affects this balance. In 2024, a focus on proprietary tech could lessen supplier power. This is because the more unique the tech, the less reliant it is on standard components.

Switching costs for Tejas Networks involve time, money, and operational disruption. High switching costs amplify supplier power, potentially increasing expenses. In 2024, Tejas's strategic alliances aim to mitigate supplier risks and maintain competitive pricing. Tejas's ability to manage these costs directly impacts its profitability and market competitiveness. For example, a shift to a new chip supplier could take up to 6 months.

Supplier's Ability to Integrate Forward

If Tejas Networks' suppliers could become competitors by moving into the telecom equipment market, their bargaining power strengthens considerably. This is a real threat that can impact Tejas Networks' profitability. The 'Make in India' initiative aims to lessen dependence on foreign suppliers.

- Reliance on imports has decreased, with local value addition growing.

- 'Make in India' aims to boost domestic manufacturing.

- Suppliers can increase influence via forward integration.

Availability of Substitute Inputs

Tejas Networks' supplier power is influenced by the availability of substitute inputs. If Tejas can easily switch to alternative components or materials, supplier power diminishes. Technological advancements play a key role, creating substitutes for existing components. For example, the rise of open-source hardware could offer alternatives. In 2024, the global market for telecom equipment, where Tejas operates, is estimated at over $300 billion, with competition driving innovation and potentially, substitute availability.

- Technological innovation often leads to new materials.

- Open-source hardware can provide alternatives.

- Market competition affects supplier power.

- Telecom equipment market size in 2024.

Tejas Networks faces moderate supplier bargaining power, particularly for specialized components. Limited supplier options and unique input requirements elevate supplier influence. Strategic alliances and 'Make in India' initiatives aim to mitigate these risks and reduce reliance on imports.

| Factor | Impact on Supplier Power | Tejas Networks' Mitigation |

|---|---|---|

| Component Uniqueness | High; specialized components increase supplier leverage | Focus on proprietary tech to reduce reliance on standard components |

| Supplier Concentration | High if few suppliers exist | Strategic alliances; 'Make in India' to broaden options |

| Switching Costs | High costs boost supplier power | Managing costs and reducing dependence on any single supplier |

| Availability of Substitutes | More substitutes decrease power | Technological advancements and open-source hardware solutions. |

| Forward Integration Threat | Suppliers become competitors | Diversifying suppliers, local manufacturing boosts resilience. |

Customers Bargaining Power

Tejas Networks faces customer concentration challenges, with a few major clients potentially wielding significant influence. For example, if a handful of large customers generate a large part of the company's revenue, their bargaining power increases. Government contracts, such as those with BSNL, can shift the balance, potentially giving these large clients more leverage in negotiations. In 2024, understanding the impact of customer concentration on pricing and profitability is vital for assessing Tejas Networks' competitive position.

Tejas Networks' customers' price sensitivity significantly influences its bargaining power. Economic downturns, like the one in 2023, can make customers more cost-conscious. In 2024, telecom spending is projected to grow modestly, increasing price sensitivity. This sensitivity pressures Tejas to offer competitive pricing.

Switching costs for Tejas Networks' customers involve financial and operational hurdles. If customers switch, they face costs like reconfiguring networks. Low switching costs empower customers. Interoperability standards, like those from the ITU, can reduce these costs, increasing customer power.

Customer's Ability to Integrate Backward

If customers could produce their own telecom equipment, Tejas Networks' bargaining power would decrease. This backward integration threat is amplified by customers' growing technical expertise. For instance, some large telecom operators are developing in-house capabilities. This shift could lead to reduced orders from Tejas.

- Backward integration: Customers making their own equipment.

- Customer sophistication: Technical expertise increases.

- Impact: Reduced reliance on Tejas.

- Real-world example: Some operators developing in-house solutions.

Availability of Alternative Suppliers

Tejas Networks faces significant customer bargaining power due to the availability of alternative suppliers. The presence of global giants like Huawei, Ericsson, and Nokia offers customers numerous choices. These competitors provide similar products and services, increasing the pressure on Tejas to offer competitive pricing and terms. This dynamic limits Tejas's ability to raise prices or dictate terms, impacting its profitability.

- Huawei's revenue in 2023 was around $97 billion, indicating its strong market presence.

- Ericsson's sales in 2023 reached approximately $26.3 billion, highlighting its global reach.

- Nokia's net sales in 2023 were about €22.3 billion, demonstrating its substantial market share.

Tejas Networks confronts customer bargaining power due to concentration and price sensitivity. Major clients like BSNL can exert influence, impacting pricing. Modest telecom spending growth in 2024 amplifies customer cost-consciousness.

Switching costs and alternative suppliers further affect bargaining dynamics. Low switching costs increase customer power, especially with interoperability standards. Giants like Huawei ($97B in 2023) provide alternatives, pressuring competitive terms.

Backward integration and customer sophistication pose threats. The trend of in-house development reduces reliance on Tejas. These factors collectively limit Tejas's ability to set prices and influence profitability.

| Factor | Impact | Example (2023/2024) |

|---|---|---|

| Customer Concentration | High bargaining power | BSNL, other major clients |

| Price Sensitivity | Increased customer focus on cost | Modest telecom spending growth |

| Switching Costs | Low costs increase customer power | Interoperability standards |

| Alternative Suppliers | Pressure on pricing and terms | Huawei ($97B revenue in 2023) |

Rivalry Among Competitors

Tejas Networks operates in a market with several competitors, including established players like Nokia and Ericsson, alongside emerging firms. The presence of numerous competitors, particularly those with comparable resources, increases competitive intensity. Tejas Networks' market share is around 8% in India as of late 2024, with key rivals like Nokia and Huawei holding larger shares. Smaller, niche competitors also exist, adding to the competitive landscape.

The telecom equipment industry's growth rate significantly impacts competitive rivalry. Slow growth often intensifies competition as firms battle for limited market share. The 5G rollout and broadband infrastructure expansion are key drivers, with the global 5G services market projected to reach $81.3 billion in 2024, according to Statista. This expansion fuels industry growth, potentially easing rivalry. However, rapid changes and technological advancements can also heighten competition.

Tejas Networks faces moderate product differentiation. Competitors offer similar networking solutions, increasing price competition. Tejas invests heavily in R&D, aiming for unique features. In Q3 2024, R&D expenses were ₹105.7 crore, showing their commitment. Their goal is to stand out in a competitive market.

Switching Costs

Switching costs in the telecom equipment market significantly influence competitive rivalry. These costs include financial expenses, time investment, and potential disruption when changing vendors. Low switching costs intensify competition, making it easier for customers to move to rivals. In 2024, the global telecom equipment market was valued at approximately $400 billion, with companies constantly vying for market share. Long-term contracts and vendor lock-in strategies are used to reduce switching, maintaining customer loyalty.

- Financial Costs: Include expenses like equipment upgrades and early contract termination fees.

- Time Investment: Involves the time required to implement new systems and train staff.

- Disruption: Refers to potential downtime or service interruptions during the transition.

- Vendor Lock-in: Strategies such as proprietary technologies that make it difficult to switch.

Exit Barriers

Exit barriers significantly influence competition in the telecom equipment industry. High barriers, such as substantial investment in specialized assets and the strategic importance of telecom infrastructure, make it tough for companies to leave. These barriers can intensify rivalry, as struggling firms persist in the market rather than exiting. Government regulations and the sector's strategic national importance further complicate exits, potentially leading to overcapacity and price wars. In 2024, the global telecom equipment market was valued at approximately $370 billion, highlighting the stakes involved.

- High capital investments in specialized equipment.

- Significant government regulations and strategic importance.

- Long-term contracts and customer relationships.

- The potential for high exit costs.

Competitive rivalry for Tejas Networks is shaped by numerous competitors and market growth, impacting market share dynamics. The global 5G services market is projected at $81.3 billion in 2024, influencing competition. Product differentiation is moderate, and low switching costs intensify price competition. High exit barriers, such as regulations, further affect rivalry.

| Factor | Impact | Data (2024) |

|---|---|---|

| Competitors | High | Nokia, Ericsson, Huawei |

| Market Growth | Moderate | 5G services market: $81.3B |

| Differentiation | Moderate | R&D spend: ₹105.7Cr Q3 |

SSubstitutes Threaten

Tejas Networks faces the threat of substitutes, including satellite internet and alternative networking solutions. These options could fulfill similar customer needs as Tejas's telecom equipment. Technological advancements constantly disrupt existing solutions; for example, in 2024, satellite internet saw a surge in adoption, impacting the market. This shift puts pressure on Tejas to innovate and maintain its competitive edge.

Examining substitutes, consider their price versus performance relative to Tejas's offerings. If alternatives provide superior value, the threat intensifies. For instance, in 2024, the cost-effectiveness of open-source software compared to proprietary solutions significantly impacts market dynamics. Evaluate technologies' suitability across applications; for example, cloud-based services versus on-premise hardware. Factors like scalability and maintenance costs, as seen in the telecom sector's shift, influence choices.

Switching costs are crucial for Tejas Networks. If customers find it easy and cheap to switch, the threat from substitutes rises. Consider the time, money, and operational disruption involved. Low switching costs make customers more likely to adopt new technologies. In 2024, the telecom equipment market saw a rise in interoperable solutions, potentially lowering switching costs.

Customer's Propensity to Substitute

Customer's propensity to substitute assesses how easily clients switch to alternatives. This willingness hinges on perceived value, performance, and risk. Shifting preferences and industry standards also play a role. In 2024, the telecom equipment market saw a rise in open RAN deployments, which offers more supplier choices. This increased competition could make substitution easier.

- Open RAN deployments offer more supplier choices.

- Changing customer preferences.

- Evolving industry standards.

Innovation in Substitute Technologies

The threat of substitutes for Tejas Networks involves monitoring innovation in related sectors. Rapid technological advancements can render existing solutions outdated quickly. Software-defined networking (SDN) and virtualization are trends that could impact traditional hardware. In 2024, the SDN market was valued at $18.5 billion, projected to reach $77.8 billion by 2029, showing significant growth. This expansion highlights the potential substitution risk.

- SDN and virtualization pose a threat.

- Market growth indicates potential disruption.

- Monitor tech advancements closely.

- Adaptation is key to mitigating risks.

The threat of substitutes for Tejas Networks stems from alternative telecom solutions. Satellite internet and open-source software present viable options, amplified by evolving customer preferences. The SDN market's growth, valued at $18.5B in 2024, signals a potential disruption. Adaptability is crucial to manage these risks effectively.

| Substitute | Description | Impact on Tejas |

|---|---|---|

| Satellite Internet | Offers connectivity via satellite, alternative to traditional telecom equipment. | Provides an alternative to traditional telecom equipment, potentially lowering demand. |

| Open-Source Software | Software that offers similar functionality to proprietary solutions but at a potentially lower cost. | May undermine pricing strategies and decrease the appeal of Tejas' solutions. |

| SDN and Virtualization | Trends that could impact traditional hardware. | Can reduce the need for specialized telecom hardware, threatening market share. |

Entrants Threaten

New telecom equipment market entrants face significant hurdles. High capital requirements, including R&D, are a major barrier. Regulatory compliance adds complexity and cost, as seen with the FCC's oversight. Access to established distribution channels is also crucial, making it tough for new players to compete with existing giants like Nokia and Ericsson, who had revenues of $20.9 billion and $24.5 billion respectively in 2024.

Existing firms like Tejas Networks often have a cost advantage due to economies of scale. New entrants face challenges if they can't match these efficiencies, especially in manufacturing. For instance, in 2024, Tejas Networks' R&D spending was a significant portion of its revenue, impacting cost competitiveness. Achieving similar scale requires substantial investment, creating a barrier.

Tejas Networks faces challenges from product differentiation, where established firms have strong brands. High customer loyalty to existing brands makes it harder for new entrants. Innovation and quality are key for brand loyalty. For instance, in 2024, brand loyalty significantly impacted market share across the telecom equipment sector.

Capital Requirements

Capital requirements pose a significant barrier for new entrants in the telecom equipment market. Starting a company in this sector demands substantial upfront investment. These costs are mainly related to R&D, manufacturing, and marketing.

- R&D expenses can reach hundreds of millions of dollars annually.

- Manufacturing setup may require billions, including specialized machinery.

- Marketing and sales efforts are costly, particularly to build brand awareness.

For example, in 2024, major players like Ericsson and Nokia allocated billions to R&D, reflecting the high investment needed to compete. High capital needs make it tough for new firms to enter.

Government Policies

Government policies significantly influence the threat of new entrants in the telecom sector. Tariffs and subsidies can either protect or open the market to new competitors. The 'Make in India' initiative and the Production Linked Incentive (PLI) scheme are crucial. These schemes aim to boost domestic manufacturing and attract new players.

- The PLI scheme for telecom and networking products has an outlay of ₹12,195 crore.

- In 2024, the Indian government is focused on increasing domestic manufacturing.

- These policies are designed to reduce reliance on imports.

The threat of new entrants for Tejas Networks is moderate due to substantial barriers. High capital investment, including R&D, is a significant obstacle, with major players like Ericsson spending billions in 2024. Government policies, such as the PLI scheme, also influence market dynamics.

| Barrier | Details | Impact |

|---|---|---|

| Capital Requirements | R&D, Manufacturing, Marketing | High investment needed for entry. |

| Government Policies | PLI Scheme, Tariffs | Shapes market access. |

| Existing Competition | Established brands, economies of scale. | Challenges for new entrants. |

Porter's Five Forces Analysis Data Sources

Our analysis uses annual reports, market share data, industry research, and financial filings to evaluate the competitive landscape surrounding Tejas Networks.