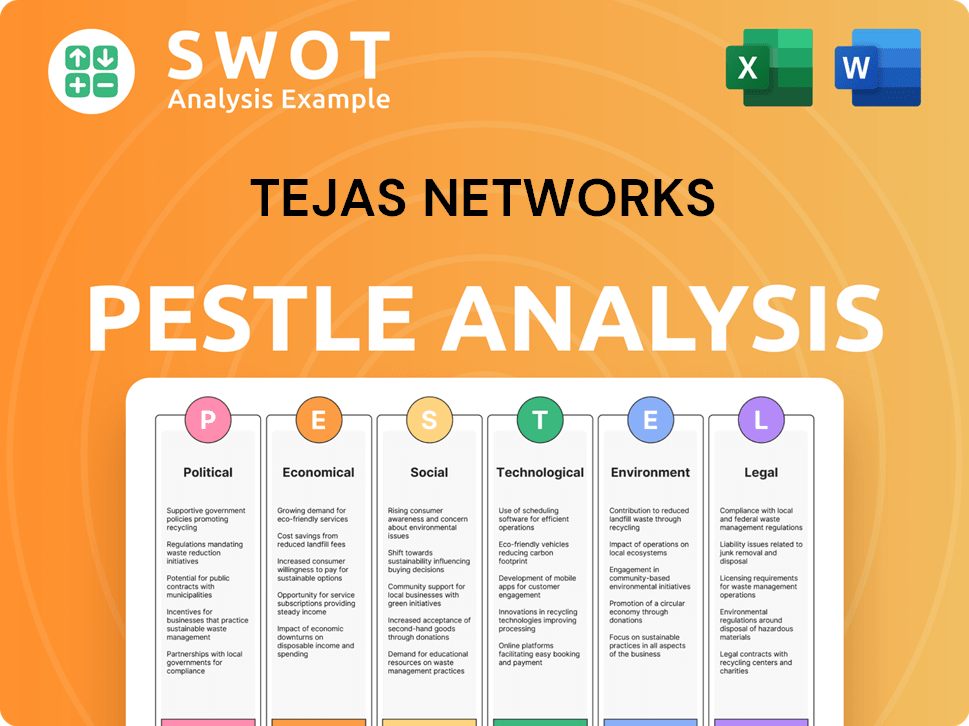

Tejas Networks PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tejas Networks Bundle

What is included in the product

Evaluates Tejas Networks' macro-environment via Political, Economic, Social, etc. dimensions.

Provides a concise version for use in strategic planning meetings or quick reference.

Preview Before You Purchase

Tejas Networks PESTLE Analysis

The preview you're viewing offers the complete Tejas Networks PESTLE Analysis. The final document mirrors this preview exactly. You’ll find no changes in content or formatting post-purchase. Download the file immediately and start using it. Get instant access to the full analysis.

PESTLE Analysis Template

Explore the external forces impacting Tejas Networks with our PESTLE Analysis. Uncover political stability, economic trends, and technological advancements influencing its trajectory. Gain insights into social shifts, legal frameworks, and environmental considerations. Our comprehensive analysis helps you anticipate challenges and opportunities. Arm yourself with essential market intelligence for strategic decision-making. Access the full analysis and get a competitive edge today!

Political factors

Government policies heavily influence Tejas Networks. 'Atmanirbhar Bharat' fosters domestic telecom manufacturing, boosting demand. In 2024, the Indian government allocated ₹1.64 lakh crore for digital infrastructure. These initiatives create growth opportunities for companies like Tejas.

Tejas Networks faces geopolitical risks due to its global operations. Trade tensions and sanctions can disrupt supply chains and limit market access. Political instability in regions where it operates poses additional challenges. For example, in 2024, global trade tensions affected tech companies. Geopolitical factors significantly influence business operations.

Tejas Networks relies on government contracts, particularly in defense and telecom. Government spending shifts, priorities, and procurement directly affect its business. For instance, the BSNL 4G project, a major government order, significantly boosted Tejas's revenue. In fiscal year 2024, government and PSU orders accounted for a substantial portion of their revenue.

Regulatory Environment

The regulatory environment significantly shapes Tejas Networks' operations. Changes in telecom regulations, standards, and licensing policies directly affect its product development and market access. For instance, India's telecom sector saw reforms in 2024, including spectrum auctions and eased FDI norms, potentially benefiting Tejas. These shifts necessitate constant adaptation to remain compliant and competitive. Further complicating matters, the company must navigate varying regulations across different countries.

- India's telecom market is projected to reach $39.7 billion by 2025.

- Tejas Networks' revenue for FY24 was INR 2,290 crore.

- The company invests heavily in R&D to meet evolving regulatory demands.

- Compliance costs can be a substantial part of operational expenses.

Political Stability

Political stability is critical for Tejas Networks, especially in regions where it operates. Infrastructure projects, which heavily rely on the company's products, are highly sensitive to political climates. Unstable governments or policy shifts can disrupt network expansion plans, impacting Tejas Networks' revenue streams and project timelines. For instance, in 2024, political transitions in several emerging markets led to project delays.

- Delays in 5G network deployments in India due to regulatory changes.

- Potential impacts on contracts and project approvals in politically volatile regions.

- Changes in government priorities affecting infrastructure spending.

Political factors profoundly impact Tejas Networks, influencing market dynamics and operational strategies.

Government policies and spending, crucial for the telecom sector, can dramatically alter company prospects; 'Atmanirbhar Bharat' boosts domestic manufacturing. However, global geopolitical instability presents challenges to supply chains and market access.

Regulatory environments also shape the business; compliance and adaptations are necessary for global operations.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Government Policies | Fosters domestic manufacturing | ₹1.64 lakh crore allocated for digital infra (2024) |

| Geopolitical Risks | Disrupts supply chains | Global trade tensions impacted tech (2024) |

| Regulatory Changes | Affects product development | Telecom sector saw reforms, including FDI in 2024 |

Economic factors

The telecom equipment market is expanding, fueled by high-speed broadband, 5G, and bandwidth-heavy applications. This growth offers Tejas Networks significant opportunities. The global telecom equipment market is projected to reach $400 billion by 2025, according to recent reports. Tejas Networks, with its innovative solutions, is well-positioned to capitalize on this trend, as seen in their revenue growth of 20% in fiscal year 2024.

Tejas Networks' performance is significantly tied to global economic health. Inflation, like the 3.1% rate in the US for January 2024, impacts project costs. Rising interest rates, such as those influenced by the Federal Reserve, affect investment decisions. Economic growth, with projections of around 2.1% for the US in 2024, influences infrastructure spending and thus, Tejas's profitability.

Tejas Networks faces foreign exchange risk due to international sales and suppliers. Currency fluctuations can significantly affect its financial performance. For example, a stronger INR against USD could lower revenue from exports. The company needs hedging strategies to mitigate these risks.

Competition

Tejas Networks operates in a highly competitive market, contending with established global and domestic companies. This competition significantly impacts pricing strategies and market share dynamics. The need for continuous innovation is crucial to maintain a competitive edge in this fast-evolving sector. In 2024, the telecom equipment market saw intense rivalry, influencing profit margins. The competitive landscape necessitates agile adaptation and strategic investments.

- Market share battles among major players.

- Pressure on pricing due to competitive offerings.

- Increased investment in R&D to stay ahead.

- Rapid technological advancements requiring quick adaptation.

Customer Capital Expenditure

Tejas Networks heavily relies on its customers' capital expenditure (CapEx) decisions. These decisions, driven by factors like network upgrades and expansions, directly influence Tejas's revenue streams. For instance, if major telecom companies reduce their CapEx, Tejas's sales may decline, as seen in 2023. In contrast, increased investments in 5G infrastructure could significantly boost its sales. The timing of these expenditures is crucial, with large projects often taking several quarters to materialize into revenue.

- In FY24, Tejas Networks reported a significant increase in order book.

- Major telecom providers' CapEx plans for 2024-2025 are expected to be around 10% of revenue.

- Government projects, which are major customers, can have longer lead times.

Economic factors play a vital role in Tejas Networks' success, including inflation, interest rates, and overall economic growth. In January 2024, the US saw inflation at 3.1%, influencing project costs. Projections for US economic growth in 2024 hover around 2.1%, directly impacting infrastructure spending.

| Economic Indicator | Impact on Tejas | 2024-2025 Data/Forecast |

|---|---|---|

| Inflation Rate (US) | Affects project costs and profitability | 3.1% (January 2024), forecasted to 2.5% by end of 2024 |

| Interest Rates | Influence investment decisions in telecom sector | Federal Reserve influenced; potential cuts in 2024 |

| Economic Growth (US) | Impacts infrastructure spending & demand | Projected ~2.1% in 2024 |

Sociological factors

Data consumption is surging globally. This trend boosts demand for networking gear. Cisco projects global IP traffic to reach 41.6 exabytes per month by 2025. This growth benefits companies like Tejas Networks. The rise in data consumption is driven by IoT devices and cloud services.

Societal demands for broader digital access, particularly in developing nations, are increasing. This trend fuels the necessity for more extensive telecom infrastructure. Tejas Networks can capitalize on this by providing solutions. For instance, in 2024, global internet users surpassed 5.3 billion, highlighting the vast market potential.

Tejas Networks, as a tech firm, hinges on skilled engineers. India's engineering graduates in 2024 totaled ~1.5M. Retention is key, given the competitive tech job market. High attrition rates (15-20% in 2024) can hinder innovation. Government initiatives aim to boost tech talent.

Customer Requirements and Evolving Standards

Tejas Networks must stay agile to meet shifting customer demands and new industry benchmarks in the fast-paced telecom sector. This impacts how they design and improve their products. For example, the global 5G infrastructure market is projected to reach $47.8 billion in 2024. It’s expected to hit $68.9 billion by 2029, reflecting a growing need for advanced solutions. This necessitates continuous innovation.

- 5G infrastructure market size in 2024: $47.8 billion.

- 5G infrastructure market size in 2029: $68.9 billion.

- This growth demands constant innovation.

Intellectual Property Protection

Intellectual property (IP) protection is paramount for Tejas Networks in the tech sector, safeguarding its innovations. Strong IP rights are crucial for competitiveness and brand reputation. Failure to protect IP can lead to revenue loss and market share erosion. The global market for IP protection is projected to reach $75 billion by 2025.

- Patent filings in India increased by 31% in 2023, reflecting growing IP awareness.

- Tejas Networks' success hinges on its ability to secure and defend its patents.

- IP infringement lawsuits in the tech industry cost companies billions annually.

Societal expectations for digital access drive telecom infrastructure growth. Tejas Networks benefits from providing solutions. Global internet users topped 5.3 billion in 2024. India's engineering graduates in 2024 totaled ~1.5M.

| Aspect | Details | Impact on Tejas Networks |

|---|---|---|

| Digital Inclusion | Growing demand in developing nations for wider internet access. | Increased need for telecom solutions, expanding market opportunities. |

| Talent Pool | ~1.5M engineering graduates in India in 2024; High attrition rates. | Challenges in attracting and retaining skilled engineers; need for competitive benefits. |

| Innovation | Rapid changes, benchmarks, & consumer behavior in telecom, tech. | Tejas needs flexibility for new products, customer adaptation to meet fast growing, shifting needs. |

Technological factors

The telecommunications sector sees fast tech shifts, especially in 5G and fiber optics. Tejas Networks needs to invest heavily in research and development (R&D). In fiscal year 2024, Tejas Networks' R&D expenses were approximately ₹450 crore. This investment is crucial to stay ahead of the curve. The company's ability to innovate will significantly impact its market position by 2025.

Tejas Networks heavily invests in technology, innovation, and R&D. This focus helps them create new products and solutions. In FY24, R&D expenses were ₹249.7 crore, showcasing their commitment. This strategy allows them to meet changing customer needs and compete effectively. They aim to stay ahead by constantly developing advanced tech.

The rise of Software-Defined Networking (SDN) and cloudification is reshaping network infrastructures. This shift towards automated, flexible networks is a key technological factor. Tejas Networks is adapting by integrating software-programmable features into its products. In fiscal year 2024, Tejas Networks reported a significant increase in orders related to SDN solutions. The company's focus on cloud-native applications is expected to drive further growth.

Emerging Technologies (AI/ML, IoT)

The rise of AI/ML and the Internet of Things (IoT) is reshaping network demands. Tejas Networks must adapt to these shifts by integrating these technologies. This will involve developing solutions that can handle increased data traffic and complexity. For example, the global IoT market is projected to reach $1.8 trillion by 2025. This expansion will create opportunities and challenges for network providers.

- AI/ML integration in network management for automated optimization.

- IoT device proliferation, increasing data traffic exponentially.

- Demand for low-latency, high-bandwidth network solutions.

- Cybersecurity concerns due to interconnected devices.

Supply Chain Technology and Component Availability

Tejas Networks faces technological challenges in supply chain management. Component availability, particularly semiconductors, directly impacts production. Global shortages can lead to delays and increased costs, affecting project timelines. The company must optimize its supply chain.

- In Q3 FY24, Tejas Networks reported a revenue of ₹418.6 crore, impacted by supply chain issues.

- The semiconductor market is projected to reach $1 trillion by 2030, highlighting the importance of securing components.

Technological advancements drive rapid changes in the telecom sector. Tejas Networks' R&D investments, about ₹450 crore in fiscal year 2024, are crucial for innovation. The integration of AI/ML and IoT also shapes network demands, requiring adaptable solutions. The IoT market, expected to hit $1.8 trillion by 2025, highlights the importance of network providers adapting. Additionally, supply chain issues impacted Q3 FY24 revenue, at ₹418.6 crore.

| Technology Aspect | Impact | 2024-2025 Data |

|---|---|---|

| R&D Investment | Drives Innovation and Product Development | ₹450 crore (FY24) |

| AI/ML & IoT | Increased Data Traffic & Network Complexity | IoT market: $1.8T by 2025 |

| Supply Chain | Affects Production & Revenue | Q3 FY24 Revenue: ₹418.6 cr |

Legal factors

Tejas Networks faces stringent regulatory compliance requirements across its global operations. These include adhering to telecommunications laws, environmental standards, and corporate governance practices. The company's compliance efforts are critical, especially given the rapidly evolving tech landscape. Failing to comply could lead to significant penalties, impacting its financial performance. In 2024, regulatory fines within the telecom sector have increased by 15% globally.

Tejas Networks must safeguard its innovations via patents, copyrights, and trademarks. Patent infringement by rivals presents a significant legal risk. In 2024, the global patent litigation market was valued at $6.5 billion, highlighting the importance of IP protection. The company needs a robust IP strategy to defend its market position.

Tejas Networks operates on intricate contractual agreements with clients and vendors, which are critical for its business operations. These agreements dictate the terms of service, product delivery, and payment schedules. In 2024, the company's legal team focused on mitigating risks associated with these contracts. Contractual compliance and risk management are crucial aspects of Tejas Networks' legal strategy.

Data Privacy and Security Regulations

Tejas Networks operates in a landscape where data privacy and security are paramount. The company must adhere to data protection regulations like GDPR and CCPA. Non-compliance can lead to hefty fines and reputational damage. In 2024, the global cybersecurity market was valued at over $200 billion, reflecting the importance of these factors.

- GDPR fines can reach up to 4% of global annual turnover.

- The average cost of a data breach in 2023 was nearly $4.5 million.

- The cybersecurity market is projected to reach $300 billion by 2027.

Trade and Export Regulations

Tejas Networks, operating globally, must comply with trade and export rules. These regulations can influence where and how they sell their products. For example, the US restricts certain tech exports to specific countries. Compliance costs can also affect profitability. Failing to comply can lead to penalties, affecting the company's financial performance.

- US export controls impact tech companies.

- Compliance costs can cut into profits.

- Penalties for non-compliance can be substantial.

Tejas Networks must navigate complex telecom regulations worldwide, facing potential penalties for non-compliance. Intellectual property protection through patents and trademarks is vital, with patent litigation costs reaching billions. Compliance with data privacy laws like GDPR and CCPA is essential to avoid hefty fines and maintain its reputation.

| Aspect | Details | 2024 Data/Forecast |

|---|---|---|

| Regulatory Compliance | Adherence to telecom laws and standards. | Global telecom fines increased by 15%. |

| Intellectual Property | Protection of patents and trademarks. | Patent litigation market valued at $6.5B. |

| Data Privacy | Compliance with GDPR, CCPA. | Cybersecurity market reached $200B in 2024. |

Environmental factors

Tejas Networks faces environmental risks due to stricter regulations. It must comply with environmental and safety rules. Compliance is essential for operations and product design. Failing to comply can lead to penalties. The global environmental technology market is projected to reach $140.9 billion by 2025.

Tejas Networks must focus on sustainable product design to reduce its environmental impact. This involves creating energy-efficient and eco-friendly products from development to disposal. In 2024, the demand for green technology is growing, with the global market projected to reach $70 billion. This includes components and equipment. Tejas can gain a competitive advantage by prioritizing sustainability.

Tejas Networks must prioritize waste and e-waste management. Proper recycling is crucial for environmental responsibility. The global e-waste market is projected to reach $100 billion by 2025, highlighting the significance. Implementing effective recycling programs minimizes environmental impact and supports sustainability goals. Tejas can adhere to the latest e-waste regulations.

Supply Chain Environmental Impact

Tejas Networks should assess its supply chain's environmental footprint, focusing on sustainable sourcing and supplier practices. The tech sector is under pressure to reduce its carbon emissions. According to a 2024 report, the ICT industry accounts for roughly 2-3% of global carbon emissions. Tejas can improve its ESG rating.

- Supplier sustainability audits are becoming increasingly common.

- Focus on materials with lower environmental impact.

- Explore partnerships with eco-conscious suppliers.

Climate Change Considerations

Tejas Networks recognizes the crucial importance of addressing climate change. The company is committed to minimizing its environmental footprint through various initiatives. Tejas Networks has established a target to reach net-zero emissions. This reflects a proactive approach to sustainability in its operations and supply chain.

- The global market for green technology is projected to reach $74.1 billion by 2025.

- Tejas Networks' commitment aligns with the trend of companies setting net-zero targets.

- Companies are increasingly investing in renewable energy and energy-efficient technologies.

Tejas Networks faces environmental scrutiny with stringent regulations requiring compliance for its operations and product design, and the global environmental technology market is expected to hit $140.9 billion by 2025.

Focusing on sustainable product design and efficient e-waste management is crucial, aligning with the growth of the green tech market, projected to be $74.1 billion in 2025, emphasizing recycling to meet sustainability goals.

The company needs to evaluate its supply chain, particularly aiming at the tech sector that is accounting for roughly 2-3% of global carbon emissions, improving ESG ratings, and pursuing a net-zero emissions target.

| Area | Focus | Impact |

|---|---|---|

| Regulations | Compliance with environmental and safety rules | Avoid penalties, market access |

| Sustainable Design | Energy-efficient and eco-friendly products | Competitive advantage, reduces footprint |

| Waste Management | Effective recycling and e-waste programs | Environmental responsibility, compliance |

PESTLE Analysis Data Sources

Tejas Networks' PESTLE Analysis draws on industry reports, financial data, and regulatory information from governmental and private sources. We integrate market research and tech analysis for detailed insights.