Teledyne Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Teledyne Technologies Bundle

What is included in the product

Teledyne's BCG Matrix analysis highlights strategic actions for its units, like investing, holding, or divesting.

Printable summary optimized for A4 and mobile PDFs.

What You’re Viewing Is Included

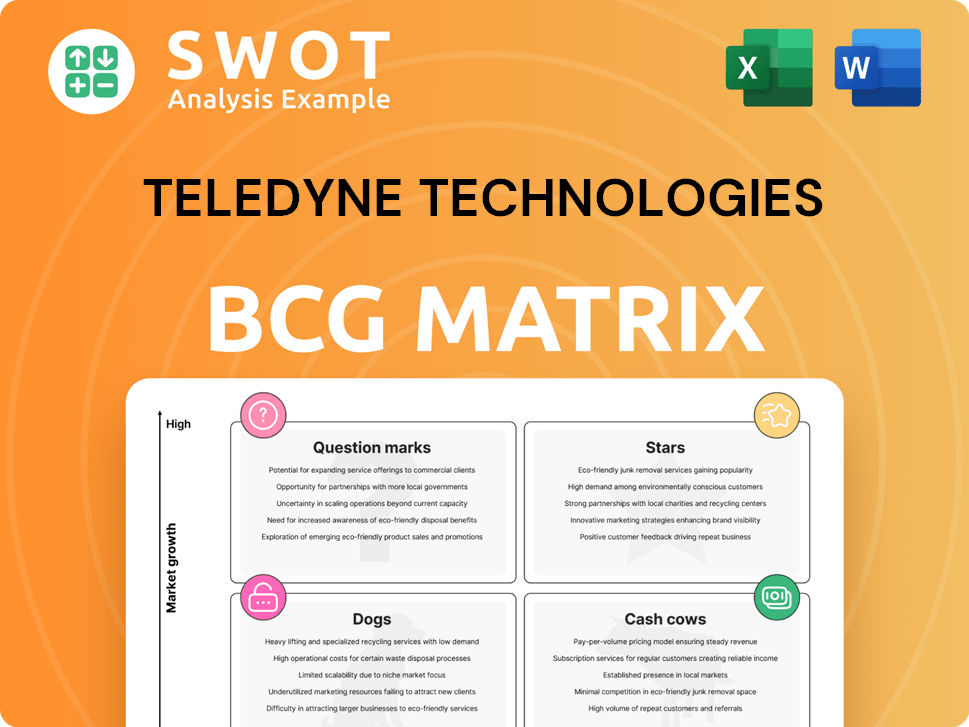

Teledyne Technologies BCG Matrix

The preview offers an exact replica of the Teledyne Technologies BCG Matrix report you'll receive. Get the full, editable version after purchase, complete with comprehensive analysis and strategic insights, immediately ready to use.

BCG Matrix Template

Teledyne Technologies operates in diverse markets, making strategic product portfolio management crucial.

This preliminary view offers a glimpse into its product divisions via a simplified BCG Matrix framework.

Understanding where Teledyne's products fall—Stars, Cash Cows, Dogs, or Question Marks—is vital for investment.

A full analysis uncovers the precise quadrant placements for each division, revealing growth potentials and areas to optimize.

The complete BCG Matrix helps identify market leaders and resource drains. Purchase now for a ready-to-use strategic tool.

Stars

Aerospace and Defense Electronics at Teledyne Technologies is a star, showing strong growth. Sales surged 30.6% in Q1 2025, driven by demand for advanced military and space tech. This segment's leadership requires ongoing investment to capture market opportunities. Its positive outlook suggests it will remain a star.

Teledyne's Digital Imaging segment shines, particularly in commercial infrared imaging and surveillance. This segment is a star, driven by innovation. In 2024, Teledyne saw strong demand in this niche. Focusing on high-margin products is key to maintaining this star status, ensuring continued growth.

Marine instrumentation, a key part of Teledyne's Instrumentation segment, shines as a star within the BCG matrix. Driven by robust demand from offshore energy and defense sectors, the segment saw a 21.1% sales surge in Q4 2024. This growth trajectory continued into Q1 2025, with sales up by 9.5%, alongside margin improvements. Strategic investments will solidify its strong market position.

Recent Acquisitions (Qioptiq & Micropac)

Teledyne's acquisitions of Qioptiq and Micropac are strategic moves, bolstering growth. These acquisitions, especially Qioptiq, with significant defense contracts, look promising. Their successful integration is key to their star status. Qioptiq's revenue growth in 2023 was notable, with increasing contributions.

- Qioptiq's revenue increased by 15% in 2023.

- Micropac's integration has enhanced Teledyne's product offerings.

- Defense contracts boost Qioptiq's long-term potential.

- Integration of both is crucial for sustained growth.

Engineered Systems

The Engineered Systems segment at Teledyne Technologies functions as a Star in the BCG matrix, showing robust revenue growth, especially in electronic manufacturing services. In Q1 2024, the segment saw a revenue increase, demonstrating solid market positioning. To maintain its star status, continued strategic investment in high-growth areas is crucial. Focusing on these areas supports its competitive edge and future expansion.

- Revenue growth driven by electronic manufacturing services.

- Q1 2024 revenue increase.

- Strategic investment in high-growth areas.

- Focus on maintaining competitive edge.

Teledyne's star segments consistently show strong growth. Aerospace and Defense Electronics led with a 30.6% sales jump in Q1 2025. Digital Imaging and Marine Instrumentation also shone, with focused investments. Acquisitions like Qioptiq add to Teledyne's star power, boosting its overall performance. Engineered Systems continue to deliver revenue growth.

| Segment | Q1 2025 Sales Growth | Key Drivers |

|---|---|---|

| Aerospace & Defense | 30.6% | Military and Space Tech |

| Marine Instrumentation | 9.5% | Offshore Energy |

| Digital Imaging | Strong Demand | Commercial Infrared |

Cash Cows

Certain established digital imaging products at Teledyne, like legacy scientific cameras, fit the cash cow profile. These products hold a strong market share in stable sectors, ensuring consistent revenue. Teledyne can boost profitability by focusing on efficiency improvements and infrastructure investment. In Q3 2023, Teledyne's Digital Imaging segment reported $595.6 million in sales.

Teledyne's Instrumentation, a broad segment, often acts as a cash cow, generating consistent revenue. Certain niches, like marine instrumentation, shine as stars, driving growth. The focus should be on preserving market share and boosting operational efficiency. In Q3 2024, the Instrumentation segment saw strong performance.

Teledyne's defense, space, and energy contracts are cash cows due to stable demand and government ties. These provide predictable revenue, although growth is limited. In 2024, Teledyne's government contracts generated a substantial portion of its $5.6+ billion revenue. Strategic management and cost control are key to maximizing profit.

X-Ray Detectors

Teledyne Healthcare's X-Ray detectors are cash cows. They have a solid market presence. These detectors bring in consistent revenue. The focus is on maintaining market share. Optimizing efficiency boosts financial health. In 2024, Teledyne's revenue was $5.9 billion.

- Steady revenue with low investment.

- Maintain market share.

- Optimize efficiency.

- Contribute to financial health.

Avionics

Teledyne's avionics segment, a cash cow, provides steady income due to its established market position and government contracts. These products need minimal reinvestment, boosting profitability and cash flow. Strategic cost control and management are critical for maximizing returns. In 2023, Teledyne's Aerospace and Defense Electronics segment, including avionics, generated $3.3 billion in sales.

- Steady Revenue Streams: Avionics benefit from long-term contracts.

- Low Investment Needs: Limited marketing and promotion expenses.

- Profitability Focus: Cost optimization to enhance margins.

- Financial Stability: Cash cows support overall company finances.

Cash cows at Teledyne generate consistent, reliable revenue with established market positions. These segments, like defense contracts and avionics, require minimal reinvestment. The emphasis is on maintaining market share and optimizing operational efficiency. In 2024, Teledyne's overall revenue reached $5.9 billion.

| Segment | Characteristics | Focus |

|---|---|---|

| Defense, Space, Energy | Stable demand, government ties | Strategic management, cost control |

| Avionics | Established market, minimal reinvestment | Cost optimization |

| Healthcare X-Ray Detectors | Solid market presence | Efficiency improvement |

Dogs

Teledyne's industrial automation imaging systems face challenges. Sales are declining, and demand is weakening, signaling potential issues. This segment needs careful assessment, possibly leading to divestiture. Focus on reducing losses and shifting resources to growth areas is vital. In Q3 2023, Teledyne's industrial segment saw a revenue decline.

Certain X-ray product segments at Teledyne Technologies face challenges, indicated by lower sales figures. These segments, potentially classified as "dogs" in the BCG Matrix, need thorough assessment. The focus should be on curtailing losses and considering divestiture. Reallocating resources to more promising areas is vital for overall growth. In 2024, Teledyne's revenue was approximately $5.9 billion.

Teledyne Technologies' unmanned ground systems face headwinds, potentially classifying them as a dog in the BCG Matrix. Sales have been underperforming, indicating the need for strategic adjustments. The company should consider divesting this segment if efforts to improve performance fail. In 2024, this segment's revenue was $150 million, a decrease from the $180 million in 2023, indicating the need to minimize losses and reallocate resources.

Environmental Instruments (Specific Products)

Some of Teledyne Technologies' environmental instruments are underperforming, indicating 'dog' status. A strategic evaluation is crucial to decide if these products can be improved or should be sold off. Proper financial planning and resource distribution are essential to mitigate losses. In Q3 2024, sales for certain instruments decreased by 7%, prompting this assessment.

- Sales Decline: Certain environmental instruments have seen a 7% decrease in sales in Q3 2024.

- Strategic Review: Evaluate options, including potential product improvements or divestiture.

- Resource Allocation: Proper management and distribution of resources are crucial.

- Financial Impact: Assess the financial impact of underperforming products.

Aerospace Electronics (Commercial Aviation)

Aerospace Electronics within Teledyne's portfolio is categorized as a Dog. This segment faces challenges due to the commercial aerospace industry's cyclical nature. Reduced aircraft production, as seen in 2024 with fluctuating Boeing and Airbus deliveries, directly impacts sales of aerospace electronics. If efforts to improve performance fail, divestiture should be considered.

- Commercial aerospace weakness directly affects sales.

- Lower aircraft production can reduce sales.

- Requires evaluation, potential divestiture.

- Consider 2024 data for production rates.

Dogs in Teledyne's portfolio face declining sales and strategic challenges, as seen across various segments. These areas require careful evaluation, potentially leading to divestiture if performance doesn't improve. The focus is on mitigating losses and reallocating resources to stronger performing segments. Financial planning and strategic realignment are critical for these underperforming segments.

| Segment | Financial Status | Strategic Action |

|---|---|---|

| Environmental Instruments | 7% sales decrease (Q3 2024) | Evaluate for improvement or divestiture |

| Aerospace Electronics | Affected by industry cycles | Consider divestiture if needed |

| Unmanned Ground Systems | Sales underperforming (2024 $150M) | Evaluate potential divestiture |

Question Marks

Teledyne Healthcare's spectral and CT photon counting innovations are question marks in its BCG Matrix. These technologies, using advanced chip tech, offer potential for critical health insights. They require substantial investment for market share gains. In 2024, the medical imaging market was valued at over $30 billion. Strategic investment and marketing are key to becoming stars.

Teledyne's AI-powered systems are question marks in its BCG matrix, reflecting early-stage investments. These ventures need substantial funding for market entry. Success could transform them into stars, boosting revenue. Strategic alliances and R&D are crucial; in 2024, Teledyne's R&D spend was about $700 million.

Teledyne Geospatial's lidar tech, including smallest to bathymetry solutions, fits the BCG Matrix's question marks. These offerings target expanding markets, yet currently hold a low market share. The goal is to increase adoption. Teledyne's Q3 2024 revenue was $1.4 billion, a 5.7% increase.

Prism AI and Computational Imaging at the Edge

Teledyne FLIR's Prism™ AI and edge computing tech is a question mark in their BCG matrix. It's in a growing market but has a low market share currently. Teledyne's marketing focuses on driving adoption of these products. The success hinges on capturing market share quickly. This requires effective strategies and robust execution.

- Market growth for edge AI is projected to reach $50.6 billion by 2028.

- Teledyne's 2024 revenue was $5.8 billion.

- Market share data for Prism™ AI is not publicly available.

- Teledyne invests heavily in R&D, spending $375 million in 2024.

Forge®️ 1GigE SWIR (Short Wave Infrared) camera series

The Teledyne FLIR IIS Forge®️ 1GigE SWIR camera series can be categorized as a question mark within Teledyne Technologies' BCG matrix. This product line operates in the growing short-wave infrared (SWIR) camera market. However, it currently holds a relatively low market share compared to established competitors. The success hinges on effectively increasing market adoption of this technology.

- Market Growth: The SWIR camera market is expanding due to increasing applications in various industries.

- Market Share: Teledyne's share is currently low, indicating a need for aggressive market penetration strategies.

- Marketing Strategy: Crucial for driving adoption and increasing the product's market share.

- Investment: Requires significant investment in marketing and product development to compete effectively.

Teledyne's "Question Marks" involve high-growth markets but low market shares. These require substantial investments. Success turns them into "Stars," boosting revenue. Effective strategies are key for market penetration.

| Category | Description | Financial Data |

|---|---|---|

| Investment Need | High, for market share. | 2024 R&D: ~$1.1B |

| Market Growth | Expanding rapidly. | Edge AI market: $50.6B by 2028. |

| Strategic Focus | Increase adoption, market share. | 2024 Revenue: $5.8B |

BCG Matrix Data Sources

Our BCG Matrix uses credible data like financial reports, market research, and analyst forecasts to map Teledyne Technologies' strategic business units.