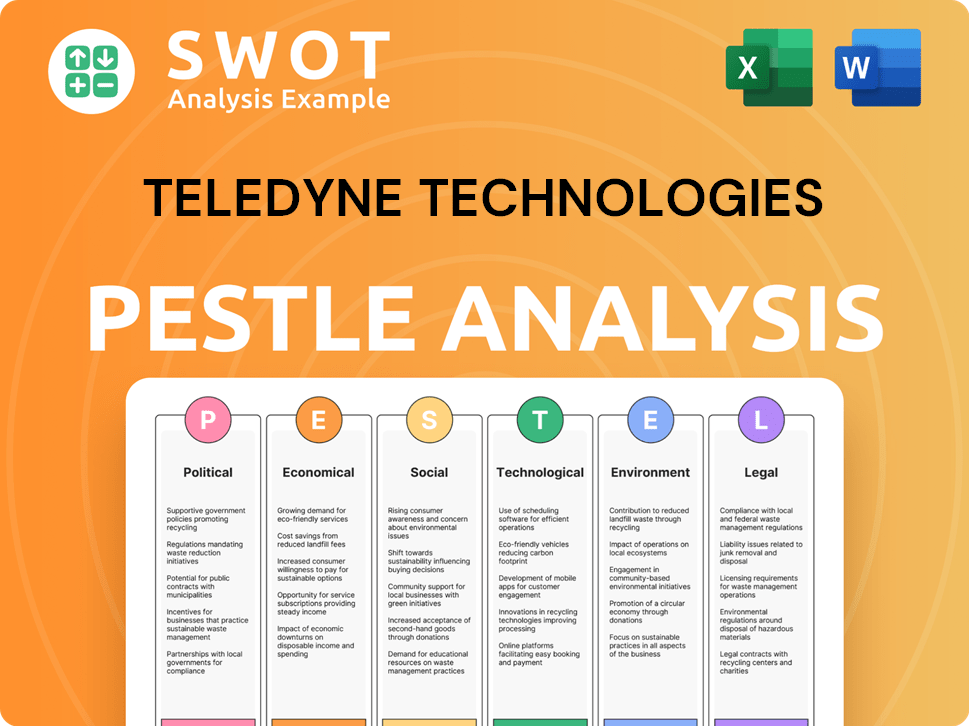

Teledyne Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Teledyne Technologies Bundle

What is included in the product

Analyzes how macro-factors influence Teledyne across political, economic, social, technological, environmental, and legal realms.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Teledyne Technologies PESTLE Analysis

Explore this Teledyne Technologies PESTLE Analysis preview. What you’re previewing here is the actual file—fully formatted and professionally structured. This includes all analysis sections across Political, Economic, Social, Technological, Legal, and Environmental factors. The file is ready to download after purchase. No surprises guaranteed!

PESTLE Analysis Template

Teledyne Technologies operates in a complex environment. Our PESTLE analysis reveals critical external factors. Economic shifts, such as inflation and supply chain issues, impact operations. Political regulations, including trade policies, are also key considerations. Environmental concerns influence Teledyne's product development. Technological advancements change competitive landscapes. Social trends also create opportunities. Buy the full analysis now for a complete, actionable strategic tool.

Political factors

Teledyne Technologies heavily relies on government contracts, especially in defense and aerospace. In 2024, approximately 45% of Teledyne's revenue came from U.S. government contracts. Changes in government spending, like the 2024 defense budget which saw a 3% increase, directly affect Teledyne. Policy shifts under new administrations, such as alterations to funding for agencies like NASA, can significantly impact their business.

Teledyne Technologies faces risks from shifting trade policies. Tariffs and trade wars, especially US-China, impact its global supply chain. In 2024, potential tariffs could raise costs. For example, in 2024, the U.S. imposed tariffs on some Chinese goods, affecting costs. These changes influence pricing and sales strategies.

Teledyne Technologies faces export control regulations, impacting international sales. ITAR compliance is essential for its advanced tech offerings. These regulations can restrict access to certain markets. In 2024, Teledyne's international revenue was approximately $2.8 billion, highlighting the importance of navigating these controls effectively.

Government Regulations on Technology

Teledyne Technologies faces significant political factors, particularly through government regulations affecting the technology sector. Compliance with standards, such as those from NIST, is crucial. These regulations influence product development and market access, especially for government contracts. Evolving regulations can substantially increase compliance costs.

- NIST's budget for 2024 was $1.3 billion, highlighting its regulatory impact.

- Teledyne's defense segment, accounting for 30% of revenue in 2024, is heavily impacted by these regulations.

- Compliance costs in the tech sector have risen by 15% in 2024 due to increased regulatory scrutiny.

Political Stability and Geopolitical Events

Political stability and geopolitical events significantly affect Teledyne's business, especially in its aerospace and defense sectors. Recent conflicts and heightened geopolitical tensions have driven increased demand for defense-related products. Conversely, instability can disrupt supply chains and market access. For instance, in 2024, defense spending in the U.S. reached $886 billion, influencing Teledyne's revenue.

- Increased defense spending can lead to higher sales.

- Political instability may disrupt supply chains.

- Geopolitical events can create new market opportunities.

Political factors significantly impact Teledyne through government contracts and regulations. The U.S. defense budget reached $886 billion in 2024, impacting its revenue. Compliance costs rose by 15% in 2024 due to increased scrutiny. Changes in government spending and geopolitical events drive demand, influencing sales.

| Political Factor | Impact on Teledyne | Data (2024) |

|---|---|---|

| Government Contracts | Revenue, Compliance Costs | 45% revenue from US govt; 15% increase in compliance costs |

| Defense Spending | Sales Growth | $886 billion US defense budget |

| Geopolitical Events | Supply Chain, Market Access | Increased demand for defense products. |

Economic factors

Teledyne's financial health is significantly affected by global economic trends. A downturn in economies like the US or Europe could curb spending on their goods. In 2023, Teledyne's revenue was $5.8 billion, a 10.2% rise. Slowdowns in these areas could affect future growth rates.

Interest rate fluctuations influence Teledyne's borrowing costs and investment strategies. As of May 2024, the Federal Reserve maintained interest rates, impacting financing options. Inflation affects Teledyne's expenses, including raw materials. In Q1 2024, the U.S. inflation rate was around 3.5%, potentially increasing operational costs. These dynamics can squeeze profit margins.

Teledyne's global operations mean currency exchange rates significantly affect financial outcomes. In 2024, fluctuations in EUR/USD and other major pairs can alter reported revenues and profits. For example, a strengthening dollar reduces the value of foreign sales when converted. This currency risk demands careful hedging strategies to stabilize earnings.

Market Demand in Key Segments

Teledyne Technologies' market demand fluctuates significantly across its diverse segments. Strong growth has been observed in areas like marine and environmental instruments, driven by increasing environmental regulations and research investments. However, laboratory instrumentation and industrial automation face potential demand softening due to economic downturns or shifts in industrial spending. For instance, the industrial automation market is projected to reach $274.8 billion in 2024, with a CAGR of 8.7% from 2024 to 2032. This variability necessitates careful market analysis and strategic resource allocation to capitalize on growth opportunities and mitigate risks in less buoyant sectors.

- Marine instrumentation market size was valued at $4.9 billion in 2023 and is projected to reach $8.5 billion by 2033.

- The global laboratory instrumentation market is expected to reach $78.68 billion by 2029.

- Industrial automation market is projected to reach $274.8 billion in 2024.

Acquisition and Integration Costs

Teledyne Technologies actively pursues acquisitions to expand its business portfolio. These acquisitions, while beneficial for long-term growth, introduce significant transaction and integration costs. Such costs can temporarily affect Teledyne's financial results, including profitability margins. For example, in 2024, Teledyne's acquisition-related expenses were approximately $50 million.

- Acquisition of FLIR Systems: a major acquisition in 2021, incurring significant integration costs.

- Integration challenges: combining different company cultures, systems, and operations.

- Financial impact: short-term decrease in earnings due to upfront costs.

- Long-term benefits: expanded market reach and product offerings.

Teledyne’s economic performance hinges on global financial health. Economic downturns can affect its sales; for instance, 2023 revenue was $5.8B, growing by 10.2%. Interest rates and inflation impact borrowing and costs. Q1 2024 U.S. inflation was around 3.5%.

| Economic Factor | Impact | Recent Data |

|---|---|---|

| Economic Growth | Affects demand and spending | Industrial Automation: $274.8B in 2024 |

| Interest Rates | Influence costs and investments | Federal Reserve maintained rates in May 2024 |

| Inflation | Impacts operational costs | Q1 2024 U.S. Inflation: ~3.5% |

Sociological factors

Teledyne prioritizes workplace safety and employee well-being. They implement robust safety policies and management systems. In 2024, workplace incidents decreased by 8% due to these initiatives. Teledyne invests in health programs, reflecting its commitment to employee welfare.

Teledyne Technologies actively promotes diversity and inclusion. In 2024, Teledyne reported a workforce comprised of diverse backgrounds. They have implemented programs to ensure equal opportunities. The company's commitment is reflected in its inclusive policies and training initiatives. Teledyne strives for a workplace where all employees feel valued and respected, fostering innovation.

Teledyne actively engages with local communities, supporting various initiatives. The company's focus on human rights is evident through policies combating child labor and human trafficking. In 2024, Teledyne invested $2.5 million in community projects. They also ensure fair labor practices across their supply chain.

Talent Acquisition and Development

Teledyne Technologies' ability to secure and nurture talent significantly influences its performance. Access to a skilled workforce is crucial for innovation and operational efficiency. The company must attract and retain employees with expertise in engineering, technology, and manufacturing. Teledyne's success hinges on continuous employee development and adaptation to evolving industry demands.

- In 2024, the demand for skilled engineers and technicians in the aerospace and defense sectors (Teledyne's key markets) is projected to grow by 5-7%.

- Teledyne's training and development expenses in 2023 were approximately $75 million, reflecting its investment in employee skills.

- Employee turnover rate at Teledyne was around 8% in 2023, slightly below the industry average.

Public Perception and Corporate Reputation

Teledyne Technologies' reputation hinges on ethical practices, social responsibility, and product quality, significantly impacting public perception. A strong reputation fosters trust, crucial for customer loyalty and attracting top talent. Negative publicity, such as product recalls or ethical breaches, can severely damage brand value and financial performance. Maintaining a positive image involves consistent stakeholder engagement and transparent communication. In 2024, Teledyne's stock performance was closely watched, with its reputation influencing investor confidence.

- Teledyne's 2024 stock price fluctuated, reflecting market sentiment and public perception.

- Ethical conduct and social responsibility are increasingly vital for corporate success.

- Product quality directly impacts customer satisfaction and brand reputation.

- Transparent communication is crucial for managing public perception effectively.

Teledyne focuses on employee well-being with safety initiatives. Diversity and inclusion programs are actively promoted within the company. In 2024, community investment reached $2.5 million.

| Aspect | Details | 2024 Data |

|---|---|---|

| Workplace Safety | Decrease in incidents | 8% Reduction |

| Diversity & Inclusion | Diverse workforce initiatives | Reported diverse backgrounds |

| Community Investment | Support for initiatives | $2.5M invested |

Technological factors

Teledyne Technologies faces constant technological shifts. Innovation is key to staying ahead in its markets. In 2024, the company invested heavily in R&D, spending over $500 million to fuel new product development. This helps them avoid their products becoming outdated. Their focus remains on advanced imaging and aerospace tech.

Teledyne Technologies heavily invests in research and development to stay ahead. In 2024, R&D spending was a significant portion of revenue. Government contracts further boost their R&D capabilities, fostering innovation. This focus allows Teledyne to improve existing products and create new technologies. Their continuous investment is key for future growth.

Miniaturization and increased efficiency are critical technological factors for Teledyne. The space electronics sector and others are driving demand for smaller, more efficient components. Teledyne excels in developing these technologies. In 2024, the global market for miniaturized components was valued at $150 billion, growing annually at 7%. Teledyne's focus on this area supports its competitive edge.

Advancements in Imaging and Sensing Technologies

Teledyne Technologies heavily relies on advancements in imaging and sensing technologies. These advancements, including infrared and thermal imaging, are crucial for product development. The market for these technologies is expanding, with the global thermal imaging market projected to reach $8.6 billion by 2025. Teledyne's ability to innovate in this area directly impacts its revenue and market share.

- Teledyne's Digital Imaging segment generated $1.9 billion in revenue in 2023.

- The global infrared imaging market is expected to grow at a CAGR of 7.5% from 2024 to 2030.

Cybersecurity Threats

Teledyne Technologies, as a technology-driven company, is highly susceptible to cybersecurity threats. These threats can lead to data breaches, financial losses, and reputational damage. The company must invest heavily in cybersecurity measures, including advanced firewalls and employee training, to protect its sensitive information. In 2024, the global cybersecurity market was valued at $200 billion, projected to reach $300 billion by 2027.

- Data breaches can cost companies millions.

- Cybersecurity insurance is a growing expense.

- Ransomware attacks are on the rise.

- Cloud security is a major concern.

Teledyne heavily invests in R&D, with over $500 million spent in 2024. They focus on miniaturization and advanced imaging technologies. Cybersecurity remains a significant concern due to rising threats.

| Factor | Impact | Data |

|---|---|---|

| R&D Investment | Product Innovation | $500M+ in 2024 |

| Miniaturization Market | Competitive Advantage | $150B in 2024, 7% annual growth |

| Cybersecurity Threats | Risk Mitigation | Market valued $200B in 2024, growing |

Legal factors

Teledyne Technologies faces legal hurdles, ensuring compliance with antitrust laws and anti-corruption measures. Export controls and environmental regulations also demand strict adherence. In 2024, the company allocated a significant budget for legal and compliance, reflecting the complex regulatory landscape. Failure to comply could result in hefty fines and operational restrictions.

Teledyne Technologies heavily relies on government contracts, making it subject to stringent regulations. These rules cover everything from bidding to performance, ensuring fair practices. In 2024, government contracts accounted for a substantial portion of Teledyne's revenue, underscoring the importance of regulatory compliance. Failure to adhere to these regulations could result in penalties or loss of contracts, impacting financial performance. Staying compliant is vital for Teledyne's continued success in the government sector.

Teledyne Technologies must adhere to environmental laws. This includes rules on emissions, waste, and hazardous substances. Compliance with RoHS and REACH is crucial for its products. In 2024, environmental fines for non-compliance in similar industries averaged $500,000. Teledyne's actions directly impact these costs.

Workplace Health and Safety Regulations

Teledyne Technologies is legally obligated to adhere to workplace health and safety regulations across all its operations. These regulations, such as those enforced by OSHA in the U.S. and similar bodies globally, mandate safe working conditions. Compliance involves implementing safety protocols, providing necessary protective equipment, and conducting regular safety training. Failure to comply can result in significant penalties, including fines and legal action, as well as reputational damage.

- OSHA inspections increased by 5% in 2024, reflecting heightened scrutiny.

- Average fines for safety violations rose by 7% in 2024.

- Teledyne's legal and compliance costs increased by 3% in 2024.

Intellectual Property Laws

Teledyne Technologies heavily relies on intellectual property, particularly patents, to secure its technological advantages. Strong IP protection is crucial in the competitive aerospace and defense industries, where Teledyne operates. The company actively seeks and maintains a robust portfolio of patents to safeguard its innovations and market position. In 2024, Teledyne's R&D spending was approximately $700 million, underscoring its commitment to innovation and IP creation.

- Patents: Teledyne holds numerous patents globally.

- R&D Investment: Around $700 million in 2024.

- Competitive Advantage: IP protects market position.

- Legal Enforcement: Actively defends its IP rights.

Teledyne must adhere to legal standards like antitrust and anti-corruption laws, and environmental regulations. Government contracts demand compliance, impacting revenue substantially. Intellectual property, particularly patents, protects its technological advantages; in 2024, R&D spending reached about $700 million. Non-compliance risks fines and contract loss, impacting financial performance, so staying compliant is vital for continued success.

| Legal Area | Regulatory Compliance | 2024 Impact/Data |

|---|---|---|

| Antitrust & Anti-Corruption | Adherence to laws | Compliance costs up 3% |

| Government Contracts | Bidding to performance | Avg. fine for violations: +7% |

| Environmental Regulations | Emissions, waste, hazardous substances | Environmental fines in similar inds.: ~$500,000 |

| Workplace Safety | OSHA, safety protocols, equipment, training | OSHA inspections +5% |

| Intellectual Property | Patents, R&D investment | R&D spending: ~$700M in 2024 |

Environmental factors

Teledyne's environmental segment offers instruments and sensors for monitoring air and water quality. In 2024, the global environmental monitoring market was valued at approximately $18.5 billion. This includes sensors crucial for climate change research, aligning with growing environmental concerns. The company's involvement positions them for growth as environmental regulations tighten. The environmental monitoring market is projected to reach $25 billion by 2028.

Climate change poses physical risks to Teledyne's infrastructure, potentially disrupting operations. Indirect financial risks, such as supply chain disruptions, could elevate expenses. Extreme weather events, like those causing $100 billion+ in damages annually, can impact operations. The company's exposure to these risks requires strategic adaptation.

Teledyne Technologies focuses on reducing its environmental impact. The company has set goals to lower greenhouse gas emissions from its facilities. For example, in 2024, Teledyne reported a 10% reduction in emissions. They are investing in energy-efficient technologies and sustainable practices.

Waste Minimization and Recycling

Teledyne Technologies focuses on waste minimization and recycling, aligning with environmental responsibility. The company implements initiatives to reduce waste, encourage recycling, and handle waste materials responsibly. These efforts comply with international environmental standards. In 2024, Teledyne invested $1.5 million in waste reduction programs.

- Waste Reduction: 10% reduction in waste generation by 2025.

- Recycling Rate: Aiming for 75% recycling rate across all facilities by 2026.

- Compliance: 100% compliance with all environmental regulations.

Sustainable Practices in Operations

Teledyne Technologies is actively integrating sustainable practices into its operations. This includes managing energy consumption and investing in energy-saving projects. The company is also exploring the use of renewable energy sources to reduce its environmental impact. In 2024, Teledyne reported a 10% reduction in energy use across key facilities. This is part of a larger initiative to align with environmental standards.

- Energy efficiency programs reduced carbon footprint.

- Investing in solar energy projects.

- Compliance with environmental regulations.

Teledyne addresses environmental factors through its monitoring products, catering to a $18.5 billion market in 2024. It actively works to lower its environmental footprint by reducing greenhouse gas emissions and improving waste management. Climate risks and stringent environmental regulations drive the firm's strategic adaptions.

| Environmental Aspect | Teledyne's Actions | Key Metrics (2024/2025 Targets) |

|---|---|---|

| Emissions Reduction | Invests in energy-efficient tech and sustainable practices. | 10% emissions cut in 2024; aiming for further reductions. |

| Waste Management | Waste reduction, recycling, responsible handling of waste. | Waste reduction, target by 2025: 10% reduction |

| Sustainable Practices | Managing energy use, using renewable energy sources | Energy Use - 10% reduction across sites in 2024 |

PESTLE Analysis Data Sources

The analysis is informed by diverse sources, including government databases, market research firms, and industry publications.