Foschini Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foschini Group Bundle

What is included in the product

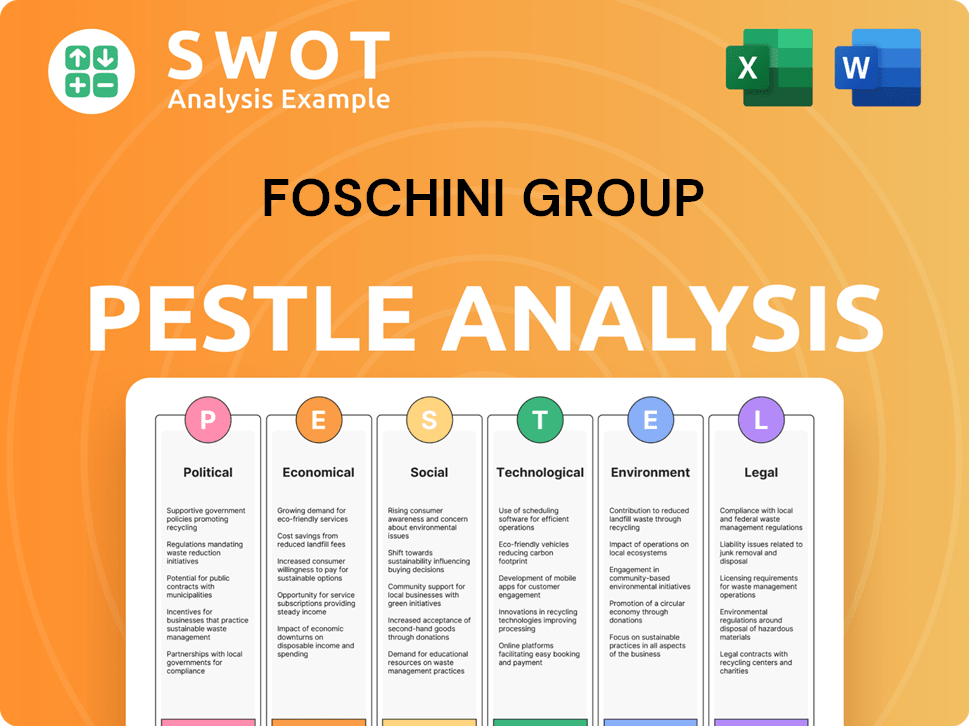

Analyzes the Foschini Group through Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Foschini Group PESTLE Analysis

The content you see is the complete Foschini Group PESTLE analysis. This is the identical document you'll download immediately after purchase. It's fully formatted and contains all the presented information.

PESTLE Analysis Template

Navigate the dynamic world surrounding Foschini Group with our insightful PESTLE Analysis. We delve into crucial Political factors impacting the brand's operations and growth. Explore the Economic landscape affecting consumer behavior and purchasing power. Understand how Social trends shape consumer preferences and brand perceptions. Analyze Technological advancements relevant to Foschini Group's business models and innovation. Identify the Legal & Environmental forces impacting their strategies. Download the full analysis for a complete market intelligence!

Political factors

TFG's operations are sensitive to political stability in South Africa and elsewhere. Policy shifts affect trade, taxes, and labor. For instance, South Africa's 2024 budget included tax adjustments. These changes can directly influence TFG's profitability and operational strategies.

TFG's international operations expose it to trade agreements and tariffs. For example, in 2024, the EU imposed tariffs on certain Chinese goods, potentially impacting TFG's supply chain. These changes directly affect the cost of goods sold (COGS). Fluctuations in tariffs can necessitate adjustments to pricing strategies, impacting profit margins.

Government regulations significantly impact TFG. Consumer protection laws, product safety standards, and advertising rules directly affect TFG's operations and compliance costs. For example, in 2024, the South African government implemented stricter advertising regulations, increasing compliance expenses by 5%. These regulations necessitate adjustments in product sourcing, marketing strategies, and operational procedures. These can include the latest changes in the Consumer Protection Act.

Political Events and Social Unrest

Political instability and social unrest in South Africa pose significant risks to The Foschini Group (TFG). These events can lead to store closures, supply chain disruptions, and decreased consumer spending. For instance, the July 2021 unrest in South Africa resulted in widespread looting and damage to retail stores, impacting TFG's operations. TFG needs to navigate these challenges effectively to maintain its financial performance.

- In FY2024, TFG reported a 9.2% increase in retail turnover in South Africa, indicating resilience despite socio-political challenges.

- The company has implemented strategies to mitigate risks, including diversifying its supply chain and enhancing security measures at its stores.

Black Economic Empowerment (BEE) Policies

In South Africa, The Foschini Group (TFG) operates under Black Economic Empowerment (BEE) policies designed to transform the economy. TFG's BEE status is crucial, impacting its ability to secure government contracts and access incentives. Companies are rated on their BEE compliance, with higher ratings potentially leading to more favorable business opportunities. TFG's commitment to BEE affects its stakeholder relationships and operational environment.

- TFG's BEE score is regularly assessed and updated to maintain compliance.

- BEE compliance is a key factor in government procurement processes in South Africa.

- Failure to meet BEE requirements can lead to penalties or exclusion from certain contracts.

Political stability is crucial for TFG, as it directly impacts operations through policy shifts like tax adjustments and trade agreements. Tariffs imposed by the EU on Chinese goods can affect TFG's supply chain, impacting costs. Government regulations, such as stricter advertising rules, drive compliance expenses, and any instability presents significant risks.

| Aspect | Details |

|---|---|

| Tax Adjustments (South Africa) | Impact profitability, with adjustments influencing operational strategies. |

| EU Tariffs (2024) | Potentially impacts COGS and necessitates pricing adjustments. |

| Advertising Regulations (South Africa, 2024) | Increased compliance costs by 5%. |

Economic factors

Economic growth significantly influences consumer spending, a key driver for retailers like Foschini Group (TFG). Increased disposable income, a direct result of positive economic trends, typically boosts sales. For instance, South Africa's GDP growth in 2024 is projected at around 1.0%, impacting consumer confidence. TFG's performance is closely tied to these economic indicators.

High inflation diminishes consumer buying power. In South Africa, the inflation rate was 5.3% in March 2024. Elevated interest rates raise TFG's borrowing costs. The prime interest rate in South Africa is currently at 11.75% as of May 2024. This can reduce sales and increase customer debt.

The Foschini Group (TFG) operates in multiple countries, making it vulnerable to currency exchange rate fluctuations. Unfavorable exchange rate movements can increase the cost of imported merchandise, affecting profit margins. In fiscal year 2024, TFG reported that currency fluctuations impacted their international sales. These fluctuations necessitate careful financial hedging strategies.

Unemployment Rates

High unemployment in South Africa diminishes consumer spending, crucial for retail. The Foschini Group faces challenges as joblessness limits the customer base and disposable income. Youth unemployment remains a significant concern, further constricting market growth. This impacts the company's revenue and profitability directly.

- South Africa's unemployment rate was 32.9% in Q4 2023.

- Youth unemployment (ages 15-24) was approximately 60% in late 2023.

- Reduced consumer spending directly impacts retail sales performance.

- Foschini Group's financial results are sensitive to economic downturns.

Income Levels and Distribution

Income levels and their distribution significantly shape consumer spending habits. TFG's wide range of brands targets different income brackets. Changes in how income is spread out can shift demand across its portfolio. For example, in 2024, South Africa's Gini coefficient, a measure of income inequality, remained high at around 0.65, influencing consumer behavior.

- High income inequality can lead to varied sales performances across TFG's brands.

- Brands targeting lower-income groups may experience increased or decreased sales depending on economic conditions.

- TFG needs to understand these shifts to manage its inventory and marketing effectively.

- Consumer confidence levels are crucial to monitor.

Economic factors greatly impact Foschini Group (TFG). South Africa's GDP growth forecast for 2024 is around 1.0%, affecting consumer spending. Inflation at 5.3% in March 2024, and a prime interest rate of 11.75% (May 2024) also affect consumer behavior. Unemployment at 32.9% (Q4 2023) adds to the challenge.

| Economic Indicator | Impact on TFG | Data (2024) |

|---|---|---|

| GDP Growth | Influences Consumer Spending | Projected 1.0% |

| Inflation Rate | Reduces Buying Power | 5.3% (March) |

| Prime Interest Rate | Increases Borrowing Costs | 11.75% (May) |

Sociological factors

Consumer preferences are constantly changing, impacting TFG's offerings. Fashion trends and lifestyle choices determine product demand. In 2024, online retail sales in South Africa reached R189.6 billion. Staying current with trends is crucial for TFG to remain competitive. The company must adapt to evolving tastes.

South Africa's population growth and evolving demographics are key. The Foschini Group (TFG) must adapt to these changes. Urbanization continues, with more people in cities. This shifts consumer needs and preferences. A young, growing population boosts demand for fashion and lifestyle goods. In 2024, South Africa's population was about 62 million.

Growing consumer focus on sustainability and ethics shapes fashion choices. TFG's commitment to waste reduction and ethical sourcing is crucial. In 2024, sustainable fashion market share rose, reflecting consumer demand. Ethical sourcing boosts brand reputation and sales. This trend highlights the need for TFG to prioritize eco-friendly practices.

Lifestyle Changes and Cultural Influences

Lifestyle shifts significantly impact The Foschini Group (TFG). For example, the rising wellness trend influences demand for activewear. Casualization in workplaces impacts clothing choices. Cultural trends also shape consumer preferences, affecting product offerings. TFG must stay agile to adapt.

- 2024: Activewear sales grew by 15% due to wellness trends.

- 2024: Casual clothing sales increased by 10% in response to relaxed dress codes.

Consumer Confidence and Sentiment

Consumer confidence significantly influences spending on Foschini Group's products. When confidence is high, consumers tend to spend more on fashion and homeware. Conversely, economic downturns can lead to decreased spending. In South Africa, consumer confidence has fluctuated. For example, in Q4 2024, consumer confidence was at -10 index points, reflecting economic uncertainty.

- Consumer confidence indices are key indicators.

- Economic instability can reduce spending.

- Foschini's performance is linked to consumer sentiment.

- Monitoring these trends is crucial for business strategy.

Consumer preferences evolve, affecting TFG's offerings, driven by fashion and lifestyle shifts. South Africa's population dynamics—growth, urbanization—influence demand for goods. Focus on sustainability, ethical sourcing is growing.

| Factor | Impact | 2024 Data |

|---|---|---|

| Fashion Trends | Shapes product demand. | Online retail sales R189.6B |

| Demographics | Urbanization impacts consumer needs. | South Africa's population 62M |

| Sustainability | Drives ethical choices. | Sustainable fashion market share up |

Technological factors

E-commerce's surge demands TFG's digital investment. Online retail is booming; in 2024, e-commerce accounted for about 10% of total retail sales in South Africa. This forces TFG to enhance its platforms and digital infrastructure. TFG reported a 22.4% increase in online sales for the year ended March 2024, signaling the need for robust digital strategies. This ensures competitiveness and broader market reach.

Technological advancements are transforming retail operations, impacting Foschini Group's supply chain, inventory, and customer experience. Implementing technologies like AI-powered analytics can optimize stock levels, potentially reducing holding costs by up to 15% in 2024. Enhanced in-store tech, such as interactive displays, can boost sales conversion rates, observed to increase by approximately 10% in pilot programs during early 2025. These tech integrations also streamline operations, increasing overall efficiency.

Data analytics is crucial. TFG uses it to understand customers, personalize marketing, and refine product choices. This boosts sales and loyalty. TFG's digital sales grew by 19.4% in the first half of 2024, showing the impact of these strategies. They are investing heavily in AI and machine learning to enhance this further.

Cyber Security Threats

As The Foschini Group (TFG) expands its digital footprint, it confronts escalating cyber security threats. These threats can cause data breaches, operational interruptions, and harm to its reputation. For instance, in 2024, the average cost of a data breach was $4.45 million globally. TFG must invest heavily in robust cyber defenses.

- Data breaches can lead to significant financial losses.

- Operational disruptions can affect sales and customer service.

- Reputational damage can erode customer trust.

Mobile Technology and Social Media

Mobile technology and social media significantly shape consumer behavior. TFG must use these channels for marketing and customer engagement. In 2024, mobile commerce accounted for over 70% of e-commerce sales globally. Social media marketing spend is projected to reach $226 billion by 2027. TFG can boost brand visibility and sales by optimizing its mobile presence and social media strategies.

- Mobile commerce share of e-commerce sales (2024): Over 70%

- Projected social media marketing spend (2027): $226 billion

TFG leverages tech for e-commerce growth; online sales rose by 22.4% in March 2024. AI optimizes stock, potentially cutting costs. Cyber security investment is critical due to rising threats. Mobile tech/social media boost sales.

| Aspect | Details | Data |

|---|---|---|

| E-commerce Growth | Digital sales increase | 22.4% (March 2024) |

| Tech Integration | AI & Stock optimization | Cost reduction up to 15% |

| Mobile Commerce | % of E-commerce sales | 70% (2024) |

Legal factors

The Foschini Group (TFG) faces legal obligations regarding labor laws across its operational regions. These laws encompass minimum wage stipulations, impacting cost structures. Compliance also involves adhering to working hour regulations, affecting operational scheduling. Employee benefits, like healthcare and retirement plans, are another legal factor, with costs varying by location. For example, in South Africa, minimum wage increased in 2024.

Consumer protection laws, focusing on product quality and warranties, significantly influence TFG's operations. The National Consumer Tribunal handles disputes, with 2,200 cases in 2024. Compliance requires robust quality control and fair return policies. TFG must adhere to the Consumer Protection Act. This impacts customer service and potential litigation risks.

TFG must comply with POPIA, ensuring customer data is handled securely. This includes obtaining consent for data use and providing data access. Non-compliance can lead to significant penalties, like fines up to R10 million. In 2024, data breaches cost companies an average of $4.45 million globally.

Import and Export Regulations

Import and export regulations significantly influence TFG's operations, particularly its supply chain and product costs. Changes in tariffs, quotas, and trade agreements directly impact the profitability of imported goods. Compliance with these regulations adds complexity and potential costs, affecting sourcing decisions and market access. For example, in 2024, TFG likely navigated evolving trade policies.

- Tariffs and duties on imported textiles and apparel can substantially raise costs.

- Trade agreements, like those with the EU, can create both opportunities and challenges.

- Stringent import regulations can cause delays and increased expenses.

- Currency fluctuations affect the final price of imported goods.

Intellectual Property Laws

Intellectual property laws are vital for The Foschini Group (TFG) to protect its brand identity and prevent unauthorized use of its designs. These laws, including trademarks and copyright, safeguard TFG's unique offerings in the competitive retail market. TFG needs to actively monitor and enforce these rights to maintain its brand value and consumer trust. In 2024, the global market for counterfeit goods was estimated at $2.8 trillion, emphasizing the importance of IP protection.

- Trademark registrations are key to protecting brand names and logos.

- Copyright protects original designs and creative works.

- IP enforcement includes legal action against infringers.

- TFG's IP strategy supports its long-term profitability.

TFG must comply with labor laws, including minimum wage. In South Africa, minimum wage rose in 2024. This impacts cost structures.

Consumer protection laws are another key factor; The National Consumer Tribunal handled about 2,200 cases in 2024, and POPIA compliance is also essential.

Import/export regulations affect TFG's supply chain. Currency fluctuations and trade agreements add complexities; in 2024, TFG faced evolving trade policies, like tariffs.

Intellectual property laws protect TFG’s brand. The counterfeit goods market in 2024 was worth $2.8 trillion, emphasizing the need for IP protection through trademarks and copyright.

| Legal Area | Impact on TFG | 2024 Data/Fact |

|---|---|---|

| Labor Laws | Affects operational costs | Minimum wage increase in South Africa |

| Consumer Protection | Customer service & litigation risk | 2,200 cases in the National Consumer Tribunal |

| Data Protection (POPIA) | Fines for non-compliance | Global data breaches cost $4.45 million on average |

| Import/Export | Supply chain & product costs | Navigated evolving trade policies; Tariffs influence costs |

| Intellectual Property | Brand protection | $2.8 trillion global counterfeit market |

Environmental factors

Environmental sustainability is a growing concern for the fashion industry. This includes resource use, waste, and carbon emissions, which pressure TFG. In 2024, the fashion industry's carbon footprint was significant. The Ellen MacArthur Foundation reports that fashion generates 10% of global carbon emissions. TFG must adapt to stay competitive and meet consumer demands.

Climate change poses significant risks for Foschini Group. Supply chain disruptions are possible due to extreme weather. Increased energy costs and potential damage to physical stores could follow. For example, 2024 saw a 15% rise in weather-related supply chain issues. The company must adapt to these challenges.

Waste management and recycling regulations are critical for TFG. Compliance necessitates investment in waste reduction and recycling programs. South Africa's waste legislation, like the National Environmental Management: Waste Act, impacts TFG's operations. In 2024, the focus is on reducing landfill waste and increasing recycling rates. TFG is investing in sustainable packaging and waste diversion strategies to meet these regulatory requirements.

Ethical Sourcing and Supply Chain Transparency

TFG faces growing pressure to ensure ethical sourcing and supply chain transparency. Consumers and stakeholders increasingly demand visibility into labor practices and environmental impacts. Modern slavery and other ethical concerns require TFG to implement robust monitoring and compliance programs. This includes auditing suppliers and tracing product origins to demonstrate responsible practices.

- In 2024, the global ethical fashion market was valued at $6.35 billion, projected to reach $8.2 billion by 2025.

- TFG's 2024 Integrated Report highlights its commitment to supply chain transparency.

- The company conducts regular supplier audits, with 98% of strategic suppliers assessed in 2024.

- TFG aims to improve traceability of key raw materials by 2025.

Water Usage and Management

Water scarcity and regulations on water usage are critical for TFG, especially in textile manufacturing. Stricter water management is becoming increasingly necessary due to climate change and rising demand. This affects production costs and supply chain reliability. TFG must adopt water-efficient practices and consider water risk assessments.

- South Africa, where TFG has significant operations, faces increasing water stress.

- Textile industry is water-intensive, making it vulnerable to water-related disruptions.

- Water-efficient technologies and sustainable sourcing are key strategies.

Environmental factors significantly impact TFG's operations and strategy. Climate change poses risks like supply chain disruptions, with a 15% rise in weather-related issues in 2024. Ethical sourcing is crucial, the ethical fashion market reached $6.35 billion in 2024. TFG focuses on sustainable practices and supply chain transparency.

| Environmental Aspect | Impact on TFG | 2024/2025 Data |

|---|---|---|

| Climate Change | Supply chain disruption, increased costs | 15% rise in weather-related issues (2024) |

| Waste Management | Regulatory compliance, sustainable packaging | Focus on reducing landfill waste and recycling |

| Ethical Sourcing | Meeting consumer demands, brand reputation | Ethical fashion market at $6.35 billion (2024) |

PESTLE Analysis Data Sources

This PESTLE Analysis uses official reports from global bodies, governmental publications, and market research.