Hartford Financial Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hartford Financial Services Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean, distraction-free view optimized for C-level presentation, ensuring impact.

What You See Is What You Get

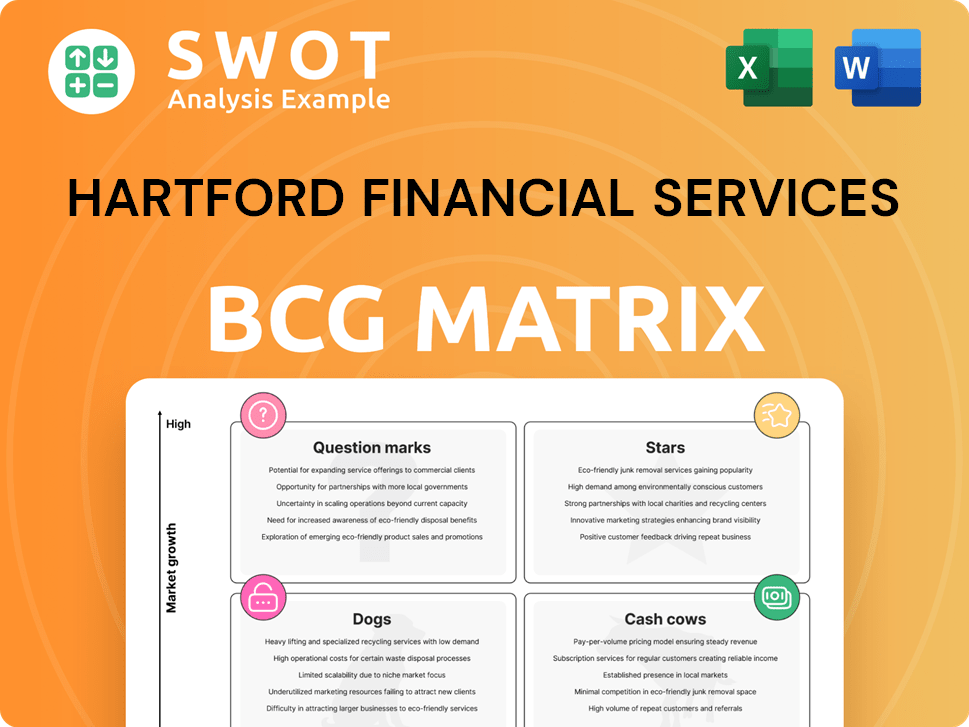

Hartford Financial Services BCG Matrix

The Hartford Financial Services BCG Matrix you're previewing is the final document you'll receive. It's a complete, ready-to-use report for your strategic planning, with no differences after purchase.

BCG Matrix Template

Hartford Financial Services' BCG Matrix reveals its diverse product portfolio across the insurance and financial services landscapes. This preview gives a glimpse into potential Stars, Cash Cows, Dogs, and Question Marks. Understand how different offerings contribute to growth and profitability. Identify areas for investment and optimization, crucial for strategic decision-making.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hartford's Commercial Lines is a star in its BCG Matrix, showing robust growth. The segment's written premiums hit $3.7B in Q1 2025, a 10% rise from Q1 2024. They excel in the Small Commercial sector, maintaining top digital capabilities for six years. Renewal written pricing reached 6.5% overall.

The Personal Lines segment at Hartford Financial Services is a "Star" in the BCG Matrix. It has shown a remarkable improvement in underwriting results. Net income surged to $154 million in Q4 2024, a significant increase from $34 million in Q4 2023. The combined ratio improved to 85.8 from 101.2, demonstrating increased profitability.

Hartford's digital capabilities are a star in its BCG matrix. The company leverages AI and data analytics to enhance its competitive advantage. Hartford's 'Hartford Next' plan includes significant digital investments. In 2024, they focused on tech to improve business outcomes. For example, in 2023, The Hartford's net income increased by 11%.

Brand Recognition

The Hartford, positioned as a "Star" in the BCG matrix, has significantly refreshed its brand. This update, featuring a modernized stag logo, underscores the company's stability and agility. The new branding aims to resonate with customers by emphasizing clarity and connection, symbolizing a forward-looking approach.

- The Hartford's brand refresh included a modernized stag logo.

- The rebranding aimed to highlight the company's strength and customer focus.

- The new design improves legibility across various platforms.

Strong Financial Performance

The Hartford, a "Star" in the BCG Matrix, shows robust financial health. They've achieved consistent growth, notably with an 11% rise in net income to $848 million in Q4 2024. This success is fueled by strong underwriting and cost control. Their core earnings ROE hit 16.7%, highlighting their efficient operations.

- Net income of $848 million in Q4 2024.

- 11% increase from Q4 2023.

- Core earnings ROE of 16.7%.

- Consistent earnings beats.

Hartford's segments labeled as "Stars" in the BCG matrix, showcase strong performance and growth potential. The Commercial Lines sector saw written premiums reach $3.7B in Q1 2025, up 10% from Q1 2024. In Q4 2024, net income reached $848M, marking an 11% increase YoY.

| Segment | Q1 2025 Premium | Q4 2024 Net Income |

|---|---|---|

| Commercial Lines | $3.7B (10% YoY growth) | N/A |

| Personal Lines | N/A | $154M (Q4 2024) |

| Overall | N/A | $848M (11% YoY growth) |

Cash Cows

The Group Benefits segment is a cash cow for Hartford Financial Services. It has consistently delivered strong margins, with core earnings margin at 8.7% and net income margin at 8.8%. In Q1 2025, net income reached $133 million, up from $108 million in Q1 2024, showcasing its stability. Core earnings for the same period increased to $136 million from $107 million.

The Hartford's underwriting discipline prioritizes profitability over simply increasing premiums, a hallmark of its "Cash Cow" status. This approach involves retaining profitable policies while exiting less lucrative markets. In 2024, the company's combined ratio improved to 95.2% from 98% in 2023, reflecting improved margins.

The Hartford's diversified business model, spanning P&C insurance, Group Benefits, and Hartford Funds, is a key strength. This diversification reduces reliance on any single area, offering stability. They provide life, pension, auto, home, and commercial insurance. This variety allows The Hartford to tap into many market segments. In Q4 2023, Commercial Lines saw a 6% increase in net written premiums.

Effective Risk Management

The Hartford Financial Services' "Cash Cows" status is bolstered by robust risk management. This includes leveraging data analytics and AI for market navigation and sustained profitability. They employ AI to automate tasks, boosting efficiency and enhancing client experiences. AI algorithms process applications, and text processing directs customer requests effectively.

- In 2024, The Hartford's net income rose to $2.2 billion, reflecting effective risk management.

- Their AI initiatives have reduced processing times by 15% in key areas.

- The company's expense ratio improved to 30.1%, indicating better operational efficiency.

- Hartford's investment portfolio generated $1.1 billion in net investment income, illustrating financial stability.

Investment Portfolio

The Hartford's investment portfolio acts as a cash cow, significantly boosting its financial health. A strong investment yield directly supports the company's cash generation capabilities. The portfolio is diversified and holds high ratings, ensuring a consistent flow of net investment income. In Q4 2024, net investment income for Commercial Lines reached $479 million, up from $435 million in Q4 2023.

- Generates consistent net investment income.

- The portfolio is diversified.

- Net investment income for Commercial Lines was $479 million in Q4 2024.

- This is up from $435 million in Q4 2023.

Hartford's Group Benefits is a cash cow, showing consistent profitability. In Q1 2025, core earnings reached $136 million, up from $107 million in Q1 2024, due to effective risk management. Their focus on profitability over volume, alongside a diversified business model, further solidifies this status. The investment portfolio in Q4 2024 brought in $479 million.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Core Earnings | $136 million | $107 million |

| Net Income | $133 million | $108 million |

| Combined Ratio | N/A | 98% |

| Net Investment Income (Commercial Lines, Q4) | N/A | $435 million |

Dogs

Legacy systems at The Hartford Financial Services can be a drag on efficiency and innovation. Outdated tech may hike up operational costs, a concern for any business. The Hartford has been pushing digital transformation to modernize its operations, but the switch from old systems needs constant effort. The Hartford's move to the cloud aims to cut costs and boost transparency. In 2024, The Hartford's tech investments totaled approximately $300 million to bolster digital capabilities.

In Hartford's BCG Matrix, some Personal Insurance areas, especially those hit by disasters or high costs, are "Dogs." Personal Insurance net income dropped to $5M in Q1 2025 from $34M in Q1 2024. This was due to $187M in catastrophe losses and increased expenses. The Hartford is actively trying to boost profits in these personal lines through corrective actions.

Hartford's Employee Benefits segment includes products like supplemental health, which may have lower profitability. In 2024, higher loss ratios in group disability and supplemental health impacted net income. The group disability loss ratio was 69.0%, improving slightly but still a concern. Careful management is crucial for these underperforming products.

Geographic Concentration

The Hartford, categorized as a "Dog" in the BCG matrix, faces geographic concentration challenges. Its primary operations are within the United States, exposing it to localized economic impacts and regulatory shifts. This focus, while strong domestically, potentially restricts growth compared to globally diversified competitors. Despite this, Hartford expanded its presence by opening a service company in Singapore in January 2024.

- US market focus creates both strengths and weaknesses.

- Limited international diversification.

- New Singapore operations could change the situation.

- Vulnerable to US economic fluctuations.

Commoditization of Insurance Products

The commoditization of insurance products presents a challenge for Hartford Financial Services, potentially leading to price wars and shrinking profit margins. The insurance sector is becoming more competitive, with new players and tech disruptions challenging established practices. However, Hartford is actively countering this by strengthening its pricing and risk management strategies. This proactive approach aims to maintain profitability amid evolving market dynamics.

- In 2023, the U.S. property and casualty insurance industry saw a 9.3% increase in net written premiums.

- Hartford's focus on enhanced risk management includes using advanced analytics to assess and price risks more accurately.

- The company's strategic initiatives aim to improve customer experience and retention, which could offset price pressures.

The Hartford's "Dogs" include struggling Personal Insurance lines and certain Employee Benefits offerings. Personal Insurance net income fell to $5M in Q1 2025 from $34M in Q1 2024 due to catastrophe losses. Employee Benefits faced margin pressures.

| Area | Details | 2024 Data |

|---|---|---|

| Personal Insurance | Impacted by disasters and costs. | Q1 Net Income: $34M |

| Employee Benefits | Facing loss ratio issues. | Group Disability Loss Ratio: 69.0% |

| Geographic Concentration | Primarily US-focused. | New Singapore service company opened in January 2024 |

Question Marks

Insurtech partnerships are a high-growth area for The Hartford, potentially boosting its market position. These collaborations aim to modernize the company's digital capabilities and enhance customer experience. For instance, in 2024, The Hartford increased its investment in digital transformation by 15%. Success hinges on seamless integration and high customer adoption rates.

Expansion into new markets is a strategic move for The Hartford. Geographic expansion, especially into emerging markets, provides growth potential. The Hartford's service company in Singapore is an example. However, it carries risks. The Hartford has a presence in the US, UK, and other international locations.

The cyber insurance market is a question mark for The Hartford, showing rapid growth but facing evolving risks. Cyber threats, including ransomware, pose significant risks to financial services. In 2024, cyber insurance premiums are projected to reach $20 billion. The Hartford is investing in cybersecurity, requiring continuous adaptation.

Data Analytics and AI

Data analytics and AI investments at The Hartford show high potential. They aim to improve underwriting, pricing, and customer service, requiring substantial resources. The claims department uses data to offer innovative services. Data analytics identifies patterns and suggests additional treatments. The company also creates customized insurance plans.

- The Hartford invested $200 million in digital transformation initiatives in 2024.

- AI-driven fraud detection saved the company $50 million in 2024.

- Customer satisfaction scores increased by 15% due to AI-powered services.

- Personalized insurance plans grew by 20% in 2024, driven by data analytics.

Sustainable and Responsible Investing

Sustainable and Responsible Investing (SRI) presents a growth area for The Hartford, reflecting increasing investor demand. However, this shift demands strategic adjustments and enhanced transparency in investment practices. The Hartford has committed to net-zero emissions, a crucial step. Yet, specific implementation plans remain undisclosed, creating uncertainty.

- The global sustainable investment market was valued at $35.3 trillion in 2020.

- The Hartford's net-zero commitment lacks detailed, public strategies for emissions reduction.

- Clear strategies are needed to align investments with sustainability goals.

The cyber insurance market is a question mark for The Hartford, characterized by rapid growth and evolving risks, particularly from cyber threats like ransomware. In 2024, cyber insurance premiums reached $20 billion. This market requires continuous adaptation and significant investment.

Data analytics and AI investments also represent a question mark, demanding substantial resources to improve underwriting, pricing, and customer service. The claims department uses data to offer innovative services. These initiatives have demonstrated significant potential, with AI-driven fraud detection saving the company $50 million in 2024.

Sustainable and Responsible Investing (SRI) is a question mark, highlighting increased investor demand. However, this shift demands strategic adjustments and enhanced transparency in investment practices, creating uncertainty. The global sustainable investment market reached $35.3 trillion in 2020.

| Category | Description | 2024 Data |

|---|---|---|

| Cyber Insurance Market | Rapid growth, evolving risks | $20B in premiums |

| Data Analytics & AI | Improve underwriting | $50M savings |

| SRI | Investor demand | $35.3T market (2020) |

BCG Matrix Data Sources

The Hartford Financial Services BCG Matrix leverages financial statements, market share data, and industry reports for data-backed positions. We also use market research and analyst reports.