Hartford Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hartford Financial Services Bundle

What is included in the product

Evaluates how external factors influence Hartford's strategy in Political, Economic, Social, etc.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

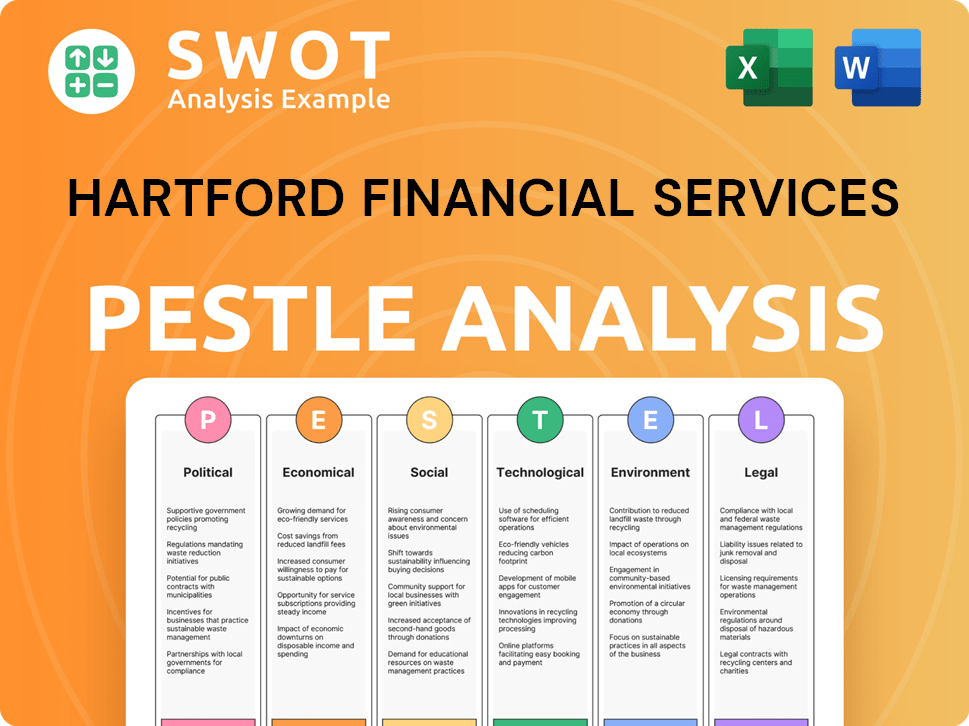

Hartford Financial Services PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Hartford Financial Services PESTLE analysis delves into key external factors.

It analyzes the political, economic, social, technological, legal, and environmental influences. Get detailed insights.

The document is ready for your strategic analysis immediately after purchase. It is as you see.

Use this as a base for understanding The Hartford and improving strategy! Ready now!

PESTLE Analysis Template

Navigate the complex world of Hartford Financial Services with our detailed PESTLE analysis. Uncover key insights into political, economic, social, technological, legal, and environmental factors. This report will help you identify risks and opportunities in the insurance industry. Understand market trends and develop winning strategies with this ready-to-use analysis. Download the full report now to get your edge!

Political factors

The Hartford faces stringent U.S. insurance regulations, impacting operations. Compliance with data privacy, anti-money laundering, and licensing is vital. In 2024, regulatory costs rose by 3% due to new state laws. Anticipating shifts is key to avoid penalties and ensure smooth business operations.

Political instability and geopolitical tensions worldwide can inject volatility into financial markets, affecting The Hartford's investment returns and financial health. For example, in Q1 2024, geopolitical risks contributed to a 5% increase in market volatility. Trade wars or regional conflicts could heighten risk assessments, possibly reducing demand for insurance products. The Hartford's 2024 annual report highlights these risks.

Government infrastructure spending significantly impacts The Hartford's surety bond market. In 2024, the U.S. government allocated billions to infrastructure projects, creating surety bond opportunities. This spending drives growth for companies like The Hartford. For example, the Infrastructure Investment and Jobs Act passed in 2021 continues to fuel construction activity.

Healthcare Policy Changes

As a major provider of group benefits, The Hartford is significantly affected by healthcare policy changes. Governmental reforms and shifts in healthcare systems directly influence their pricing strategies and the demand for employer-sponsored health coverage. The evolving landscape of healthcare policy introduces both risks and opportunities, impacting the company's financial performance. The Hartford must adapt to regulatory changes to maintain competitiveness.

- In 2024, healthcare spending in the U.S. is projected to reach nearly $4.8 trillion.

- Changes in the Affordable Care Act (ACA) could alter the number of insured individuals, affecting demand.

- The potential for increased government involvement in healthcare could influence The Hartford's product offerings.

Trade Policies and Protectionism

Trade policies and protectionism are significant political factors. Changes in these policies can affect global growth and trade patterns, indirectly impacting The Hartford. For example, rising protectionism could increase costs for businesses, affecting their insurance needs. The World Bank predicts global trade growth of 2.5% in 2024, down from 5.0% in 2022.

- Tariffs and trade wars increase costs for businesses.

- Changes in trade agreements can alter risk profiles.

- Protectionist measures may reduce international trade volumes.

The Hartford navigates complex U.S. insurance regulations. Compliance costs rose in 2024. Geopolitical risks caused market volatility, as highlighted in its 2024 report.

Infrastructure spending creates surety bond opportunities, fueled by acts like the Infrastructure Investment and Jobs Act. Healthcare policy changes impact benefit pricing. Trade policies indirectly affect business costs and insurance needs.

The evolving regulatory landscape necessitates adaptation for The Hartford's strategic financial planning and competitive positioning, influencing how they operate. These elements influence financial results. The World Bank forecasts trade growth.

| Political Factor | Impact on The Hartford | 2024 Data/Forecast |

|---|---|---|

| Insurance Regulations | Compliance costs; Operational impact | Regulatory costs +3% |

| Geopolitical Tensions | Market volatility; Investment returns | Q1 2024 volatility: +5% |

| Infrastructure Spending | Surety bond opportunities | Continued investment, fueled by 2021 Act |

| Healthcare Policy | Pricing, demand for health coverage | 2024 spending: ~$4.8T |

| Trade Policies | Affects business costs & insurance needs | Global trade growth forecast: 2.5% (World Bank) |

Economic factors

Inflation poses a risk by potentially increasing claim costs for The Hartford. Rising interest rates can boost investment income, but also affect borrowing costs. The company must actively manage its investment portfolios and adjust pricing strategies. In Q1 2024, the U.S. inflation rate was around 3.5%, impacting financial planning. The Federal Reserve's actions, like maintaining rates, are crucial for The Hartford's financial outlook.

Economic growth and consumer spending are crucial for Hartford. A robust economy boosts demand for insurance products. In 2024, U.S. GDP grew by 3.1%, reflecting positive consumer spending. Increased business activity and personal wealth drive sales of insurance and financial products.

Employment levels significantly influence The Hartford. Rising unemployment can weaken its Group Benefits segment. Diminished employment growth might decrease group insurance persistency. Economic forecasts about unemployment are crucial for the company's future. In March 2024, the U.S. unemployment rate was 3.8%, according to the Bureau of Labor Statistics.

Investment Yields and Financial Market Conditions

Investment yields and financial market conditions are crucial for The Hartford's profitability, with investment income significantly impacting its financial health. Changes in interest rates and market volatility directly influence returns from fixed-income securities and alternative assets. For instance, in Q1 2024, The Hartford's net investment income was $618 million, up from $533 million in Q1 2023. The company’s investment portfolio includes a mix of assets, making it sensitive to economic shifts.

- Q1 2024 net investment income: $618 million.

- Q1 2023 net investment income: $533 million.

- Investment portfolio includes fixed-income and alternative assets.

Rising Cost of Healthcare

The rising cost of healthcare significantly impacts The Hartford's Group Benefits segment, potentially increasing health insurance premiums. These costs directly influence pricing models, affecting both employers and individual consumers. For 2024, healthcare spending is projected to reach $4.8 trillion. This increase in healthcare expenses could lead to decreased affordability of coverage.

- Healthcare spending in the U.S. is projected to grow at an average annual rate of 5.4% from 2019 to 2028.

- In 2023, healthcare costs rose by 4.9%.

The Hartford faces economic impacts from inflation, employment, and market conditions. Inflation, about 3.5% in Q1 2024, can raise claim costs and affect pricing. U.S. GDP growth of 3.1% in 2024 indicates positive market for insurance. The Q1 2024 net investment income rose to $618 million.

| Metric | Q1 2023 | Q1 2024 |

|---|---|---|

| Net Investment Income (USD million) | $533 | $618 |

| Unemployment Rate | N/A | 3.8% (March) |

| GDP Growth (2024 est.) | N/A | 3.1% |

Sociological factors

Shifting demographics significantly affect Hartford's business. An aging population boosts demand for life insurance and long-term care. This demographic change influences group benefits offerings. In 2024, the U.S. population aged 65+ reached 58 million, driving insurance needs.

Customer expectations are shifting towards digital convenience and personalization. The Hartford must enhance its digital platforms and tailor insurance products to individual needs. For instance, in 2024, over 60% of insurance customers preferred digital claims submissions. Adapting to these changes is crucial for maintaining customer satisfaction and market competitiveness. The evolving demands are driven by technological advancements.

Social inflation, driven by litigation and liability expansions, elevates claims costs. This impacts insurers like Hartford. For example, the US property-casualty industry saw loss cost increases, with social inflation contributing significantly. These trends necessitate risk assessment and pricing adjustments. In 2024, overall loss cost inflation in the US was around 6-8%.

Workforce Trends and Talent Shortage

The Hartford Financial Services Group confronts workforce challenges, particularly a talent shortage as experienced employees retire. This necessitates proactive strategies to attract and retain skilled professionals. The insurance sector, including The Hartford, must compete for talent in specialized fields. These include underwriting, actuarial science, and technology to ensure operational efficiency and foster innovation.

- The U.S. insurance industry could face a significant talent gap, with estimates suggesting a need to fill approximately 400,000 positions by 2025, according to recent industry reports.

- The Hartford's strategic initiatives include enhanced employee benefits and development programs, which have shown a 15% increase in employee retention rates in the past two years.

- Investments in technology and automation are critical, with projections indicating that companies embracing digital transformation can improve operational efficiency by up to 20%.

Increased Focus on Mental Health

The rising emphasis on mental health significantly influences employee benefits. This trend directly affects The Hartford, a major group benefits provider. They may experience increased demand for mental health coverage and services. In 2024, the CDC reported that 21% of U.S. adults experienced mental illness. This drives companies to prioritize mental health benefits.

- Increased demand for mental health services.

- Emphasis on comprehensive coverage options.

- Potential for new product development.

- Cost implications for benefit plans.

Demographic shifts, like an aging population, drive demand for insurance products such as life insurance and long-term care, significantly impacting Hartford. The customer base now increasingly demands digital and personalized insurance options. Also, social inflation continues to elevate the costs for Hartford.

| Sociological Factor | Impact | 2024/2025 Data |

|---|---|---|

| Aging Population | Increased demand for insurance products. | U.S. 65+ population reached 58M (2024) |

| Digital Transformation | Demand for online & personalized services | 60% prefer digital claims submissions (2024) |

| Social Inflation | Increases in claims cost | Overall loss cost inflation at 6-8% in US (2024) |

Technological factors

The Hartford is navigating a landscape reshaped by technology. Digital transformation and automation are key for the insurance sector. The company is likely focused on AI, machine learning, and process automation. These efforts aim to boost efficiency in claims, underwriting, and policy management. For example, in 2024, AI adoption in insurance increased by 25% to streamline operations.

The Hartford is poised to leverage AI and generative AI. This could lead to innovations in risk assessment, fraud detection, and customer service. However, the company must address concerns about the skills gap and trust in automation. In 2024, the AI market is estimated to reach $196.63 billion.

The Hartford faces rising cybersecurity threats due to its tech reliance. Protecting client data is vital to avoid breaches. In 2024, cyberattacks cost the financial sector billions. The Hartford must invest in robust defenses to maintain trust and prevent damage. Recent data shows a 30% increase in cyberattacks on financial firms.

Use of Data Analytics and Predictive Modeling

The Hartford is increasingly reliant on advanced data analytics and predictive modeling for precise risk assessment and pricing strategies. This shift allows for a deeper understanding of risks, enhancing underwriting accuracy and decision-making processes. By leveraging these technologies, The Hartford can optimize its portfolio, potentially boosting profitability. For instance, in 2024, the company invested $150 million in AI and data analytics.

- Risk Assessment Improvement: Enhanced accuracy in identifying and quantifying risks.

- Pricing Optimization: Data-driven strategies for competitive and profitable pricing.

- Underwriting Efficiency: Streamlined processes for faster and more informed decisions.

- Profitability Enhancement: Improved financial outcomes through better risk management.

Emergence of InsurTech

The emergence of InsurTech presents both challenges and opportunities for The Hartford. InsurTech startups are disrupting the insurance landscape with innovative models. The Hartford must adapt to stay competitive, possibly through partnerships or acquisitions. This shift involves leveraging technologies like AI and blockchain.

- InsurTech funding reached $14.8 billion globally in 2023.

- The global InsurTech market is projected to reach $1.4 trillion by 2030.

- The Hartford's investments in technology totaled $325 million in 2024.

The Hartford utilizes advanced tech, like AI, machine learning, and data analytics, to boost operational efficiency and risk assessment. Investment in cybersecurity is crucial to protect client data, given rising cyber threats, with a 30% increase in attacks on financial firms reported in 2024. Moreover, InsurTech innovations create a dynamic market landscape for The Hartford.

| Technology Aspect | Impact | Data |

|---|---|---|

| AI & Automation | Improved efficiency | Insurance AI adoption increased 25% in 2024 |

| Cybersecurity | Data protection | Cyberattacks cost billions in 2024; a 30% rise in attacks. |

| InsurTech | Market disruption | $14.8B global funding in 2023, $1.4T market by 2030 |

Legal factors

The Hartford faces stringent insurance regulations. It must comply with state and federal laws, including solvency rules. In 2024, the insurance industry saw increased regulatory scrutiny. The Hartford's compliance costs are significant.

Data privacy laws are becoming stricter. The Hartford must follow rules on how it collects, uses, and protects customer data. This means the company needs strong data management and security. In 2024, data breaches cost companies an average of $4.45 million.

Changes in corporate tax laws and international tax regulations affect The Hartford. The implementation of global minimum tax rules, like those proposed by the OECD, could alter its effective tax rate. In 2024, companies face increased scrutiny from tax authorities. The Hartford must adjust its financial reporting and tax strategies to comply. In Q1 2024, the company's effective tax rate was 22.8%.

Legal and Litigation Risks

The Hartford faces legal and litigation risks from claims and disputes. These could impact finances and reputation significantly. In 2024, the company reported ongoing legal expenses. The outcomes of these cases can be unpredictable and costly. Litigation can affect investor confidence and market perception.

- Legal expenses in 2024 were a notable part of operational costs.

- The company has a dedicated legal team to manage risks.

- Settlements and judgements can vary widely in financial impact.

- Regulatory changes also create legal challenges.

Regulatory Scrutiny and Enforcement Actions

The Hartford, like all financial institutions, faces heightened regulatory scrutiny, which can lead to enforcement actions. Insurance regulators, such as those in the U.S. and internationally, closely monitor The Hartford's operations. This scrutiny necessitates significant investments in compliance programs and internal controls to mitigate risks. For instance, in 2024, the company allocated approximately $150 million for regulatory compliance and risk management efforts.

- Increased regulatory scrutiny can lead to enforcement actions.

- The Hartford invests heavily in compliance.

- These investments can affect financial performance.

The Hartford navigates a complex web of legal factors, facing scrutiny on insurance regulations and data privacy. They must comply with evolving data protection laws to avoid penalties and maintain customer trust. Litigation, tax law changes, and compliance are critical concerns impacting financial performance.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Compliance | Operational Costs | $150M spent on regulatory compliance (2024) |

| Data Privacy | Risk Mitigation | Average data breach cost: $4.45M (2024) |

| Litigation | Financial Risk | Ongoing legal expenses reported throughout 2024 |

Environmental factors

Climate change fuels extreme weather, heightening risks for insurers like The Hartford. Rising claims from hurricanes and wildfires strain property-casualty operations. In 2023, insured losses from natural disasters totaled $95 billion globally. The Hartford must adapt coverage and risk models to catastrophe-prone regions.

The Hartford, like other insurers, is increasingly scrutinized for its ESG performance. Investors are prioritizing companies that manage climate risk effectively. In 2024, ESG-focused assets reached $42 trillion globally. The Hartford must adapt to meet these rising expectations.

Environmental regulations influence The Hartford's business. These regulations, concerning pollution and hazardous materials, can create new insurance claims. Specialized environmental insurance products are essential. The EPA reported over 17,000 Superfund sites as of 2024, potentially affecting claims. The environmental insurance market is projected to reach $10 billion by 2025.

Sustainability and Corporate Responsibility

The Hartford Financial Services faces growing pressures regarding sustainability and corporate responsibility. Customers, investors, and regulators are increasingly focused on environmental practices. In 2024, the insurance industry saw a 20% rise in ESG (Environmental, Social, and Governance) investment mandates. The Hartford must show its commitment to sustainability and address climate-related risks. This includes transparently disclosing its climate risk exposure, which is becoming a standard requirement.

- 20% rise in ESG investment mandates in 2024.

- Increased regulatory scrutiny on climate risk disclosure.

Physical Risks from Climate Change

The Hartford faces physical risks from climate change, influencing its property insurance. Extreme weather events like hurricanes and floods can damage property and infrastructure. These events directly impact The Hartford's underwriting and claims costs. The company must manage these risks to maintain profitability and stability.

- In 2023, insured losses from natural disasters in the U.S. totaled over $70 billion.

- The Hartford's property insurance segment is particularly exposed to these losses.

- The company uses sophisticated models to assess and price these risks.

Environmental factors significantly influence The Hartford's operations and strategic planning.

Climate change and extreme weather events heighten risks, affecting insurance claims and costs.

ESG demands and regulatory pressures drive the need for sustainable practices and risk disclosure, like the 20% rise in ESG investment mandates in 2024.

| Environmental Factor | Impact on The Hartford | Data Point (2024/2025) |

|---|---|---|

| Climate Change | Increased claims from extreme weather | U.S. insured losses over $70B in 2023. |

| ESG Pressures | Investor and regulator scrutiny | 20% rise in ESG investment mandates. |

| Environmental Regulations | New insurance product opportunities | Environmental insurance market to reach $10B by 2025. |

PESTLE Analysis Data Sources

This Hartford Financial Services PESTLE Analysis incorporates financial reports, market research, and regulatory updates from governmental and financial institutions.