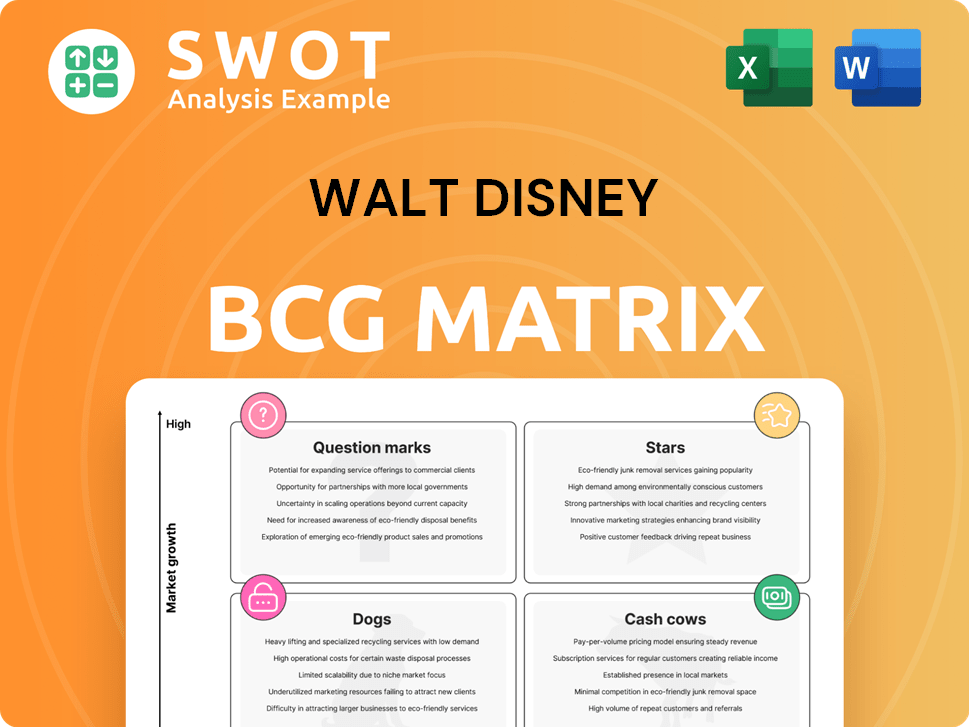

Walt Disney Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Walt Disney Bundle

What is included in the product

Tailored analysis for Disney's product portfolio across BCG quadrants, like Parks or Movies.

Optimized for strategic meetings, the matrix facilitates discussions on resource allocation and portfolio management.

What You’re Viewing Is Included

Walt Disney BCG Matrix

The preview is the same Walt Disney BCG Matrix you'll receive after purchase. This fully functional, strategic planning tool is instantly downloadable and ready for your analysis. Expect no differences between the preview and the final, editable document.

BCG Matrix Template

Walt Disney's BCG Matrix reveals a captivating portfolio of products and ventures. Identifying "Stars" like theme parks and streaming services is key. "Cash Cows" such as classic movie franchises provide steady revenue. Question marks, including new ventures, require careful investment. Finally, "Dogs" need strategic evaluation. Uncover Disney's true market position. Purchase the full BCG Matrix for detailed analysis, actionable strategies, and impactful insights.

Stars

Disney+ rapidly grew subscribers after its launch. The platform offers Disney, Pixar, Marvel, Star Wars, and National Geographic content. Disney+ is key in streaming, supporting Disney's consumer strategy. In Q1 2024, Disney+ reached 150 million subscribers, boosting profitability.

The Marvel Cinematic Universe (MCU) remains a "Star" for Disney. In 2024, MCU films like "Deadpool & Wolverine" are expected to boost box office revenue. Disney+ streaming series and merchandise sales further drive profitability. The interconnected narratives and strong marketing support the MCU's continued financial success.

Disney's theme parks and resorts remain a robust business, drawing in numerous visitors annually. These parks provide immersive, franchise-linked experiences. Investments in new attractions boost appeal and revenue. In Q1 2024, Experiences revenue hit $8.7 billion. Weather impacts are a factor, yet the segment's appeal endures.

Studio Entertainment: Moana 2

The anticipated success of 'Moana 2' underscores Disney's robust studio entertainment sector. This sequel's projected strong box office numbers and positive reviews signal a continuation of theatrical success. In 2024, Disney's studio entertainment generated substantial revenue, with films like 'Inside Out 2' contributing significantly. Content sales and licensing, boosted by popular movies, fuel the Entertainment segment's expansion.

- 'Moana' (2016) grossed over $643 million worldwide.

- 'Inside Out 2' had a record-breaking opening weekend in 2024.

- Disney's studio entertainment revenue in 2024 is projected to be over $10 billion.

- Content licensing deals are a key revenue stream for Disney.

Franchise-based Consumer Products

Disney's franchise-based consumer products, spanning Star Wars, Marvel, and classic characters, are cash cows. These products leverage immense brand recognition and global demand, driving significant revenue. Merchandise sales, licensing, and retail operations all contribute substantially to Disney's financial performance. Disney strategically extends its intellectual property into various consumer goods.

- In 2024, consumer products revenue was a key component of Disney's overall earnings.

- Licensing agreements for Marvel and Star Wars generated billions.

- Retail partnerships expanded the reach of Disney-branded merchandise.

- Consumer products accounted for a significant portion of Disney's revenue.

Disney's "Stars" include Disney+, MCU, theme parks, and hit movies. These segments drive revenue growth through strong content, experiences, and merchandise. In 2024, these areas showcased substantial financial success for Disney.

| Category | Key Elements | 2024 Performance Highlights |

|---|---|---|

| Disney+ | Streaming service, original content | 150M subscribers, significant revenue growth |

| MCU | Films, series, merchandise | "Deadpool & Wolverine" box office success |

| Theme Parks | Parks and resorts worldwide | Experiences revenue $8.7B in Q1 2024 |

| Studio Entertainment | Movies, licensing | "Inside Out 2" record opening; $10B+ projected revenue |

Cash Cows

Classic Disney animated films are cash cows. They generate consistent revenue through home entertainment, licensing, and Disney+. These films have enduring appeal across generations. In 2024, Disney's film revenue reached $22.5 billion. Disney leverages these titles through re-releases and merchandise.

Disney Channel and related media networks function as cash cows within Disney's portfolio. Despite cord-cutting, these networks continue to generate substantial revenue. They benefit from advertising and affiliate fees, maintaining a broad audience. Strategic partnerships and digital efforts help sustain their relevance. In fiscal year 2024, Disney's linear networks generated over $27 billion in revenue.

Disneyland and Walt Disney World are cash cows. They boast strong brand recognition, drawing in visitors consistently. These parks require less marketing. In 2024, Disney Parks & Resorts revenue was over $30 billion.

Licensed Merchandise Featuring Core Characters

Licensed merchandise featuring core Disney characters such as Mickey Mouse consistently generates significant revenue. These characters have global appeal, appearing on diverse products. Disney strategically manages these licenses to maximize revenue. Merchandise sales in 2024 contributed significantly to overall revenue.

- Disney's consumer products segment reported $6.1 billion in revenue in fiscal year 2023.

- Licensed merchandise accounted for a substantial portion of this segment's revenue.

- Mickey Mouse and related characters drive a large percentage of these sales.

- Strategic licensing ensures brand integrity and revenue optimization.

Disney Vacation Club

Disney Vacation Club (DVC) is a cash cow, generating consistent revenue from membership fees and resort bookings. DVC members exhibit high loyalty, leading to frequent repeat visits. The program's exclusive benefits and experiences fuel its ongoing success. In 2024, DVC's revenue contributed significantly to Disney's overall profitability. This model ensures a stable financial base.

- Steady Revenue: DVC provides a reliable income stream.

- High Loyalty: Members repeatedly visit Disney properties.

- Exclusive Benefits: These enhance the program's appeal.

- Financial Contribution: DVC supports Disney's financial health.

Cash cows like classic animated films and TV channels provide consistent revenue streams for Disney.

These established assets require less investment compared to stars or question marks.

In 2024, Disney's cash cow segments generated billions, reinforcing financial stability.

| Segment | Revenue in 2024 (approx.) | Key Features |

|---|---|---|

| Film Revenue | $22.5 Billion | Home Entertainment, Licensing, Disney+ |

| Linear Networks | Over $27 Billion | Advertising and Affiliate Fees |

| Parks & Resorts | Over $30 Billion | Brand Recognition |

| Consumer Products | $6.1 Billion (FY2023) | Licensed Merchandise |

| DVC | Significant Contribution | Membership Fees and Resort Bookings |

Dogs

Disney's linear TV networks, excluding ESPN, are "dogs" due to cord-cutting. Ad revenue declined, and viewership is down. Ratings have dropped for many shows. In Q1 2024, Disney's linear networks saw a 5% revenue decrease.

Certain television shows, like 'The Mysterious Benedict Society,' have underperformed. Low viewership and critical reception indicate possible cancellation or divestiture. Disney regularly assesses television content performance. In Q1 2024, Disney+ added 1.3 million subscribers, highlighting content importance.

Dogs in Disney's BCG matrix include consumer product segments tied to underperforming franchises. These segments might have low market share and slow growth. For example, in 2024, merchandise tied to less popular animated films saw lower sales. Disney may need to adjust product offerings and licensing. In Q1 2024, overall consumer products revenue decreased slightly.

Touchstone Pictures

Touchstone Pictures, once a key Disney label, currently faces challenges, potentially positioning it as a Dog in the BCG Matrix. The studio has seen a decline in significant releases and lacks the robust franchise power seen in other Disney brands. With a limited slate of films in 2024, its contribution to overall revenue is comparatively small. Disney might need to rethink Touchstone's strategy.

- Limited 2024 releases impact revenue.

- Franchise absence weakens market position.

- Strategic re-evaluation is likely needed.

- Smaller revenue contribution compared to other Disney brands.

Certain Underperforming International Ventures

Certain international ventures, especially those facing economic headwinds or market saturation, can be categorized as Dogs in Disney's BCG Matrix. The company's India business, for instance, is projected to contribute less to operating income in fiscal 2025. These ventures may need restructuring or strategic changes to improve performance. Disney's international segment revenue in 2024 was $20.2 billion, reflecting these challenges.

- India's contribution to operating income is expected to decrease in fiscal 2025.

- Restructuring or strategic adjustments may be necessary for these ventures.

- Disney's international segment revenue in 2024 was $20.2 billion.

Disney's "dogs" also include segments where growth lags. This category often has low market share in slow-growing markets. For instance, some consumer products related to underperforming franchises fall into this group. In 2024, some merchandise saw reduced sales, prompting Disney to consider adjustments.

| Segment | Characteristics | 2024 Performance |

|---|---|---|

| Consumer Products (Select) | Low market share, slow growth | Sales decline in some areas |

| Underperforming Franchises | Limited appeal, lower consumer interest | Merchandise underperformed in sales |

| Strategic Response | Re-evaluate product offerings | Disney considers licensing adjustments |

Question Marks

ESPN+ is a question mark in Disney's portfolio. It's in a high-growth market, but faces tough competition. Subscribers grew to 30.1 million in Q1 2024. Continued investment is crucial for subscriber growth. The Disney+ ESPN tile integration is a key strategy.

Hulu is a Question Mark in Disney's BCG Matrix due to its high growth potential in a crowded streaming market. It competes with Netflix and Amazon Prime Video, necessitating significant investment in original content. In Q4 2023, Hulu had 49.7 million subscribers. Disney is considering strategic moves for Hulu, possibly integrating it with Disney+ or selling it.

Disney's AI initiatives are a key Question Mark, demanding significant R&D investment. In 2024, $350 million was allocated to AI research. This focuses on new tech integrations, potentially boosting various Disney business areas.

Expansion into New International Markets

Disney's expansion into new international markets is a question mark in its BCG matrix, indicating high growth potential coupled with significant risk. The company faces challenges like adapting to diverse cultures and adhering to varying regulations. Success hinges on forming strategic partnerships and creating localized content to resonate with different audiences. For instance, Disney+ saw international subscriber growth, but faced losses in 2023.

- International revenue accounted for 45% of Disney's total revenue in 2023.

- Disney+ international subscribers grew to 61.3 million by the end of 2023.

- Localized content investments are rising, with a 30% increase in spending in 2023.

- Navigating regulatory hurdles in China and India remains a key challenge.

Theatrical Releases Based on Untested IPs

Theatrical releases based on new or untested intellectual properties represent "question marks" within the Walt Disney BCG Matrix. These films have the potential for high growth but also carry significant risk. Disney must carefully evaluate the potential of these projects, considering market trends and audience preferences. Effective marketing campaigns are crucial for success, especially for unfamiliar IPs.

- High-risk, high-reward investments.

- Require careful market analysis.

- Marketing is key to success.

- Examples include original animated features.

New theatrical releases, like original animated features, are question marks in Disney's portfolio. These projects promise high growth but involve substantial market risk. Disney must assess market trends and audience preferences before investing significantly. Strong marketing is essential for unfamiliar IPs.

| Aspect | Details |

|---|---|

| Market Risk | Dependent on audience reception and competition. |

| Investment | Significant, including production and marketing costs. |

| Marketing Strategy | Critical for building audience anticipation. |

BCG Matrix Data Sources

The Walt Disney BCG Matrix utilizes financial data, market analysis, and industry publications for comprehensive insights.