Texas Instruments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Texas Instruments Bundle

What is included in the product

Strategic roadmap: TI's BCG Matrix unveils growth opportunities, risks, & resource allocation across its product lines.

One-page overview placing each business unit in a quadrant

Delivered as Shown

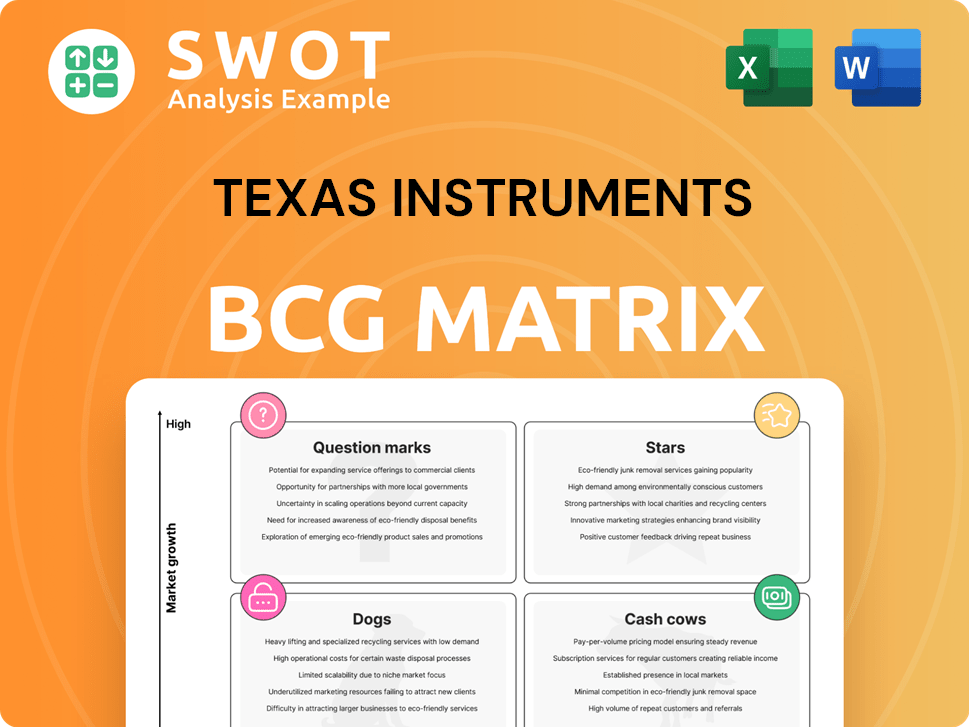

Texas Instruments BCG Matrix

The Texas Instruments BCG Matrix preview mirrors the purchased document. Receive a complete, ready-to-use strategic analysis tool, just as presented, optimized for impact. Download the fully formatted report, perfect for immediate application in your business strategy and analysis.

BCG Matrix Template

Texas Instruments' BCG Matrix provides a snapshot of its product portfolio's competitive positions. Explore how its products are categorized: Stars, Cash Cows, Dogs, and Question Marks. This framework helps visualize growth and resource allocation opportunities.

A brief overview reveals key insights, but the full BCG Matrix unlocks comprehensive details. Uncover strategic recommendations and data-driven analysis for informed decisions.

The complete report offers a deeper dive into TI's market dynamics. Purchase the full version for a ready-to-use strategic tool that will guide your decision making.

Stars

Texas Instruments' analog business is a "Star" in its BCG Matrix, showing strong growth. This segment, including power products and signal chain, benefits from trends like automotive electrification. TI leads the analog market with a substantial share, approximately 19% in 2024, according to market data. The analog sector's revenue reached $15.7 billion in 2023, reflecting its importance.

Texas Instruments' automotive semiconductor solutions are a "Star" in its BCG matrix. TI excels in the EV market, fueled by rising semiconductor demand in vehicles. ADAS and EV components boost TI's position. In Q3 2023, TI's automotive revenue grew, showing strong performance. Continued investment and innovation will solidify TI's market position.

Texas Instruments' Industrial Semiconductor Solutions are a star in the BCG Matrix. The industrial sector offers substantial growth, especially in factory automation. Demand for integrated circuits is rising. In 2024, TI's industrial revenue was a significant portion of its total, reflecting their focus and growth in this area.

Power Management ICs

Power Management ICs (PMICs) are crucial in analog semiconductors, showing significant growth. Texas Instruments (TI) excels in power management, meeting the rising need for energy-efficient devices. TI's strategy involves acquisitions and R&D to solidify its market position. In 2024, the PMIC market is valued at approximately $50 billion, with TI holding a substantial share.

- Market size: $50 billion in 2024

- TI's focus: Energy-efficient devices

- Strategy: Acquisitions and R&D

- Growth: Substantial in analog semiconductors

Strategic Focus on Key Markets

Texas Instruments (TI) strategically concentrates on the industrial and automotive markets, which are vital for its revenue. In 2024, these sectors generated roughly 70% of TI's total revenue, highlighting their significance. TI's capacity to maintain and expand its market share in these key areas is essential for sustained growth and profitability. This focus allows for targeted investments and innovation.

- Industrial and automotive markets are key.

- 70% of revenue from these sectors in 2024.

- Market share growth is crucial.

- Focus enables targeted investments.

Texas Instruments (TI) has multiple "Star" businesses in its portfolio. Automotive and industrial semiconductor solutions are key drivers. These areas show significant growth, contributing substantially to TI's overall revenue.

| Business Segment | Market Share (2024) | 2024 Revenue (Approx.) |

|---|---|---|

| Analog | 19% | $16 billion |

| Automotive | Leading Position | Significant Growth |

| Industrial | Growing | Growing |

| PMICs | Substantial | $50 billion market |

Cash Cows

Texas Instruments' mature analog product lines, enjoying a strong market presence, are key cash cows. These products, needing little promotion, offer consistent revenue streams. In 2024, TI's analog segment accounted for a significant portion of its $14.5 billion revenue. Efficient operations further boost cash flow from these well-established lines. TI's focus on these areas reflects its strategy.

Texas Instruments' legacy embedded processing products, though mature, remain crucial cash cows. These products, benefiting from enduring customer relationships, provide steady cash flow. TI maximizes returns by focusing on efficiency and cost optimization. In 2024, this segment generated substantial revenue, supporting overall profitability. The company's strategy ensures these products remain profitable.

DLP® (Digital Light Processing) products, a part of Texas Instruments' portfolio, serve as cash cows. These established products generate consistent revenue with lower investment needs. Their maturity means steady, reliable income for the company. For instance, in 2024, DLP products contributed significantly to TI's overall revenue, reflecting their stable market position. Continued support ensures sustained profitability.

Calculators

Texas Instruments' (TI) calculators are a cash cow, especially in education. The market is mature but consistent, ensuring steady revenue. TI doesn't need to invest much in this product line. This makes it a dependable source of cash flow.

- TI's Education Technology revenue in 2023 was approximately $136 million.

- The global calculator market is expected to reach $1.6 billion by 2029.

- TI's calculators hold a significant market share in the U.S. education sector.

Strong Manufacturing Capabilities

Texas Instruments (TI) excels in manufacturing, a key cash cow. Their in-house wafer fabs provide supply chain stability, a significant advantage. This lets TI keep production steady, effectively meeting customer needs. They invest in tech and capacity expansion, strengthening their market position.

- TI's 300mm wafer fab in Richardson, Texas, is a key asset.

- In 2024, TI's capital expenditures were around $5 billion, largely for manufacturing.

- This investment supports a high level of control over production costs.

- TI's gross profit margin in 2024 was approximately 68%.

Texas Instruments' analog products are cash cows, providing steady revenue with minimal investment. In 2024, the analog segment was a major contributor to TI's $14.5B revenue. They benefit from strong market presence and efficient operations. This strategy ensures consistent profits.

Legacy embedded processing products are also cash cows. They offer steady cash flow from long-term customer relations. TI concentrates on efficiency to maximize returns, with the segment producing significant revenue in 2024. This supports overall profitability through the company's effective strategy.

DLP products serve as cash cows due to consistent revenue from established markets. These products require less investment, bringing in reliable income. In 2024, DLP products were significant revenue contributors, reflecting their stable market position. Continued support from TI ensures sustained profitability.

Calculators are cash cows for TI, particularly in education, with a consistent market. The low investment makes it a dependable source of cash flow. TI's education tech revenue was roughly $136M in 2023, supporting stable income. TI’s calculators have a significant U.S. market share.

Manufacturing is a crucial cash cow for Texas Instruments. Their in-house wafer fabs provide supply chain stability. This lets them meet customer needs. TI invested $5B in 2024 for manufacturing capacity and tech, with a gross profit margin around 68%, boosting market position and cost control.

| Cash Cow | Key Features | 2024 Data |

|---|---|---|

| Analog Products | Mature, strong market presence | Significant portion of $14.5B revenue |

| Embedded Processing | Established customer relationships | Substantial revenue |

| DLP Products | Consistent revenue, low investment | Significant revenue contribution |

| Calculators | Steady market, low investment | Education tech ~$136M (2023) |

| Manufacturing | In-house wafer fabs, supply chain stability | Capital expenditures ~$5B, 68% margin |

Dogs

Consumer electronics components, facing stiff competition and rapid obsolescence, may fit the "Dog" category. For instance, in 2024, consumer electronics saw a 5% average price decline due to oversupply. Texas Instruments might consider reducing investment in these segments.

Within Texas Instruments' embedded processing, "dogs" could be specific, low-growth areas with minimal market share. These might need costly recovery plans that may not pay off. Divesting such underperforming segments can redirect resources. In 2024, TI's Embedded Processing revenue was approximately $11.7 billion.

Products like those in consumer electronics and IT, facing inventory corrections, can become 'dogs'. These see reduced demand and profitability. For example, in Q4 2023, the semiconductor industry saw a 10% decrease in revenue. Managing inventory and adjusting production is key to lessening the impact.

Low-Margin Products

In Texas Instruments' BCG Matrix, low-margin products with limited growth are "dogs." These products, like some older analog chips, may have low profit margins. They consume resources without substantial returns. For instance, in 2024, TI might have observed that certain legacy products generated only a 5% profit margin. Streamlining or discontinuing these can boost profitability.

- Low profit margins, limited growth.

- Resource-intensive without high returns.

- Examples: older analog chips.

- Strategic options: streamline or discontinue.

Products with Declining Market Share

Dogs represent products with low market share in a low-growth market. These offerings often struggle against strong rivals and lack unique selling points. For example, in 2024, certain legacy semiconductor products experienced declining sales due to increased competition and obsolescence. Strategic repositioning and innovation are crucial.

- These products face challenges like high competition and market saturation.

- Focus on innovation to create new product features and stay relevant.

- Consider cost-cutting measures to improve profit margins.

- Evaluate the potential for strategic partnerships or acquisitions.

Dogs in Texas Instruments' BCG Matrix have low market share and growth. They often struggle in competitive markets and may require strategic adjustments. In 2024, certain legacy semiconductor products faced sales declines. Strategic moves like repositioning or discontinuing are crucial.

| Characteristic | Description | Example (2024 Data) |

|---|---|---|

| Market Share | Low relative to competitors | Specific legacy chip lines |

| Growth Rate | Low or negative market growth | Observed in older analog chips |

| Strategic Action | Streamline or discontinue | 5% profit margin for older products |

Question Marks

Texas Instruments (TI) can capitalize on the rising AI chip demand. This positions TI to potentially become a "star" in the market. Strategic investment in R&D and partnerships are key to success. The AI chip market is projected to reach $200 billion by 2028. TI's focus on AI could significantly boost its revenue.

Texas Instruments' new embedded processing solutions, akin to question marks in the BCG matrix, target high-growth areas. These products, despite low initial market share, show promise. For instance, in 2024, TI invested $4.5 billion in R&D. Success hinges on marketing and development, requiring substantial capital.

Texas Instruments' wireless connectivity solutions face a "question mark" scenario, especially in expanding markets. High demand exists, yet significant investment is needed to capture market share. In 2024, the wireless connectivity market saw a 15% growth. Strategic partnerships, like the one with Amazon, are key. Targeted marketing efforts can boost adoption, aiming for a 20% increase in sales.

Sensor Technologies

Sensor technologies are a question mark for Texas Instruments (TI) within the BCG matrix. These technologies are in expanding markets, such as automotive and industrial applications. Significant investment is needed to compete and capture a bigger market share. Acquisitions and partnerships could boost TI's growth in the sensor sector.

- TI's revenue in Q4 2023 was approximately $4.58 billion, showing stable performance.

- TI has been investing in new technologies, including sensors, to diversify its portfolio.

- The sensor market is projected to grow, offering opportunities for strategic moves.

- Partnerships could provide access to crucial technologies and accelerate market entry.

Emerging Automotive Technologies

Within Texas Instruments' BCG matrix, components for emerging automotive technologies, like advanced driver-assistance systems (ADAS) that go beyond their current offerings, would be considered question marks. These require substantial investment, with the ADAS market projected to reach $91.8 billion by 2030. Success hinges on innovation and differentiating products in a competitive environment.

- ADAS market expected to hit $91.8B by 2030.

- Focus on innovation and differentiation is key.

- Significant investment is needed.

- Competitive automotive market.

Question marks for Texas Instruments (TI) represent high-growth, low-share products. This necessitates heavy investment for market share gains. Success depends on strategic moves and innovation.

| Product Category | Market Growth (2024) | TI's Strategy |

|---|---|---|

| Embedded Processing | High | R&D investment ($4.5B in 2024) |

| Wireless Connectivity | 15% | Partnerships (e.g., Amazon), targeted marketing (20% sales increase goal) |

| Sensors | Growing | Acquisitions, partnerships |

| Automotive (ADAS) | High (ADAS market $91.8B by 2030) | Innovation, differentiation |

BCG Matrix Data Sources

The BCG Matrix is fueled by company filings, market share data, industry reports, and competitive analyses.