Texas Instruments Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Texas Instruments Bundle

What is included in the product

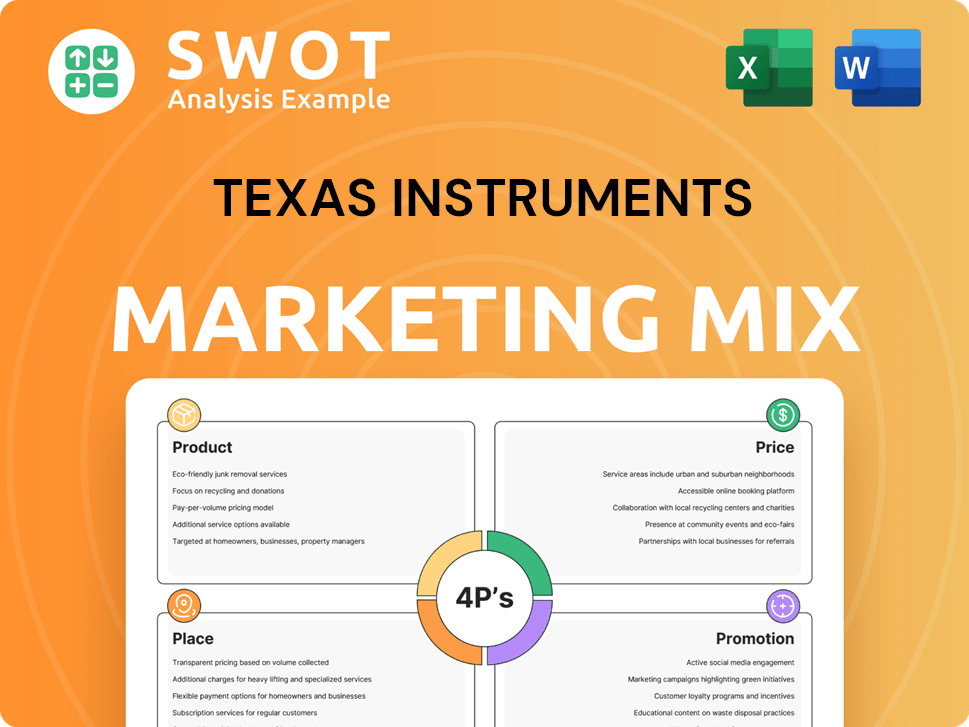

A thorough analysis of Texas Instruments' 4Ps: Product, Price, Place, and Promotion, with strategic implications.

Summarizes TI's 4Ps in an accessible format to clarify complex marketing strategies.

What You Preview Is What You Download

Texas Instruments 4P's Marketing Mix Analysis

The preview here is the genuine, ready-to-download Texas Instruments 4P's Marketing Mix Analysis. There are no differences—what you see is what you get. Expect immediate access to this complete, in-depth document after your purchase. We prioritize transparency and deliver the final version upfront.

4P's Marketing Mix Analysis Template

Texas Instruments dominates the semiconductor industry, but how? They likely tailor product lines to diverse needs. Strategic pricing is a key part of their profitability. Extensive global distribution is a must for widespread reach. Sophisticated promotional tactics surely drive brand awareness and sales.

This deep dive showcases how they seamlessly integrate the 4Ps. Uncover the secrets behind their marketing brilliance. Get the full analysis to level up your knowledge now.

Product

Texas Instruments (TI) is a key player in analog semiconductors. These crucial products handle real-world signals in electronics. TI's Analog segment, including Power and Signal Chain, is vital for power control and data processing. In Q1 2024, TI's Analog revenue was $3.44 billion, showing its market importance.

Texas Instruments' Embedded Processing segment, a cornerstone of its product strategy, encompasses microcontrollers and processors. These components are crucial for various applications, from industrial equipment to consumer electronics. In 2024, this segment accounted for a significant portion of TI's revenue, with a projected growth of 5-7% in 2025, driven by increasing demand across multiple sectors.

Texas Instruments (TI) leverages Digital Light Processing (DLP) technology, a key product offering. DLP creates high-quality images, crucial for its market presence. In 2024, TI's DLP sales reached $1.8 billion. This tech powers projectors and digital signage, boosting visibility and market reach.

Calculators and Educational Technology

Texas Instruments (TI) is famous for its graphing calculators, particularly the TI-84 series, which are key in its educational technology segment. TI offers resources and activities to support calculator use in education. The educational technology sector is critical for TI's revenue, with educational products contributing significantly. In 2024, TI's Education Technology revenue was approximately $165 million.

- TI-84 calculators dominate the market.

- Educational resources boost product utility.

- Revenue from education tech is significant.

- TI supports educators with training.

Broad Portfolio

Texas Instruments boasts a broad portfolio, with around 80,000 products. These products support diverse industries like automotive and industrial sectors. This wide range allows TI to capture significant market share. In Q1 2024, TI reported revenue of $3.66 billion, demonstrating its portfolio's strength.

- Diverse product range of ~80,000 items.

- Serves automotive, industrial, and more.

- Q1 2024 revenue: $3.66 billion.

Texas Instruments' (TI) products include a variety of semiconductors and embedded processors designed for several markets. TI’s product diversity ensures substantial market capture. The company’s wide range includes components for automotive and industrial use.

| Product Segment | Description | 2024 Revenue (Estimate) |

|---|---|---|

| Analog | Power & Signal Chain products. | $14.2B |

| Embedded Processing | Microcontrollers and processors. | $6.5B |

| Digital Light Processing (DLP) | Projection Technology | $1.8B |

Place

Texas Instruments (TI) is boosting direct sales to deepen customer ties. This includes TI.com and their sales force. In 2024, direct sales accounted for a significant portion of TI's revenue. They are investing in tools to enhance these direct interactions. This strategy allows for better customer insights and tailored solutions.

Texas Instruments (TI) strategically uses authorized distributors to broaden its market presence, especially in regions where direct sales aren't as effective. Key distributors like Arrow Electronics and Digi-Key help fulfill orders and provide local support. In 2024, these distributors contributed significantly to TI's revenue, enabling efficient distribution globally. They ensure product availability and cater to diverse customer needs.

Texas Instruments heavily utilizes online platforms for sales and customer engagement, with a strong presence on TI.com for direct sales. This digital approach includes authorized online resellers, expanding product accessibility. In 2024, online sales accounted for approximately 30% of total revenue, reflecting the importance of digital channels. These platforms offer convenience and a broad product range.

Global Manufacturing Footprint

Texas Instruments (TI) strategically maintains a global manufacturing footprint, essential for its 4Ps of marketing. TI operates its own wafer fabs and assembly/test factories globally. This diverse internal manufacturing network supports quality control and cost management.

Owning these facilities boosts supply chain resilience. In 2024, TI's capital expenditures were approximately $4.3 billion, significantly invested in manufacturing capacity.

- Global Presence: Manufacturing sites worldwide.

- Control: Ownership ensures quality and cost control.

- Resilience: Internal operations fortify supply chains.

- Investment: High capital expenditures in manufacturing.

Strategic Emphasis on Key Markets

Texas Instruments (TI) strategically focuses its marketing efforts on vital end markets, notably industrial and automotive sectors. These segments are crucial, contributing substantially to their financial performance. For instance, in 2024, industrial and automotive sales accounted for over 60% of TI's total revenue. This emphasis is supported by a distribution strategy optimized for these key sectors.

- Industrial and automotive markets are the primary focus.

- Over 60% of revenue comes from these sectors (2024 data).

- Distribution is tailored to reach customers in these areas.

Texas Instruments (TI) strategically manages its locations via diverse sales channels. Direct sales through TI.com and a dedicated sales force are prioritized to build customer relations, contributing a large portion of revenue in 2024. Also, they utilize a network of authorized distributors and online platforms. These efforts, in 2024, aimed to expand product availability and tailored solutions.

| Channel Type | Focus | 2024 Contribution |

|---|---|---|

| Direct Sales | Customer Engagement, Customized Solutions | Significant Revenue Portion |

| Authorized Distributors | Market Reach, Local Support | Key to Global Distribution |

| Online Platforms | Digital Sales, Accessibility | Approximately 30% of Total Revenue |

Promotion

Texas Instruments (TI) prioritizes targeted marketing, focusing on engineering and technology professionals. They use specialized channels like industry-specific publications and online platforms. This approach ensures TI's message reaches the right audience. In 2024, TI invested heavily in digital marketing, allocating approximately 30% of its marketing budget to online channels. This strategy aims to inform and engage designers and users of their semiconductor products.

Texas Instruments (TI) heavily utilizes digital marketing. They offer technical documents, webinars, and product videos. TI actively uses YouTube, Twitter, and Facebook. In 2024, TI's digital marketing spend was approximately $150 million. This strategy boosts product awareness and engagement.

Texas Instruments excels in promotion through robust technical support. They offer technical assistance, training, and troubleshooting. This customer-centric approach boosts product usability. In 2024, TI's customer satisfaction scores remained consistently high. Online forums and support centers further enhance engagement, a strategy critical for maintaining market share.

Educational Partnerships

Texas Instruments (TI) actively fosters educational partnerships. These collaborations are crucial for integrating TI's technology into academic programs. TI offers resources, grants, and collaborative projects to support research and curriculum development. This approach strengthens TI's brand and ensures future engineers and scientists are familiar with their products. In 2024, TI invested $100 million in educational programs.

- TI University Program provides hardware and software.

- Partnerships with over 1,000 universities globally.

- Focus on STEM education and innovation.

- Grants and scholarships to support students.

Trade Shows and Events

Texas Instruments (TI) actively uses trade shows and events to promote its products and connect with customers. These events are crucial for demonstrating new technologies and fostering relationships. TI's presence at events allows for direct interaction, crucial for showcasing complex products. This strategy helps TI stay competitive in the fast-paced semiconductor market.

- TI often participates in major industry events like the Consumer Electronics Show (CES) and embedded world.

- In 2024, TI spent approximately $100 million on marketing activities, including events.

- These events generate leads and support sales efforts, contributing to revenue growth.

Texas Instruments' promotional efforts leverage targeted digital strategies, allocating substantial resources to online channels for product awareness and customer engagement. TI focuses on providing robust technical support, training, and customer assistance, enhancing product usability and customer satisfaction. Educational partnerships are central, with significant investments in academic programs.

| Promotion Strategy | Description | 2024/2025 Data |

|---|---|---|

| Digital Marketing | Online channels for product info | $150M digital spend in 2024, aiming for 32% in 2025 |

| Technical Support | Training, troubleshooting | Consistently high customer satisfaction scores |

| Educational Partnerships | Support academic programs | $100M investment in 2024; aim for 12% growth by Q4 2025. |

| Events and Trade Shows | Product demos and connections | $100M spent on events in 2024, expect 11% participation by 2025 |

Price

Texas Instruments (TI) uses a competitive pricing strategy, crucial in the semiconductor market. Their pricing adapts to market shifts and rival strategies. For instance, in Q1 2024, TI's revenue was $3.66 billion, showing how pricing affects market share. They focus on effective price management to stay competitive.

Texas Instruments employs premium pricing for its cutting-edge semiconductor products. Analog chip prices fluctuate based on intricacy and performance attributes. This pricing model mirrors the company's technological prowess and innovation. In Q1 2024, TI's revenue was approximately $3.66 billion, demonstrating the success of its premium pricing strategy. This approach enables high-profit margins, fueling further R&D investments.

Texas Instruments employs differentiated pricing across its diverse product lines. Analog chips, embedded processing, and DLP technologies have varied price points. For example, in Q1 2024, TI's analog revenue was $2.89 billion, and embedded processing was $1.45 billion.

Customized Pricing for Bulk Orders

Texas Instruments tailors pricing for bulk orders and long-term deals. This approach offers flexibility, often including volume-based discounts. For example, in 2024, TI offered up to 15% off for large volume orders of certain components. Customized pricing helps secure long-term supply commitments. These strategies are key in the competitive semiconductor market.

- Discounts can reach 15% for volume purchases.

- Pricing adjusts based on order size and duration.

Value-Based Pricing

Texas Instruments (TXN) employs value-based pricing, aligning prices with the perceived benefits of its products. This approach highlights the value of high-performance and energy-efficient solutions, appealing to customers seeking quality. They also adjust pricing based on market demand and economic conditions. For example, in Q1 2024, TXN reported a revenue of $3.65 billion, reflecting its pricing strategies.

- Value-based pricing strategy.

- Focus on high-performance and efficiency.

- Market demand and economic conditions.

Texas Instruments strategically prices its products in the competitive semiconductor market, adjusting based on various factors. Competitive pricing ensures TI remains competitive, using market shifts and rivals’ actions as key drivers. For Q1 2024, TI's revenue was $3.66 billion, showcasing how price management affects market share.

TI employs a premium pricing approach for its advanced semiconductor goods. Analog chips’ pricing fluctuates by their complexity. Premium pricing strategy yielded $3.66 billion in Q1 2024. This boosts profit margins, fueling R&D.

TI employs differentiated pricing across its diverse product lines like analog chips, and embedded processing. Tailoring for bulk orders includes volume discounts. Up to 15% off on bulk orders of some components in 2024, this helped to ensure commitments.

| Pricing Strategy | Description | Impact |

|---|---|---|

| Competitive | Adjusts to market shifts and rivals. | Maintains market share. |

| Premium | Applies to advanced semiconductor products. | Supports high profit margins. |

| Differentiated | Varies across product lines. | Adaptable to market needs. |

4P's Marketing Mix Analysis Data Sources

We analyze Texas Instruments using company filings, investor presentations, website data, and competitor benchmarks for a comprehensive 4Ps analysis.