Topgolf Callaway Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Topgolf Callaway Brands Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, helping stakeholders to easily grasp the complex analysis on the go.

Preview = Final Product

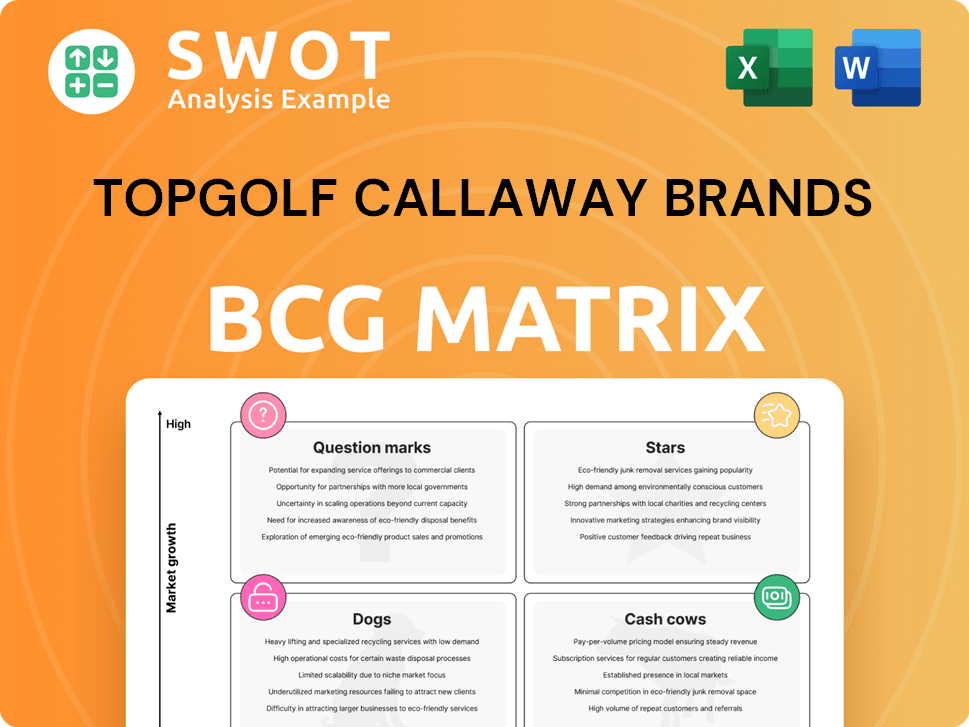

Topgolf Callaway Brands BCG Matrix

The BCG Matrix preview shows the complete document you'll get after purchase. Featuring detailed insights, it’s ready for immediate application in your strategic planning—no further modifications needed.

BCG Matrix Template

Topgolf Callaway Brands operates in a dynamic market with diverse product lines. Analyzing its portfolio using the BCG Matrix reveals strategic strengths and weaknesses. We can see some products excelling, while others might need restructuring. This preliminary look helps identify investment priorities and potential growth areas.

To understand the full strategic implications of its diverse portfolio, you need the detailed BCG Matrix analysis. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Callaway Golf Clubs, a key part of Topgolf Callaway Brands, holds the top spot in U.S. market share for total golf clubs. This marks its third straight year at number one and the ninth time in the last ten years. This consistent leadership shows a strong brand and effective strategies. In 2024, Callaway's golf club sales reached $1.5 billion.

Callaway's golf balls are Stars in Topgolf Callaway Brands' BCG Matrix. They achieved record U.S. market share in 2024, reflecting strong consumer appeal. This success is fueled by effective distribution and innovation. Continued R&D and marketing can help maintain their leading position. In Q3 2024, golf equipment sales increased by 2.8% to $319.2 million.

TravisMathew is a star in Topgolf Callaway Brands' portfolio, achieving significant growth in active lifestyle apparel. The brand's appeal spans a wide customer base, blending golf and lifestyle wear. In 2024, TravisMathew's revenue grew, reflecting its expanding market presence. Strategic actions like product line expansion and increased retail presence can boost its stellar status.

Topgolf Venues (Selected)

Topgolf venues, especially those with robust margins, shine as stars in the BCG Matrix, despite same-venue sales challenges. These venues excel in operations, customer engagement, and revenue. Focusing on replicating their successful strategies is key for overall performance. In Q3 2024, Topgolf's same-venue sales increased by 3.4% demonstrating their potential.

- Strong Venue-Level Margins: Indicates efficient operations and profitability.

- Effective Operational Strategies: Drives customer satisfaction and repeat visits.

- High Revenue Generation: Reflects successful marketing and pricing.

- Customer Engagement: Fosters loyalty and positive word-of-mouth.

Toptracer Technology

Toptracer technology, a key asset for Topgolf Callaway Brands, is integral to its success. This ball-tracking system boosts player experience and provides rich data analytics. Its interactive games and data-driven insights draw in a wide audience. In 2024, Toptracer's revenue grew, showing its market impact.

- Revenue Growth: Toptracer revenue saw a notable increase in 2024, reflecting its expanding footprint and popularity.

- Data Analytics: Toptracer provides crucial data, which helps improve player experience.

- Player Engagement: Interactive games and features increase player engagement.

- Market Expansion: Toptracer is expanding beyond Topgolf venues.

Callaway golf balls, a Star in Topgolf Callaway Brands' BCG Matrix, led the U.S. market in 2024. Innovation and distribution boosted its consumer appeal, which is reflected in its market share growth. Callaway golf ball sales reached $380 million in 2024.

| Metric | 2024 Performance | Notes |

|---|---|---|

| Market Share | Record High in U.S. | Reflects strong consumer preference. |

| Sales | $380 Million | Significant revenue contribution. |

| Growth Drivers | Innovation, Distribution | Key to sustained market leadership. |

Cash Cows

The Callaway brand is a cash cow, known for consistent revenue. Its strong brand image fuels a loyal customer base. Callaway's diverse product range helps maintain stable cash flow. In 2024, Callaway's net revenue was approximately $4.3 billion. Strategic marketing keeps the brand thriving.

Odyssey putters, like the Ai-One Square 2, are cash cows. They generate consistent revenue due to their strong market presence and quality. In Q3 2023, Topgolf Callaway's golf equipment sales, which includes Odyssey, were $324.7 million. Innovation and marketing will sustain this.

Licensing and merchandise are key cash cows for Topgolf Callaway Brands. These generate consistent revenue with minimal investment, leveraging the brand's strong market presence. Strategic partnerships and expanded merchandise, including apparel and equipment, boost cash flow. In 2024, merchandise sales saw a rise, contributing significantly to overall revenue.

Golf Accessories (General)

Golf accessories, including tees and gloves, are consistent revenue generators for Topgolf Callaway Brands. These essential items ensure steady cash flow, even if individual profits are modest. A wide selection and availability across channels are key to maximizing their financial impact. In 2024, the golf accessories market is estimated to be worth around $3 billion globally.

- Essential items like tees and gloves drive consistent sales.

- These accessories contribute to a stable cash flow for the company.

- Broad distribution and variety are key for maximizing revenue.

- The global golf accessories market was valued around $3 billion in 2024.

E-Commerce Platforms

Topgolf Callaway Brands' e-commerce platforms, like Topgolf Shop, are cash cows, bringing in steady revenue directly from consumers. Despite needing investment in website upkeep and marketing, these platforms boast better profit margins than physical stores. For instance, in 2024, direct-to-consumer sales accounted for a significant portion of overall revenue, showcasing their importance.

- Direct-to-consumer sales consistently contribute a substantial revenue stream.

- E-commerce platforms offer higher profit margins compared to traditional retail.

- Ongoing investments are needed for website maintenance and marketing.

- Enhancements like product expansion and user experience can boost performance.

Consistent revenue from the Callaway brand stems from a loyal customer base. In 2024, net revenue was about $4.3 billion. Strategic marketing is essential.

| Category | Details |

|---|---|

| 2024 Net Revenue (Callaway) | Approx. $4.3B |

| Q3 2023 Golf Equipment Sales | $324.7M |

| 2024 Global Golf Accessories Market Value | $3B |

Dogs

Jack Wolfskin, prior to its divestiture, struggled with declining revenue and profitability. This was especially evident in its European wholesale operations. Its performance negatively impacted the Active Lifestyle segment's overall growth, reflecting its status as a dog. The divestiture to ANTA Sports in 2024 was a strategic move. This move helped Topgolf Callaway Brands refocus on core brands.

While Topgolf overall performs well, some venues struggle. These "dog" locations show low same-venue sales and poor finances. Issues like location or operations drag them down. Addressing problems or considering closure can boost profits. For 2024, analyze venue-specific data for targeted strategies.

OGIO's brand strength faces internal challenges. Some lines may struggle due to outdated designs or unpopular colors. For example, in 2024, sales data may reveal underperforming luggage styles. Streamlining the product range can boost profitability. This strategic move allows OGIO to focus on its best-selling items.

Legacy Golf Equipment (Outdated Models)

Legacy golf equipment, including outdated clubs and accessories, falls into the "Dogs" category for Topgolf Callaway Brands. These products, no longer aligning with current performance standards, generate little revenue and occupy inventory space. Their presence hinders the promotion of innovative offerings. Clearing them out through discounts is crucial.

- Outdated clubs and accessories have low profit margins.

- These products may account for less than 5% of total sales.

- Inventory space can be better utilized for new items.

- Clearance sales are essential to free up resources.

BigShots Golf (Acquired Location)

Topgolf's acquisition of a BigShots Golf location presents a mixed bag within the BCG matrix. This single acquired location could potentially underperform relative to other Topgolf venues, impacting its overall financial contribution. Integrating this location efficiently is critical for its success and avoiding the 'dog' classification. Improving operational efficiency and customer engagement are key to boosting its performance.

- Acquisition of BigShots location aimed at expanding Topgolf's footprint.

- Operational improvements are needed to match the performance of other venues.

- Customer engagement strategies are critical for revenue growth.

- Financial performance of the acquired location needs close monitoring.

Dogs within Topgolf Callaway Brands include underperforming venues and certain product lines. Outdated or poorly performing items like legacy golf equipment generate low profits. Strategic actions like venue improvements or product line streamlining are necessary. These help boost profitability by freeing up resources for more successful ventures.

| Category | Examples | Strategies |

|---|---|---|

| Underperforming Venues | Topgolf locations with low sales | Improve operations, consider closure |

| Unpopular Products | Outdated golf clubs, OGIO luggage | Clearance sales, streamline product lines |

| Financial Impact | <5% of sales from outdated clubs | Focus on high-performing products |

Question Marks

Topgolf's international expansion, like its move into Jakarta and Wuhan, fits the "Question Mark" category in the BCG Matrix. These new markets offer high growth prospects but also face considerable risks. Success depends on strategic investments and partnerships. For instance, in 2024, Topgolf announced plans to open locations in several new international cities, including expansion in Europe and Asia.

Topgolf Shop, a 2024 initiative, is a question mark in Topgolf Callaway Brands' portfolio. This beginner-focused e-commerce site aims to capture a new market segment. Its success hinges on effective marketing and competitive pricing, which will be key to driving sales growth. The company needs to closely monitor its performance and adapt its strategies accordingly.

TravisMathew's women's line, launched in 2022, is a question mark for Topgolf Callaway. The line's growth is promising, but its future hinges on market share. Investment in product, marketing, and retail is vital. In 2023, Callaway's net revenue was $4.28 billion, reflecting overall growth.

New Golf Technologies (AI-Driven Designs)

Topgolf Callaway Brands' foray into AI-driven golf technology places it firmly in the question mark quadrant of the BCG matrix. These innovations, including AI-designed clubs and balls, could disrupt the market. However, their future hinges on consumer adoption and measurable performance improvements. The company's R&D spending in 2024 was $150 million, indicating a significant commitment.

- Investment: $150M in R&D in 2024.

- Market Potential: High, but unproven.

- Risk: Dependent on consumer acceptance.

- Strategy: Requires robust testing and validation.

Topgolf's Separation Strategy

Topgolf's planned separation from Callaway Brands by the second half of 2025 positions it as a "Question Mark" in the BCG Matrix. This strategic move hinges on market dynamics, regulatory clearances, and each entity's standalone operational success. Careful execution and strategic foresight are key for maximizing shareholder value post-separation. The outcome remains uncertain, making it a high-risk, high-reward scenario for investors.

- Separation scheduled for the second half of 2025.

- Success depends on market conditions and regulatory approvals.

- Requires careful planning and execution.

- Aims to maximize shareholder value.

Topgolf's international expansion is a question mark, with high growth potential but significant risks. The Topgolf Shop, launched in 2024, also faces uncertain prospects. TravisMathew's women's line from 2022 remains a question mark, needing market share growth. AI tech and planned 2025 separation pose high-risk, high-reward scenarios.

| Initiative | Status | Risk |

|---|---|---|

| Int'l Expansion | Ongoing | Market acceptance |

| Topgolf Shop | New | Marketing, pricing |

| TravisMathew Women's | Growing | Market share |

BCG Matrix Data Sources

The BCG Matrix uses company financials, market research, and analyst reports for dependable insights into Topgolf Callaway Brands.