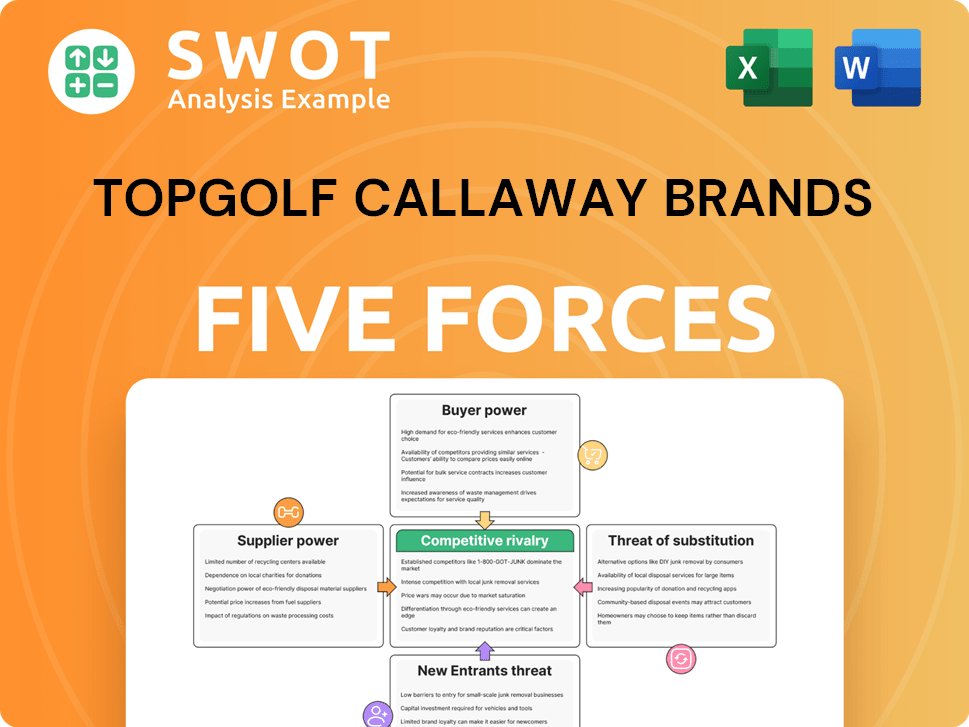

Topgolf Callaway Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Topgolf Callaway Brands Bundle

What is included in the product

Analyzes competitive forces shaping Topgolf Callaway Brands, including suppliers, buyers, and new market entrants.

Clean, simplified layout—ready to copy into pitch decks or boardroom slides.

Preview the Actual Deliverable

Topgolf Callaway Brands Porter's Five Forces Analysis

This preview provides the complete Porter's Five Forces analysis of Topgolf Callaway Brands. It's a fully formatted document, detailing competitive rivalry, and other forces. The document is the same one you'll receive immediately after your purchase. You can download and utilize this file instantly after buying it.

Porter's Five Forces Analysis Template

Topgolf Callaway Brands faces moderate competition, with established rivals and the threat of new entrants. Buyer power is moderate, influenced by consumer preferences and spending. Supplier power is relatively low, given the availability of materials. Substitutes like other entertainment options pose a threat. The intensity of rivalry shapes the competitive landscape.

Ready to move beyond the basics? Get a full strategic breakdown of Topgolf Callaway Brands’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration in the golf industry is moderate. Topgolf Callaway sources from various suppliers, lessening individual supplier power. Specialized components may come from fewer sources, increasing supplier leverage. In 2024, TCG's cost of goods sold was $2.6 billion; managing supplier relationships is key.

Topgolf Callaway Brands' supplier power is lessened by standardized inputs. Common materials, like steel or plastics, are easily sourced, reducing supplier control. For example, in 2024, the company sourced many raw materials from various vendors, keeping costs competitive. Specialized components, however, could increase supplier leverage.

Switching costs significantly influence supplier power for Topgolf Callaway Brands. If it's easy and cheap to change suppliers, that reduces supplier power. Conversely, if switching is costly due to specialized materials, suppliers gain leverage. For example, in 2024, Topgolf Callaway Brands spent approximately $1.6 billion on cost of goods sold, indicating the impact of supplier pricing.

Threat of Forward Integration

The threat of forward integration by suppliers, meaning they could become competitors, is a factor to consider. This threat is generally lower in the golf equipment sector. However, if raw material suppliers decided to manufacture finished goods, their leverage would increase. This scenario could influence Topgolf Callaway Brands' cost structure and market position.

- Less likely in the golf equipment industry due to specialized manufacturing processes.

- Raw material suppliers could gain bargaining power if they integrated forward.

- This could affect production costs and market dynamics.

Impact of Supplier Size

The bargaining power of suppliers for Topgolf Callaway Brands hinges on their size and concentration relative to the company. Suppliers with greater size and market concentration wield more influence, particularly when providing essential components. This dynamic can impact Topgolf Callaway Brands' profitability and operational flexibility.

- In 2024, Topgolf Callaway Brands faced fluctuations in raw material costs, affecting its cost of goods sold.

- Key suppliers of golf equipment and related accessories have a significant market share.

- The company's ability to negotiate favorable terms depends on the availability of alternative suppliers.

- Supplier concentration remains a crucial factor in determining the overall cost structure.

Supplier power varies based on component specialization. Standard materials reduce supplier control; specialized ones increase it. In 2024, TCG managed $2.6B in costs. Switching costs also impact supplier power.

| Factor | Impact on Supplier Power | 2024 Example for TCG |

|---|---|---|

| Concentration | High concentration = Higher Power | Key golf equipment suppliers have significant market share. |

| Switching Costs | High costs = Higher Power | Specialized components increase power. |

| Integration Threat | Potential forward integration = Higher Power | Raw material suppliers could become competitors. |

Customers Bargaining Power

Topgolf Callaway Brands faces a fragmented customer base, including individual golfers and retail partners, which limits customer bargaining power. In 2024, the company saw strong demand from both consumer segments, indicating balanced influence. While large retail chains could wield some leverage, their impact is mitigated by brand strength. Topgolf's diverse revenue streams further balance customer power. The company's 2024 revenue was $4.3 billion.

Customers' price sensitivity significantly influences their bargaining power. In 2024, premium golf equipment customers showed less price sensitivity. However, budget-conscious apparel shoppers may negotiate harder. Topgolf venue pricing strategy also impacts consumer choices; a 2024 report showed a 10% variance in patronage based on price.

Switching costs significantly influence customer power. Low switching costs empower customers; they can easily choose among golf club brands. For instance, in 2024, the golf equipment market saw various brands offering competitive pricing. Consumers also have many entertainment options, heightening Topgolf's competition. Therefore, customer bargaining power is high.

Availability of Information

Customers gain significant power through readily available information. Online reviews, product comparisons, and easy access to pricing data boost their knowledge. This increased awareness strengthens their ability to negotiate better terms. In 2024, 80% of consumers research products online before purchasing. This trend underscores the importance of managing customer information and influencing their purchasing decisions.

- Online reviews significantly impact purchasing decisions, with over 90% of consumers reading reviews before buying.

- Price comparison websites allow customers to easily compare prices, increasing their bargaining power.

- The digital age has accelerated information availability, empowering customers with data.

Product Differentiation

Product differentiation significantly impacts customer bargaining power at Topgolf Callaway Brands. Callaway's strong brand and innovative products, such as AI-designed clubs, reduce customer price sensitivity. This differentiation helps maintain customer loyalty. Conversely, a lack of differentiation would heighten customer power. In 2024, Callaway's brand strength contributed to a gross margin of approximately 45%.

- Callaway's AI-designed clubs reduce price sensitivity.

- Strong brand equity lessens customer bargaining power.

- A lack of differentiation increases customer power.

- Gross margin in 2024 was approximately 45%.

Topgolf Callaway Brands experiences varied customer bargaining power due to a fragmented market and product differentiation.

Price sensitivity varies; premium golf equipment customers are less sensitive, but budget-conscious shoppers may negotiate harder.

Switching costs are low, especially in golf equipment, increasing customer bargaining power. Online information availability, with over 90% of consumers reading reviews before purchasing, further empowers customers.

| Factor | Impact | Data |

|---|---|---|

| Customer Base | Fragmented | Individual golfers, retail partners |

| Price Sensitivity | Varies | Premium vs. budget |

| Switching Costs | Low | Easy brand changes |

Rivalry Among Competitors

Topgolf Callaway Brands faces intense competition across its diverse segments. The golf equipment market alone features significant rivals like Acushnet (Titleist), TaylorMade, and PING. This crowded landscape means Topgolf Callaway must continuously innovate. In 2024, the golf equipment market was valued at approximately $7.8 billion.

The golf equipment and apparel markets show moderate growth, contrasting with the dynamic entertainment sector. Market analysis indicates that the global golf equipment market was valued at $7.66 billion in 2023. This figure is expected to reach $8.78 billion by the end of 2024. [3, 5] Slow growth intensifies rivalry, pushing companies to compete for market share. This environment demands innovative strategies and operational efficiency to succeed.

Product differentiation exists in Topgolf Callaway Brands, especially through technology and brand equity. Callaway's AI-driven designs aim to set them apart, crucial for a competitive edge. Despite innovations, apparel differentiation can be less distinct, intensifying rivalry. In 2024, Callaway's net revenue was $4.3 billion, showing the impact of their differentiation efforts.

Switching Costs

Low switching costs intensify competitive rivalry. Consumers can readily swap between golf equipment brands or explore different entertainment choices. This ease of switching compels Topgolf Callaway Brands to consistently innovate and invest in marketing. The golf equipment market is highly competitive, with major players like Titleist and TaylorMade vying for market share. Topgolf's entertainment segment faces competition from Topgolf's entertainment segment faces competition from other entertainment venues. This environment necessitates robust strategies to retain customers.

- Golf equipment sales in the U.S. were approximately $3.3 billion in 2024.

- Topgolf Callaway Brands' net revenue for 2024 was around $4.3 billion.

- Marketing expenses for Topgolf Callaway Brands are a significant percentage of revenue.

Exit Barriers

High exit barriers, like specialized assets or contract obligations, can keep companies in the market, intensifying rivalry. This isn't as crucial for Topgolf Callaway Brands, but it could impact smaller competitors. For instance, a golf course might face high exit barriers due to land leases or specialized equipment. The golf equipment market had an estimated value of $8.4 billion in 2024.

- Specialized Assets

- Contractual Obligations

- Impact on Smaller Players

- 2024 Market Value

Competitive rivalry significantly impacts Topgolf Callaway Brands due to a crowded market. The golf equipment sector, valued at $8.4 billion in 2024, includes major players like Titleist. Low switching costs amplify this rivalry, pressuring Topgolf to innovate constantly. Topgolf Callaway Brands' net revenue for 2024 was roughly $4.3 billion, showcasing the scale of operations.

| Factor | Impact | Data (2024) |

|---|---|---|

| Market Size | Intense competition | Golf equipment: $8.4B |

| Switching Costs | High rivalry | Easy to switch brands |

| Revenue | Scale of operations | Topgolf Callaway: $4.3B |

SSubstitutes Threaten

Topgolf Callaway Brands confronts the threat of substitutes, particularly within its equipment and apparel segments, where consumers can opt for diverse sports and leisure activities. In 2024, the global sports and fitness market was estimated at $486.3 billion, indicating a wide range of alternatives. Topgolf venues compete with entertainment options; the U.S. amusement park industry generated $28.8 billion in revenue in 2023. Consumers have numerous choices, impacting Topgolf Callaway Brands' market share.

The threat from substitutes for Topgolf Callaway Brands hinges on price and performance. Cheaper alternatives like general sports equipment or alternative entertainment venues can sway consumers. For example, the cost for a round of golf in the US is around $35, creating a price comparison.

Low switching costs amplify the threat of substitutes for Topgolf Callaway Brands. Consumers can easily switch to alternatives like other sports, recreational activities, or entertainment venues. The company must provide exceptional value to keep its customers. This includes offering unique experiences and competitive pricing. In 2024, Topgolf's revenue was approximately $1.7 billion, highlighting the importance of customer retention.

Customer Loyalty

Strong brand loyalty significantly diminishes the threat of substitutes for Topgolf Callaway Brands. Customers devoted to their products and venues are less inclined to explore alternatives, showcasing the power of a robust brand. This loyalty is a crucial asset, safeguarding market share in a competitive landscape. Building and maintaining strong customer relationships are vital for sustained success.

- Topgolf venues saw 23.1 million visits in 2023, demonstrating strong customer engagement.

- Callaway's golf equipment brand recognition further solidifies customer loyalty.

- Repeat customer rates at Topgolf venues are a key indicator of loyalty.

- The company's investment in customer experience supports brand loyalty.

Perceived Differentiation

The perceived differentiation of Topgolf Callaway Brands' offerings significantly influences the threat of substitutes. If Topgolf Callaway Brands can establish a strong brand image, it can reduce the attractiveness of alternatives. However, a lack of differentiation, such as generic golf clubs, increases the threat from rivals. Consider that in 2024, Callaway's golf equipment sales were $1.5 billion.

- Unique Experiences: Topgolf's entertainment venues offer differentiated experiences.

- Innovative Products: Callaway's golf clubs and balls often feature advanced technology.

- Brand Equity: Strong brand recognition can reduce the threat of substitutes.

- Lack of Differentiation: If products are perceived as generic, the threat increases.

Topgolf Callaway Brands faces substitution risks due to varied leisure options. The sports and fitness market was $486.3B in 2024, showing many alternatives. Competition from cheaper sports gear and entertainment venues also impacts them. Loyalty and differentiation are key to mitigating these threats.

| Aspect | Impact | Data |

|---|---|---|

| Market Size | High | $486.3B (Global sports market 2024) |

| Venue Visits | High | 23.1M (Topgolf visits in 2023) |

| Equipment Sales | Important | $1.5B (Callaway golf equipment sales 2024) |

Entrants Threaten

High capital needs, especially for Topgolf venues, make it tough for new players. The golf equipment sector demands big R&D and manufacturing investments. In 2024, building a single Topgolf site could cost tens of millions. [17, 19] These financial hurdles limit the number of companies that can enter the market. This protects Topgolf Callaway Brands from easy competition.

Topgolf Callaway Brands benefits from established brand equity, a significant barrier against new entrants. Topgolf's and Callaway's strong brand recognition gives them a competitive edge. Building brand awareness is a major hurdle for new apparel brands. In 2024, Callaway's net revenue reached $4.3 billion. This highlights the brand's strength.

Topgolf Callaway Brands benefits from economies of scale in manufacturing and distribution, which creates a barrier to entry. New competitors face higher costs until they reach a comparable scale, putting them at a disadvantage. In 2024, the company's global presence and large-volume purchasing allowed them to negotiate favorable supplier agreements. This advantage helps maintain profitability and market share.

Access to Distribution Channels

New golf equipment and apparel brands face hurdles due to existing distribution networks. Topgolf Callaway Brands benefits from established retailer and distributor relationships, a significant advantage. Securing shelf space and distribution agreements is difficult for new entrants. This advantage is crucial in a market where brand visibility is key. The challenge is amplified by the competitive landscape.

- Market share: Topgolf Callaway Brands held a significant market share in golf equipment in 2024.

- Distribution agreements: The company's extensive network provides widespread product availability.

- Retail partnerships: Strong relationships with major retailers are vital for sales.

- Brand recognition: Established brands are well-known, creating a barrier for newcomers.

Government Regulations

Government regulations and licensing requirements present a notable barrier for new entrants in the entertainment industry. Compliance with safety standards and local regulations, such as those related to construction, alcohol sales, and noise levels, significantly increases the complexity and cost for potential competitors. These regulatory hurdles can be particularly challenging for smaller businesses or startups, potentially deterring them from entering the market. For instance, obtaining the necessary permits and adhering to zoning laws can be a lengthy and expensive process, impacting the feasibility of new ventures.

- Compliance costs can include fees for inspections and permits.

- Zoning laws may restrict where entertainment venues can be located.

- Safety standards necessitate specific building designs and equipment.

- Alcohol licensing requires adherence to strict regulations.

Topgolf Callaway Brands faces a moderate threat from new entrants. High capital needs, brand recognition, and economies of scale provide some protection. Government regulations also add to the barriers.

| Barrier | Description | Impact |

|---|---|---|

| Capital Costs | Building venues is expensive. | Limits new entrants. |

| Brand Equity | Established brands hold an advantage. | Strong brand recognition. |

| Regulations | Compliance is complex and costly. | Adds to the market entry. |

Porter's Five Forces Analysis Data Sources

Our analysis draws on SEC filings, industry reports, and market research data to assess Topgolf Callaway's competitive landscape.