TotalEnergies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TotalEnergies Bundle

What is included in the product

TotalEnergies' BCG Matrix analysis across its diverse portfolio.

Printable summary optimized for A4 and mobile PDFs, allowing quick sharing of TotalEnergies' BCG analysis.

Full Transparency, Always

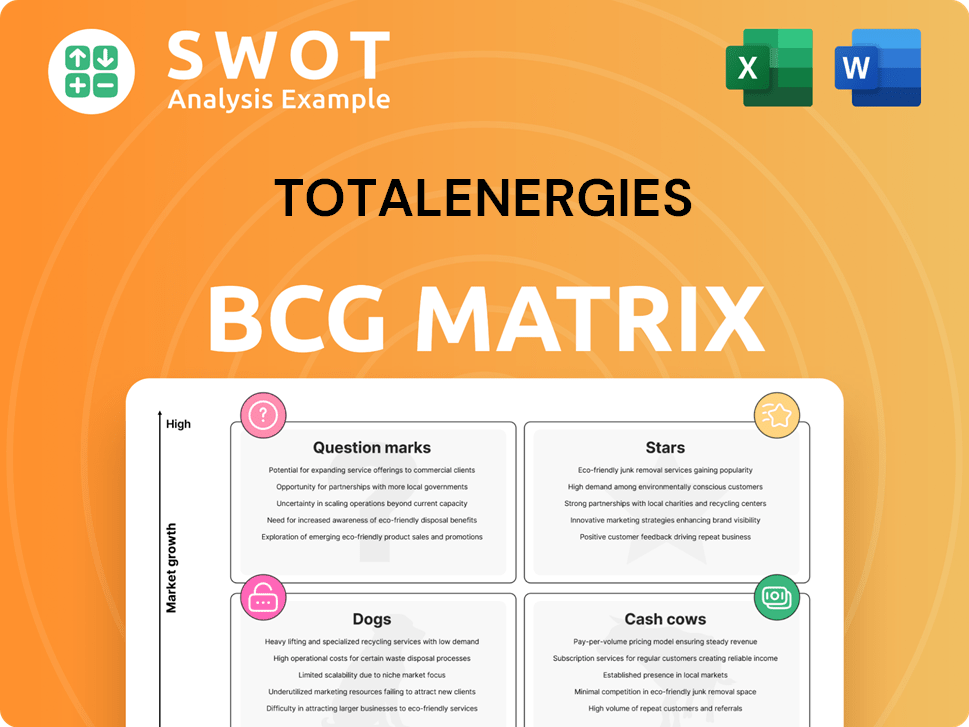

TotalEnergies BCG Matrix

The TotalEnergies BCG Matrix preview showcases the complete, ready-to-use document you'll receive. This isn't a demo; it's the actual report, fully formatted and primed for your strategic analysis and presentation needs.

BCG Matrix Template

TotalEnergies' BCG Matrix categorizes its diverse portfolio into Stars, Cash Cows, Question Marks, and Dogs.

This strategic tool assesses growth potential and market share for each business unit.

Understanding the quadrant placement reveals investment priorities and resource allocation.

This snapshot highlights key areas, but the full matrix provides deeper insights.

Discover detailed quadrant analysis, strategic recommendations, and editable formats.

Purchase the complete report now for competitive clarity and actionable strategies.

Get instant access to the full TotalEnergies BCG Matrix for informed decision-making.

Stars

TotalEnergies' Integrated LNG is a star in its BCG Matrix. In Q4 2024, it showed strong performance with a 35% earnings increase. This was driven by favorable gas prices and increased upstream production. TotalEnergies' position as the largest US LNG exporter provides a competitive edge.

The Integrated Power segment at TotalEnergies is experiencing substantial growth. In 2024, net electricity production surged by 23%, a clear indicator of expansion. TotalEnergies is strategically investing in renewables, targeting 100 TWh of electricity by 2030. This area is evolving into a key source of cash flow for the company.

TotalEnergies is aggressively pursuing renewable energy projects. They are investing in wind, solar, and hydropower. The company is targeting 35 GW of gross renewable capacity by the end of 2025. In 2024, TotalEnergies increased its renewable power generation by 28%.

Low-Cost, Low-Emission Oil & Gas Portfolio

TotalEnergies strategically manages its oil and gas assets, emphasizing low-cost, low-emission projects. The company has demonstrated its commitment by cutting methane emissions by 50% and reducing Scope 1+2 emissions by 28% by the end of 2024. This approach balances environmental responsibility with financial performance. TotalEnergies aims to provide energy while minimizing its carbon footprint.

- Methane emissions reduction: 50%

- Scope 1+2 emissions reduction: 28%

- Focus: Low-cost, low-emission projects

- Objective: Sustainable development and profitability

New Oil & Gas Projects

TotalEnergies significantly expanded its oil and gas projects in 2024, launching six major projects across Brazil, Suriname, Angola, Oman, and Nigeria. These initiatives are designed to boost production post-2025, supporting the company's strategic growth. The new projects are key to maintaining TotalEnergies' competitive edge in the energy market. This expansion aligns with TotalEnergies' balanced growth strategy.

- 2024 Projects: Brazil, Suriname, Angola, Oman, Nigeria

- Production Growth: Expected beyond 2025

- Strategic Goal: Maintain Competitive Advantage

- Financial Strategy: Balanced Growth

TotalEnergies' stars include Integrated LNG and Integrated Power, showing significant growth in 2024. The LNG segment saw a 35% earnings increase, while net electricity production jumped 23%. Renewables are a key area, with 28% generation growth in 2024.

| Segment | 2024 Performance | Strategic Focus |

|---|---|---|

| Integrated LNG | 35% Earnings Increase | Largest US LNG Exporter |

| Integrated Power | 23% Net Electricity Production Growth | 100 TWh Electricity by 2030 |

| Renewables | 28% Renewable Power Generation Growth | 35 GW Gross Capacity by 2025 |

Cash Cows

TotalEnergies' established oil production in regions like the North Sea and Africa generates substantial, steady revenue. Despite slower growth in the oil market, these operations are highly profitable. TotalEnergies benefits from its efficient infrastructure and low upstream production costs, approximately $5.9 per barrel in 2024, bolstering its financial stability.

The Refining and Chemicals segment remains a cash cow for TotalEnergies, generating substantial cash flow. Despite margin declines, high utilization rates and integrated operations support profitability. In 2024, the segment's adjusted operating income was around $1.9 billion. TotalEnergies is investing in biofuel production to ensure future relevance.

TotalEnergies has locked in medium-term LNG sales deals in Asia, largely linked to Brent crude. These agreements create predictable revenue and shield against volatile spot gas prices. In 2024, LNG sales contributed significantly to TotalEnergies' revenue. The company's robust LNG market presence guarantees a reliable cash flow. TotalEnergies' LNG sales are expected to generate $10-12 billion in free cash flow in 2024.

Marketing & Services

TotalEnergies' marketing and services segment acts as a reliable cash cow, especially in areas with developed networks. The firm capitalizes on its brand and distribution to stay competitive. This segment focuses on boosting efficiency and client contentment. In 2024, this sector generated approximately $40 billion in revenue.

- Consistent Revenue: Marketing and services provide stable income.

- Brand Strength: TotalEnergies uses its brand for market presence.

- Efficiency Focus: The segment prioritizes operational improvements.

- Financial Impact: Contributed significantly to 2024 revenue.

Hydrocarbon Exploration & Production

TotalEnergies' Hydrocarbon Exploration & Production is a cash cow, generating significant cash flow. This is bolstered by projects ramping up in 2024, ensuring continued profitability. The company prioritizes low-cost, high-return projects, maintaining financial strength. A strong organic reserve replacement ratio highlights the portfolio's robustness.

- In 2024, TotalEnergies expects to produce 2.6 million barrels of oil equivalent per day.

- The company's organic reserve replacement ratio was 103% in 2023.

- TotalEnergies plans to invest $16-18 billion in 2024, a significant portion in E&P.

TotalEnergies' cash cows, including oil production and refining, generate stable revenue. LNG sales and marketing also act as cash cows, providing predictable income. The company's focus on efficiency and brand strength supports these profitable segments.

| Cash Cow Segment | Key Feature | 2024 Financial Data |

|---|---|---|

| Oil Production | Efficient infrastructure | Upstream production costs $5.9/bbl |

| Refining & Chemicals | High utilization rates | Adjusted operating income ~$1.9B |

| LNG Sales | Medium-term contracts | Expected FCF $10-12B |

Dogs

Some of TotalEnergies' older exploration ventures, burdened by high extraction expenses, currently face scrutiny due to their low profitability and restricted expansion prospects. These projects frequently grapple with extraction costs surpassing $45 per barrel, coupled with modest production levels. For instance, in 2024, TotalEnergies might be assessing the viability of assets where these conditions persist. The company explores divestiture or strategic optimization of such holdings.

TotalEnergies' assets in regions with dwindling fossil fuel demand, like Europe, are under pressure. These might include older refineries or distribution networks. The company may need to find new uses for these assets. In 2024, European oil demand decreased by about 2%, impacting these assets.

Certain petrochemical operations, especially in Europe, might struggle due to overcapacity and shrinking profit margins. These operations could be considered "Dogs" if they don't align with TotalEnergies' long-term goals. In 2024, European petrochemical margins have faced significant pressure. The company may need to optimize or seek partnerships for these assets.

Underperforming Biofuel Ventures

If TotalEnergies' biofuel ventures aren't performing well, they fall into the "Dogs" category in a BCG Matrix. These ventures might struggle with high feedstock costs or regulatory issues, hindering profitability. For example, in 2024, biofuel production costs have risen by about 10% due to increased raw material prices. TotalEnergies might need to rethink its strategy for these ventures.

- Poor profitability.

- High feedstock costs.

- Regulatory hurdles.

- Market share decline.

Assets Facing Environmental Liabilities

Assets facing environmental liabilities at TotalEnergies, like contaminated sites, fit the "Dogs" quadrant in the BCG Matrix. These assets pose financial and reputational risks, potentially requiring costly remediation or divestiture. For example, in 2023, TotalEnergies allocated significant funds for environmental provisions. This impacts profitability and future investment.

- Environmental liabilities can lead to significant financial burdens.

- Reputational risks may arise from environmental concerns.

- Remediation efforts or divestiture could be necessary.

- TotalEnergies allocated significant funds for environmental provisions in 2023.

The "Dogs" in TotalEnergies' BCG Matrix include underperforming ventures with low growth and market share. This encompasses high-cost oil exploration (extraction over $45/barrel), and assets facing environmental liabilities. In 2024, TotalEnergies faced challenges from shrinking petrochemical margins and rising biofuel production costs.

| Category | Example | 2024 Impact |

|---|---|---|

| Oil Exploration | High Extraction Costs | Extraction costs surpassing $45/barrel. |

| Petrochemicals | European Operations | Significant pressure on margins. |

| Biofuels | Production Ventures | 10% rise in production costs. |

Question Marks

TotalEnergies is allocating resources to carbon capture, yet the long-term financial success of these technologies remains questionable. High upfront expenses and extensive infrastructure needs characterize carbon capture projects. Regulatory backing and technological progress are crucial for the widespread adoption of carbon capture. In 2024, the global carbon capture market was valued at approximately $3.8 billion, with projections indicating significant growth.

TotalEnergies views advanced biofuels, including sustainable aviation fuel (SAF), as a question mark in its BCG matrix. SAF faces challenges like feedstock limits and high costs. The Grandpuits biorefinery is set to start SAF production in mid-2025. SAF's market expansion relies on favorable regulations and tech advances. In 2024, SAF production remains small compared to traditional fuels.

TotalEnergies is investing heavily in EV charging, a "question mark" in its BCG matrix. The market is competitive, requiring substantial investment for growth. Profitability hinges on EV adoption and charging tech advancements. TotalEnergies aims for 150,000 charging points by 2025.

Green Hydrogen Production

TotalEnergies views green hydrogen as a "Question Mark" in its BCG matrix. This means the company is investing in this area, but the future is uncertain. Production costs and infrastructure limitations currently pose challenges. The International Energy Agency (IEA) estimates green hydrogen demand could reach 530 million tonnes by 2050.

- TotalEnergies plans to invest $100 million in green hydrogen projects by 2030.

- The company is exploring partnerships to develop green hydrogen production facilities in various countries.

- Green hydrogen adoption depends on technological breakthroughs and cost reduction.

New Market Entries in Renewable Energy

TotalEnergies is venturing into new renewable energy markets, including offshore wind and energy storage. These areas present significant growth potential but come with initial low market share. The company faces competition from established firms and requires specialized knowledge to succeed. Strategic alliances and technological advancements are key for TotalEnergies to gain ground.

- Offshore wind capacity is projected to reach 230 GW globally by 2030.

- Energy storage market is expected to hit $15.4 billion by 2024.

- TotalEnergies aims to increase its gross power generation capacity to 100 GW by 2030.

- Partnerships are vital, such as the recent deal with Veolia for sustainable solutions.

TotalEnergies considers carbon capture a question mark, investing amid uncertainty. The market was valued at roughly $3.8B in 2024, expecting growth. High costs and infrastructure needs challenge its success.

Advanced biofuels, particularly SAF, are also "question marks". SAF production started at Grandpuits in mid-2025. It faces feedstock and cost issues. SAF’s expansion depends on regulations and tech.

EV charging is a "question mark", requiring significant investment. Profitability relies on EV adoption and tech advancements. TotalEnergies targets 150,000 charging points by 2025.

Green hydrogen is a "question mark" with an uncertain future. Production costs and infrastructure are barriers. TotalEnergies plans $100M in projects by 2030. IEA forecasts 530M tonnes demand by 2050.

New renewables, like offshore wind, pose growth potential, but face competition. Offshore wind capacity is forecast at 230 GW by 2030. Strategic alliances are vital.

| Investment Area | Market Status | Challenges |

|---|---|---|

| Carbon Capture | $3.8B (2024) | High costs, infrastructure |

| Advanced Biofuels (SAF) | Small scale (2024) | Feedstock, cost |

| EV Charging | Growing market | Competition, tech |

| Green Hydrogen | Uncertain | Costs, infrastructure |

| Offshore Wind/Storage | High growth potential | Competition |

BCG Matrix Data Sources

The TotalEnergies BCG Matrix leverages data from financial filings, market analyses, and industry publications.