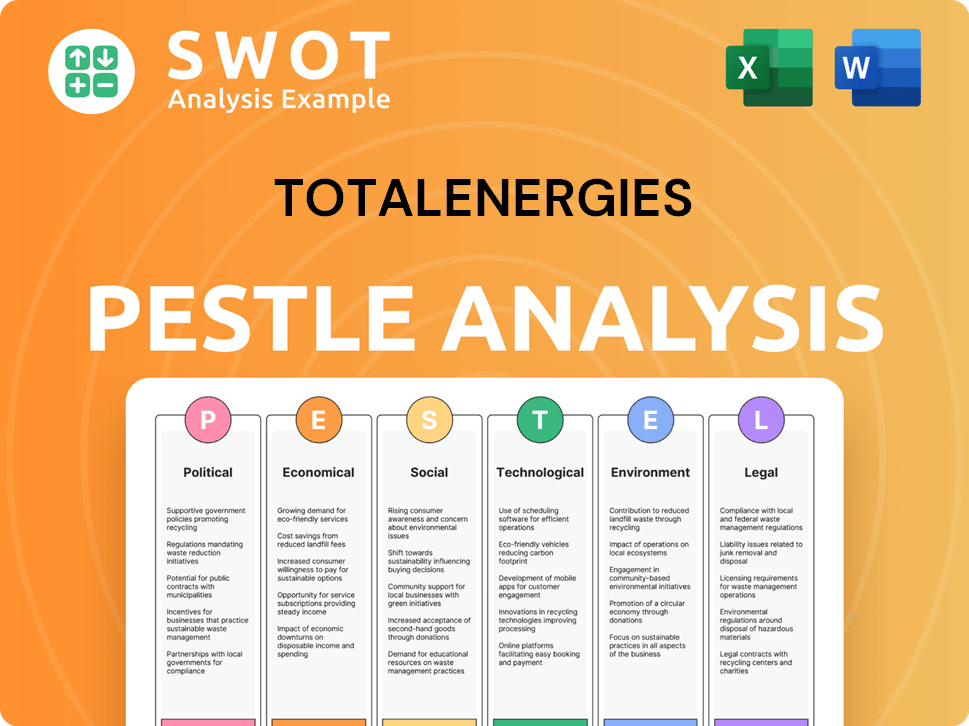

TotalEnergies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TotalEnergies Bundle

What is included in the product

Explores external factors influencing TotalEnergies across Political, Economic, etc., dimensions.

Helps to pinpoint critical factors, facilitating data-driven decision-making for agile problem-solving.

Full Version Awaits

TotalEnergies PESTLE Analysis

The TotalEnergies PESTLE analysis you see is the same, fully formatted document you'll download after purchase.

PESTLE Analysis Template

Uncover the forces shaping TotalEnergies with our PESTLE analysis. We explore political shifts, economic trends, and technological advancements impacting their operations. Understand social factors, legal frameworks, and environmental considerations. Get actionable insights to refine your strategies. Download the full version for a comprehensive view!

Political factors

TotalEnergies faces geopolitical risks, impacting its global operations. The Mozambique LNG project's suspension highlights these risks. Political instability can halt projects and deter investments. In 2024, the company's exposure remains significant, affecting its operational stability and financial performance. These challenges necessitate robust risk management strategies.

Government policies drive TotalEnergies' energy transition. Decarbonization targets and renewable energy support are key. The company adapts its strategy, investing heavily in renewables. For example, in 2024, TotalEnergies invested $4 billion in low-carbon energy. They actively engage governments.

TotalEnergies operates globally, facing intricate international sanctions and regulatory frameworks. The company has a strong track record of navigating these challenges. For example, in 2024, TotalEnergies complied with sanctions, adjusting operations where needed. Maintaining compliance with international regulations is a key focus. In 2024, they allocated $200 million for compliance.

Political Uncertainty in Key Markets

Political instability significantly affects TotalEnergies' operations. For instance, regulatory changes post-elections in major markets like the US can alter investment strategies. The company paused investments in US offshore wind projects due to such uncertainties. This highlights the direct impact of political risk on financial decisions.

- US offshore wind project investment pause due to political uncertainties.

- Regulatory changes affect investment strategies.

- Political risk impacts financial decisions.

Engagement with Governments and Stakeholders

TotalEnergies actively engages with governments and stakeholders, addressing energy policies and operational impacts. This interaction is vital for managing political risks and ensuring project success. For example, in 2024, TotalEnergies invested significantly in lobbying efforts, spending over $1.5 million in the first half of the year. This proactive approach helps in adapting to changing regulations and maintaining operational licenses. Such engagement is crucial, especially in regions with evolving energy policies.

- Lobbying spending in 2024: Over $1.5 million (first half).

- Focus: Energy policies, operational impacts, and regulatory compliance.

- Goal: Ensuring project viability and securing operational licenses.

- Impact: Adapting to changing regulations and maintaining stakeholder relations.

TotalEnergies navigates global political instability, impacting projects and investments, as seen in Mozambique. Government policies on decarbonization significantly influence the company's strategy, prompting substantial investments in renewables; for instance, $4 billion in 2024. Active engagement with governments, demonstrated by over $1.5 million in lobbying in early 2024, is crucial for adapting to changing regulations.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Geopolitical Risk | Project delays, investment uncertainty | Mozambique LNG project suspension |

| Decarbonization Policies | Energy transition strategy, investments in renewables | $4B investment in low-carbon energy |

| Regulatory Compliance | Operational adjustments, financial implications | $200M allocated for compliance |

Economic factors

TotalEnergies' financial health is significantly affected by global energy market shifts. This includes crude oil and natural gas prices, and refining margins. In Q1 2024, TotalEnergies reported adjusted net operating income of $6.1 billion. These shifts directly impact profitability and investment capabilities. For example, in 2023, TotalEnergies' production was 2.487 million barrels of oil equivalent per day.

TotalEnergies is heavily investing in the energy transition, focusing on low-carbon electricity and renewables. In 2024, about 35% of its investments were directed towards new energies. This shift in capital allocation, from traditional oil and gas to green energy, is a significant economic factor. The company plans to increase its renewable power generation capacity to 100 GW by 2030. This transition impacts future profitability and market valuation.

TotalEnergies prioritizes shareholder returns via dividends and buybacks. In 2024, the company's financial results showed strong cash flow generation. This supports ongoing investments and shareholder rewards. These actions are key to maintaining investor confidence. Strategic decisions impact financial health.

Competition from New Refineries

TotalEnergies faces increasing competition from new refineries, especially in Africa and Asia, which is putting pressure on refining margins. This economic factor directly challenges the profitability of its downstream operations. The global refining capacity is expanding, with significant projects coming online in regions like Nigeria and China. According to the IEA, global refining capacity is expected to increase by 2.5 million barrels per day in 2024 and 2025. This rise in capacity intensifies competition, potentially reducing profit margins for TotalEnergies.

- IEA forecasts 2.5 million barrels per day capacity increase in 2024/2025.

- New refineries in Africa and Asia are key competitors.

- Increased competition impacts refining margins negatively.

Economic Conditions in Operating Countries

TotalEnergies' financial performance is significantly influenced by economic conditions in its operating countries. Economic stability, marked by factors like GDP growth and inflation rates, directly impacts the demand for energy products. For instance, in 2024, countries like Qatar and the United Arab Emirates, where TotalEnergies has significant investments, are projected to have robust GDP growth, positively affecting the company's revenue. Budget deficits and public debt levels in host nations also pose financial risks.

- GDP Growth: Projected at 3-5% in key operating regions in 2024.

- Inflation: Expected to be between 2-4% in major markets.

- Public Debt: Concerns in some African nations, exceeding 70% of GDP.

- Oil Prices: Fluctuations impact profitability, with Brent crude trading around $80-$90 per barrel.

Economic factors profoundly shape TotalEnergies' financial outcomes.

Refining margin pressures intensify due to rising global capacity.

Key operational regions forecast GDP growth around 3-5% in 2024, impacting energy demand.

| Economic Indicator | Details | Impact on TotalEnergies |

|---|---|---|

| Oil Prices (Brent) | Trading range: $80-$90/barrel | Directly affects revenue and profitability. |

| GDP Growth (Key Regions, 2024) | Projected: 3-5% | Increases demand for energy products. |

| Global Refining Capacity (2024/2025) | Expected increase: 2.5 million bpd | Increases competitive pressure and lowers margins. |

Sociological factors

Public perception significantly impacts TotalEnergies' operations. Concerns about climate change and the oil and gas industry's role fuel scrutiny. In 2024, environmental activism intensified, affecting project approvals. TotalEnergies' social license hinges on addressing environmental and social impacts. They face pressure to transition towards renewable energy sources.

TotalEnergies' operations significantly affect local communities. Positive relationships depend on community engagement. They address concerns related to environment, social, and human rights issues. In 2024, TotalEnergies invested $1.5 billion in social programs. This includes education, health, and infrastructure projects.

TotalEnergies, as a major employer, faces workforce adjustments due to the energy transition. The company must adapt to evolving skill demands, particularly in renewable energy and sustainable technologies. For example, TotalEnergies plans to increase its workforce in renewable energy by 30% by 2025. This shift requires retraining programs and new talent acquisition strategies.

Consumer Preferences and Demand Evolution

Consumer preferences are shifting, with more people wanting cleaner energy and electric vehicles. TotalEnergies is responding by adjusting its products and services. This shift is evident in the growing global EV market, which reached approximately 14 million units in 2023. The company aims to expand its EV charging network.

- Global EV sales increased by 35% in 2023.

- TotalEnergies plans to invest heavily in renewable energy.

- Consumer demand for sustainable products is on the rise.

Stakeholder Expectations on Sustainability

Stakeholder expectations significantly influence TotalEnergies. Investors, NGOs, and the public increasingly demand corporate sustainability. TotalEnergies' actions, like emissions targets, are closely scrutinized. Failure to meet these expectations can damage the company's reputation and financial performance.

- In 2024, ESG-focused funds saw significant inflows, highlighting investor priorities.

- TotalEnergies aims to reduce Scope 1, 2 emissions by 40% by 2030 (from 2015 levels).

- NGOs actively monitor and report on the company's sustainability efforts.

TotalEnergies faces societal pressure tied to climate change. Public perception is shaped by environmental concerns, influencing project approvals and corporate reputation. Investment in social programs reached $1.5B in 2024, supporting communities. Changing consumer preferences drive the shift to renewables.

| Aspect | Details |

|---|---|

| EV Market (2023) | ~14M units sold |

| EV Sales Growth | 35% increase in 2023 |

| TotalEnergies ESG Focus | Reduce Scope 1, 2 emissions by 40% by 2030 (from 2015) |

Technological factors

TotalEnergies is leveraging tech for emission reduction. Innovations in methane detection, like drone-based systems, are crucial. The company is investing heavily in these technologies. In 2024, TotalEnergies allocated $4 billion for low-carbon projects. This aligns with its goal to cut methane emissions by 50% by 2025.

TotalEnergies heavily invests in renewable energy tech like solar and wind. In 2024, they allocated $4 billion to low-carbon energy. Battery storage tech is also key, with investments projected to increase by 15% by 2025. These advancements support their shift to a sustainable energy model.

TotalEnergies invests in digital transformation, using IoT and AI to boost efficiency. This includes deploying drones for infrastructure inspections. In 2024, the company aimed to cut operational costs by $1.5 billion via digital initiatives. By 2025, they anticipate even greater savings through enhanced digital integration.

Advancements in Battery Technology and EV Infrastructure

TotalEnergies faces technological shifts in the automotive industry. Battery technology advancements and EV infrastructure expansion influence demand for conventional fuels and offer e-mobility chances. The company is researching EV battery solutions. Global EV sales reached 14 million units in 2023, up from 10.5 million in 2022.

- TotalEnergies invested €1.5 billion in electric mobility and renewables in 2023.

- The company plans to have over 100,000 EV charging points by 2025.

- Battery technology improvements are projected to reduce EV costs by 30% by 2030.

Carbon Capture, Utilization, and Storage (CCUS)

Carbon Capture, Utilization, and Storage (CCUS) technologies are key for reducing emissions, particularly in sectors that are difficult to decarbonize. TotalEnergies is investing in CCUS to meet its emission reduction targets. The International Energy Agency (IEA) estimates that CCUS capacity needs to increase significantly to achieve global net-zero goals. TotalEnergies is involved in various CCUS projects worldwide.

- TotalEnergies aims to capture 10 million metric tons of CO2 per year by 2030.

- The company is involved in the Northern Lights project in Norway, a large-scale CO2 storage facility.

- CCUS projects can receive financial support through various government incentives and carbon pricing mechanisms.

TotalEnergies adopts tech to curb emissions and boost efficiency, with €1.5B in EV & renewables in 2023. The company aims for over 100,000 EV charging points by 2025 and targets capturing 10M tons of CO2 annually by 2030. Battery tech advancements aim to cut EV costs by 30% by 2030.

| Technology Area | 2023/2024 Actions | 2025 Targets/Forecasts |

|---|---|---|

| Emission Reduction | $4B allocated for low-carbon projects | Reduce methane emissions by 50% by 2025 |

| Renewable Energy | €1.5B invested in electric mobility | Increase battery storage investments by 15% by 2025 |

| Digital Transformation | Aimed to cut $1.5B operational costs | Further digital integration for cost savings |

Legal factors

TotalEnergies faces stringent environmental regulations globally. Compliance is a major legal concern, impacting operational costs. In 2024, TotalEnergies allocated billions for environmental projects. Non-compliance can lead to hefty fines and legal battles, affecting profitability and reputation.

TotalEnergies faces growing legal battles over its climate impact. NGOs are increasingly suing energy firms. In 2024, climate litigation surged globally. Cases target emissions and environmental damage. The company's legal risks are rising.

TotalEnergies must secure and uphold operating licenses and permits across diverse regions. Legal and regulatory obstacles can significantly influence project schedules and feasibility. In 2024, compliance costs related to permits and licenses amounted to approximately $1.2 billion. These legal requirements are critical for operational continuity.

International Law and Treaties

TotalEnergies' extensive international operations place it under the jurisdiction of various international laws and treaties. These include agreements concerning maritime boundaries, particularly relevant for offshore oil and gas projects. Geopolitical tensions and disputes, such as those observed in the South China Sea, directly impact the legality and feasibility of its projects. The company must navigate complex legal landscapes to ensure compliance and mitigate risks. For instance, in 2024, TotalEnergies faced legal challenges related to its operations in certain regions, costing them millions in compliance adjustments.

- International laws impact project feasibility.

- Geopolitical disputes create legal uncertainties.

- Compliance costs can significantly impact financials.

- Treaty adherence is crucial for operations.

Corporate Governance and Reporting Requirements

TotalEnergies faces rigorous corporate governance and reporting demands across its global operations. These regulations dictate how the company discloses its financial results, which is crucial for investor trust. TotalEnergies must report on its financial performance, risk factors, and sustainability initiatives to meet these requirements. Compliance with these standards is vital for maintaining its listing status and operational licenses.

- In 2024, TotalEnergies reported €23.7 billion in net operating income.

- The company's annual report includes extensive sections on risk management and sustainability.

- TotalEnergies is subject to the EU's Corporate Sustainability Reporting Directive (CSRD).

TotalEnergies is subject to a web of international laws impacting project feasibility, facing geopolitical and financial challenges. Treaty adherence and operational compliance costs are crucial considerations. In 2024, it reported on €23.7 billion net operating income, subject to stringent reporting.

| Legal Aspect | Impact | 2024 Data/Example |

|---|---|---|

| Environmental Regulations | High compliance costs, litigation risks | Billions allocated for environmental projects; $1.2 billion in permit compliance costs. |

| Climate Litigation | Rising legal risks, potential fines | Surge in climate-related lawsuits globally. |

| Corporate Governance | Investor trust, operational licenses | EU's CSRD; detailed financial and sustainability reports. |

Environmental factors

Climate change significantly shapes TotalEnergies' strategy. The company aims to cut greenhouse gas emissions, including methane, as part of its environmental goals. TotalEnergies is actively investing in renewable energy sources. In 2024, they allocated over $4 billion to low-carbon projects. Their Scope 3 emissions were around 400 MtCO2e in 2023.

The global shift towards cleaner energy significantly impacts TotalEnergies. The company is investing heavily in renewables, allocating over 35% of its investments to low-carbon energy sources in 2024. This adaptation is crucial to align with growing decarbonization demands, aiming for a 20% reduction in Scope 3 emissions by 2030.

TotalEnergies' operations, including exploration and production, can affect biodiversity and ecosystems. The company is actively working on plans to minimize its environmental footprint. For example, in 2024, TotalEnergies invested $1 billion in nature-based solutions. These initiatives aim to protect biodiversity. The company's goal is to achieve net-zero emissions by 2050.

Resource Scarcity and Water Management

Resource scarcity, especially water, is a growing environmental concern impacting TotalEnergies. Water management is crucial for its operations, particularly in water-stressed areas. TotalEnergies has pledged to reduce its water consumption. In 2024, the company invested significantly in water-efficient technologies across its global operations.

- Water stress is increasing globally; by 2025, 2.8 billion people may face water scarcity.

- TotalEnergies' operations in regions like the Middle East and Africa are particularly vulnerable.

- The company's 2024 sustainability report highlights water conservation efforts.

Environmental Incidents and Remediation

Environmental incidents pose considerable risks for TotalEnergies, encompassing spills and leaks requiring remediation. The company actively works to reduce these risks, implementing stringent safety protocols across its operations. In 2024, TotalEnergies allocated approximately $500 million for environmental remediation efforts. Effective response strategies are crucial if incidents happen, impacting both finances and reputation.

- 2024 Remediation Spending: ~$500 million.

- Focus: Minimizing spills and leaks.

- Goal: Effective incident response.

TotalEnergies navigates environmental challenges by investing in renewables and nature-based solutions. This includes reducing its carbon footprint, with a goal to achieve net-zero emissions by 2050. Water scarcity poses a risk, so the company focuses on efficient water management. The company invests in water-efficient technologies. Environmental incidents require proactive response. TotalEnergies spent roughly $500 million on remediation in 2024.

| Environmental Aspect | TotalEnergies Action | 2024 Data |

|---|---|---|

| Climate Change | Invest in renewable energy; Reduce emissions | >$4B in low-carbon projects |

| Resource Scarcity | Water conservation efforts | Investment in water-efficient tech |

| Environmental Incidents | Implement safety protocols; Remediation | ~$500M spent on remediation |

PESTLE Analysis Data Sources

TotalEnergies PESTLE Analysis incorporates data from government publications, industry reports, and financial news to build reliable insights.