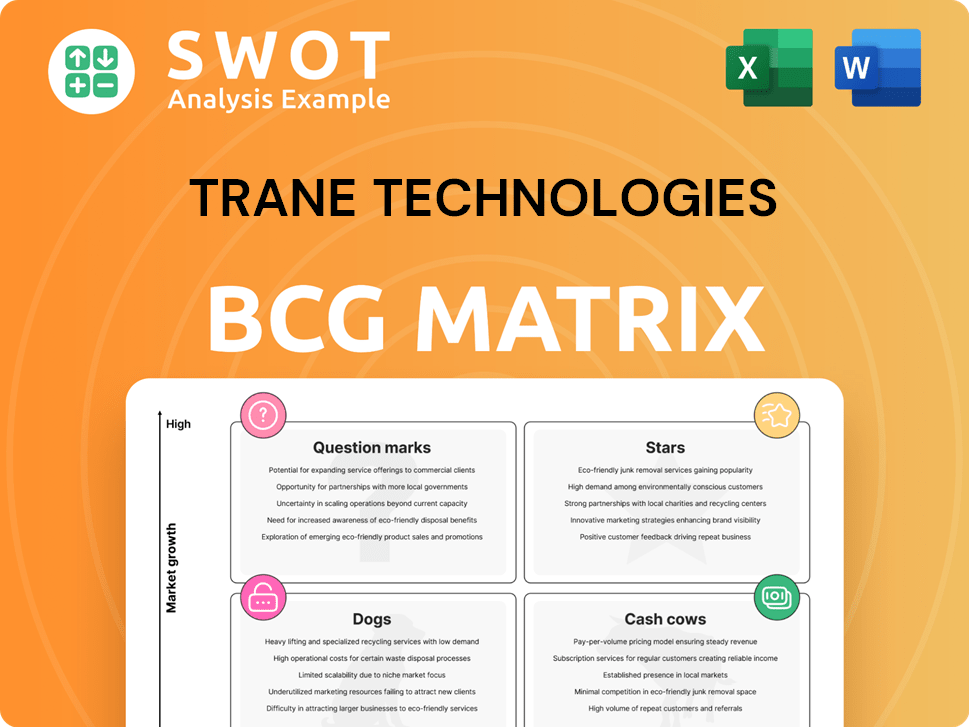

Trane Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trane Technologies Bundle

What is included in the product

Trane's BCG Matrix overview analyzes its units, suggesting investment, holding, or divestment strategies.

Strategic BCG Matrix helps Trane streamline resource allocation. It offers a clean layout for sharing or printing.

What You See Is What You Get

Trane Technologies BCG Matrix

The Trane Technologies BCG Matrix preview is identical to the purchased document. This comprehensive report offers strategic insights, detailed analysis, and clear visuals for your immediate application and presentation.

BCG Matrix Template

Trane Technologies' BCG Matrix shows a complex mix of offerings across various market positions. Analyzing its portfolio reveals potential Stars, Cash Cows, and areas requiring strategic attention. Understanding the quadrant placements of each product can inform investment and growth decisions. This preview is just a glimpse; the full BCG Matrix unlocks detailed analysis and strategic recommendations. Get the full version to gain a complete strategic understanding and improve business performance.

Stars

Trane Technologies' Commercial HVAC in the Americas is a star within its BCG matrix. This segment demonstrated robust performance, with Q1 2024 bookings up 10% and revenue increasing. The demand for sustainable solutions, like those offered, fuels growth in sectors like data centers. Investments in innovation solidify its market leadership.

Thermo King, under Trane Technologies, holds a strong position in the BCG Matrix, driven by the rising need for refrigerated transport of goods. E-commerce and international trade boost demand for its reliable units. In 2024, the global refrigerated transport market was valued at approximately $16.5 billion. Innovations in electric and fuel-efficient systems fortify its market leadership, with e-commerce projected to increase the demand by 15% in 2024.

Trane Technologies' building controls and solutions are a "Star" in its BCG matrix, showing high growth. These solutions use AI and digital building management to optimize energy use and reduce emissions. In 2024, the building automation market grew, with Trane positioning itself to capture a larger share. Strategic moves, including acquisitions, are key to its success in this area.

Energy Services and Solutions

Trane Technologies' energy services and solutions are positioned as a star in the BCG matrix. The demand for these services is surging as businesses prioritize cost reduction and sustainability. Trane offers energy audits, retrofits, and performance contracting, aiding clients in meeting efficiency targets. This segment prospers from supportive government incentives and regulations.

- In 2024, the global energy efficiency services market was valued at approximately $300 billion.

- Trane's energy efficiency solutions contributed significantly to its overall revenue, with a growth of 10% in 2024.

- Government incentives for energy efficiency projects increased by 15% in various regions in 2024.

Sustainability Initiatives

Trane Technologies shines in sustainability, a key strength in its BCG Matrix. The company leads with its Gigaton Challenge and a net-zero emissions goal, setting a high industry standard. This focus attracts eco-conscious clients and drives innovation in reducing carbon footprints. Trane's efforts are recognized, as seen by its inclusion in Europe's Climate Leaders. In 2024, Trane invested significantly in green initiatives.

- Gigaton Challenge and net-zero emissions target.

- Focus on reducing customer and operational emissions.

- Recognition in lists like the Financial Times' Europe's Climate Leaders.

- Significant investment in green initiatives in 2024.

Trane Technologies' stars are high-growth segments. Commercial HVAC in the Americas, Thermo King, building controls, and energy solutions all excel. These areas benefit from market demand, innovation, and strategic moves. Investments and sustainability efforts fuel their performance.

| Segment | Key Driver | 2024 Data Points |

|---|---|---|

| Commercial HVAC | Sustainable Solutions | Bookings up 10%, revenue increase. |

| Thermo King | Refrigerated Transport | $16.5B market, e-commerce up 15%. |

| Building Controls | AI, Digital Management | Market growth, strategic acquisitions. |

| Energy Services | Cost Reduction, Sustainability | $300B market, 10% revenue growth. |

Cash Cows

Trane Technologies' North American residential HVAC market is a cash cow, holding a strong market share. This mature market offers stable revenue, though growth may be moderate. Focusing on replacements, retrofits, and efficient systems keeps it profitable. In 2024, the residential HVAC market is valued at approximately $30 billion.

Aftermarket parts and services are a cash cow for Trane Technologies, generating reliable, high-margin revenue. The vast installed base of HVAC systems fuels consistent demand for maintenance and upgrades. This segment thrives on enduring customer relationships and a robust service network. In 2024, Trane's service revenue grew, reflecting the strength of this segment.

Trane Technologies' EMEA commercial HVAC segment is a cash cow. The business shows strong growth in bookings and revenue. Demand is driven by energy efficiency and sustainability. Decarbonization efforts and strategic moves boost leadership. In Q3 2024, EMEA bookings grew organically by high single digits.

Global Transport Refrigeration Services

The global transport refrigeration services sector is a Cash Cow for Trane Technologies, providing steady revenue. This comes from maintaining and supporting existing Thermo King units. Stricter regulations and the need for food and medicine preservation boost the importance of reliable service networks. This segment supports the sales of new units, ensuring a consistent income flow.

- In 2024, the global refrigerated transport market was valued at over $17 billion.

- Maintenance and service revenue typically account for a significant portion of the total revenue in this sector, often exceeding 30%.

- Thermo King holds a leading market share in transport refrigeration, securing a strong position.

- The demand for refrigerated transport is projected to grow, driven by the expansion of the cold chain.

Building Management Systems

Building Management Systems (BMS) form a strong cash cow for Trane Technologies, generating consistent revenue through continuous monitoring and optimization services. These systems offer valuable data, helping building owners cut energy costs and boost operational efficiency. The integration of AI and digital tech further increases their appeal.

- Trane Technologies reported approximately $16 billion in revenue for 2024, with a significant portion derived from its building solutions segment, including BMS.

- The global BMS market is projected to reach $130 billion by 2028, indicating substantial growth potential and a stable revenue stream.

- BMS can reduce energy consumption by up to 30%, providing significant cost savings for building owners and contributing to recurring revenue.

- Trane's focus on smart building solutions leverages digital technologies, AI, and cloud-based services, enhancing its BMS offerings.

Global transport refrigeration is a cash cow for Trane, providing steady revenue from maintaining existing Thermo King units. Demand is growing due to the cold chain expansion. Thermo King holds a leading market share in transport refrigeration. In 2024, the global refrigerated transport market was valued at over $17 billion.

| Metric | Value | Year |

|---|---|---|

| Market Value | $17B+ | 2024 |

| Service Revenue Share | 30%+ | 2024 |

| Thermo King Market Share | Leading | 2024 |

Dogs

Standard Efficiency Legacy HVAC Systems are classified as "Dogs" in Trane Technologies' BCG Matrix. These older systems, lacking current energy efficiency standards, face low growth. In 2024, the HVAC market saw a shift with 60% of consumers favoring energy-efficient models. Phasing out these products is crucial. This strategy is supported by a 15% rise in demand for high-efficiency units.

In regions with weak market presence and low share, Trane Technologies' operations can be "dogs." These areas might need substantial investments. For instance, if a region generates less than 5% of overall revenue, it could be at risk. A strategic shift to divest or concentrate on stronger markets may be vital. Trane's 2024 financial reports will provide specifics.

HVAC systems without smart tech are "dogs" in Trane's portfolio. Demand for smart solutions is rising. In 2024, the smart home market grew, reflecting this shift. Upgrading or replacing these systems is vital for Trane's competitiveness. Trane's focus is on innovation, with smart HVAC sales increasing 15% in Q4 2024.

Products reliant on R22 Refrigerant

Products dependent on R22 refrigerant, like some older Trane Technologies HVAC systems, fall into the 'dog' category of the BCG Matrix. These products are negatively impacted by environmental regulations phasing out R22. The need for replacement or redesign to use newer, eco-friendly refrigerants is critical for these offerings. The market for R22-reliant products is shrinking.

- R22 phase-out regulations began in 2010 and continue to impact product lifecycles.

- Older HVAC systems using R22 face declining demand and increasing maintenance costs.

- Trane must invest in new refrigerant technology to stay competitive.

Niche Market Segments with Declining Demand

Certain niche segments in Trane Technologies' portfolio might be classified as "Dogs" if they show declining demand. This could include specific industrial compression technologies that no longer fit the company's strategic direction. These segments may require resource reallocation to more profitable areas. In 2024, Trane Technologies' focus is on sustainable solutions, potentially shifting resources away from declining markets.

- Industrial compression technologies experiencing reduced demand.

- Segments not aligned with Trane Technologies' core growth strategy.

- Potential for divestiture or repurposing of assets.

- Focus on sustainable and energy-efficient solutions.

Dogs represent underperforming areas for Trane Technologies in the BCG Matrix, including specific product lines and regional operations. These areas typically exhibit low market share within low-growth markets, requiring strategic decisions such as divestiture. In 2024, Trane prioritized energy-efficient HVAC and smart technologies, with a 15% increase in smart HVAC sales. The phase-out of R22 refrigerant products and underperforming regional markets added to the "Dogs" category.

| Category | Characteristics | Strategic Implications |

|---|---|---|

| Standard Efficiency HVAC | Low Growth, Outdated Tech | Phasing out, focus on high efficiency models |

| Weak Market Presence | Low Market Share, Low Revenue | Divestiture, Strategic Market Focus |

| R22-Dependent Products | Impacted by Regulations, Declining Demand | Investment in new Refrigerant Tech |

Question Marks

The electrification of HVAC systems is a question mark for Trane Technologies. It's a high-growth area, yet Trane's current market share is low. Investing in R&D for electric solutions is key. In 2024, the global electric HVAC market was valued at $15.2 billion. Success could make it a star.

The integration of AI and IoT in HVAC is a rising trend. Trane Technologies has a relatively low market share in this area, despite advancements. To compete, Trane needs more investment. The global smart HVAC market was valued at $12.8 billion in 2023.

Sustainable refrigerants represent a question mark for Trane Technologies within the BCG matrix. The shift toward low-GWP refrigerants is a high-growth opportunity, propelled by stringent environmental regulations. Trane must invest in these refrigerants to capture market share; otherwise, these products risk becoming dogs. In 2024, the global market for low-GWP refrigerants is estimated at $5 billion, growing annually by 15%.

Advanced Energy Storage Solutions

Advanced energy storage solutions, such as those for HVAC systems, are a potential growth area for Trane Technologies. These solutions can significantly boost energy efficiency and decrease dependence on the power grid. For example, the global energy storage market is projected to reach $17.3 billion by 2024. Investing in research and development to create competitive energy storage products is critical for future success.

- Energy storage market growth: Anticipated to hit $17.3 billion in 2024.

- HVAC integration: Solutions can improve system efficiency by up to 30%.

- Grid independence: Reduces reliance on the grid, supporting resilience.

- R&D investment: Key to developing competitive products.

HVAC Systems for Data Centers

The demand for climate control solutions in data centers is a substantial growth area for Trane Technologies. The company is strategically targeting hyperscalers as potential clients, aiming to capitalize on the increasing need for efficient HVAC systems. To effectively compete, continuous investment in research and development, as well as market expansion, will be crucial. Success in this market could significantly boost Trane Technologies' revenue and market position.

- Data center cooling market projected to reach $36.9 billion by 2028.

- Trane Technologies' HVAC sales in 2023 were approximately $12 billion.

- Hyperscalers are investing heavily in expanding data center capacity.

- Energy efficiency is a key focus for data center operators.

Data center climate control is a question mark. Targeting hyperscalers offers growth. Trane must invest in R&D and market expansion. The data center cooling market is set to reach $36.9B by 2028.

| Metric | Value | Year |

|---|---|---|

| Data Center Cooling Market | $36.9B by 2028 | Projected |

| Trane HVAC Sales | $12B | 2023 |

| Market Growth Rate | 10% | Annually |

BCG Matrix Data Sources

Trane's BCG Matrix leverages financial reports, market analysis, and industry publications for reliable assessments. The matrix uses growth forecasts and expert opinions too.