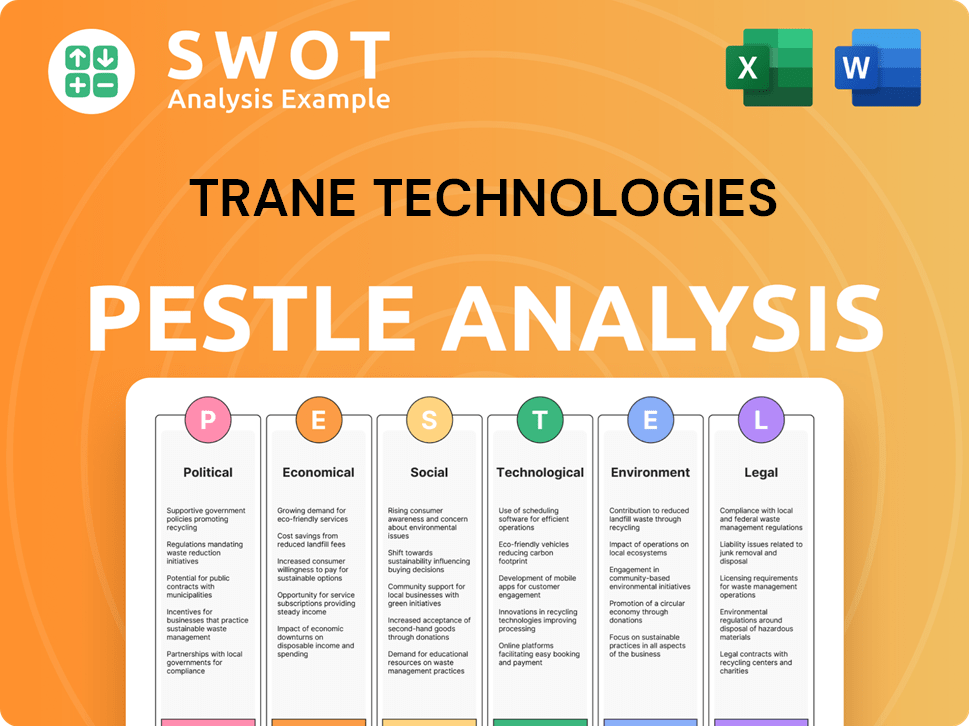

Trane Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Trane Technologies Bundle

What is included in the product

Assesses Trane Technologies across Political, Economic, Social, Technological, Environmental, and Legal factors. Identifies threats and opportunities with data.

Helps support discussions on external risk during planning sessions.

What You See Is What You Get

Trane Technologies PESTLE Analysis

Preview the comprehensive Trane Technologies PESTLE Analysis! This detailed document you are viewing mirrors what you’ll receive.

It examines Political, Economic, Social, Technological, Legal, & Environmental factors affecting the company.

The analysis offers strategic insights and a structured approach, ready for your use after purchase.

The final document has the same layout and structure, so what you see is what you'll get.

Download it and apply insights instantly after buying.

PESTLE Analysis Template

See how global shifts affect Trane Technologies with our PESTLE Analysis. Explore key factors: political stability, economic growth, technological innovation, and social trends. Analyze environmental regulations and legal challenges shaping its path. Understand market dynamics, risk, and potential. Equip yourself for strategic success: download the full analysis now!

Political factors

Government regulations heavily influence Trane Technologies. The Inflation Reduction Act boosts demand for efficient HVAC systems. Compliance with evolving rules, like the EU's F-Gas Regulation, is crucial. These factors directly affect product development and market strategies. In 2024, Trane's revenue was $17.2 billion, reflecting the impact of these regulations.

Global trade policies significantly influence Trane Technologies' operations. Tariffs and trade restrictions, such as those arising from U.S.-China tensions, directly affect the cost of components. For example, tariffs on Chinese-made HVAC components could increase costs by 5-10%. This impacts Trane's pricing and profitability. Uncertainty in international markets is another key concern.

Political stability is vital for Trane Technologies' global operations. Geopolitical conflicts can disrupt supply chains. For example, the Russia-Ukraine war impacted supply chains. In 2024, geopolitical risks continue to affect investment decisions.

Government Incentives and Funding

Government policies significantly influence Trane Technologies' market. Incentives like tax credits for energy-efficient systems boost demand for Trane's products. The Inflation Reduction Act of 2022, for example, provides substantial tax credits, potentially increasing Trane's sales. These policies align with Trane's focus on sustainability, supporting its growth. Furthermore, government funding for green initiatives creates opportunities.

- The Inflation Reduction Act (IRA) of 2022 allocated approximately $369 billion to climate and energy provisions, which indirectly benefits Trane Technologies.

- U.S. federal tax credits for energy-efficient commercial buildings can cover up to $1.88 per square foot, encouraging upgrades with Trane's equipment.

- In 2024, the global energy efficiency market is projected to reach $290 billion, with government policies playing a significant role.

Lobbying and Political Contributions

Trane Technologies actively participates in lobbying to shape climate policies and regulations that impact its business. In 2024, the company spent approximately $1.6 million on lobbying activities, focusing on energy efficiency and HVAC standards. Several of Trane's lobbyists previously held government positions, suggesting a strategic approach to influence decision-making. This involvement is crucial for navigating the evolving political landscape and ensuring favorable conditions for its products and services.

- 2024 Lobbying Expenditure: ~$1.6 million

- Focus Areas: Climate policy, energy efficiency, and HVAC standards

- Strategic Advantage: Influence over policy and regulations

Government regulations such as the Inflation Reduction Act impact Trane's demand. Trade policies, including tariffs, affect component costs and market dynamics. Political stability is critical for supply chains and global operations.

| Factor | Impact | Data |

|---|---|---|

| IRA | Boosts Demand | $369B allocated to climate |

| Trade | Affects Costs | Tariffs up costs 5-10% |

| Stability | Disrupts Chains | 2024: geopolitical risks continue |

Economic factors

Global economic conditions, including recessions, inflation, and interest rate volatility, significantly impact infrastructure and construction investments, affecting Trane Technologies' demand. For example, despite economic uncertainties, the company's 2024 revenue grew, partly due to strong commercial HVAC demand. In Q1 2024, Trane's organic sales increased 7%, demonstrating resilience. However, rising interest rates and inflation in 2024 could potentially impact future projects.

Trane Technologies navigates inflation by leveraging volume, price adjustments, and efficiency gains. In 2024, the company reported a 6% organic revenue growth, fueled by strong demand and pricing strategies. This approach helped maintain and improve margins, despite rising costs. The company's focus on productivity enhancements further supports its financial health.

The global construction market's size and growth significantly affect Trane Technologies' HVAC revenue. Experts predict this market to reach $15.2 trillion by 2025, growing at 4.2% annually. North America and Europe show strong growth potential, which Trane can leverage. This expansion offers major opportunities for Trane's construction-related HVAC solutions.

Currency Exchange Rate Volatility

Currency exchange rate volatility poses a risk to Trane Technologies, given its global operations. Fluctuations in exchange rates can significantly affect the company's financial outcomes. For instance, a stronger U.S. dollar can reduce the value of sales made in other currencies. This can lead to lower reported revenue growth. In 2024, currency fluctuations impacted several multinational companies.

- In Q1 2024, currency exchange negatively impacted Trane's revenue by approximately $50 million.

- The Eurozone and Asia-Pacific regions are key areas where currency volatility is closely monitored.

Market Demand for Energy Efficiency and Sustainability

The market's strong appetite for energy efficiency and sustainability is a key economic driver for Trane Technologies. This demand is fueled by increasing energy expenses and the urgent need to lower building emissions, creating a favorable environment for their HVAC and sustainable solutions. This trend is projected to boost revenue growth, particularly in their commercial HVAC segment. For instance, the global green building materials market is expected to reach $439.3 billion by 2027.

- Growing demand for energy-efficient systems.

- Rising energy costs.

- Need to reduce building emissions.

- Supports revenue growth in commercial HVAC.

Economic conditions, including inflation and interest rates, influence Trane Technologies. Strong demand fueled a 6% organic revenue growth in 2024. Rising interest rates could impact future projects. The global construction market is forecast to reach $15.2 trillion by 2025, offering opportunities.

| Metric | Data | Year |

|---|---|---|

| Organic Revenue Growth | 6% | 2024 |

| Global Construction Market Size (Forecast) | $15.2 Trillion | 2025 |

| Green Building Materials Market (Forecast) | $439.3 Billion | 2027 |

Sociological factors

Growing consumer and corporate emphasis on sustainability and reducing carbon footprints significantly impacts purchasing behaviors, boosting the demand for Trane Technologies' eco-friendly solutions. This societal trend perfectly complements the company's mission and product range. In 2024, Trane Technologies reported that 69% of its revenue came from sustainable products and services. The company aims to reduce its customers' carbon emissions by 50% by 2030.

Societal shifts emphasize indoor environmental quality (IEQ). Growing awareness of health impacts drives HVAC demand. Trane's focus on comfort and efficiency aligns with this. The global HVAC market is projected to reach $270.7 billion by 2025. This presents a significant opportunity for Trane Technologies.

The HVAC industry faces a growing need for skilled labor, a key sociological factor for Trane Technologies. To combat this, Trane invests heavily in training facilities and apprenticeship programs. In 2024, Trane spent $25 million on workforce development initiatives. This investment aims to ensure a pipeline of qualified technicians and engineers. These efforts are critical for Trane's long-term growth and operational efficiency.

Community Engagement and Social Responsibility

Trane Technologies prioritizes community engagement and social responsibility, actively participating in corporate citizenship initiatives. The company focuses on education programs and creating pathways to green careers, aligning with societal expectations for positive contributions. In 2024, Trane invested $17 million in community programs globally. This commitment is part of their larger ESG strategy.

- $17 million invested in community programs in 2024.

- Focus on education and green career pathways.

- Aligned with broader ESG goals.

Demographic Trends

Demographic trends significantly impact Trane Technologies. Urbanization and housing starts directly affect HVAC demand. Increased multi-family housing and individual homeowners create residential sector opportunities. In 2024, U.S. housing starts reached 1.4 million units, influencing Trane's market.

- U.S. housing starts in 2024 were at 1.4 million.

- Multi-family housing growth is a key market for Trane.

- Urbanization fuels demand for commercial HVAC systems.

Sustainability and carbon footprint concerns drive demand for Trane's eco-friendly solutions, with 69% of 2024 revenue from sustainable products. Focus on indoor environmental quality increases HVAC needs. Community engagement and ESG initiatives are central.

| Sociological Factor | Impact | 2024 Data |

|---|---|---|

| Sustainability | Boosts demand | 69% Revenue from sustainable products |

| Indoor Air Quality | Drives HVAC needs | HVAC market projected to $270.7B by 2025 |

| Community Engagement | Supports ESG goals | $17M invested in community programs |

Technological factors

Trane Technologies is at the forefront of innovation in sustainable technologies. The company is focused on energy-efficient HVAC systems, transport refrigeration, and building management systems. In 2024, Trane Technologies invested $400 million in R&D, driving advancements in eco-friendly solutions. This commitment supports its goal to reduce customers' carbon footprint by one gigaton by 2030.

Trane Technologies benefits from digital transformation and smart building trends. They leverage data analytics to enhance energy efficiency in buildings, aligning with their core business. In 2024, the smart building market was valued at $80.6 billion, projected to reach $156.3 billion by 2029. This growth underscores the potential for Trane's offerings. Their focus on connected systems supports building optimization and sustainability goals.

The shift toward electric heating and cooling is a significant technological trend. Trane Technologies is at the forefront, developing electric and hybrid HVAC systems. In 2024, the global market for electric HVAC systems was valued at $45 billion. Trane's Center of Excellence for Electrification supports these innovations. This focus aligns with the growing demand for energy-efficient and sustainable solutions.

Refrigerant Technology

Trane Technologies faces significant technological shifts due to refrigerant advancements. The industry is transitioning towards lower Global Warming Potential (GWP) refrigerants to meet environmental standards. This transition is driven by regulations like the Clean Air Act, necessitating rapid adaptation. For instance, the company's 2024 sustainability report highlights their investment in new refrigerant technologies.

- Trane Technologies aims to achieve a 50% reduction in greenhouse gas emissions from its products by 2030.

- The company invested approximately $100 million in R&D for sustainable products in 2024.

- Regulations such as the European F-Gas Regulation and the U.S. AIM Act are major drivers.

Integration of Technologies

Trane Technologies recognizes the increasing demand for scalable, interoperable building management systems. The company is actively developing solutions designed for seamless integration with existing infrastructures. This approach is crucial as the market shifts towards unified systems. In 2024, the global smart building market was valued at $80.6 billion, with projections to reach $201.8 billion by 2029, reflecting this trend.

- Smart building market growth underscores the need for integrated solutions.

- Trane's focus on compatibility aims to capture market share.

- The company’s strategy aligns with industry demands for unified systems.

Trane Technologies prioritizes innovation in energy-efficient and smart solutions. The company is investing heavily in R&D, with $400 million allocated in 2024, and is developing eco-friendly HVAC and refrigeration systems. Technological advancements drive its commitment to lowering customer carbon footprints and developing the company's emission cuts.

| Technological Aspect | 2024 Data | 2029 Projection |

|---|---|---|

| Smart Building Market | $80.6 billion | $156.3 billion |

| Electric HVAC Market | $45 billion | Growing significantly |

| R&D Investment | $400 million | Continued growth |

Legal factors

Trane Technologies faces legal obligations tied to environmental rules. Stricter emission standards, refrigerant handling, and energy efficiency targets are in place. The F-Gas Regulation and the Clean Air Act, for example, affect operations. In 2024, the company allocated $100 million for environmental compliance. This includes investments to meet new regulations.

Trane Technologies must adhere to strict product safety standards. This includes managing potential legal liabilities linked to its products' environmental impact and safety. As of 2024, Trane allocates significant resources to maintain product liability insurance and environmental compliance reserves, reflecting its commitment to risk management. For example, in 2024, the company's legal and compliance expenses were approximately $100 million.

Trane Technologies heavily relies on patents to safeguard its intellectual property, which is crucial for its legal standing. The company's commitment to research and development (R&D) is substantial, with approximately $250 million invested annually to create new intellectual property. This investment is vital for maintaining Trane's competitive advantage in the HVAC and building automation markets. In 2024, Trane secured over 100 new patents, further solidifying its intellectual property portfolio.

Trade and Export Control Regulations

Trane Technologies must adhere to international trade and export control regulations, critical for its worldwide activities. These regulations encompass trade protection measures and tariffs, impacting the company's costs and market access. For example, in 2024, the U.S. imposed tariffs on certain imported goods, potentially affecting Trane's supply chain. Compliance is essential to avoid penalties and maintain operational efficiency.

- Trade protection measures, like tariffs, can increase costs.

- Export controls affect the movement of goods across borders.

- Non-compliance can lead to significant financial penalties.

- Global operations require strict adherence to trade laws.

Corporate Governance and Reporting Requirements

Trane Technologies, as a publicly traded entity, must adhere to rigorous corporate governance rules and financial reporting standards. These requirements encompass full compliance with securities laws and the meticulous preparation of financial statements. The company's adherence to these regulations is crucial for maintaining investor trust and market confidence. In 2024, Trane Technologies' commitment to transparent reporting was evident in its consistent filings with the SEC.

- SEC filings are a key aspect of compliance.

- Financial reporting must be accurate and timely.

- Investor confidence is directly linked to governance.

- Trane Technologies' stock performance reflects compliance.

Trane Technologies navigates environmental laws and safety regulations, investing $100 million in compliance in 2024. Intellectual property is crucial; they invest $250M yearly in R&D. Global operations hinge on trade and export controls. In 2024, over 100 new patents were secured. Corporate governance and financial reporting standards ensure transparency, demonstrated by consistent SEC filings.

| Regulation Area | Compliance Aspect | 2024/2025 Impact |

|---|---|---|

| Environmental | Emission standards, refrigerant handling | $100M allocated for environmental compliance; F-Gas impact |

| Product Safety | Liability management, product impact | Significant resources for insurance and reserves, Legal & Compliance $100M. |

| Intellectual Property | Patents, R&D investments | 100+ patents secured in 2024; $250M annual R&D |

| Trade | Tariffs, export controls | U.S. tariffs potentially affecting supply chain; Compliance crucial |

| Corporate Governance | SEC filings, reporting standards | Consistent SEC filings; impact on investor trust and market confidence |

Environmental factors

Climate change is a critical environmental factor, increasing demand for Trane Technologies' sustainable solutions. The global push for decarbonizing buildings, industry, and cold chains supports the company's goals. In 2024, Trane reported that 70% of its revenue comes from products and services that improve energy efficiency and reduce emissions. This focus opens up significant market opportunities. The company's investments in green technologies align with evolving environmental regulations and consumer preferences.

Trane Technologies is deeply committed to cutting greenhouse gas emissions. The company has set ambitious targets for reducing its operational emissions and helping customers lower theirs. This commitment is a core environmental focus, with specific initiatives like the Gigaton Challenge. In 2023, Trane reduced its operational emissions by 36% compared to 2019 levels.

Rising demands for energy-efficient solutions are crucial. Trane Technologies focuses on reducing energy use in buildings and transport. For example, in 2024, the company's products helped customers avoid 11 million metric tons of CO2 emissions. Energy efficiency investments are expected to rise by 10% in 2025.

Sustainable Resource Management

Trane Technologies prioritizes sustainable resource management by reducing its environmental footprint. The company actively works on minimizing water usage and aims for zero waste to landfill across its manufacturing facilities. These efforts are part of a broader strategy to lessen its impact on the environment. In 2023, Trane's waste diversion rate was 85%.

- Water usage reduction initiatives.

- Zero waste to landfill goals.

- Waste diversion rate.

Development of Environmentally Responsible Products

Trane Technologies focuses on creating and selling eco-friendly products and services, which is key to their environmental strategy and how they compete in the market. They are investing in technologies that use refrigerants with a lower Global Warming Potential (GWP) and also in electric technologies. This approach helps them meet sustainability goals and stay ahead of environmental regulations. In 2023, Trane Technologies reported that its sustainable offerings generated approximately $14 billion in revenue.

- Investments in R&D for low-GWP refrigerants and electric HVAC systems.

- Expansion of the EcoWise portfolio, which includes products designed to minimize environmental impact.

- Collaboration with customers to reduce their carbon footprint through energy-efficient solutions.

- Compliance with and anticipation of evolving environmental regulations worldwide.

Environmental factors strongly influence Trane Technologies' business strategy and market opportunities.

Climate change drives demand for energy-efficient and sustainable solutions. Their sustainable offerings generated approximately $14 billion in revenue in 2023. In 2023, they reduced operational emissions by 36% (vs. 2019 levels).

| Environmental Focus | Initiatives | 2024/2025 Data |

|---|---|---|

| Emissions Reduction | Gigaton Challenge; Operational improvements | 70% revenue from green products, emissions down 36% vs. 2019 |

| Resource Management | Water reduction; Zero waste initiatives | Waste diversion 85% in 2023, 10% investment increase (2025) |

| Sustainable Products | Low-GWP refrigerants, EcoWise expansion | Sustainable revenue ~$14B (2023) |

PESTLE Analysis Data Sources

The PESTLE for Trane Technologies is fueled by sources like industry reports, financial data, and government publications.