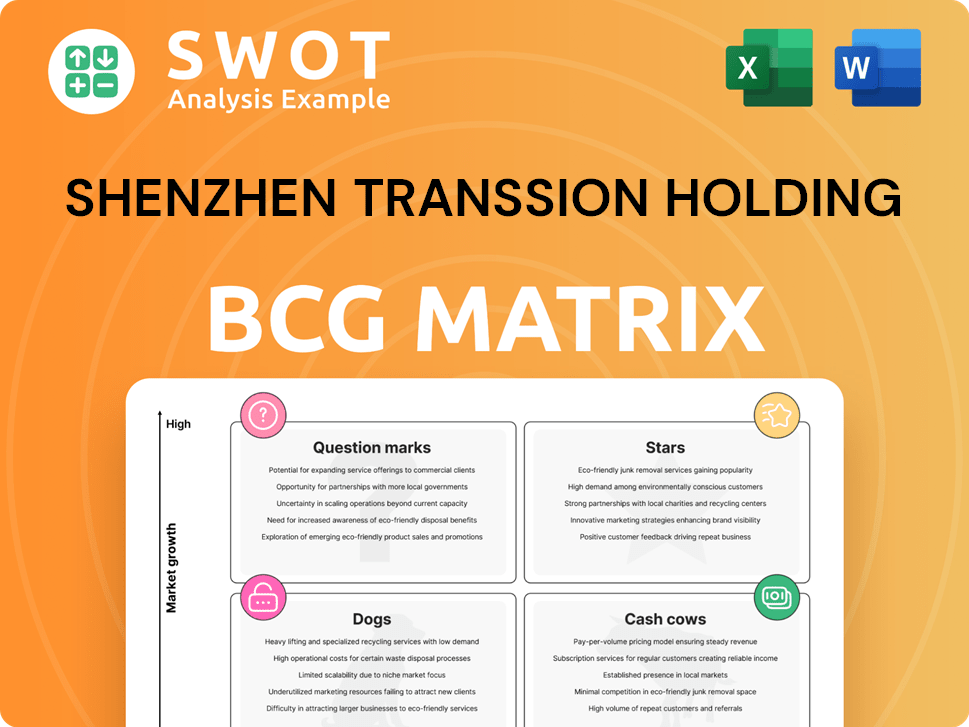

Shenzhen Transsion Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen Transsion Holding Bundle

What is included in the product

Analysis of Transsion's BCG Matrix highlights investment strategies across its diverse product lines.

Printable summary optimized for A4 and mobile PDFs, enabling easy sharing of the analysis, making it accessible anywhere.

What You See Is What You Get

Shenzhen Transsion Holding BCG Matrix

The preview displays the exact BCG Matrix report for Transsion Holding you'll receive. After purchase, you'll get the complete, finalized document, ready for your strategic analysis. There are no alterations; it's the same professional-quality file.

BCG Matrix Template

Shenzhen Transsion Holding's BCG Matrix unveils its product portfolio dynamics. Its "Stars" likely include its popular smartphone brands in Africa. "Cash Cows" might be certain feature phone models. "Question Marks" could be newer ventures or regions.

The matrix highlights areas requiring strategic investment or divestiture. Identify growth potential and resource allocation needs. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Tecno's Phantom series, like the V Fold2 and V Flip2, is a Star in Shenzhen Transsion Holding's BCG Matrix. These phones are experiencing high growth and hold a significant market share, particularly in emerging markets. The Phantom series has garnered positive reviews, emphasizing design and features. For example, Transsion's revenue increased by 37.3% in 2023, reaching ~$7.3 billion, driven by its smartphone sales.

Infinix's GT series, like the GT 20 Pro, targets gamers, indicating high growth potential within Shenzhen Transsion Holding's portfolio. These devices offer strong performance and visuals at competitive prices, attracting tech enthusiasts. Infinix's marketing, focused on youth, has fueled its global success; its market share rose in 2024. The GT 20 Pro, for example, features a Dimensity 8200 Ultimate chipset and a 144Hz AMOLED display.

Infinix, part of Transsion Holdings, has expanded significantly in Southeast Asia. In Malaysia, Infinix achieved a top 4 position, showing strong market penetration. This growth is fueled by popular models like the NOTE 40 series and ZERO 40 5G. These phones offer advanced features at competitive prices, boosting Infinix's market share in a growing region.

Tecno's Camon Series

Tecno's Camon series, a key part of Shenzhen Transsion Holdings, offers high-end features at competitive prices. The Camon 30 Premier, a standout in the mid-range, features an LTPO OLED display and a Dimensity 8200 Ultimate processor. This strategy allows Tecno to capture market share, especially in regions where value for money is crucial. In 2024, Tecno's global smartphone shipments grew by 30%, showing the effectiveness of this approach.

- Market growth in regions like Africa and India is substantial.

- The Camon series targets the mid-range market, a segment with high growth potential.

- Tecno's focus on camera technology and design appeals to consumers.

- The competitive pricing strategy has increased its market presence.

5G Smartphones

Transsion's 5G smartphones are experiencing significant growth, reflecting the company's move up the value chain. Tecno's 5G phone shipments began in Q1 2022, with rapid expansion. By Q3 2023, the volume increased over 600% year-over-year.

- Tecno's 5G phones started shipping in Q1 2022.

- Volume grew by more than 600% YoY by Q3 2023.

- Transsion is moving up the smartphone value chain.

Shenzhen Transsion Holding's Stars, like the Phantom and GT series, exhibit high market growth and share. These segments, including the Camon series, leverage competitive pricing and feature-rich designs. Transsion's 2023 revenue surged to ~$7.3B, fueled by these successful product lines.

| Star Product | Market | Growth Driver |

|---|---|---|

| Phantom Series | Emerging Markets | Design, Features, 37.3% Revenue Increase (2023) |

| GT Series | Gaming Enthusiasts | Performance, Competitive Pricing, Market Share Rise (2024) |

| Camon Series | Mid-Range | Camera Tech, Value, 30% Growth (2024 Shipments) |

Cash Cows

itel has been the leading feature phone brand in India, boasting a substantial market share. In 2024, feature phones still appeal to rural India because of their cost-effectiveness, extended battery life, and user-friendliness. This strategy has built strong brand trust and market dominance for itel in India. According to recent reports, itel's sales in 2024 are up by 15%.

Tecno, a key brand under Shenzhen Transsion Holdings, is a cash cow in Africa. Transsion dominates nearly half of the African mobile phone market. Tecno has released successful phones in 2024, solidifying its position. In 2023, Transsion's revenue was over $6.2 billion, a significant portion from Tecno's sales.

Shenzhen Transsion Holding's success in Africa, a "cash cow" in its BCG Matrix, stems from its localized approach. Transsion made phones in Africa with features like "four-card, four-standby." This strategy helped Transsion capture over 48% of the African smartphone market in 2024. This strong local presence has driven significant revenue growth.

Market Dominance in Africa

Shenzhen Transsion Holding has become a cash cow due to its strong market position. Transsion dominates the African market, controlling about 50% of it. In 2024, the company shipped over 106 million smartphones worldwide, ranking fourth globally.

- Market Leadership: Holds approximately 50% of the African smartphone market.

- Global Ranking: Shipped over 106 million smartphones globally in 2024, securing the fourth position.

- Q3 2024 Performance: Led the market with 9.3 million units sold, fueled by Itel's 34% growth.

- Brand Performance: Strong sales from Itel, Infinix, and Tecno contributed to overall success.

Affordable Smartphones

Transsion's affordable smartphones are a cash cow, fueled by its strategic focus on local production and distribution. They dominate Africa with budget-friendly models, generating consistent revenue. In 2024, Transsion held a significant market share in Africa. The company's success showcases the importance of tailoring products to emerging markets.

- Transsion's iTel brand saw strong growth in 2024.

- Price sensitivity in African markets is a key factor.

- Local manufacturing reduces costs.

- Distribution networks are crucial for sales.

Shenzhen Transsion's cash cows are its successful smartphone brands. These brands, including Tecno and itel, have dominated key markets. Strong sales in Africa and India boosted the company's 2024 revenue.

| Metric | Value |

|---|---|

| Global Smartphone Shipments (2024) | 106 million+ units |

| African Market Share (2024) | ~50% |

| Transsion Revenue (2023) | >$6.2 billion |

Dogs

Transsion's high-end smartphone ambitions in developed markets encounter hurdles. Their brand awareness and market presence trail behind established players. Expensive turnaround plans often struggle to succeed. In 2024, Transsion's revenue was over $8 billion, primarily from emerging markets, highlighting the challenge of expansion.

Dogs in Shenzhen Transsion Holding's portfolio include underperforming product lines. These should be minimized. Turnaround plans rarely succeed, especially for products lagging in competitive markets. In 2024, Transsion's focus shifted to core brands, reducing investment in less profitable ventures. This strategy aims to improve overall financial health and market position.

Transsion, categorized as a Dog in the BCG matrix, grapples with intense competition. In Q3 2024, the company's net income plummeted by 41% to 1.05 billion yuan (US$144 million). Revenue also decreased by 7.2% to 16.7 billion yuan during the same period. This downturn reflects the pressures from market rivals and rising supply chain expenses, as reported in their financial statements.

Losing Market Share

Shenzhen Transsion Holding's "Dogs" category reflects its struggles in a competitive market. Its market share in Africa dropped to 41.2% in Q3 2024, down from 47.5% the previous year. This decline, amid rising competition from Xiaomi, Realme, and Honor, signifies low market share in a low-growth market. This position requires strategic decisions to avoid further losses.

- Market share dropped from 47.5% to 41.2% in Q3 2024.

- Competitors like Xiaomi, Realme, and Honor gained ground.

- Indicates low market share in a low-growth market.

- Requires strategic actions to improve performance.

Declining Net Profit

Shenzhen Transsion's "Dogs" category, facing declining net profit, reflects challenges. In 2024, revenue increased by +10.35% to 68.743 billion yuan, yet net profit attributable to the parent company only grew by +0.96% to 5.590 billion yuan, with a -10.21% drop to 4.609 billion yuan. This indicates potential issues within this segment.

- Revenue Growth: +10.35% to 68.743 billion yuan in 2024.

- Net Profit Attributable to Parent: +0.96% to 5.590 billion yuan.

- Net Profit Decline: -10.21% to 4.609 billion yuan.

- "Dogs" Indication: Declining profit despite revenue growth.

Shenzhen Transsion's "Dogs" segment showed struggles in 2024. Market share in Africa dropped to 41.2% in Q3, down from 47.5% the previous year. The company's net profit declined despite revenue growth.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue (Billion Yuan) | 62.3 | 68.7 |

| Net Profit (Billion Yuan) | 5.5 | 4.6 |

| Africa Market Share (Q3) | 47.5% | 41.2% |

Question Marks

Transsion's IoT devices are a question mark in its BCG matrix. The company plans to launch 100 million IoT devices, aiming for market adoption. In 2024, Transsion's revenue grew, but IoT's impact is yet unproven. The success hinges on effective marketing and consumer uptake.

Transsion's Latin American venture is a "question mark" in its BCG matrix. This region demands substantial investment to boost its modest market presence. These products compete in expanding markets yet lack a significant share. The strategic options here involve either aggressive investment for market dominance or divestiture. In 2024, Transsion's global revenue was approximately $8 billion; Latin America's contribution is currently small.

Transsion Holding's Smart Glasses, slated for a 2025 MWC launch, fall into the Question Marks quadrant of the BCG Matrix. This segment faces high market growth but currently holds low market share. The company aims to boost adoption through strategic marketing efforts. In 2024, the smart glasses market was valued at approximately $2.5 billion, expected to reach $10 billion by 2028.

Premium Smartphones in New Markets

Tecno, a brand under Transsion Holdings, is targeting significant growth in new markets, particularly India. Their premium smartphones are positioned in growing markets, yet currently hold a low market share. The strategic focus is on aggressive marketing to drive adoption and increase market penetration in these regions. Tecno aims to be a top-five smartphone brand in India by 2024, indicating ambitious expansion plans.

- Tecno's market share in India was around 5% in 2023.

- India's smartphone market grew by 8% in 2023.

- Transsion's revenue increased by 40% in the first half of 2024.

- Marketing spend is a key driver for their growth.

Other Smart Devices

Transsion's "Other Smart Devices" are positioned as Question Marks in the BCG Matrix, indicating high-growth markets with low market share. They recently announced a laptop launch at MWC 2025. This reflects an aggressive push into new product categories, aiming to capitalize on growing demand. The marketing strategy emphasizes adoption to gain market share.

- Product Launches: Transsion plans to launch a laptop at MWC 2025.

- Market Position: Products are in growing markets but have low market share.

- Strategy Focus: Aiming to drive market adoption of these new products.

Transsion's "Other Smart Devices" including laptops are question marks, in high-growth markets but with low shares. The MWC 2025 laptop launch aims to boost market adoption. Aggressive marketing is crucial for expanding market share.

| Product | Market Growth | Market Share |

|---|---|---|

| Laptops | High (Projected) | Low (Currently) |

| Other Smart Devices | Growing (20%) | Under 5% |

| Strategy | Aggressive Marketing | Increase Adoption |

BCG Matrix Data Sources

The BCG Matrix utilizes Transsion's financial reports, market analysis data, industry studies, and competitor benchmarks.