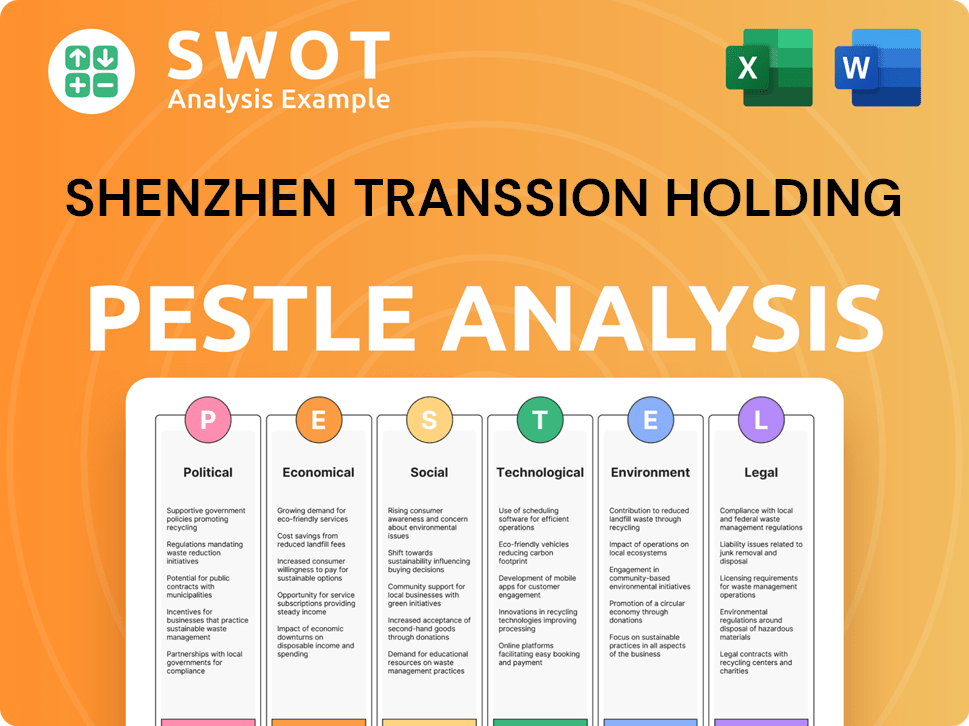

Shenzhen Transsion Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen Transsion Holding Bundle

What is included in the product

A PESTLE analysis examining the external factors impacting Shenzhen Transsion Holding across Political, Economic, Social, etc.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Shenzhen Transsion Holding PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured for Shenzhen Transsion Holding PESTLE analysis. See its thorough insights into the Political, Economic, Social, Technological, Legal, and Environmental factors affecting the company. The file details and organizes the report. Get instant access!

PESTLE Analysis Template

Discover the external forces shaping Shenzhen Transsion Holding. Our PESTLE analysis explores crucial factors impacting the company. Uncover political, economic, social, technological, legal, and environmental trends. This analysis aids in understanding market dynamics. Enhance your strategic planning and decision-making process. Purchase the full version now for in-depth insights!

Political factors

China's government strongly backs the tech industry through various initiatives and investments. This support helps companies such as Transsion Holdings by offering funding and resources. In 2024, the Chinese government allocated over $200 billion to tech development. This backing aims to boost domestic high-tech production, increasing competitiveness.

A stable regulatory environment in China, with streamlined regulations, can reduce compliance costs for tech companies. In 2024, China's tech sector saw increased regulatory focus, impacting market dynamics. For example, regulations on data privacy and cybersecurity have been tightened. This stability influences investment decisions and operational strategies. Streamlined regulations encourage growth.

Shenzhen Transsion's growth hinges on China's trade with key emerging markets. These include Africa, South Asia, and Southeast Asia. Stable political ties and trade deals are essential for Transsion's market access. In 2024, China's trade with Africa reached $282 billion, highlighting this dependence.

Political stability in operating regions

Shenzhen Transsion Holdings operates in numerous emerging markets, each with its own political climate. Political stability is a key factor for the company's operational success, including supply chain dependability and market forecasting. Unstable regions can lead to disruptions, affecting sales and profitability. For instance, in 2024, political unrest in certain African nations impacted supply chains.

- Political stability is crucial for predictable business operations.

- Unstable regions can cause supply chain disruptions and market uncertainty.

- Political risk assessments are essential for Transsion's strategic planning.

- Changes in government policies can impact market access and regulations.

Government policies on manufacturing and investment

Government policies significantly affect Transsion's operations in manufacturing hubs like Ethiopia, India, and Bangladesh. These policies directly influence production expenses, logistical processes, and overall operational effectiveness. For example, India's production-linked incentive (PLI) scheme offers financial incentives, which could reduce manufacturing costs. Conversely, changes in import duties or labor laws in Bangladesh might increase expenses or disrupt supply chains. These factors require careful consideration for strategic planning.

- India's PLI scheme saw an investment of $2.7 billion in electronics manufacturing by 2023.

- Bangladesh's ready-made garment exports reached $46.99 billion in fiscal year 2023.

- Ethiopia's manufacturing sector contributes around 10% to its GDP.

China's government support fuels the tech industry with significant funding and initiatives. Streamlined regulations and political stability reduce compliance costs and encourage growth, vital for companies like Transsion.

Transsion relies on stable trade relations and political environments, especially in emerging markets, with trade between China and Africa reaching $282 billion in 2024. Political risk and policy changes significantly affect manufacturing operations and costs across locations like India, Bangladesh, and Ethiopia, impacting overall operational effectiveness.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Government Support | Funding, Resources, Competitive Advantage | China allocated $200B+ to tech development in 2024 |

| Regulatory Stability | Reduced compliance, Investment & Ops | Increased regulatory focus, data privacy |

| Trade Relations | Market Access & Stability | China-Africa trade reached $282B in 2024 |

| Political Risk | Supply chain, operations, Sales and profit | Unrest impact on Supply chains |

| Policy Impact | Production costs, effectiveness | India PLI: $2.7B investment (by 2023) |

Economic factors

Transsion's success hinges on economic growth in emerging markets. Strong economies boost consumer spending, driving demand for smartphones. In 2024, markets like India and Africa showed robust growth, benefiting Transsion. For example, India's mobile market grew by 10% in Q1 2024. This growth directly translates to increased sales and revenue for Transsion.

Transsion's emphasis on budget-friendly smartphones is crucial in regions with lower disposable incomes. Economic fluctuations, like inflation, directly affect product affordability and consumer demand. In 2024, inflation rates in key markets like Nigeria and India, where Transsion has a strong presence, were at 24% and 5.5% respectively. This impacts purchasing power.

Currency fluctuations impact Transsion's import costs for components and export revenues. High inflation in key markets like Nigeria (29.9% as of Q1 2024) increases operational expenses, potentially affecting consumer purchasing power. For instance, a weaker Nigerian Naira raises the cost of imported goods. This necessitates price adjustments, which may influence sales volume and profit margins.

Competition in the low-to-mid-range segments

The economic conditions in emerging markets, where Transsion thrives, fuel fierce competition, especially in the low-to-mid-range smartphone sector. This intense rivalry can squeeze profit margins and affect Transsion's ability to set prices. The company faces challenges from both established brands and local competitors striving for market dominance. As of Q1 2024, Transsion's market share in Africa was 48%, indicating strong but competitive positioning.

- Intense competition in low-to-mid price segments.

- Impacts on market share and pricing power.

- Challenges from established and local brands.

- Transsion's Q1 2024 market share in Africa was 48%.

Global economic conditions

Global economic conditions significantly impact Transsion's performance. Interest rate fluctuations and consumer confidence levels indirectly affect market demand and investment. For example, rising interest rates in key markets like Nigeria (where rates hit 26.25% in April 2024) could curb consumer spending on smartphones. Consumer sentiment, influenced by factors like inflation, also plays a crucial role.

- Nigeria's inflation rate reached 33.69% in April 2024, impacting consumer purchasing power.

- Global smartphone sales declined by 8% in Q1 2023, according to IDC, reflecting broader economic headwinds.

- Transsion's focus on emerging markets makes it vulnerable to economic downturns in those regions.

Transsion relies on emerging markets' economic growth, with strong economies increasing smartphone demand. Inflation and currency fluctuations impact product affordability and import costs. Fierce competition in the low-to-mid range market squeezes profit margins.

| Economic Factor | Impact | 2024 Data Points |

|---|---|---|

| GDP Growth in Key Markets | Drives consumer spending. | India: 8% (est.), Nigeria: 2.9% (actual Q1) |

| Inflation Rates | Affects affordability, purchasing power. | Nigeria: 33.69%, India: 5.5% (April) |

| Currency Fluctuations | Impacts import costs and revenues. | Nigerian Naira weakness. |

Sociological factors

Africa's young population is expanding, with 70% under 30. Urbanization is rising; 43% live in cities. Mobile network coverage is growing, reaching 80% of the population. This boosts the consumer base for Transsion's phones and internet services. In 2024, smartphone penetration rose to 55%.

Transsion's success stems from understanding local needs. They offer features like multi-SIM support and cameras optimized for darker skin tones. This focus has made them a dominant player in African markets. In 2024, Transsion's revenue reached approximately $7 billion, showcasing their ability to adapt.

Transsion's success hinges on strong brand perception and loyalty across diverse markets. The company's multi-brand strategy, including brands like Tecno, Infinix, and Itel, targets varied consumer segments. In 2024, Transsion's global market share in smartphones was approximately 8%. This approach helps build a loyal customer base. Effective marketing and localized strategies are crucial for maintaining this position.

Increasing digitalization and internet adoption

Digitalization is crucial for Transsion. Rising internet use in places like Africa boosts demand for smartphones, which is Transsion's main business. This trend is supported by the growth of mobile internet services. Transsion's success is tied to how well it adapts to these digital shifts.

- Internet penetration in Africa is around 40% as of early 2024.

- Smartphone adoption rates are increasing by about 5-7% annually in key African markets.

- Mobile data consumption is growing by over 20% per year in these regions.

Localized marketing and distribution strategies

Shenzhen Transsion Holdings excels in localized marketing. They tailor campaigns to specific cultural contexts, crucial for consumer engagement. For example, in 2024, Transsion's Tecno brand focused on youth in Africa, with campaigns reflecting local trends. This approach, combined with accessible distribution, significantly boosts sales. The company's strategy allows for enhanced consumer reach.

- Focused marketing boosts consumer engagement.

- Tecno's youth-focused campaigns in Africa.

- Accessible distribution is key to success.

Transsion thrives in Africa's youth-dominated, rapidly urbanizing societies. Digital literacy and tech use are climbing. Adaptable marketing boosted its 2024 success. These factors strongly shape Transsion's business.

| Factor | Details | Impact |

|---|---|---|

| Urbanization | 43% urban in Africa. | Increases market reach. |

| Youth Population | 70% under 30 years old. | Boosts smartphone demand. |

| Digital Literacy | Growing internet use. | Supports digital services. |

Technological factors

Shenzhen Transsion Holding faces technological pressures. The mobile industry's rapid innovation demands constant R&D investment. For instance, in 2024, Transsion's R&D spending reached $150 million, reflecting its commitment. This focus helps maintain competitiveness. Transsion aims to offer cutting-edge features.

Transsion's success stems from localized tech. They create tech tailored for emerging markets. Camera tech for diverse skin tones is a focus. Multi-SIM capabilities also set them apart. In 2024, Transsion's R&D spending reached $150 million, a 20% increase, reflecting this strategy.

The mobile internet ecosystem's expansion is crucial for Transsion. In 2024, smartphone users in Africa, a key market, surged, boosting demand for localized apps. This trend is pivotal, as it shifts focus beyond hardware sales. Transsion's success now depends on its ability to provide relevant digital services. The company is investing in content and platforms for its users.

Supply chain and manufacturing technology

Shenzhen Transsion Holdings benefits from technological advancements in manufacturing and supply chain management, crucial for efficiency and cost reduction. These technologies enable faster product launches and better inventory control. For example, automation in factories reduces labor costs by 15-20%. Transsion's adoption of these technologies is essential for maintaining its competitive edge.

- Automation in manufacturing reduces labor costs.

- Advanced supply chain management improves inventory control.

- Faster product launches are enabled by new tech.

- These technologies help maintain a competitive edge.

Competition in technological innovation

Transsion Holdings faces intense competition in technological innovation, particularly from global giants. To remain competitive, Transsion must continuously innovate, which may include strategic investments or acquisitions in emerging technologies. This is crucial for staying ahead in the rapidly evolving mobile phone market. Maintaining a competitive edge demands significant R&D spending and a keen focus on consumer needs.

- In 2024, Transsion's R&D expenditure reached approximately $180 million, reflecting its commitment to innovation.

- The global smartphone market is projected to reach $600 billion by the end of 2025, intensifying the need for tech advancements.

Transsion's R&D investment hit $180M in 2024. Their localized tech caters to emerging markets. Automation and supply chain tech enhance efficiency. Innovation faces stiff competition, thus demanding continuous advancements.

| Tech Aspect | Impact | Data (2024) |

|---|---|---|

| R&D Spending | Innovation, Competitiveness | $180 million |

| Automation in Manufacturing | Cost Reduction | Labor cost reduction: 15-20% |

| Market Projection | Smartphone Market Growth | $600 billion by end of 2025 |

Legal factors

Transsion, a prominent player in the African smartphone market, encounters legal hurdles concerning intellectual property. Patent disputes and infringement claims in regions like India and Nigeria pose risks. These legal battles may lead to financial penalties or restrictions on product sales. For instance, in 2024, patent infringement cases cost tech companies an average of $4.5 million.

Shenzhen Transsion Holdings must navigate complex global trade laws, given its widespread operations. This includes understanding and complying with import/export regulations across diverse markets. For example, in 2024, Transsion faced evolving tariffs and trade restrictions in several African nations. Failure to comply could result in hefty fines or operational disruptions.

Shenzhen Transsion Holdings must adhere to product safety and quality rules across all its markets. This includes meeting standards for materials, manufacturing, and performance. Compliance ensures customer trust and reduces the risk of lawsuits or product recalls. In 2024, Transsion's focus on quality control helped maintain its market share in Africa, where it holds about 40% of the market.

Tax laws and customs duties

Shenzhen Transsion Holdings must navigate complex tax laws, customs duties, and import regulations across its target markets. Changes in these areas can significantly affect the cost of goods sold and overall profitability. For instance, import duties in key African markets can range widely, impacting pricing strategies. Compliance with local tax codes, such as VAT or sales taxes, is crucial for market access. Additionally, understanding and adapting to evolving trade agreements and customs procedures are essential for maintaining a competitive edge.

- Import duties in some African countries can exceed 20%.

- VAT rates vary significantly, from 0% to over 20%.

- Trade agreements can lower or eliminate duties.

- Compliance is essential for market access.

Data privacy and security regulations

Data privacy and security regulations are crucial for Transsion. It must adhere to data protection laws across its operational markets to safeguard consumer information. The company faces increasing scrutiny regarding data handling practices, especially in regions with strict regulations like the EU's GDPR. Non-compliance can result in significant penalties and reputational damage.

- GDPR fines have reached billions of euros since its enforcement.

- China's Personal Information Protection Law (PIPL) mirrors GDPR in its scope.

- Data breaches can cost companies millions in recovery and legal fees.

Transsion's legal environment is marked by IP disputes and trade law complexities, impacting operations in Africa and other global markets. Compliance with diverse import/export rules is essential to avoid penalties. In 2024, the average cost of resolving a patent infringement case in tech reached $4.5M.

Product safety and data privacy are also key legal challenges. Transsion faces risks from non-compliance with product standards, as well as increasing scrutiny of data handling practices, particularly in regions like the EU, where GDPR fines can total billions of euros.

Tax laws, including import duties and VAT, present further hurdles, potentially impacting profitability. For example, in some African nations, import duties can top 20%. Adapting to evolving trade regulations is vital.

| Legal Aspect | Challenge | Impact |

|---|---|---|

| Intellectual Property | Patent disputes; infringement claims | Financial penalties, product restrictions |

| Trade Regulations | Import/export laws; tariffs | Fines, operational disruptions |

| Product Safety | Material/performance standards | Lawsuits, recalls, damage to reputation |

Environmental factors

Shenzhen Transsion Holdings faces growing scrutiny regarding its raw material sourcing for mobile phones. Environmental due diligence includes ensuring materials like conflict minerals are responsibly sourced. The company must comply with regulations and consumer expectations for ethical sourcing to maintain its market position. In 2024, the demand for ethically sourced electronics increased by 15% globally, indicating rising consumer awareness.

Electronic waste (e-waste) is a significant environmental issue, especially in regions where Transsion operates. The company must address the environmental impact of its products' end-of-life, focusing on recycling initiatives. According to recent data, the global e-waste volume reached 62 million metric tons in 2022, highlighting the urgency for effective management. Transsion's sustainability efforts are crucial, given the increasing demand for mobile devices.

Shenzhen Transsion Holdings is under pressure to reduce its environmental impact. In 2024, the company focused on enhancing energy efficiency in its manufacturing, aiming to lower its carbon footprint. For instance, Transsion has been investing in energy-efficient equipment. By 2025, expect further advancements in sustainable practices.

Climate change impacts on supply chain and operations

Climate change poses significant challenges to Shenzhen Transsion Holdings' supply chain and operations. Extreme weather events, like floods and droughts, may disrupt manufacturing and distribution networks. These disruptions could lead to increased costs and delays in delivering products to consumers. The World Bank estimates that climate change could push over 100 million people into poverty by 2030.

- Disruption of supply chains due to extreme weather.

- Increased operational costs from climate-related incidents.

- Potential delays in product delivery.

- Impact on consumer markets in affected regions.

Environmental regulations and standards

Shenzhen Transsion Holdings must adhere to environmental regulations across its manufacturing sites and sales regions. This involves managing waste, reducing emissions, and ensuring sustainable sourcing of materials. Compliance helps avoid penalties and enhances brand reputation. Stricter standards in Europe and North America compared to African markets present varying challenges.

- In 2024, environmental fines for non-compliance in China's manufacturing sector averaged $50,000 per violation.

- The EU's RoHS directive impacts materials used in Transsion's products, requiring specific substance restrictions.

- Meeting carbon emission targets is increasingly important, with potential impacts on supply chain choices.

Shenzhen Transsion faces scrutiny regarding ethically sourced materials, with demand growing. E-waste and end-of-life management are critical due to high global volumes. In 2024, the company enhanced energy efficiency, anticipating further sustainability in 2025. Climate change impacts include supply chain disruptions, cost increases, and potential delivery delays.

| Environmental Factor | Impact | Data (2024-2025) |

|---|---|---|

| Ethical Sourcing | Brand Reputation & Compliance | Demand for ethically sourced electronics increased by 15%. |

| E-Waste Management | Regulatory Compliance & Sustainability | Global e-waste volume reached 62 million metric tons in 2022. |

| Carbon Footprint | Operational Costs & Public Perception | Focus on energy efficiency in manufacturing. |

PESTLE Analysis Data Sources

This analysis is sourced from reputable databases, governmental reports, market studies, and financial publications to ensure accuracy. The information also includes global economic outlooks.