Tronox Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tronox Holdings Bundle

What is included in the product

Tailored analysis for Tronox's product portfolio, identifying optimal strategies.

Clean, distraction-free view optimized for C-level presentation, enabling quick strategic decisions.

What You See Is What You Get

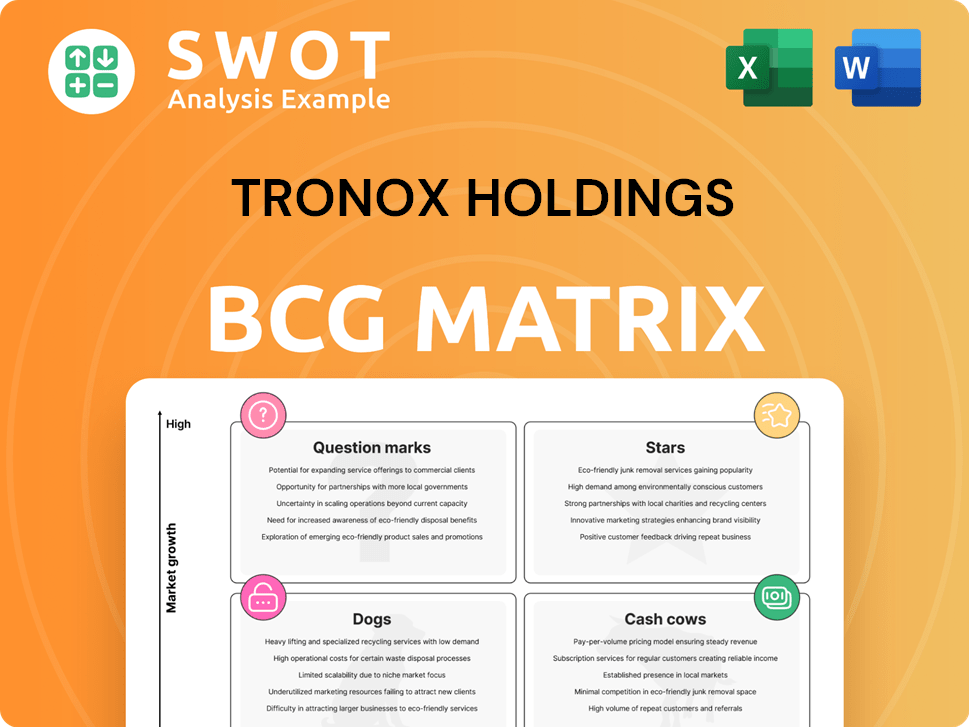

Tronox Holdings BCG Matrix

The BCG Matrix preview mirrors the complete Tronox Holdings analysis you'll get. This purchased document delivers a ready-to-use, strategically focused assessment of Tronox Holdings' business units.

BCG Matrix Template

Tronox Holdings navigates the chemicals and mineral sands markets. Their BCG Matrix reveals intriguing product portfolio dynamics. Some areas likely shine as "Stars," fueling growth and requiring investment. Others may be "Cash Cows," generating profits for reinvestment. Potential "Dogs" and "Question Marks" will need careful evaluation. Analyzing these quadrants is key to understanding Tronox's strategy.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Tronox's TiO2 pigment, crucial for paints and coatings, sees high demand in Asia-Pacific and Latin America. These regions' construction and automotive sectors are booming, driving pigment needs. Urbanization and industrialization fuel this growth. Protective tariffs in Europe and potential measures elsewhere could boost Tronox. In 2024, Asia-Pacific's construction grew by 6.2%, with Latin America at 4.8%.

Zircon, a key product for Tronox, likely fits the "Star" category. It's seeing increased sales volumes, especially in Asia Pacific. The global zircon market, valued at approximately $1.5 billion in 2024, is fueled by ceramics, foundry, and chemical industries. Tronox's strong performance in this area indicates high growth and market presence.

Tronox's specialty-grade TiO2 products, including ultrafine TiO2, show promise. These products serve niche markets like premium paints and coatings. Innovation in nano-sized TiO2 is boosting growth in medical and environmental fields. In 2024, the global TiO2 market was valued at approximately $23 billion, with specialty grades contributing significantly to revenue.

Vertically Integrated Operations

Tronox's vertically integrated operations, from mining to manufacturing, position it as a potential Star in the BCG matrix. This model reduces reliance on external suppliers, offering a buffer against market volatility and ensuring quality control. This integrated approach provides a competitive edge, enabling cost optimization and agile market response. In 2024, Tronox reported a revenue of $3.3 billion, with the vertically integrated model contributing significantly to its operational efficiency.

- Vertically integrated model enhances control over the value chain.

- Reduces external dependencies, mitigating supply chain risks.

- Contributes to cost optimization and improved profit margins.

- Supports a strong market position and competitive advantage.

Renewable Energy Initiatives

Tronox's renewable energy initiatives, such as solar and wind power agreements in South Africa, are considered Stars in its BCG Matrix. These projects reduce the company's carbon footprint and lower operational costs. The move to renewable power boosts sustainability, attracting investors. In 2024, Tronox increased its sustainable energy use.

- Tronox's South African solar and wind projects are key.

- These initiatives cut carbon emissions and costs.

- Sustainability efforts attract investors.

- Sustainable energy use increased in 2024.

Tronox's Zircon is a Star, with increasing sales in the Asia-Pacific. The global zircon market was about $1.5 billion in 2024, fueled by several industries. Tronox's performance indicates high growth and market presence in this area.

| Product | Market | 2024 Market Value (approx.) |

|---|---|---|

| Zircon | Global | $1.5 billion |

| TiO2 | Global | $23 billion |

| Tronox Revenue (2024) | Overall | $3.3 billion |

Cash Cows

In mature markets like North America and Europe, Tronox's TiO2 pigment operations act as a Cash Cow. These regions show steady demand from construction and industrial sectors, ensuring predictable revenue. For example, in 2024, the global TiO2 market was valued at around $22 billion. Optimized production and cost management are key to maintaining profitability.

Tronox's high-purity titanium chemicals, including titanium tetrachloride, fit as Cash Cows. These chemicals serve industries with consistent demand, such as aerospace and electronics. Tronox benefits from high-profit margins and a stable customer base in 2024. In Q3 2024, Tronox reported $84 million in adjusted EBITDA for its Titanium Dioxide segment.

Tronox's production of high-grade titanium feedstock, pig iron, and other minerals is a cash cow. These materials are vital inputs for industries and generate consistent revenue. Tronox's mining and upgrading facilities ensure a reliable supply, contributing to a stable segment. In 2024, Tronox reported revenue of $3.3 billion.

Operational Cost Savings

Tronox's focus on operational cost savings is a key aspect of its "Cash Cow" status within the BCG matrix. Cost-saving initiatives, such as the cost improvement plan, are designed to boost profitability. This approach directly enhances cash flow, essential for maintaining a strong financial position. By improving efficiency and utilizing technology, Tronox aims for significant financial gains.

- Tronox is targeting $125-175 million in sustainable savings by the end of 2026.

- Cost efficiency, asset optimization, and technology leverage are key strategies.

- These savings directly contribute to increased profitability and cash flow.

Global Footprint Advantage

Tronox's global presence and strong market position generate a Cash Cow advantage. This extensive operational footprint allows capitalizing on varied market conditions. Its global network ensures a stable revenue stream, crucial for financial health. Tronox reported $3.3 billion in revenue for 2023.

- Global Market Position: Dominant in multiple regions.

- Operational Footprint: Extensive, enabling market responsiveness.

- Revenue Stability: Supported by a strong global network.

- 2023 Revenue: Reported $3.3 billion.

Tronox's cash cow status is evident across various segments, including TiO2, high-purity chemicals, and mineral feedstock. Steady demand and optimized operations ensure profitability, with the TiO2 market valued at $22 billion in 2024. Cost savings, with a target of $125-175 million by 2026, bolster financial gains. Tronox's global footprint and strong market position contribute to stable revenue streams.

| Aspect | Details |

|---|---|

| Key Products | TiO2, Titanium Tetrachloride, Feedstock |

| 2024 TiO2 Market Value | $22 Billion |

| Targeted Savings by 2026 | $125-175 Million |

Dogs

Opportunistic ilmenite sales, despite a revenue decline, might be considered. In 2024, Tronox reported ilmenite sales contributing to overall revenue. The non-recurring nature and revenue decrease indicate ilmenite's unreliability. A strategic review of this line is likely needed.

Decreases in pig iron sales volumes and average selling prices suggest this product could be a Dog. If pig iron isn't a core product and faces declining demand, it might be divested. Tronox's 2024 financials will reveal sales figures. A market analysis is needed, especially given 2024's economic shifts.

Tronox's European operations face challenges due to weak demand, potentially making them "Dogs" in its BCG Matrix. Competitive pricing and underperformance could lead to restructuring. For example, in 2024, European TiO2 demand saw a 2% decrease. A strategic shift or scaled-back operations may be needed.

High-Cost Inventory

High-cost inventory, a "Dog" in Tronox's BCG matrix, burdens the balance sheet. This ties up capital and diminishes profitability, as seen in 2024. Efficient inventory management is key to boost financial performance and free up resources.

- Inventory turnover ratios reflect inventory management efficiency.

- High inventory costs can lead to lower profit margins.

- Excess inventory may result in write-downs.

- Reducing inventory costs improves ROI.

Sulfate Process TiO2 Production

If Tronox continues to use the sulfate process for TiO2 production, it might be categorized as a Dog in the BCG matrix, especially with growing environmental rules. The sulfate method has a higher environmental footprint compared to the chloride process. This could lead to tougher regulations, potentially increasing costs and decreasing profitability. Investments in cleaner tech or a shift to chloride could be needed.

- Sulfate process generates more waste, increasing environmental impact.

- Regulatory scrutiny is intensifying, potentially raising compliance costs.

- Switching to chloride process might require significant capital expenditure.

- Tronox's 2024 financial results show a need for strategic adjustments.

The sulfate process for TiO2 production at Tronox is a Dog, given its environmental footprint. This legacy method could lead to escalating costs. By 2024, environmental regulations were tightened, impacting companies.

| Aspect | Sulfate Process | Chloride Process |

|---|---|---|

| Environmental Impact | Higher waste, greater footprint | Lower waste, reduced footprint |

| Regulatory Risks | Increasing compliance costs | Lower risk of rising costs |

| 2024 Costs | Likely increased | Potentially stable |

Question Marks

Tronox's venture into rare earth minerals, particularly those found in monazite, positions it as a Question Mark in its BCG Matrix. The rare earths market shows strong growth, yet it's also quite unpredictable. To succeed, Tronox might need smart investments and partnerships. Global demand for rare earths, crucial for tech and EVs, is projected to grow significantly by 2030.

The new TiONA grades, like TiONA 233 for plastics, are Question Marks within Tronox's BCG Matrix. These products target growing markets but currently have a low market share. To succeed, aggressive marketing and strategic positioning are vital. For instance, the global plastics market was valued at $620.5 billion in 2023.

Ultrafine titanium dioxide (TiO2) in solar panels and advanced polymers fits the Question Mark quadrant. These sectors, with high growth potential, demand substantial R&D investment. Tronox's 2023 revenue was $3.3 billion, indicating potential for expansion. Partnerships and tech innovation are key to market penetration.

NewTron Project

The newTRON project, a sustainability initiative by Tronox, is categorized as a Question Mark in the BCG matrix. This classification reflects the uncertainty surrounding its financial viability and market impact, despite growing emphasis on reducing emissions. The project's success hinges on its ability to generate substantial returns and align with evolving market preferences, a factor that is still being evaluated. Strategic communication of its environmental benefits and economic advantages is critical to attract investment and ensure long-term sustainability.

- Tronox reported in Q3 2024 a focus on ESG initiatives.

- The project's financial performance is yet to be fully realized.

- Market analysis indicates a rising demand for sustainable products.

- Effective communication is vital for securing investor confidence.

Monazite

Monazite, a rare earth-bearing mineral, is classified as a Question Mark in Tronox Holdings' BCG Matrix. The demand for rare earth elements, essential for high-tech applications, is rising. However, the market's volatility necessitates strategic evaluation by Tronox.

Tronox must assess monazite's potential, focusing on efficient extraction and processing. Securing stable supply agreements is crucial to capitalize on this opportunity. These strategic moves are vital for success.

- Rare earth elements market projected to reach $20.9 billion by 2024.

- Tronox's revenue in 2023 was approximately $3.4 billion.

- Market volatility influences investment decisions.

Tronox views the rare earth elements market as a Question Mark, facing high growth but market unpredictability.

TiONA grades and ultrafine TiO2 also fit this category, requiring strategic market positioning.

The newTRON project and monazite ventures highlight Tronox's focus on innovation, with careful financial and market impact evaluations, vital for future growth.

| Category | Details | 2024 Data |

|---|---|---|

| Market Growth (Rare Earths) | Projected growth | $20.9B market by 2024 |

| Tronox Revenue (2023) | Overall revenue | ~$3.4B |

| Plastics Market (2023) | Global value | $620.5B |

BCG Matrix Data Sources

The Tronox BCG Matrix utilizes SEC filings, analyst reports, and market growth data for accuracy. We also draw from industry publications and expert evaluations.