Tronox Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tronox Holdings Bundle

What is included in the product

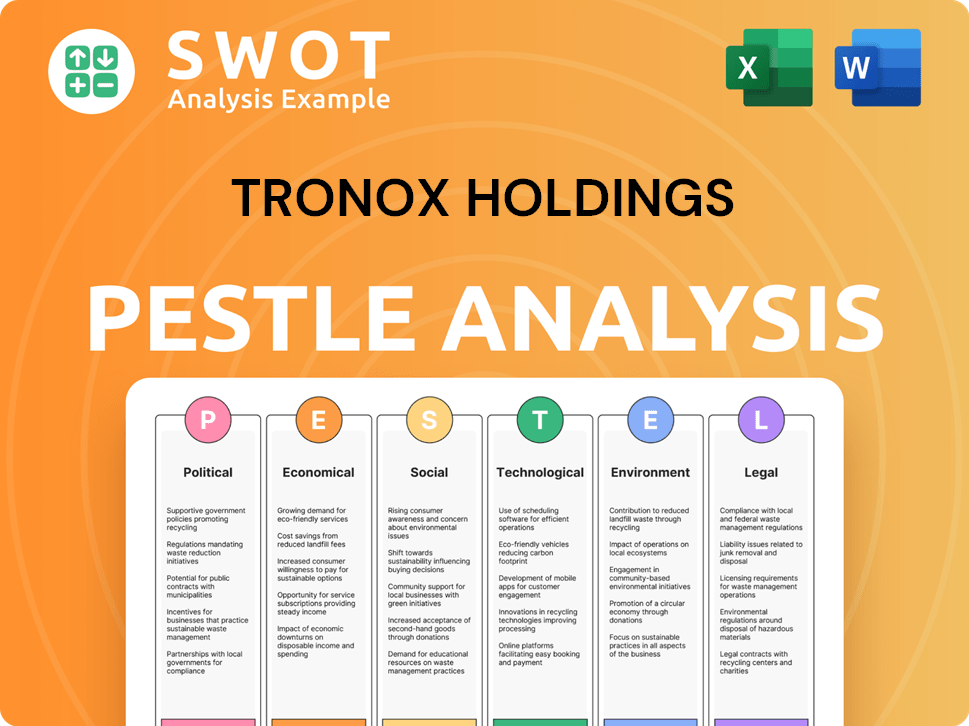

The Tronox Holdings PESTLE analysis provides insights into external macro-environmental factors.

Helps support discussions on external risk & market positioning during planning sessions.

Same Document Delivered

Tronox Holdings PESTLE Analysis

What you’re previewing here is the actual file—a complete Tronox Holdings PESTLE Analysis. It covers Political, Economic, Social, Technological, Legal, and Environmental factors. The in-depth analysis and structured presentation are what you'll get. This detailed document is ready to download after you buy.

PESTLE Analysis Template

Uncover Tronox Holdings' future with our concise PESTLE analysis.

Explore how political, economic, social, technological, legal, and environmental factors shape their strategy.

This snapshot offers key insights into global trends impacting the company’s operations and performance.

Understand regulatory challenges, market dynamics, and sustainability impacts.

Strengthen your strategic planning with this overview.

Dive deeper and get the full PESTLE Analysis to elevate your decisions.

Download the complete report today and unlock in-depth strategic intelligence!

Political factors

Tronox operates under strict environmental regulations due to its mining and chemical processes. In 2024, compliance costs rose by 7% due to stricter EPA standards. Labor practices are also heavily regulated, affecting workforce expenses. Trade policies impact the import/export of raw materials and products. For instance, tariffs on titanium dioxide could affect profitability.

Changes in global trade policies significantly impact Tronox. Tariffs and trade restrictions on titanium dioxide and mineral sands can directly affect sales and pricing. For instance, anti-dumping measures in Europe have reshaped market dynamics. Fluctuations in trade agreements require constant monitoring to assess potential impacts on Tronox's competitiveness.

Tronox operates globally, facing political risks. Instability in operating regions can disrupt production and supply chains. Recent geopolitical events have increased these risks. In 2024, Tronox reported potential impacts from global political shifts. This can affect its financial performance.

Resource Nationalism and Mining Rights

Resource nationalism poses a significant political risk for Tronox, particularly in countries rich in mineral sands. Governments can alter ownership rules, mining rights, and require local processing, impacting Tronox's supply chain and operations. These shifts can lead to increased costs, reduced access to raw materials, or operational disruptions. For instance, in 2024, some African nations were reviewing mining codes, potentially affecting foreign ownership.

- Changes in mining laws can directly affect Tronox's profitability.

- Local content regulations might increase operational costs.

- Political instability can lead to sudden policy changes.

International Relations and Sanctions

Geopolitical instability and sanctions significantly affect Tronox. These factors can disrupt operations in specific areas, influencing customer relationships and supply chains. For example, sanctions on Russia, a key market for titanium dioxide, could limit Tronox's access and increase costs. This situation demands strategic adjustments.

- Sanctions compliance adds operational complexity and expense.

- Trade restrictions can lead to supply chain disruptions.

- Geopolitical risks necessitate market diversification.

Tronox confronts multifaceted political factors influencing operations globally. Changes in environmental regulations have driven up compliance costs, increasing by 7% in 2024 due to tighter EPA standards. Geopolitical instability, including sanctions, affects market access, supply chains, and operational expenses. Resource nationalism also poses risks, as alterations in mining laws can influence profitability and operational costs.

| Political Risk | Impact | 2024 Data |

|---|---|---|

| Environmental Regulations | Increased Compliance Costs | 7% rise in compliance costs |

| Geopolitical Instability | Supply Chain Disruptions | Sanctions impacted market access |

| Resource Nationalism | Changes in Mining Laws | Review of mining codes in African nations |

Economic factors

Global and regional economic slowdowns, alongside inflation and energy costs, affect the demand for titanium dioxide (TiO2) and zircon. These materials are vital in many industries. For example, in Q1 2024, Tronox reported a revenue of $756 million, facing these economic headwinds. These factors directly influence Tronox's top and bottom lines. Specifically, higher energy prices push up production costs.

Tronox's global presence means currency exchange rates are crucial. Changes impact production costs, competitiveness, and reported financials. For example, a stronger USD can make exports pricier. In 2024, currency volatility affected many firms. Consider that a 5% swing can significantly impact profitability.

Tronox's revenue heavily depends on the demand for titanium dioxide (TiO2) and zircon, crucial in paints, plastics, and paper. The price volatility of these materials significantly affects Tronox's profitability. In 2024, TiO2 prices fluctuated, impacting earnings. For example, in Q1 2024, TiO2 prices ranged from $2,800 to $3,200 per metric ton. Zircon prices also varied. These fluctuations require careful financial planning.

Inflationary Pressures

Rising inflation poses a significant challenge for Tronox. Increased costs for raw materials, energy, and labor can squeeze profit margins if not offset by higher prices. For example, in 2024, the global TiO2 market, a key Tronox product, experienced inflationary pressures, with raw material costs rising by approximately 5-7%. This could affect Tronox's bottom line.

- Increased operating costs can reduce profitability.

- Ability to pass costs to customers is crucial.

- Inflation rates impact pricing strategies.

- Monitoring inflation's effects on earnings is vital.

Capital Expenditures and Investment

Tronox's capital expenditures significantly affect its financial health. The company strategically allocates resources for asset maintenance, operational expansions, and growth initiatives. These investments directly influence cash flow and future earnings potential, as seen in recent financial reports. For instance, in 2024, Tronox invested heavily in upgrading its production facilities and securing new mineral resources.

- 2024 capital expenditures are expected to be around $200 million.

- These investments are crucial for maintaining production capacity.

- Strategic investments drive long-term growth.

- They enhance operational efficiency.

Economic downturns, inflation, and energy costs are headwinds for Tronox, impacting TiO2 and zircon demand. Currency exchange rates influence costs and competitiveness; a stronger USD can raise export prices. Material price volatility directly affects profitability. In Q1 2024, TiO2 prices ranged from $2,800-$3,200/MT. Rising inflation can squeeze margins, raw material costs rising 5-7% in 2024.

| Economic Factor | Impact on Tronox | 2024 Data/Forecast |

|---|---|---|

| Global Slowdown | Reduced demand for TiO2 & Zircon | Q1 Revenue: $756M (Affected) |

| Currency Volatility | Impacts production costs, competitiveness | 5% swing in profitability possible |

| Inflation | Increased costs, margin squeeze | Raw material costs +5-7% in TiO2 market. |

Sociological factors

Tronox must manage community relations due to its impact on local areas. Negative impacts can disrupt operations, making a social license vital. In 2024, community engagement spending was $5 million, up 10% from 2023, reflecting its importance. Positive relations ensure long-term operational success.

Tronox, as a global entity, faces labor relations impacting operations. Potential disputes or strikes can disrupt production and supply chains. Effective workforce management and safety are critical for stability. In 2024, labor costs represented a significant portion of operational expenses. Safety incidents remain a key performance indicator.

Consumer preferences are evolving, with a growing emphasis on product safety and sustainability. This trend impacts demand for TiO2, as consumers increasingly favor eco-friendly options. The global market for sustainable products is projected to reach $8.5 trillion by 2025, reflecting this shift. This could influence Tronox's product development and marketing strategies.

Health and Safety Standards

Prioritizing health and safety is vital for Tronox. Mining and manufacturing inherently involve risks, making stringent standards essential. Accidents can disrupt operations, damage the company's image, and hurt its finances. Tronox's commitment to safety impacts its ability to operate and its long-term success. Data from 2024 indicates a continued focus on reducing workplace incidents.

- Tronox's 2024 safety reports reflect ongoing efforts to maintain and improve safety protocols.

- Compliance with health and safety regulations is a key operational cost factor.

- A strong safety record can enhance investor confidence and stakeholder relations.

Public Perception and Corporate Reputation

Tronox's public image hinges on its environmental stewardship, social responsibility, and ethical behavior. A tarnished reputation can significantly affect sales, investor trust, and its standing with various stakeholders. For instance, in 2024, companies with strong ESG (Environmental, Social, and Governance) scores saw a 10% increase in investor interest. Conversely, firms with negative publicity experienced a 15% drop in stock value. This highlights the critical link between public perception and financial performance.

- ESG ratings directly influence investor decisions.

- Negative publicity can lead to significant financial losses.

- Stakeholder relationships are crucial for long-term success.

Tronox navigates community ties, allocating $5 million for community engagement in 2024, up 10% from 2023, ensuring operational harmony. Effective workforce and safety management are key amid global labor dynamics, with labor costs a key 2024 metric. The company's brand image heavily relies on ESG factors, which are strongly tied to stakeholder relations.

| Factor | Details | 2024 Data |

|---|---|---|

| Community Engagement | Spending on community relations. | $5 million, +10% vs. 2023 |

| Labor Costs | Portion of operational expenses. | Significant portion of op. costs |

| ESG Impact | Affects investors & stakeholder relations | Companies w/strong ESG saw +10% interest |

Technological factors

Technological advancements are pivotal in mineral sands mining. They boost efficiency, cut costs, and improve resource extraction. Tronox's tech investments offer a competitive edge. In 2024, the mining tech market was valued at $80 billion, projected to reach $110 billion by 2025, reflecting the importance of innovation.

Technological advancements significantly influence TiO2 production. Innovations in processes can enhance product quality, cut energy use, and lessen environmental effects. Tronox invests in R&D for advanced materials. In 2024, the global TiO2 market was valued at approximately $20 billion, with efficiency improvements being a key focus.

Automation and process control are key for Tronox. Implementing automated controls in its manufacturing facilities improves operational efficiency. This reduces waste and enhances product consistency, which is crucial. Tronox is using technology to boost efficiency, and in 2024, the company allocated $50 million for technology improvements.

Development of Substitute Materials

The emergence of substitutes for titanium dioxide (TiO2) presents a technological challenge for Tronox. These alternatives could undermine its market share in paints, plastics, and other sectors. Tronox must monitor, and possibly invest in, the development of such materials. This proactive stance is vital for maintaining its competitive edge. In 2024, the global TiO2 market was valued at approximately $23 billion.

- Market size: The TiO2 market was valued at $23 billion in 2024.

- Competitive pressure: Alternative materials can take away market share.

- Strategic response: Tronox needs to observe and develop alternatives.

Digitalization and Data Analytics

Tronox can leverage digitalization and data analytics to enhance its operations. This includes optimizing the supply chain, improving production efficiency, and gaining deeper market insights. For instance, in 2024, the company invested $50 million in digital transformation initiatives. These efforts aim to streamline processes and reduce costs. This strategic move is expected to boost overall profitability.

- Supply chain optimization: reducing lead times by 15%.

- Production efficiency: increasing output by 10%.

- Market analysis: improving forecasting accuracy by 20%.

Technological factors are key for Tronox's success, with innovations boosting efficiency and production quality.

Digitalization efforts, backed by investments of $50 million in 2024, focus on supply chain and production optimization.

The company faces tech challenges like emerging TiO2 substitutes.

| Technological Aspect | Impact on Tronox | 2024 Data |

|---|---|---|

| Mining Tech Market | Boosts Efficiency & Reduces Costs | $80B Valuation |

| TiO2 Market Value | Product Quality Improvement | $23B, alternative materials are increasing |

| Digitalization Initiatives | Supply Chain, Production Efficiency | $50M investment |

Legal factors

Tronox faces strict environmental regulations globally, focusing on emissions, waste, and land rehabilitation. Compliance costs are substantial, impacting profitability. For instance, in 2024, environmental expenses were approximately $50 million. Non-compliance can lead to hefty fines and operational disruptions, increasing financial risk. These regulations are constantly evolving, requiring ongoing investment in compliance measures.

Tronox Holdings heavily relies on securing and keeping mining rights and permits to extract raw materials. Changes in mining laws, along with permitting complexities, can significantly affect their operations. For instance, in 2024, the company faced permit renewal challenges in Australia. Delays can lead to production disruptions. These legal hurdles directly influence production costs and timelines.

Trade defense measures, like anti-dumping duties, are legal actions that can influence TiO2 pricing and competition across markets. Tronox has faced these measures, affecting its market strategies. For example, in 2024, the EU imposed anti-dumping duties on TiO2 imports from certain countries. These duties can increase costs and change market dynamics. Tronox must navigate these legal complexities to maintain its market position and profitability.

Tax Laws and Regulations

Tax laws and regulations significantly affect Tronox's financial performance. Changes in corporate tax rates across different regions directly influence the company's tax liabilities. For instance, the 2017 U.S. Tax Cuts and Jobs Act altered corporate tax rates, impacting Tronox's effective tax rate. Staying compliant with evolving tax rules globally is crucial for Tronox's financial health.

- 2023: Tronox's effective tax rate was approximately 25%.

- 2024: Projected tax rate influenced by global tax reforms.

- Compliance costs: Ongoing expenses related to tax compliance.

Product Liability and Safety Regulations

Tronox Holdings faces legal scrutiny due to product liability and safety regulations, particularly concerning its titanium dioxide pigments. These pigments are utilized in diverse applications, from paints to plastics, necessitating stringent adherence to global safety standards. The company must navigate a complex web of regulations to avoid potential lawsuits and ensure consumer safety. Recent data indicates that product liability settlements in the chemical industry average around $500,000 to $1 million per case.

- Compliance costs can significantly affect profitability.

- Failure to comply can lead to substantial fines and legal battles.

- Product recalls are costly and damage brand reputation.

- Stringent regulations vary by region, adding complexity.

Tronox's operations are subject to intricate environmental regulations. Compliance involves significant costs, such as roughly $50 million in 2024, and operational risks if standards are not met.

Securing and maintaining mining rights directly affect the company's production capabilities. Permit challenges, like those in Australia, impact timelines and operational costs.

Trade defense actions and anti-dumping duties, such as those from the EU in 2024, influence pricing strategies. Tax regulations are key for financial performance, where the 2023 effective tax rate was approximately 25%.

| Legal Factor | Impact | 2024/2025 Considerations |

|---|---|---|

| Environmental Regulations | High compliance costs, operational risks. | Ongoing investment in compliance, risk of fines, and evolving standards. |

| Mining Rights & Permits | Production disruptions, cost increases. | Navigating permit renewals, potential delays, and legal challenges. |

| Trade Defense & Anti-dumping Duties | Pricing & market strategy impacts. | Adaptation to evolving tariffs and duties, global market dynamics. |

| Tax Laws and Regulations | Affects financial performance and tax liabilities. | Staying compliant, potential tax rate impacts. |

Environmental factors

Climate change is a major environmental factor. Tronox faces pressure to cut emissions. The company aims for carbon neutrality. In 2023, Tronox's Scope 1 and 2 emissions were 1.1 million metric tons CO2e. Scope 3 emissions are also a focus.

Tronox's mining and chemical processing requires significant water. Water usage and management are critical due to environmental regulations and community expectations. In 2024, the company likely faced scrutiny regarding water consumption at its Australian operations. Water scarcity impacts operational costs and sustainability; efficient water management is vital. Tronox's reports show water-related risks.

Proper waste management is vital for Tronox. A circular economy focus spurs innovation in waste reduction. In 2024, Tronox invested $15 million in waste reduction tech. Recycling efforts increased by 10% in Q1 2025. This improves environmental sustainability and efficiency.

Biodiversity and Land Rehabilitation

Tronox's mining activities affect biodiversity, necessitating strong land rehabilitation. They must adhere to strict environmental regulations to mitigate ecological harm. The company invests in restoration projects to re-establish ecosystems post-mining. In 2024, Tronox allocated $50 million for environmental remediation.

- Environmental spending: $50 million (2024).

- Rehabilitation projects: Focus on restoring native habitats.

Renewable Energy Adoption

Tronox's transition to renewable energy sources is vital for environmental sustainability and cost efficiency. The company is actively investing in solar projects to decrease its carbon footprint. These initiatives align with global trends favoring green energy. For example, in 2024, the renewable energy sector saw investments exceeding $366 billion worldwide.

- Tronox aims to reduce emissions by adopting renewables.

- Investment in solar projects is a key strategy.

- This aligns with growing environmental regulations.

Tronox actively tackles climate change, with a goal of carbon neutrality and emission reduction targets. Water management and waste reduction are critical operational focuses; In 2025, they invested $15 million in waste reduction tech. The firm dedicates significant resources to land rehabilitation and biodiversity protection; environmental remediation totaled $50 million in 2024. The company has embraced renewables as part of its sustainability strategy.

| Environmental Factor | 2024/2025 Actions | Financial Data/Metrics |

|---|---|---|

| Climate Change | Emissions Reduction & Carbon Neutrality goals, including Scope 1, 2, and 3. | $366 Billion+ invested worldwide in Renewable energy (2024). 1.1 million metric tons CO2e (2023). |

| Water Management | Focus on efficient water use at all operations; reporting on water risks. | Water consumption data varies by site, depends on the operations. |

| Waste Management | Investments in waste reduction tech, promoting a circular economy. | $15 million invested (2024) and recycling increased 10% (Q1 2025). |

PESTLE Analysis Data Sources

The Tronox PESTLE leverages financial reports, market analysis, government data, and industry publications. We prioritize reliable and up-to-date data.