T Rowe Price Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T Rowe Price Bundle

What is included in the product

Tailored analysis for T. Rowe Price’s diverse investment portfolio.

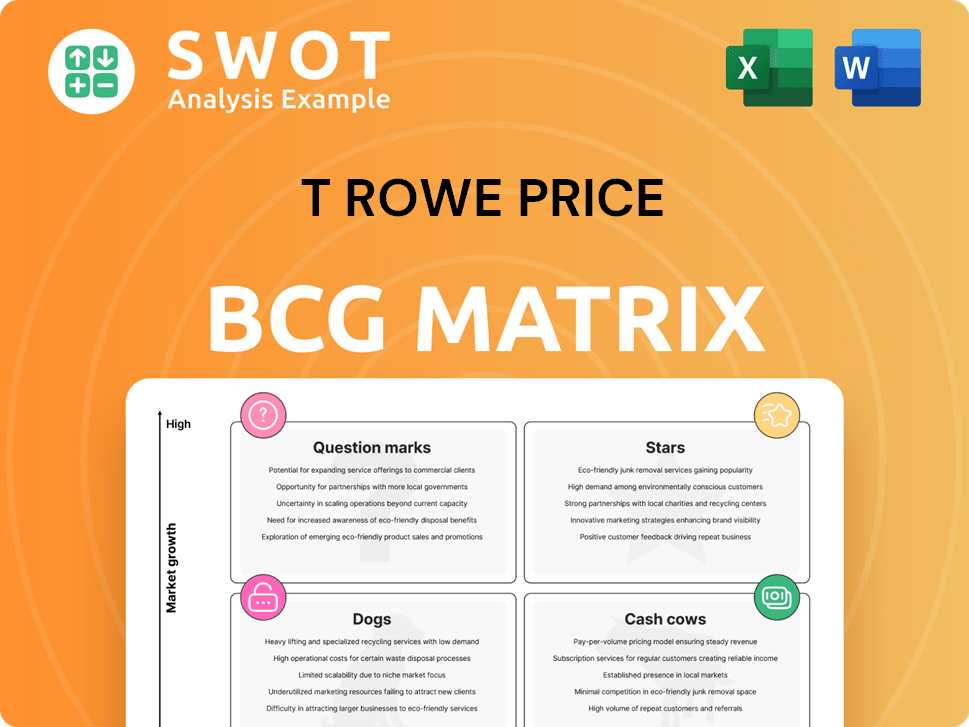

A clear BCG Matrix for T Rowe Price, removing confusion from portfolio analysis.

What You’re Viewing Is Included

T Rowe Price BCG Matrix

This preview showcases the identical T Rowe Price BCG Matrix report you'll receive post-purchase. Fully formatted and ready to implement, it offers insightful market positioning for your analysis and strategic planning.

BCG Matrix Template

T. Rowe Price’s BCG Matrix reveals its investment strengths. It categorizes its offerings, from market leaders to potential divestitures. Understanding these classifications is crucial for informed decisions. This preview offers a glimpse of its strategic landscape. See where the company is thriving! Get the full BCG Matrix report for data-driven analysis and investment strategies.

Stars

T. Rowe Price's ETF business is booming. By the end of 2024, they managed nearly $8 billion in assets across 17 ETFs. A substantial 13 of these ETFs have scaled to or exceeded $100 million in assets under management (AUM). This growth signals their strong market position and strategic success in the ETF sector.

T. Rowe Price excels in target date funds, a core strength reflected in its $492 billion in target date retirement portfolios by early 2025. Their focus on retirement solutions fuels substantial assets under management (AUM). This strategic focus secures a stable, long-term revenue stream for the firm.

T. Rowe Price's multi-asset solutions are a "Star" due to high growth and market share, fueled by rising investor demand. These solutions saw a $17 billion expansion to $553 billion by January 2025, reflecting their appeal. They offer diversification, crucial in today's volatile markets. This positions T. Rowe Price strongly for continued success.

Global Equity Research

T. Rowe Price has extended its equity research, now including International and Global Equity strategies. This mirrors the successful US Equity approach, achieving 3-year track records by September 2024. The expansion aims to deliver comprehensive equity research and investment solutions. This strengthens their position in the asset management sector.

- International and Global Equity research strategies expanded T. Rowe Price's offerings.

- US Equity strategy achieved 3-year track records by September 2024.

- The firm aims to offer comprehensive equity research and investment solutions.

- This expansion reinforces T. Rowe Price's leadership in asset management.

Insurance Channel Expansion

T. Rowe Price is expanding into the insurance channel, focusing on fixed income. A partnership with Aspida Holdings is boosting its life and annuity offerings. This move aims to capture more assets under management from insurers. This strategic shift could increase revenue streams and diversify the client base.

- Focus on fixed income for insurance clients.

- Partnership with Aspida Holdings for life and annuity.

- Seeking to increase assets under management.

- Diversifying revenue streams.

T. Rowe Price's multi-asset solutions are "Stars" due to their impressive growth and market share. These solutions attracted $17 billion, reaching $553 billion by early 2025. They offer critical diversification in volatile markets, positioning them strongly for continued success.

| Category | Metric | Value (Early 2025) |

|---|---|---|

| Multi-Asset Solutions | AUM Growth | $17 billion increase |

| Multi-Asset Solutions | Total AUM | $553 billion |

| Market Position | Strategic Significance | High |

Cash Cows

T. Rowe Price's retirement expertise is a key cash cow. A substantial part of its assets under management (AUM) comes from retirement accounts. This expertise helps retain clients and ensures reliable revenue, even during market changes. In 2024, retirement assets represented a large portion of T. Rowe Price's overall AUM.

T. Rowe Price excels in active equity management, especially in large-cap stocks, serving as a stable revenue source. Their competitive equity fund performance draws and keeps investors. In 2024, equity assets under management (AUM) constituted a significant portion of their total AUM, contributing to profitability.

T. Rowe Price's robust brand, rooted in investment success and client focus, is a key asset, drawing in and keeping clients. This reputation lets them charge higher fees, staying ahead in the asset management field. In 2024, T. Rowe Price managed around $1.46 trillion in assets. Their client retention rate is consistently high, above 90%.

Global Reach

T. Rowe Price's global reach is a key strength, supporting its "Cash Cows" status in the BCG Matrix. This presence, with a diverse client base worldwide, bolsters financial stability and resilience. Serving clients across regions and preferences diversifies revenue streams, lessening the impact of regional market downturns.

- Presence in 16 countries and serving clients in 47 as of 2024.

- Over $1.4 trillion in assets under management (AUM) in 2024.

- Approximately 50% of AUM from non-US clients in 2024.

- Generated $6.5 billion in revenue in 2023.

Fixed Income Strategies

T. Rowe Price's fixed income strategies act as cash cows, delivering steady revenue. These include municipal bonds and credit-sensitive strategies. Positive net flows boosted fixed income AUM, reaching $188 billion by late 2024. This highlights their dependability and investor confidence.

- Municipal bonds provide stable income.

- Credit-sensitive strategies offer higher yields.

- $188 billion AUM shows strong market position.

- Net inflows indicate investor trust in 2024.

T. Rowe Price's robust retirement expertise, substantial equity management, and strong brand recognition solidify its "Cash Cow" status. Their global reach and fixed income strategies offer consistent revenue streams. By late 2024, fixed income AUM reached $188 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| AUM | Total Assets Under Management | Over $1.4 trillion |

| Revenue (2023) | Total Revenue | $6.5 billion |

| Global Presence | Countries Served | 47 |

Dogs

Underperformance in core bond strategies could categorize them as a 'dog' within T. Rowe Price's framework. Recent data shows core bond funds have lagged, impacting overall returns. This underperformance might lead to outflows from this segment. For instance, in 2024, some core bond funds saw a 2% decline.

In 2024, T. Rowe Price's active management, with higher fees, could struggle as passive investments gain favor. Clients shifting to cheaper options might cause outflows from these strategies. This could impact revenue, as seen in the first half of 2024 where active strategies saw net outflows. The firm's ability to justify higher fees with performance is key.

T. Rowe Price's equity strategies face challenges. They've seen continued outflows. This is due to passive funds and active ETFs. In 2024, active equity funds saw significant outflows. Performance and costs must be addressed to regain investor trust.

Underperforming Funds

Underperforming funds at T. Rowe Price, categorized as 'dogs,' consistently lag behind benchmarks. These funds often struggle to gain assets, affecting the firm's financial results. For example, in 2024, certain international equity funds showed returns below their indexes. This impacts the firm's profitability.

- Funds may show lower returns than their benchmarks.

- Asset outflows can reduce revenue.

- The firm's overall performance is impacted.

- These funds require strategic review.

Traditional Investment Advisories

Traditional investment advisories at T. Rowe Price might be seen as a 'dog' in their BCG matrix. The company's move away from these services, as they broaden their range, could signal diminishing profits. This shift towards faster-growing areas, such as ETFs, further suggests a re-evaluation of traditional advisory services. In 2024, T. Rowe Price's ETF assets under management saw significant growth, highlighting this strategic pivot.

- Decline in traditional advisory revenue.

- Focus on ETFs and other high-growth products.

- Strategic shift towards more profitable areas.

- Re-evaluation of traditional service profitability.

Underperforming areas at T. Rowe Price fit the 'dog' profile. These strategies, like core bond funds, have shown lagging returns. This affects profitability, as seen in 2024's underperformance.

| Category | Impact | Data (2024) |

|---|---|---|

| Core Bonds | 2% decline | Underperformed benchmarks. |

| Active Equity | Outflows | Investor shift to passive. |

| Advisory | Revenue decline | Shift to ETFs seen. |

Question Marks

Within T. Rowe Price's BCG matrix, alternative investments currently fit the 'question mark' category. These investments, including real estate and private equity, carry higher risks and complexities. For instance, in 2024, T. Rowe Price's alternatives assets under management (AUM) were approximately $50 billion. To solidify their position, the firm must prove its capacity to deliver consistent returns in this area.

T. Rowe Price's new ETFs, especially those in niche markets, are 'question marks'. Their success hinges on attracting assets and competitive returns. In 2024, the ETF market saw $1.2 trillion in inflows, indicating growth potential. Their performance will be key.

T. Rowe Price's push into new locales, like Canada, fits the 'question mark' category. The firm faces uncertain outcomes amid new regulations and rivals. Success hinges on strategy adjustments and solid local establishment. In 2024, T. Rowe Price's assets under management were around $1.46 trillion.

Personalized Retirement Solutions

Personalized retirement solutions are a 'question mark' for T. Rowe Price due to rising demand. The firm must expand personalized offerings, like managed accounts. This helps meet evolving saver needs and grow market share. T. Rowe Price's assets under management totaled $1.46 trillion as of December 31, 2023.

- Increasing demand for personalized retirement solutions.

- Need to develop and scale personalized offerings.

- Aim to meet evolving needs of retirement savers.

- Goal to capture a larger market share.

AI and Technology Investments

For T. Rowe Price, investments in AI and technology are currently categorized as a "question mark" within the BCG matrix. The firm has allocated resources to these areas to boost productivity and enhance investment processes. However, the success of these investments hinges on demonstrating tangible benefits. The firm needs to prove that these tech investments lead to better investment performance and increased operational efficiency to justify the expenses.

- T. Rowe Price aims to improve investment processes with AI.

- Investments must show clear benefits like better returns.

- Operational efficiency gains are also a key goal.

- The "question mark" status reflects the need for proven outcomes.

The rise in demand for personalized retirement plans positions them as a "question mark." T. Rowe Price must expand these offerings to meet evolving saver needs. As of 2024, the retirement market is valued at $34 trillion, creating significant potential.

| Aspect | Details | Implication |

|---|---|---|

| Focus Area | Personalized Retirement Solutions | Strategy for Market Share |

| Market Size | $34 Trillion (2024) | Significant Growth Opportunity |

| T. Rowe Price Action | Expand Personalized Offerings | Adapt to Saver Needs |

BCG Matrix Data Sources

The BCG Matrix relies on diverse sources such as financial filings, market share analyses, and economic indicators.