T Rowe Price PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T Rowe Price Bundle

What is included in the product

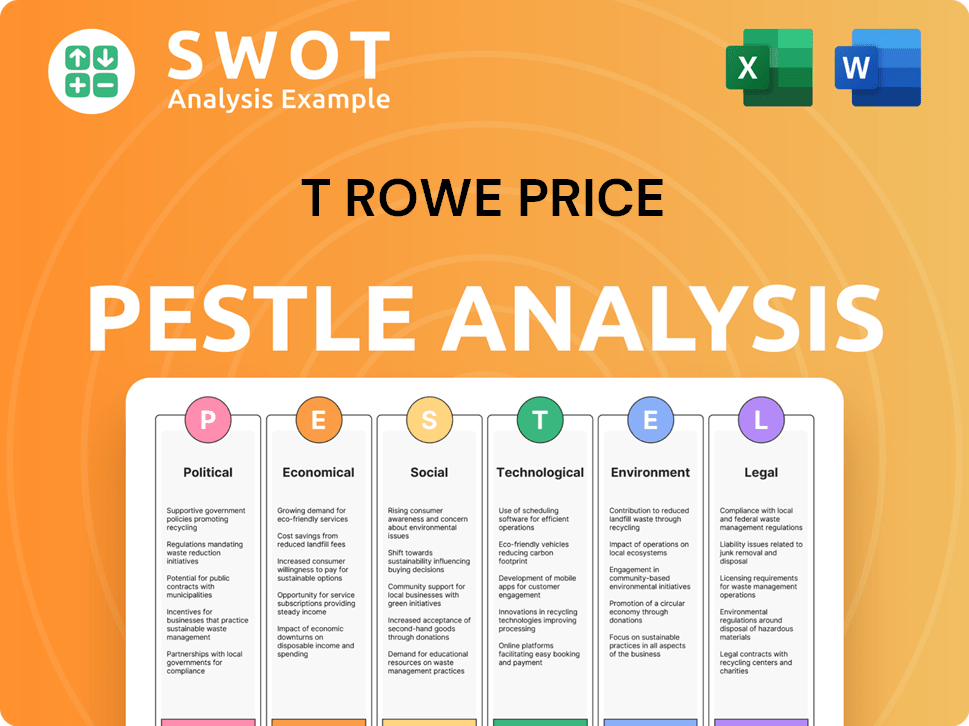

A detailed assessment of external factors impacting T Rowe Price, across six key areas: Political, Economic, Social, Technological, Environmental, and Legal.

A digestible, categorized summary prevents analysis paralysis, fostering informed decisions and clear strategies.

Preview Before You Purchase

T Rowe Price PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This T Rowe Price PESTLE Analysis presents detailed insights on various external factors. Explore the economic, political, social, technological, legal, and environmental elements influencing the company. The downloaded version mirrors this preview precisely. Instantly download this comprehensive report after purchase!

PESTLE Analysis Template

T Rowe Price operates within a complex external environment, shaped by a multitude of factors. Our PESTLE analysis offers a concise overview of these critical drivers, including political, economic, social, technological, legal, and environmental forces. Identify opportunities and navigate potential challenges affecting T Rowe Price’s operations. Get the full version for detailed strategic insights, including risk assessments, with an actionable impact on investment.

Political factors

T. Rowe Price faces significant impacts from financial regulations as a global investment management firm. Compliance with the SEC and adherence to rules like the SEC Marketing Rule, are vital. Changes in these regulations, like the 2024 updates, mean adjustments for operational and marketing strategies. In 2024, the SEC increased scrutiny on investment firms' marketing practices. This demands continuous adaptation.

Potential shifts in tax policies, like corporate tax rates, could influence T. Rowe Price's strategies. The Tax Cuts and Jobs Act's provisions expire in late 2025, signaling potential tax reform. Tax changes may affect the retirement industry, including investment firms. For instance, the corporate tax rate could change from 21% (2024) to a new rate.

Ongoing geopolitical tensions, particularly between the U.S. and China, create market volatility. Increased risk in specific markets may arise, potentially leading to sanctions and trade restrictions. For instance, in 2024, U.S.-China trade totaled $660 billion. These factors directly influence portfolio strategies, necessitating careful adaptation.

Shareholder Activism

Shareholder activism's global rise impacts corporate governance, pushing firms like T. Rowe Price to voice opinions. This trend persists, potentially leading to varied investor standards across regions. In 2024, activist campaigns increased, with a 20% rise in the U.S. and Europe. T. Rowe Price actively engages, voting on over 170,000 proposals annually.

- 20% rise in activist campaigns in the U.S. and Europe in 2024.

- T. Rowe Price votes on over 170,000 proposals annually.

Political Stability and Elections

Political stability is crucial for economic certainty, and elections play a significant role in shaping market dynamics. T. Rowe Price assesses how political transitions and policy shifts affect investment strategies. For example, the 2024 U.S. elections could influence sectors like healthcare and energy. Market volatility often increases during and after elections, as seen in various global markets.

- U.S. elections impact: Expect significant changes in sectors like healthcare and energy based on election outcomes.

- Volatility increase: Historical data shows market volatility often rises during and after major elections.

- Policy agenda: Different agendas of political parties can change the investment landscape.

T. Rowe Price navigates a complex political landscape shaped by regulations and global events. The firm's operations are heavily influenced by U.S. and global regulations like the SEC Marketing Rule, with continuous updates demanding adaptation. Corporate tax reforms, particularly after the Tax Cuts and Jobs Act provisions expire in 2025, are crucial. Geopolitical tensions, particularly those affecting U.S.-China trade ($660 billion in 2024), influence market volatility, needing careful portfolio adjustments.

| Political Factor | Impact on T. Rowe Price | 2024/2025 Data |

|---|---|---|

| Regulatory Changes | Requires continuous compliance adjustments for marketing and operational strategies. | SEC scrutiny increased, updating Marketing Rule (2024). |

| Tax Policies | Influences investment strategies and potentially impacts retirement. | Corporate tax rate currently 21%, changes in late 2025. |

| Geopolitical Tensions | Affects market volatility, sanctions, and trade restrictions. | U.S.-China trade $660 billion (2024). |

Economic factors

The global economy faces elevated inflation and interest rates. Sticky inflation and central bank rate decisions significantly affect markets. The potential for higher Treasury yields is another key consideration. In the US, inflation was 3.5% in March 2024, and the Federal Reserve held rates steady. T. Rowe Price analyzes these factors.

Economic growth in the U.S. is projected at 2.1% in 2024, according to the Federal Reserve. Non-residential investment and tech are key drivers. However, recession risks persist, with factors like inflation impacting growth. T. Rowe Price monitors indicators like the yield curve to assess downturn probability. The yield curve inverted in mid-2023, historically signaling recession.

Financial markets show considerable volatility. T. Rowe Price's performance relies on market dynamics and assets under management value. They use active management to find opportunities. In Q1 2024, the S&P 500 rose 10.2%, impacting their portfolio performance.

Client Outflows and Inflows

T. Rowe Price has navigated client flows that impact its financial performance. The firm experienced net client outflows, especially in U.S. equities, yet saw inflows into target date funds and fixed income products. These shifts necessitate careful management to sustain assets under management (AUM) and revenue streams. In Q1 2024, T. Rowe Price reported net outflows of $12.5 billion.

- Outflows in U.S. equities can pressure overall AUM.

- Inflows into target date funds offer stability.

- Fixed income inflows can offset equity outflows.

- Managing these flows is critical for financial health.

Fee Compression

Fee compression poses a significant challenge for T. Rowe Price, as the shift toward lower-fee products impacts revenue. This trend necessitates a focus on cost management. In 2023, the industry saw continued pressure on fees, with some firms adjusting their pricing models. T. Rowe Price must demonstrate the value of active management to justify its fees.

- Industry-wide fee compression continues to be a trend.

- T. Rowe Price needs to focus on expense management.

- Demonstrating the value of active management is crucial.

- Fee pressure impacts revenue streams.

Economic conditions in 2024 present both challenges and opportunities for T. Rowe Price. Inflation, though moderating, remains a concern. U.S. economic growth is expected at 2.1% in 2024, according to the Federal Reserve, impacting investment decisions.

Volatility in financial markets necessitates active management to seize opportunities and mitigate risks.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| Inflation | Influences investment strategy and market returns | US inflation 3.5% (March 2024) |

| Interest Rates | Affects market dynamics and investment costs. | Federal Reserve held rates steady (Q1 2024) |

| Economic Growth | Determines asset growth and sector performance. | US growth projected at 2.1% (2024) |

Sociological factors

T. Rowe Price caters to a broad investor base, from retail clients to major institutional investors. A key trend is the increasing demand for Environmental, Social, and Governance (ESG) investments. In 2024, ESG assets under management are projected to reach $50 trillion globally, reflecting a shift in investor priorities. This influences product development and client service strategies.

Retirement trends significantly influence T. Rowe Price. The SECURE Acts and possible tax reforms are key. These changes affect the firm's assets under management. Data from 2024 shows a continued shift in retirement planning approaches. In 2023, T. Rowe Price's retirement assets totaled billions.

Changes in the labor market, such as rising labor costs, are critical for businesses and investors. Labor costs, including wages and benefits, are a major expense. In 2024, the U.S. average hourly earnings for all employees were around $34.75. T. Rowe Price analyzes these trends to inform investment decisions.

Societal Expectations and Trust

T. Rowe Price operates within a societal context where ethical behavior and transparency are increasingly crucial. Maintaining client trust is a core element of their business model. A 2024 survey indicated that 85% of investors prioritize ethical considerations in their investments.

The firm's commitment to responsible investing is frequently assessed by both clients and regulatory bodies. Negative publicity can significantly damage their reputation.

Societal expectations influence T. Rowe Price's investment strategies and corporate governance. Failure to meet these expectations could lead to financial and reputational damage.

Building and maintaining trust is essential for attracting and retaining clients in the competitive financial market. The company's actions are constantly under scrutiny.

- 2024: 85% of investors prioritize ethical considerations.

- Reputational damage can impact financial performance.

- Responsible investing is a key focus.

- Transparency is crucial for maintaining trust.

Financial Literacy and Investor Education

Financial literacy varies widely, impacting investment decisions. T. Rowe Price offers tools and guidance to help clients. This is key for attracting and keeping clients. In 2024, the SEC emphasized investor education. The company's educational efforts are vital.

- SEC's 2024 focus on investor education.

- T. Rowe Price's tools for client support.

- Impact of financial literacy on investment choices.

Societal pressures significantly shape T. Rowe Price's strategies. Ethical investment and transparency are increasingly crucial for investors; 85% prioritized ethics in 2024. Reputational damage poses a risk, as client trust is fundamental. The firm focuses on responsible investing and educational resources.

| Factor | Impact | 2024 Data |

|---|---|---|

| Ethical Concerns | Influence investment decisions | 85% investors prioritize ethics |

| Reputation | Affects financial performance | - |

| Financial Literacy | Impacts investor choices | SEC focuses on education |

Technological factors

AI is revolutionizing finance, boosting productivity and reshaping investment strategies. T. Rowe Price actively invests in technology, recognizing AI's transformative impact. Autonomous driving, a field AI powers, is projected to reach $65 billion by 2024. This presents new investment avenues. T. Rowe Price's focus aligns with these technological shifts.

T. Rowe Price is heavily invested in digital transformation, utilizing online platforms for investment management and client interaction. This strategy requires ongoing technological investments and adherence to digital marketing regulations. The global digital transformation market is projected to reach $3.25 trillion by 2025. In 2024, digital assets under management increased by 15%.

T. Rowe Price heavily relies on data analytics and technology. In 2024, they invested $300 million in tech. They use sophisticated tools to analyze market data and manage investments. They depend on key tech vendors, facing potential concentration risks.

Cybersecurity Risks

Cybersecurity is a major technological factor for T. Rowe Price. As a financial firm, they manage substantial amounts of sensitive client data. The firm must protect against cyber threats and maintain system integrity, which is paramount. Cybersecurity breaches can lead to significant financial losses and reputational damage.

- In 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually.

- Financial services face 300% more cyberattacks than other industries.

- T. Rowe Price invests heavily in cybersecurity, spending millions each year.

Development of New Investment Technologies (e.g., ETFs)

T. Rowe Price faces a dynamic technological landscape, particularly with the rise of ETFs. The firm is actively expanding its ETF business to meet investor demand. As of Q1 2024, T. Rowe Price manages $157.8 billion in ETFs. This growth necessitates adapting product offerings and distribution strategies. The company’s strategic moves are crucial for maintaining a competitive edge.

- ETF assets under management grew 32% year-over-year in Q1 2024.

- T. Rowe Price launched several new ETFs in 2024.

- Digital platforms are key distribution channels.

Technological advancements like AI drive investment and boost productivity, and are major factors. T. Rowe Price invests in digital transformation, reaching a digital transformation market projected at $3.25 trillion by 2025, and adapting digital platforms for investment and client interaction.

Data analytics and cybersecurity are vital; T. Rowe Price uses advanced tools, having spent $300 million in 2024. They face major cybersecurity challenges, and in 2024, cybercrime is projected to cost $10.5 trillion. Cybersecurity is critical to manage client data.

The growth of ETFs represents a critical area of focus and presents an opportunity. As of Q1 2024, T. Rowe Price manages $157.8 billion in ETFs, and ETF assets grew 32% year-over-year.

| Factor | Details | Impact |

|---|---|---|

| AI & Digital | AI and Digital transformation with AI powered tools. | Productivity and investment gains. |

| Cybersecurity | $10.5T global cost of cybercrime, and protect from cyber attacks. | Protecting financial data and systems. |

| ETFs | $157.8 billion in ETFs (Q1 2024), ETF growth (32% YoY). | Adapt product offers, maintain competitive edge. |

Legal factors

T. Rowe Price faces stringent financial regulations, primarily from the SEC, impacting reporting, disclosure, and marketing. Compliance is an ongoing, resource-intensive process. In 2024, the SEC's focus on investment advisor oversight continues to evolve. This necessitates constant adaptation to new rules and interpretations. The firm's legal and compliance expenses are a significant portion of its operational budget.

Tax laws significantly influence T. Rowe Price and its investors. Recent tax reforms, like those in the Inflation Reduction Act of 2022, have altered investment strategies. The corporate tax rate, currently at 21%, is a key factor. Future tax policies, including potential changes to capital gains, demand careful planning. Staying informed is crucial for navigating these shifts.

Regulations on fiduciary duty and investor protection, including ERISA, are critical. These rules define how financial professionals, like those at T. Rowe Price, must act. The proposed Fiduciary Rule aims to enhance investor safeguards. In 2024, the SEC's focus on fiduciary duty continues. This impacts client service standards.

International Investment Regulations

Operating globally necessitates T. Rowe Price to adhere to a wide array of international investment regulations across its operational jurisdictions, significantly increasing the complexity of their legal and compliance procedures. This involves navigating varying regulatory landscapes such as those in the Asia-Pacific region, which saw a 15% increase in regulatory changes in 2024. Compliance costs are substantial; for instance, the EU's MiFID II regulations cost firms an estimated $2 billion annually. These regulations impact everything from fund structuring to marketing practices, demanding continuous adaptation.

- Compliance costs for financial institutions globally are expected to rise by 10% in 2025 due to increasing regulatory scrutiny.

- Asia-Pacific region is projected to see the most regulatory changes in the coming years, with an estimated 20% increase.

- MiFID II compliance continues to be a major cost driver, with ongoing adjustments.

Litigation and Legal Challenges

T. Rowe Price, like any financial giant, navigates a landscape of potential lawsuits. These can arise from investment practices or general business conduct, impacting its financial health. Legal risks require careful monitoring and active management to mitigate potential financial setbacks. Recent data shows that litigation costs can vary significantly year-to-year, sometimes reaching millions of dollars.

- 2023: T. Rowe Price's legal and regulatory expenses were approximately $25 million.

- 2024: Legal challenges could stem from regulatory changes, such as those related to ESG investing.

- Ongoing: The firm dedicates resources to ensure compliance and manage legal exposure.

T. Rowe Price must adhere to financial regulations, predominantly from the SEC. They face intense compliance requirements, which have been especially intense. In 2025, global compliance costs for financial institutions are anticipated to surge by 10%. Lawsuits, potentially stemming from investment practices, are a continuous concern, influencing financial stability.

| Legal Aspect | Details | Financial Impact |

|---|---|---|

| Regulations | SEC, ERISA, MiFID II compliance | MiFID II costs estimated at $2B annually globally. |

| Tax Laws | Corporate tax rate 21%, tax reforms (e.g., Inflation Reduction Act) | Tax planning crucial to investment strategy adjustments |

| Legal Risks | Lawsuits from investment or general conduct | 2023 Legal & regulatory expenses: ~$25M; litigation can be in the millions. |

Environmental factors

T. Rowe Price acknowledges climate change as a key risk. They incorporate climate risk analysis into investment decisions. The firm supports the Paris Agreement. In 2024, climate-related disasters cost billions globally. T. Rowe Price aims for net-zero emissions by 2050.

T. Rowe Price prioritizes environmental sustainability. They aim to cut greenhouse gas emissions and enhance building environmental performance. This includes waste management improvements. In 2024, they invested in green building certifications.

T. Rowe Price actively incorporates Environmental, Social, and Governance (ESG) considerations into its investment strategies. This approach aligns with rising client demand and the view that ESG factors impact financial outcomes. For example, as of 2024, over 80% of T. Rowe Price's assets under management consider ESG factors. They engage with companies on ESG matters.

Responsible Consumption and Waste Management

T. Rowe Price emphasizes responsible consumption and waste reduction in its operations. The firm actively investigates circular economy solutions and is evaluating strategies to eliminate single-use plastics. In 2024, the global waste management market was valued at approximately $2.1 trillion, reflecting the growing importance of these initiatives. Companies are increasingly adopting eco-friendly practices to meet stakeholder expectations and regulatory requirements.

- Waste Management Market Size (2024): ~$2.1 Trillion

- Focus: Circular Economy and Waste Reduction

- Initiative: Phasing out single-use plastics

Biodiversity and Nature Restoration

T. Rowe Price emphasizes biodiversity and nature restoration in its environmental strategy, recognizing the economic and social value of natural habitats. The firm integrates these considerations into its land use practices, aiming to minimize environmental impact. Globally, the market for nature-based solutions is projected to reach $300 billion by 2030, highlighting the growing financial significance of these initiatives. By focusing on biodiversity, T. Rowe Price aligns with increasing investor and regulatory pressures for sustainable practices.

- Global biodiversity loss is estimated to cost the world $2.7 trillion annually.

- The EU's Nature Restoration Law mandates restoration efforts across 20% of EU land and sea areas by 2030.

- Companies with strong environmental performance often see improved financial returns and reduced risk.

T. Rowe Price addresses climate change by analyzing climate risks in investments and supporting the Paris Agreement, aiming for net-zero emissions by 2050.

The company focuses on environmental sustainability through reduced greenhouse gas emissions and green building practices. They also emphasize responsible consumption, including efforts to phase out single-use plastics amid a $2.1 trillion waste management market in 2024.

They incorporate ESG factors into investment strategies, acknowledging the impact of environmental factors on financial outcomes and client demand. Nature-based solutions are projected to reach $300 billion by 2030, highlighting their importance.

| Aspect | Details | Financial Impact/Data (2024/2025) |

|---|---|---|

| Climate Change | Incorporation of climate risk analysis; support of the Paris Agreement | Climate-related disasters cost billions; aiming for net-zero emissions by 2050 |

| Environmental Sustainability | Reducing greenhouse gas emissions, improving building environmental performance, waste management. | Waste management market ~$2.1T in 2024; investment in green building certifications |

| ESG Integration | Incorporating ESG factors into investments; engagement with companies. | Over 80% of assets under management consider ESG factors in 2024 |

PESTLE Analysis Data Sources

Our T. Rowe Price PESTLE Analysis utilizes data from financial reports, economic forecasts, and regulatory updates.