TTEC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TTEC Bundle

What is included in the product

Focus on TTEC's business units within the BCG Matrix, suggesting investment, holding, or divestiture strategies.

Easy-to-read grid showing where each product lies, providing clear strategic investment opportunities.

Full Transparency, Always

TTEC BCG Matrix

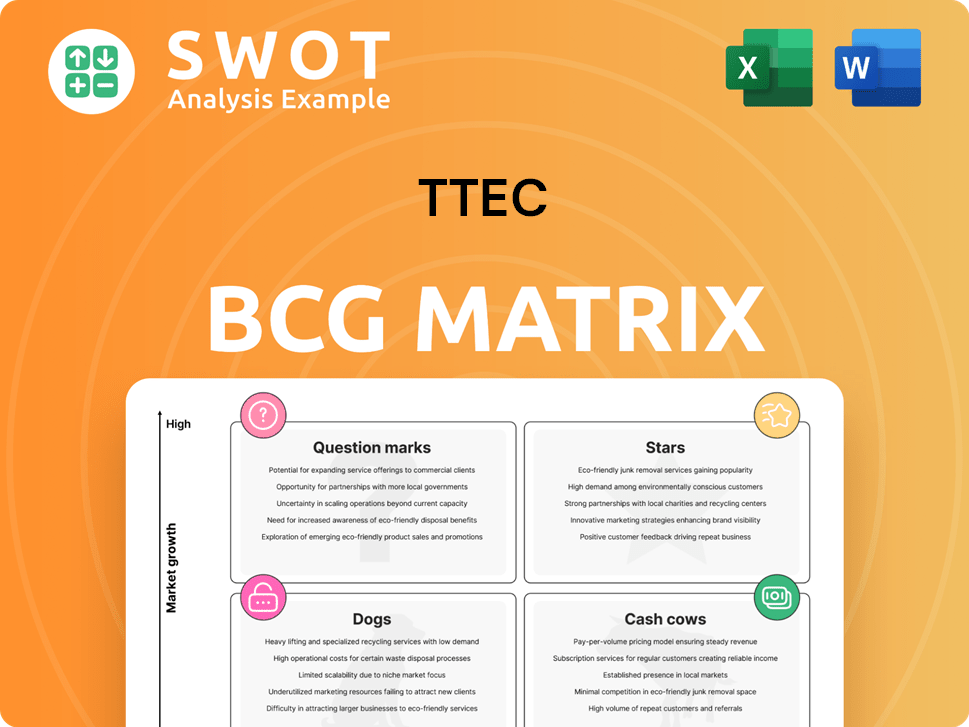

The preview shows the complete TTEC BCG Matrix you'll get. This is the final, downloadable version—ready for immediate strategic planning and analysis. No extra steps or different content will be present.

BCG Matrix Template

This snapshot offers a glimpse into TTEC's product portfolio, categorized using the BCG Matrix. We've briefly identified potential "Stars," "Cash Cows," "Dogs," and "Question Marks." Understanding these placements is crucial for strategic planning and resource allocation. The full BCG Matrix provides in-depth analysis of each quadrant. Get the complete report for detailed quadrant placements, data-driven insights, and actionable strategies.

Stars

TTEC's AI-powered customer experience solutions, particularly within TTEC Digital, are performing strongly in the market. These solutions continuously evolve, with AI integration across CX aspects. In 2024, TTEC Digital's revenue grew, reflecting its innovative leadership. TTEC is focusing on self-service and agent support, making it a key innovator.

TTEC's cloud-based CXaaS platform is a standout asset. This proprietary platform provides top CX technology and operational management, scaled effectively. It enhances every part of the customer experience, setting TTEC apart. In 2024, TTEC reported over $2.3 billion in revenue, fueled by these tech-driven solutions.

TTEC's strategic alliances with tech giants like Microsoft, a key strength, are highlighted by TTEC Digital's Microsoft Business Applications Inner Circle Award. This partnership boosts its customer experience services. TTEC Digital's recognition as Genesys' 2024 CX Evolution Partner of the Year further showcases its capabilities. In 2024, TTEC's strategic partnerships fueled a 12% revenue increase in its digital business segment.

Global Reach and Multilingual Support

TTEC's global reach is a significant strength, operating across six continents and offering support in over 50 languages. This extensive presence enables TTEC to serve a diverse range of clients, including both established and emerging brands. The company's ability to provide customer engagement through various channels is enhanced by AI-driven, real-time language translation tools, supporting the borderless CX trend. In 2024, TTEC expanded its global footprint, increasing its multilingual support by 10%.

- Global operations on six continents.

- Support in over 50 languages.

- Serves both iconic and disruptive brands.

- Utilizes AI for real-time language translation.

Focus on Personalized and Seamless Experiences

TTEC excels in providing personalized and seamless customer experiences, a key strength in the BCG matrix. Their focus on tailored solutions boosts customer satisfaction and loyalty, driving positive business outcomes. Continuous innovation and omnichannel communication further enhance these customer-centric strategies. This approach is vital for maintaining a competitive edge in the market.

- TTEC reported a revenue of $2.4 billion in 2023.

- Customer experience spending is projected to reach $641 billion by 2024.

- Over 70% of consumers expect personalized interactions.

- TTEC's cloud solutions saw a 20% increase in adoption in 2023.

TTEC's "Stars" are its rapidly growing, high-market-share business units, fueled by AI and cloud solutions. TTEC Digital's partnerships drive significant revenue growth. Their global reach and innovation support their star status.

| Key Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Growth | Digital segment and cloud solutions | Digital revenue up 12% |

| Market Presence | Global reach, diverse clients | Support in 50+ languages |

| Strategic Alliances | Partnerships with tech leaders | Microsoft, Genesys awards |

Cash Cows

TTEC's traditional customer care, like tech support and back-office operations, generates consistent revenue. These services offer steady cash flow, thanks to established clients and ongoing demand. The customer technical support market is predicted to expand, ensuring its continued relevance. In 2024, the global customer experience market was valued at $78 billion.

TTEC's strong client relationships with well-known brands create a consistent revenue flow. These enduring partnerships offer a stable foundation for repeat business. High client, customer, and employee satisfaction are key to keeping this base. In Q3 2024, TTEC reported a 3.8% revenue increase, showing the value of these relationships.

TTEC's Engage segment, a cash cow, provides content moderation and fraud prevention. These services are crucial across industries, ensuring brand reputation and trust. In 2024, the global fraud prevention market was valued at $40.7 billion. The demand for these services guarantees a steady revenue stream for TTEC.

Legacy CRM and Systems Integration Services

TTEC's legacy CRM and systems integration services form a cash cow, offering stable revenue. These services support clients updating systems, even with a slower growth rate. CRM expertise remains vital as systems evolve. In 2024, TTEC's revenue from CRM integration was approximately $500 million. These services contribute significantly to TTEC's overall financial stability.

- Steady revenue stream from existing services.

- Supports clients updating their systems.

- CRM expertise remains highly valuable.

- 2024 revenue from CRM integration: ~$500M.

Tech Support Services

TTEC's tech support services are a cash cow, especially in consumer tech support. This segment provides steady revenue due to constant tech reliance. It helps customers use products, boosting loyalty. In 2024, the global tech support market was valued at $15.8 billion.

- Steady Revenue Stream.

- Customer Loyalty.

- Market Growth.

- $15.8 Billion Market Value (2024).

TTEC's cash cows, like customer care and CRM, ensure consistent revenue. Strong client relations and a $40.7B fraud prevention market (2024) fuel this. Steady tech support revenue ($15.8B market in 2024) provides stability.

| Service | Market Value (2024) | Key Benefit |

|---|---|---|

| Customer Care | $78B | Steady Revenue |

| Fraud Prevention | $40.7B | Brand Reputation |

| Tech Support | $15.8B | Customer Loyalty |

Dogs

TTEC faces revenue challenges due to declining healthcare volumes, notably affecting Digital and Engage segments. This suggests underperformance in some healthcare services. In Q3 2023, TTEC's revenue decreased, indicating the need to reassess these offerings. Consider strategies like revitalization or divestiture based on performance.

The loss of a major financial services client suggests vulnerabilities in TTEC's client retention approach, particularly in the financial services segment. This situation necessitates a thorough review of client relationships to pinpoint and resolve the issues causing client departures. Focusing on these issues is crucial for securing a consistent client base. In 2024, TTEC's revenue from financial services clients was down by 7%, indicating the urgency of addressing retention challenges.

Traditional on-site support, while still needed, faces profitability challenges compared to remote options. Demand for on-site services may decline, impacting long-term viability. Evaluate the profitability; in 2024, on-site IT support margins were around 15%, lower than remote's 25%. Optimize resource allocation based on these evolving trends.

Outdated Technology Offerings

If TTEC has outdated technology offerings that don't meet current market needs, they're Dogs in the BCG Matrix. These technologies may need substantial investment for modernization or should be phased out. Focus on innovative solutions to meet evolving customer needs. For example, in 2024, TTEC's revenue was $2.4 billion; outdated tech could hinder growth.

- Outdated tech offerings are Dogs.

- Modernization requires significant investment.

- Focus on innovative customer solutions.

- 2024 revenue: $2.4 billion.

Low-Margin, High-Effort Services

Low-margin, high-effort services need close scrutiny. These services consume resources, potentially hindering more profitable ventures. In 2024, companies like TTEC, with a focus on customer experience, might find some services in this category. Streamlining or discontinuing these services can boost profitability. Evaluate their contribution to the overall business strategy.

- Resource Drain: Services needing significant effort but yielding low profit.

- Profit Impact: Assess how these services affect overall financial performance.

- Strategic Alignment: Ensure services match the core business goals.

- Actionable Steps: Streamline or eliminate underperforming services.

Dogs represent business units with low market share in slow-growing markets, such as outdated tech. These offerings may require substantial investment or strategic phase-out to avoid hindering the growth of TTEC. This strategic positioning aims to identify and manage underperforming assets for better resource allocation. In 2024, $2.4B revenue needs scrutiny to avoid being dogs.

| Category | Characteristics | Strategy |

|---|---|---|

| Dogs | Low market share, slow growth | Divest, Reallocate Resources |

| Risk | Outdated technology, Low margins | Modernize or Eliminate |

| Impact | May need to be phased out. | Enhance Overall Performance |

Question Marks

TTEC's AI-driven sales solutions represent a "Question Mark" in their BCG matrix. These solutions, which include AI-powered customer service and sales tools, hold significant revenue growth potential. However, they require further investment and market penetration for full realization. Early results show promise, with AI integrations boosting sales by up to 15% in pilot programs during 2024.

TTEC's move into emerging markets like South Africa and Rwanda is a high-growth, high-risk strategy. These markets demand substantial upfront investment to build a solid foundation. Despite challenges, these regions offer access to skilled, digitally adept workforces. For example, in 2024, South Africa's BPO sector saw a 15% growth. Navigating local complexities is critical for TTEC's success.

As a launch partner for Microsoft Dynamics 365 Contact Center, TTEC aims to capture market share. This venture demands continuous investment in training and expertise. TTEC's proficiency in Microsoft solutions enhances its capacity to streamline customer interactions. In 2024, the global contact center software market was valued at $38.6 billion, and it is projected to reach $57.5 billion by 2029.

AI-Enhanced Training Programs

TTEC's AI-enhanced training programs are a growth area. These programs can redefine the CX workforce. Investing in them can position TTEC as a leader in CX talent development. The global CX market is projected to reach $28.5 billion by 2024. TTEC's focus on AI aligns with this growth.

- CX training market is expected to grow by 10-12% annually.

- AI-driven training can reduce training costs by up to 30%.

- Companies with strong CX training see a 20% increase in customer satisfaction.

- TTEC's revenue in 2023 was $2.4 billion.

Borderless CX Solutions

Borderless CX solutions offered by TTEC, leveraging AI tools for real-time language translation and voice enhancement, are a "Question Mark" in the BCG Matrix. These solutions present high growth potential but require significant investment and carry inherent risks. They enable global customer support, accessing diverse talent pools, but face challenges in market adoption and technological advancements. Further investment is crucial to expand market reach and solidify their position.

- TTEC's borderless CX solutions utilize AI for real-time language translation and voice enhancement.

- These solutions enable brands to deliver seamless customer support globally.

- They tap into diverse talent pools but face adoption challenges.

- Further investment is crucial for expanding market reach.

Borderless CX solutions are TTEC's "Question Marks", offering high growth. These solutions leverage AI for global customer support, facing adoption challenges despite tapping diverse talent. Significant investment is vital for expanding their market reach.

| Feature | Details | 2024 Data |

|---|---|---|

| AI Integration | Real-time language translation & voice enhancement | CX market size: $28.5B |

| Market Focus | Global customer support | CX training growth: 10-12% annually |

| Investment Need | Expand market reach | AI training cost reduction: Up to 30% |

BCG Matrix Data Sources

TTEC's BCG Matrix utilizes financial statements, market analysis, and expert evaluations. We incorporate industry benchmarks and growth metrics.