TTEC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TTEC Bundle

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the specific company.

Customize pressure levels based on new data or evolving market trends.

Preview Before You Purchase

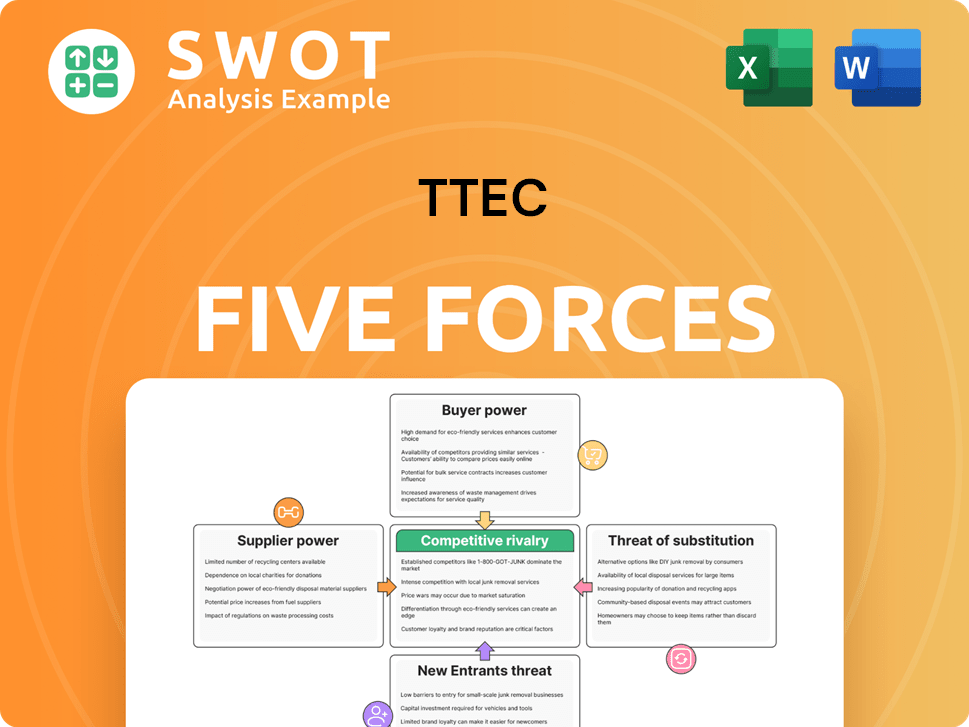

TTEC Porter's Five Forces Analysis

This preview outlines TTEC's Porter's Five Forces analysis, detailing competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants.

The analysis provides a comprehensive overview of TTEC's competitive landscape, offering insights into its industry positioning and strategic challenges.

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

The document is a professionally written analysis—fully formatted and ready for use immediately.

Gain immediate access to this thorough analysis with no modifications needed.

Porter's Five Forces Analysis Template

TTEC faces moderate rivalry, with competitors vying for market share in the customer experience space. Supplier power is relatively low due to a fragmented supplier base. Buyer power is moderate, influenced by the availability of alternative service providers. The threat of new entrants is also moderate, given the capital and expertise needed. Substitute products, such as in-house customer service departments, pose a moderate threat.

The complete report reveals the real forces shaping TTEC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the CX tech sector affects TTEC's bargaining power. A market dominated by a few major suppliers, like those providing cloud infrastructure, gives those suppliers more leverage. TTEC needs to assess the landscape of its key suppliers. In 2024, the cloud services market, relevant to TTEC, is highly concentrated, with Amazon Web Services, Microsoft Azure, and Google Cloud Platform holding a significant market share.

TTEC's bargaining power of suppliers is influenced by switching costs. High switching costs, like tech integration or retraining, favor suppliers. For instance, in 2024, TTEC's IT spending was approximately $300 million. This data highlights the company's dependency on its supplier base.

Suppliers with strong brand reputations or unique offerings can indeed influence pricing. Assessing the brand strength and distinctiveness of TTEC's key suppliers is important. For instance, if TTEC relies heavily on a few specialized tech providers, those suppliers could have significant pricing power. Consider that in 2024, brand reputation accounted for 30% of a company's market value.

Impact of Supplier Inputs on TTEC's Differentiation

Supplier power hinges on how critical their inputs are to TTEC's service differentiation. If suppliers offer unique or high-quality components that enhance TTEC's offerings, they wield more influence. This is particularly true if switching suppliers is costly or time-consuming. TTEC's competitive edge can be directly impacted by supplier capabilities and pricing.

- High-quality technology or specialized software from key vendors can significantly boost service quality.

- Dependence on a few key suppliers for essential components increases their bargaining power.

- Supplier pricing models and contracts directly affect TTEC's cost structure and profitability.

Availability of Substitute Inputs

The availability of substitute inputs significantly diminishes supplier power, giving TTEC more leverage. If suppliers raise prices, TTEC can explore alternative inputs, reducing dependence. It's crucial to identify and assess the feasibility of these substitutes. For instance, TTEC might switch between different software providers or hardware vendors. In 2024, the IT services market, where TTEC operates, saw increased competition among vendors, providing more options.

- Substitute inputs lower supplier power by providing alternatives.

- Researching substitute viability is a key step in the process.

- TTEC can switch providers if prices rise.

- Increased competition in 2024 created more options.

TTEC faces supplier power challenges due to market concentration and high switching costs. The cloud services market is dominated by a few key players. This gives them pricing leverage in 2024. Substitutes and contract negotiations reduce these risks.

| Factor | Impact on TTEC | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | Increases supplier power. | Cloud market: AWS, Azure, Google control major share. |

| Switching Costs | Favors suppliers. | IT spending approx. $300 million, indicating dependency. |

| Substitute Availability | Reduces supplier power. | IT service market competition increased in 2024. |

Customers Bargaining Power

Customer concentration is a crucial factor in assessing TTEC's bargaining power. If a few major clients generate most of TTEC's revenue, those clients wield considerable influence. Examining the revenue distribution across TTEC's customer base is essential. For example, in 2024, a significant portion of revenue could come from a limited number of large contracts.

TTEC faces high customer bargaining power due to low switching costs. Clients can readily switch to rivals, amplifying their influence. Factors affecting client decisions, such as pricing and service quality, are crucial. In 2024, TTEC's revenue was approximately $2.4 billion, with a notable churn rate impacting this area.

Customer price sensitivity significantly impacts TTEC's bargaining power. If clients are very price-conscious, they'll push TTEC for lower prices, reducing profitability. Analyzing the price elasticity of demand for TTEC's offerings is crucial. In 2024, TTEC's revenue was $2.4 billion, highlighting the importance of pricing strategies.

Availability of Information to Customers

Customers' bargaining power increases with information access regarding TTEC's costs, performance, and alternatives. Information asymmetry significantly impacts this dynamic. Transparency enables informed decisions, potentially driving better terms for clients. In 2024, TTEC's revenue was approximately $4.2 billion, highlighting the scale of its operations and customer impact.

- Customer access to data on service quality.

- Comparison of TTEC's pricing against competitors.

- Impact of customer reviews and ratings on TTEC's reputation.

- Availability of switching costs and ease of switching.

Customer's Ability to Backward Integrate

Customer's ability to backward integrate significantly impacts TTEC's bargaining power. If clients can establish their own customer experience (CX) operations, their influence over pricing and service terms rises. The feasibility of insourcing CX services varies, but it poses a real threat. In 2024, approximately 30% of companies considered or implemented in-house CX solutions, reflecting this shift.

- Cost Considerations: Evaluate the expenses associated with building and maintaining an internal CX infrastructure versus outsourcing.

- Expertise Requirements: Assess the skills and technologies needed for effective CX management.

- Scalability Challenges: Determine the ability to scale CX operations to meet fluctuating demands.

- Market Trends: Monitor the increasing preference for specialized CX providers like TTEC.

TTEC faces customer bargaining power challenges. This is due to customer concentration, low switching costs, and price sensitivity. Customers’ access to information and the potential for backward integration further amplify their influence. In 2024, TTEC's revenue was $4.2 billion.

| Factor | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low | Churn rate impacts revenue |

| Price Sensitivity | High | $2.4B revenue, pricing strategies critical |

| Backward Integration | Threat | ~30% companies explored in-house CX |

Rivalry Among Competitors

TTEC faces intense rivalry due to numerous competitors. Concentrix, Alorica, Sitel Group, Teleperformance, and Zendesk are key rivals. In 2024, the customer experience market was highly competitive. These companies compete for market share, as seen with Teleperformance's 2023 revenue of €8.3 billion.

Slower industry growth intensifies competition as firms vie for market share. Evaluating the growth rate of the CX technology and services market is vital. TTEC focuses on debt reduction and strategic growth. The global CX market was valued at $88.3 billion in 2023. TTEC aims to strengthen its market position.

Low product differentiation intensifies competition, often leading to price wars. TTEC's services, like customer experience solutions, may face rivalry if they're not distinct. In 2024, the customer experience market was valued at over $60 billion. Evaluate TTEC's unique selling propositions to gauge rivalry. Strong differentiation helps mitigate price-based competition.

Switching Costs for Customers

Low switching costs heighten competition, as customers can easily change providers. Factors like price, service quality, and brand reputation influence customer decisions to switch vendors. In the contact center industry, where TTEC operates, switching costs are often low, intensifying rivalry. For example, according to a 2024 report, 65% of customers are likely to switch providers due to poor customer service. This makes it crucial for TTEC to maintain high service standards.

- Pricing: Competitors may offer lower rates.

- Service Quality: Customers may seek better support.

- Brand Reputation: A negative image encourages switching.

- Contract Terms: Short-term contracts ease transitions.

Exit Barriers

High exit barriers, such as specialized assets or long-term contracts, intensify competition by keeping companies in the market. Assessing these barriers is crucial for understanding competitive dynamics. For example, TTEC, facing high exit costs due to its global infrastructure and client contracts, might experience increased rivalry. This can lead to price wars or increased investment in customer retention to maintain market share.

- Specialized assets tied to specific clients or projects can increase exit barriers.

- Long-term contracts with penalties for early termination make exiting costly.

- High severance costs for a large workforce can also be a significant barrier.

- The need to maintain a brand reputation might deter immediate exit.

Intense competition shapes TTEC's market position, fueled by numerous rivals like Concentrix and Teleperformance. Slow market growth and low product differentiation amplify this rivalry, potentially leading to price wars. The ease with which customers can switch providers further escalates the competitive pressure, necessitating high service standards.

| Factor | Impact on TTEC | 2024 Data |

|---|---|---|

| Rivalry | High Competition | CX market value: $60B+ |

| Differentiation | Low, Price Wars | Switching rates high |

| Switching Costs | Low, High Risk | 65% switch providers |

SSubstitutes Threaten

The threat of substitutes is a significant factor, as the availability of alternatives can restrict TTEC's pricing power. Companies exploring customer experience (CX) solutions have numerous choices, from in-house teams to other outsourcing providers. Researching these alternative solutions is crucial for TTEC to understand competitive pressures. For instance, the global CX market was valued at $10.7 billion in 2024 and is projected to reach $19.8 billion by 2029, with many providers vying for market share.

Low switching costs amplify the threat of substitutes for TTEC. This means if clients find it easy to move to alternatives, the risk increases. Consider the ease and cost for TTEC's clients to shift to competitors. For instance, in 2024, the market for customer experience solutions saw a 15% increase in adoption of AI-driven chatbots, a potential substitute.

The threat of substitutes depends on their price-performance. If alternatives like AI-powered chatbots offer similar services at lower costs, TTEC faces increased competition. Compare the value of TTEC's services to those substitutes. For instance, in 2024, the global chatbot market was valued at $19.08 billion, showing growth.

Customer Propensity to Substitute

The threat of substitutes in TTEC's market is influenced by customers' willingness to switch to alternatives. This depends on factors like price, performance, and ease of use. Understanding customer preferences and the adoption rates of substitute solutions is crucial. For example, in 2024, the rise of AI-powered chatbots presents a substitute for some of TTEC's customer service offerings. This shift could impact TTEC's market share and pricing strategies.

- Price Competitiveness

- Technological Advancements

- Customer Loyalty

- Switching Costs

Technological Advancements

Technological advancements pose a significant threat of substitutes for TTEC. New technologies can disrupt the market, creating alternative solutions for customers. It's crucial to monitor advancements that could lead to new substitutes for TTEC's services, such as AI-powered customer service platforms. For instance, the global AI in the customer service market was valued at $4.6 billion in 2023 and is projected to reach $22.9 billion by 2028.

- AI-driven chatbots and virtual assistants are becoming increasingly sophisticated, offering immediate customer support.

- Automation of tasks previously handled by human agents can reduce the need for traditional call centers.

- Self-service portals and knowledge bases empower customers to resolve issues independently.

- Cloud-based communication platforms provide flexible and scalable alternatives to on-premise solutions.

The threat of substitutes impacts TTEC's pricing and market position due to readily available alternatives. High adoption of substitutes like AI chatbots, with a $19.08 billion market in 2024, increases this threat. Low switching costs and price-performance of alternatives amplify the pressure on TTEC.

| Factor | Impact on TTEC | 2024 Data |

|---|---|---|

| AI Chatbots Market | Substitute for CX | $19.08B market value |

| CX Market | Competitive Landscape | $10.7B, expected $19.8B by 2029 |

| AI in Customer Service | Technological Threat | $4.6B in 2023, to $22.9B by 2028 |

Entrants Threaten

High barriers to entry, like capital needs, deter new firms, lowering the threat. Analyze factors hindering newcomers' competition with TTEC. TTEC's market cap as of early 2024 was approximately $1.5 billion. Industry-specific regulations and the need for specialized expertise are also barriers.

High capital requirements are a significant barrier. Entering the CX market needs substantial investments in technology, infrastructure, and talent. For example, in 2024, starting a new contact center can cost millions. This deters new companies. Evaluating capital expenditures is key for assessing competition.

If TTEC and established competitors have significant economies of scale, new entrants face higher costs. Assess TTEC's cost advantages, considering its size and global presence. For instance, TTEC's revenue in 2023 was approximately $3.9 billion, indicating substantial operational scale. This scale allows for better pricing, making it tough for new firms to compete.

Brand Loyalty

Strong brand loyalty presents a significant hurdle for new competitors in the CX technology and services sector. Established brands often have a loyal customer base, making it challenging for new entrants to gain market share. Assessing the strength of existing brands is crucial for understanding the competitive landscape and the barriers to entry. For example, companies like Amazon and Microsoft have built immense brand loyalty.

- Brand loyalty can lead to higher customer retention rates.

- New entrants may need to offer significant incentives to attract customers.

- Strong brands often have established reputations and trust.

- Evaluating brand recognition is vital.

Government Regulations

Government regulations significantly impact the threat of new entrants. Stricter rules, like those concerning data privacy or industry-specific certifications, can create high barriers to entry, safeguarding established companies. For example, the contact center industry faces regulations regarding data security and customer service standards, which can be costly for new entrants to comply with. It’s crucial to scrutinize all relevant government regulations that affect market entry.

- Compliance costs can be substantial, deterring smaller firms.

- Regulations can mandate specific technologies or operational practices.

- Established companies may have an advantage in navigating regulatory complexities.

- Regulatory changes can alter the competitive landscape.

The threat of new entrants to TTEC is moderate, largely due to substantial barriers. These include capital requirements, brand loyalty, and government regulations. TTEC's $3.9 billion revenue in 2023 indicates significant scale, deterring newcomers.

| Barrier | Impact | Example |

|---|---|---|

| Capital Needs | High entry cost | Starting a new contact center can cost millions in 2024. |

| Brand Loyalty | Customer retention | Established brands have a loyal customer base. |

| Regulations | Compliance cost | Data privacy regulations impose compliance costs. |

Porter's Five Forces Analysis Data Sources

The TTEC Porter's Five Forces analysis uses data from market reports, company financials, and industry publications. These are supplemented by regulatory filings for a comprehensive view.