Turning Point PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Turning Point Bundle

What is included in the product

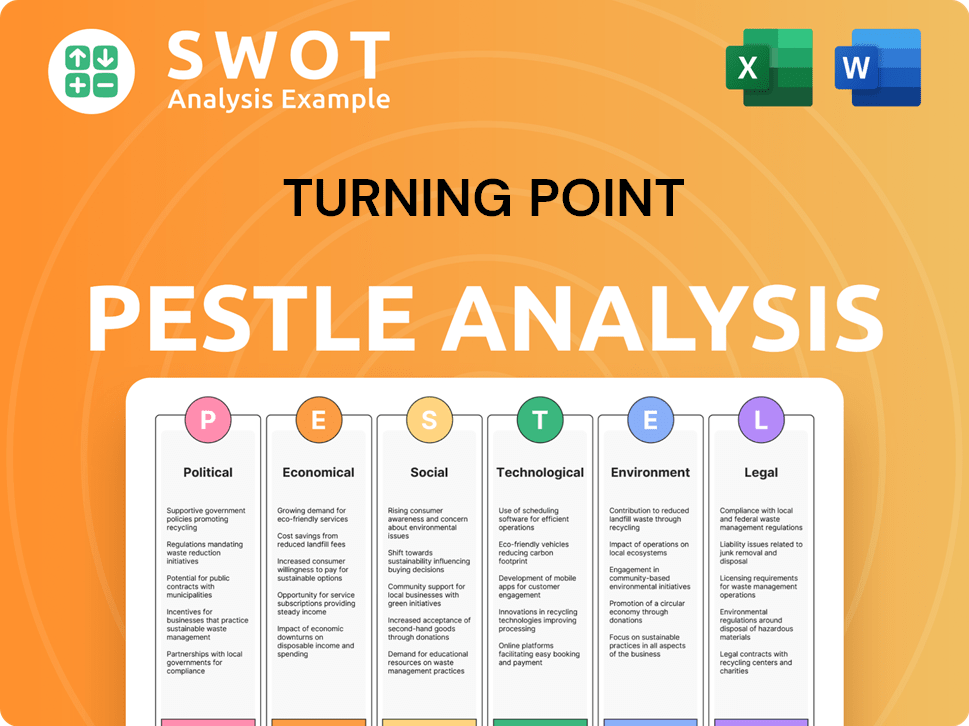

Examines macro-environmental factors affecting Turning Point. Six dimensions: Political, Economic, Social, Technological, Environmental, Legal.

A helpful aid in identifying impactful risks during crucial decision making or critical planning phase.

Preview the Actual Deliverable

Turning Point PESTLE Analysis

This preview showcases the complete Turning Point PESTLE analysis document.

You're viewing the fully formatted and ready-to-use file.

The exact content, structure, and layout will be in your download.

There are no hidden parts, just the complete product.

Own this valuable resource instantly after purchase.

PESTLE Analysis Template

Uncover the forces shaping Turning Point's destiny with our PESTLE analysis. We examine crucial Political, Economic, Social, Technological, Legal, and Environmental factors. This analysis provides a snapshot of the external landscape influencing the company.

Political factors

Government policies heavily influence industries like alternative smoking. Regulations on sales, marketing, and manufacturing are common. Some regions have banned certain products, impacting market access. For instance, in 2024, several European countries tightened restrictions, affecting product availability. These changes significantly affect business strategies.

Political stability across key markets is essential for reliable supply chains. Trade policy shifts, such as new tariffs, can directly impact the costs of raw materials and final products. For example, the US-China trade tensions in 2024/2025 continue to influence pharmaceutical costs. Geopolitical events can disrupt supply chains, potentially leading to price volatility for APIs. In 2024, the pharmaceutical industry faced a 10% rise in API costs due to global conflicts.

Public health initiatives globally, such as those promoted by the WHO, aim to curb tobacco use, potentially impacting tobacco firms. However, companies might find opportunities in harm reduction, with the global nicotine market valued at $100.2 billion in 2024. Lobbying efforts by tobacco companies and health advocates can influence regulations, affecting market dynamics. For instance, in 2024, the US spent around $20 million on tobacco lobbying.

Taxation and Fiscal Policies

Changes in taxation and fiscal policies significantly influence the financial landscape of products. Excise taxes directly affect pricing and consumer demand. For example, in 2024, tobacco taxes varied widely across the U.S., impacting consumption. Higher taxes on traditional products can shift demand to alternatives, but increased taxes on those alternatives may stifle growth.

- In 2024, federal excise tax on tobacco products was $50.33 per 1,000 cigarettes.

- State taxes on tobacco products varied significantly, from $0.17 in Missouri to $4.35 in New York.

- Proposed tax changes on vaping products could impact market dynamics in 2025.

International Relations and Market Access

Turning Point Brands' global operations are significantly influenced by international relations and trade policies. Recent trade tensions, such as those between the US and China, could impact the import and export of its products. For example, in 2024, the US imposed tariffs on certain goods from China, affecting supply chains and potentially increasing costs. Changes in diplomatic relations and trade agreements directly affect market access and profitability.

- Tariff rates on tobacco products can fluctuate based on political decisions.

- Trade agreements like NAFTA (now USMCA) have shaped the North American market.

- Political stability in key markets (e.g., Canada, Mexico) is crucial for long-term investment.

Political factors shape industry landscapes. Regulations vary widely. Tax policies directly affect costs. In 2024, federal excise tax on tobacco products was $50.33 per 1,000 cigarettes. International relations influence trade, impacting Turning Point Brands.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Government Regulations | Product availability and marketing | European countries tightened restrictions in 2024. |

| Trade Policies | Supply chain costs and market access | US-China trade tensions impacted pharmaceutical costs. |

| Taxation | Pricing and consumer demand | US federal excise tax: $50.33/1,000 cigarettes. |

Economic factors

Consumer spending heavily dictates demand for products, including those related to alternative smoking. High disposable income often boosts spending on non-essential items. During economic slumps, consumers cut back, impacting discretionary purchases. In Q1 2024, U.S. consumer spending rose by 2.5%, signaling continued, albeit cautious, spending habits.

Raw material costs, including active ingredients, are vulnerable to global market changes and geopolitical events, impacting production costs. Supply chain disruptions, like those seen in 2023-2024, can severely inflate raw material prices. For example, the price of lithium, vital for batteries, saw a 15% increase in Q1 2024 due to supply chain bottlenecks. Transportation issues and environmental factors also contribute to these fluctuations. These challenges directly affect profitability and investment decisions.

High inflation diminishes consumer purchasing power, possibly curbing demand. This also elevates a company's operational expenses. For instance, in the U.S., inflation in March 2024 was 3.5%. Therefore, monitor inflation closely for effective pricing and financial strategies. Consider how inflation could affect your business's profit margins for 2024-2025.

Exchange Rates

Exchange rate volatility is a key factor for global businesses. It affects international sales and the cost of imported resources. For example, a stronger dollar can make U.S. exports more expensive. This impacts financial performance, especially for firms with significant foreign operations. Consider the impact of the Euro's fluctuations against the USD in 2024 and early 2025.

- USD/EUR: In early 2024, the EUR/USD exchange rate fluctuated, trading between 1.08 and 1.10.

- Impact: These fluctuations can significantly affect the profitability of companies with international transactions.

- 2025 Outlook: Forecasts suggest continued volatility.

Market Competition and Pricing Pressures

The competitive landscape significantly influences Turning Point Brands' financial performance. Major players and new entrants can intensify pricing pressures and impact market share. For instance, in 2024, the vaping market saw increased competition, affecting profitability margins. This includes direct competitors like Altria and smaller, innovative firms.

- Competition from traditional tobacco companies and new alternative product providers.

- Pricing strategies and market share dynamics are key.

- Vaping market competition increased in 2024.

- Profitability margins are under pressure.

Economic factors include consumer spending and raw material costs, affecting demand and production. Inflation, at 3.5% in March 2024 in the U.S., and exchange rate volatility also play crucial roles. The EUR/USD fluctuated in early 2024.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Consumer Spending | Influences demand | US Q1 2024 up 2.5% |

| Raw Materials | Affects production costs | Lithium +15% Q1 2024 |

| Inflation | Diminishes purchasing power | US March 2024 3.5% |

Sociological factors

Consumer preferences are always changing, which affects the demand for active ingredient products. There's increased interest in natural and organic ingredients. The market for natural and organic personal care products reached $16.5 billion in 2024. Social media and lifestyle trends also shape consumer behavior. The shift towards healthier options is noticeable.

Growing health consciousness and lifestyle changes impact tobacco demand. For example, in 2024, smoking rates continued to decline, with the CDC reporting around 11.5% of U.S. adults smoked. This trend boosts demand for alternatives like vaping, which had a 6.9% usage rate in 2024. This shift creates opportunities for companies offering reduced-harm products.

Shifts in demographics influence Turning Point Brands' market. Aging populations and varying income levels impact demand for active ingredient products. In 2024, the 65+ demographic grew by 3.4%, altering consumption patterns. Understanding cultural backgrounds is key; diverse preferences exist. Income changes in specific segments are vital for product targeting.

Social Acceptance and Stigma

Social acceptance and stigma significantly influence consumer behavior regarding smoking alternatives. Shifting social norms, such as increased awareness of health risks, affect market demand for products like vapes. A 2024 study showed a 10% decrease in traditional cigarette use among adults. Public perception of companies like Turning Point is crucial.

- Public health campaigns and media coverage shape social attitudes.

- Stigma can deter users and impact brand reputation.

- Acceptance of alternatives varies by demographic and region.

- Social trends influence product adoption rates.

Cultural Influences and Habits

Cultural norms profoundly shape tobacco use and active ingredient consumption. For example, in some cultures, smoking is highly social, while in others, vaping is gaining popularity. These habits affect product acceptance and market strategies. Changing consumer behaviors requires understanding these deep-rooted cultural aspects.

- In the US, 12.5% of adults were current smokers in 2024.

- Global e-cigarette market was valued at $22.6 billion in 2023.

- Cultural preferences significantly impact product flavor choices.

Sociological factors significantly affect consumer behavior regarding Turning Point Brands. Trends like health consciousness impact tobacco product demand; in 2024, US smoking rates declined to about 11.5%. Social acceptance, media coverage, and cultural norms also shape market trends, particularly for alternatives like vaping.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Health Awareness | Drives demand shifts. | 11.5% US adult smokers |

| Social Norms | Influences brand reputation. | Vaping use at 6.9% in 2024 |

| Cultural Norms | Impacts product choices. | Global e-cig market: $22.6B (2023) |

Technological factors

Technological advancements in active ingredient delivery systems are revolutionizing product development. Innovations like encapsulation and nanotechnology enhance efficacy and stability. The global drug delivery systems market is projected to reach $3.18 trillion by 2032. These advancements improve user experience, boosting market competitiveness.

Improvements in manufacturing processes and production technologies are crucial for boosting efficiency, cutting costs, and enhancing product quality. Automation and novel production techniques significantly influence the scalability and competitiveness of business operations. In 2024, the global industrial automation market is valued at approximately $200 billion, with an expected annual growth rate of 8-10%. New technologies like AI-driven manufacturing are projected to increase productivity by up to 30% by 2025.

E-commerce and digital marketing are vital for reaching customers and product distribution. Effective online platforms and digital strategies are key for sales and brand building. In 2024, e-commerce sales hit $1.1 trillion in the U.S. alone, with digital marketing spend around $250 billion globally.

Research and Development in New Products

Ongoing research and development (R&D) is crucial for creating new product categories, especially in alternative smoking products. This innovation hinges on novel active ingredients. For example, Altria spent $166 million on R&D in 2024 to drive future product offerings. Investing in R&D is key for long-term growth and competitiveness. This focus helps companies stay ahead in a dynamic market.

- Altria's 2024 R&D expenditure: $166 million.

- R&D is essential for innovation and new product development.

- Focus on R&D is vital for long-term market competitiveness.

Data Analytics and Consumer Insights

Data analytics and technology are crucial for understanding consumer behavior, market trends, and product performance. Businesses can refine strategies, product development, and marketing using data-driven insights, achieving a competitive edge. According to a 2024 report, companies using data analytics see a 15% increase in customer satisfaction. This approach allows for more targeted campaigns and improved decision-making.

- Data-driven strategies boost efficiency.

- Consumer insights improve product-market fit.

- Market trend analysis guides innovation.

- Technology integration enhances competitive advantage.

Technological advancements are critical. The drug delivery systems market is set to reach $3.18 trillion by 2032, boosting efficacy. Automation, with an expected 8-10% growth, and e-commerce are also transforming the business.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| Drug Delivery | Enhanced efficacy | Market size: $3.18T by 2032 |

| Industrial Automation | Increased efficiency | Market: $200B, growth 8-10% |

| E-commerce | Expanded reach | U.S. Sales: $1.1T |

Legal factors

Turning Point Brands faces stringent regulations globally, affecting manufacturing and product standards. Compliance with varying international, national, and local laws is critical. These regulations can evolve rapidly, demanding continuous adaptation and adherence to standards like GMP. Non-compliance can lead to significant penalties, impacting profitability and market access. In 2024, the FDA issued over 1,000 warning letters.

Marketing and advertising of products with active ingredients, like tobacco and nicotine, face legal restrictions. These rules limit promotions and demand health warnings. In 2024, the FDA proposed a ban on menthol cigarettes, impacting marketing strategies. Regulations vary; for example, in 2024, the UK introduced stricter rules on e-cigarette advertising. This affects how companies reach consumers.

Legal factors significantly impact product labeling and packaging. These factors mandate detailed information on ingredients and potential health risks. Regulations vary geographically, influencing market strategies. For example, in 2024, the EU updated its packaging and waste directives. Plain packaging, as seen with tobacco products, may also be mandated.

Import and Export Regulations

International trade hinges on import and export regulations, including tariffs and customs. These rules vary across countries, influencing the movement of goods. For instance, the U.S. imposed tariffs on $370 billion of Chinese goods in 2018. Changes in regulations can disrupt supply chains, increasing costs and complexity. The World Trade Organization (WTO) aims to facilitate trade, but disputes and evolving policies remain challenges.

- Tariffs can significantly raise costs, as seen with the 25% tariffs on steel imports in 2018.

- Customs procedures vary widely, impacting processing times and costs.

- Trade agreements like USMCA aim to streamline trade, but require compliance.

- Regulatory changes can quickly render strategies obsolete, requiring constant adaptation.

Intellectual Property Laws

Intellectual Property (IP) laws are vital for consumer product companies. Protecting brand names, formulas, and tech via patents, trademarks, and copyrights is essential. IP protection varies by country, affecting both competition and innovation. In 2024, global IP filings saw significant growth, with China leading in patents (1.6 million) and trademarks (9.5 million). The US followed with 600,000 patents. This landscape directly influences market strategies.

- Patent applications in China grew by 10% in 2024.

- Trademark filings in the US increased by 5% in 2024.

- Copyright registrations worldwide rose by 7% in 2024.

- Infringement lawsuits in the consumer goods sector rose by 12% in 2024.

Legal factors for Turning Point Brands involve global manufacturing regulations and evolving standards like GMP, impacting compliance and profitability. Marketing restrictions on products, like nicotine, limit promotional activities due to warnings and potential bans. Product labeling is governed by regulations with mandatory disclosures on ingredients. These factors demand adaptability, affecting product development and market access. The FDA issued over 1,000 warning letters in 2024.

| Regulatory Area | Impact | Example | |

|---|---|---|---|

| Manufacturing | Compliance costs & market access | GMP standards | |

| Marketing | Limited promotions | FDA ban on menthol cigarettes | |

| Labeling & Packaging | Cost and market strategy | EU packaging directives |

Environmental factors

The creation and discarding of goods, particularly those with active ingredients and packaging, cause environmental issues like waste and pollution. Proper waste management is crucial, governed by environmental rules. In 2024, global waste generation hit 2.24 billion tons. The waste management market is expected to reach $491.2 billion by 2025, with a CAGR of 5.6%.

The environmental impact of sourcing raw materials, like tobacco, faces scrutiny. Sustainable practices are crucial amid rising consumer and regulatory pressure. In 2024, eco-friendly sourcing boosted brand value by 15% for some firms. The market for sustainable materials is projected to reach $250 billion by 2025.

Manufacturing, transportation, and distribution processes consume significant energy, leading to greenhouse gas emissions. Businesses are under increasing pressure to minimize their carbon footprint. For example, the industrial sector accounts for about 30% of global energy consumption. In 2024, global CO2 emissions from energy reached approximately 37 billion metric tons.

Water Usage and Wastewater Management

Manufacturing processes frequently rely on substantial water resources, emphasizing the critical need for effective wastewater management to mitigate environmental effects. Stringent regulations governing water usage and discharge can significantly influence operational strategies and costs. For instance, the U.S. Environmental Protection Agency (EPA) reported in 2024 that industrial water withdrawals totaled approximately 17.2 billion gallons per day. Companies must invest in advanced treatment technologies to comply with these regulations. Compliance costs and potential fines for non-compliance are substantial factors to consider.

- Industrial water withdrawals in the U.S. were about 17.2 billion gallons per day in 2024.

- Investing in wastewater treatment is crucial for regulatory compliance.

- Non-compliance can lead to significant financial penalties.

Climate Change and Extreme Weather Events

Climate change and extreme weather events pose significant risks. These events can severely disrupt supply chains, impacting the availability and cost of raw materials. For example, the agricultural sector, which relies heavily on climate-sensitive crops, is vulnerable. Businesses must adapt to these challenges to ensure resilience and sustainability.

- In 2024, the World Bank estimated that climate change could push 132 million people into poverty by 2030.

- A 2024 report by the UN highlighted that extreme weather events caused $280 billion in damages globally in 2023.

- The insurance industry is increasingly pricing in climate risks, with premiums rising in areas prone to extreme weather.

- Companies are investing in climate resilience strategies, such as diversifying suppliers and building infrastructure to withstand extreme weather.

Environmental factors encompass waste management, impacting businesses in 2025. Companies must address the impact of raw material sourcing and manufacturing to meet sustainability goals. Extreme weather, like the 2023 events causing $280B damages, is a key concern.

| Environmental Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Waste Generation | Increased Costs, Regulations | Global waste = 2.24B tons in 2024. Market: $491.2B by 2025. |

| Raw Material Sourcing | Brand Value, Sourcing Costs | Eco-friendly sourcing boosted brand value by 15% in 2024. |

| Climate Change Risks | Supply Chain Disruptions, Higher Premiums | 2023 extreme weather caused $280B in damages globally. |

PESTLE Analysis Data Sources

Our PESTLE analysis uses diverse data from government sources, market reports, and global organizations, offering reliable macro-environmental insights.