UDR Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UDR Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Quickly assess business units with a clear quadrant visual.

Full Transparency, Always

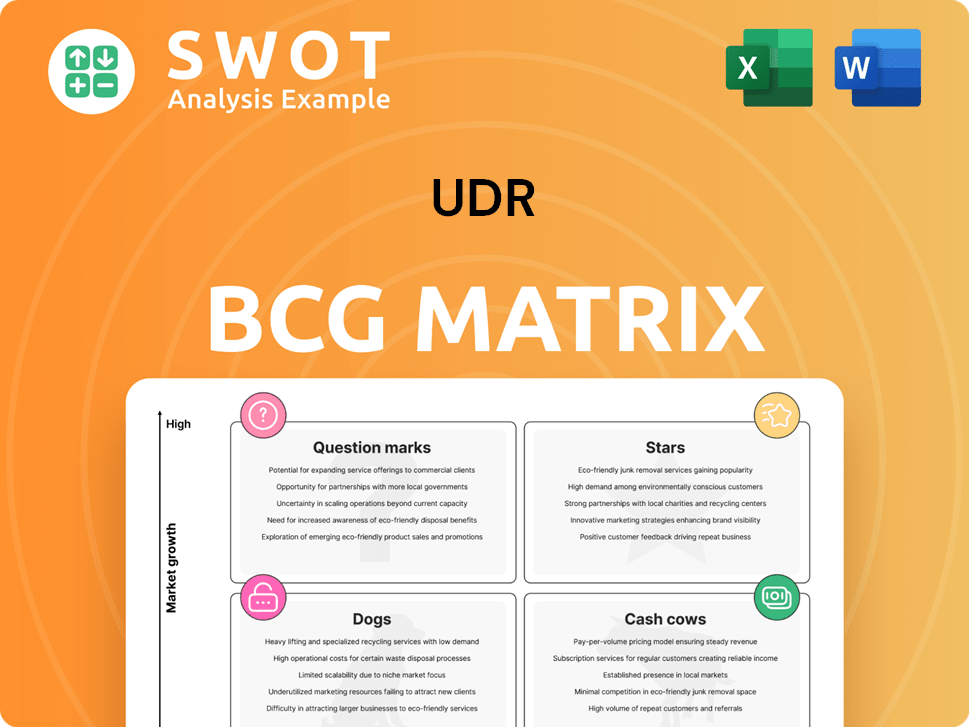

UDR BCG Matrix

This preview showcases the complete BCG Matrix report you'll receive after purchase. The downloadable document offers immediate access to a fully editable file, perfect for tailoring to your needs and presentations.

BCG Matrix Template

The UDR BCG Matrix analyzes a company's products based on market share and growth. This framework categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks. It helps visualize resource allocation and strategic direction. Identifying each product's quadrant guides investment decisions and portfolio management. This preview offers a glimpse, but the full BCG Matrix provides deep analysis and actional insights. Purchase now for data-backed recommendations to optimize your strategy.

Stars

UDR's focus on high-growth markets is a key part of its strategy. The company concentrates on areas with strong population growth and limited housing supply. In 2024, UDR saw a 5.6% increase in same-store revenue. This focus allows UDR to benefit from rising rental rates.

UDR's innovation initiatives, such as its self-service model, are designed to enhance customer experience. This focus helps UDR capture additional net operating income (NOI). For example, in 2024, UDR invested heavily in technology to improve resident satisfaction. These innovations help UDR stand out in competitive markets. They also attract residents, and this strategic move is reflected in the company's financial reports.

UDR's strong occupancy rates, surpassing 97% in early 2024, highlight robust demand. This high occupancy directly boosts revenue and financial health. These properties are considered "stars" within UDR's portfolio, reflecting their strong performance.

Strategic Acquisitions

UDR strategically acquires properties to boost its portfolio, focusing on high-growth areas. In 2023, UDR expanded its presence in Dallas and Austin through significant acquisitions. These moves are designed to drive revenue and strengthen UDR's market position. The company's approach reflects a commitment to expanding its footprint.

- Portfolio acquisitions in Dallas and Austin in 2023.

- Strategic expansion in key markets.

- Focus on revenue growth.

- Enhancement of market presence.

Sustainability Leadership

UDR shines as a sustainability leader within its portfolio, a crucial aspect for attracting environmentally conscious residents and investors. UDR's commitment to ESG principles, including emissions reduction and renewable energy investments, bolsters its reputation. This focus on sustainability sets UDR apart and builds long-term value.

- In 2023, UDR reported a 20% reduction in Scope 1 and 2 greenhouse gas emissions.

- UDR has invested over $100 million in energy-efficient upgrades and renewable energy projects.

- Over 90% of UDR's new developments are LEED certified.

UDR's "Stars" represent high-growth, high-market-share properties within its portfolio. These properties consistently perform well, driving strong revenue and occupancy rates. They benefit from strategic acquisitions and innovative customer service models. These "Stars" are key drivers of UDR's financial health and growth.

| Characteristic | Details | 2024 Data |

|---|---|---|

| Revenue Growth | Driven by high occupancy and rental rates. | 5.6% increase in same-store revenue |

| Market Position | Strategically located in high-growth areas. | Significant acquisitions in Dallas and Austin (2023) |

| Innovation | Enhancement of customer experience. | Investments in technology to improve resident satisfaction. |

Cash Cows

UDR's established properties are cash cows, producing reliable cash flow. High occupancy and stable rents characterize these mature apartment communities. These properties require minimal investment, maximizing profit extraction for UDR. In Q3 2023, UDR's same-store revenue increased by 5.4%, showcasing their financial strength.

UDR prioritizes operational efficiency, centralizing key functions and leveraging technology. This approach boosts cash flow from existing properties by cutting costs. Streamlined operations significantly improve UDR's bottom line, ensuring consistent income. In Q3 2024, UDR's same-store net operating income grew by 6.1%, showcasing efficiency.

UDR's meticulous capital allocation strategy focuses on boosting its cash cows. They channel funds into infrastructure and tech upgrades, heightening operational efficiency. For example, UDR invested $120.6 million in same-store revenue growth in 2024. This strategic investment boosts cash flow from these core assets.

Geographically Diverse Portfolio

UDR's geographically diverse portfolio, encompassing both urban and suburban communities, acts as a solid foundation for generating cash. This strategic spread minimizes risk, ensuring a dependable income flow from different markets. This diversification strategy helped UDR achieve a 3.7% same-store revenue growth in 2024. The company operates in various states, with significant holdings in coastal markets.

- Geographic diversification enhances stability.

- Reduces risk by spreading investments.

- Supports consistent income generation.

- UDR's 2024 revenue growth validates the strategy.

Resident Retention

UDR's resident retention is a cornerstone of its cash cow strategy, fostered by superior customer experiences. This approach ensures stable cash flow by minimizing turnover expenses and maintaining high occupancy levels. In 2024, UDR reported a resident retention rate of approximately 55%, a testament to their successful efforts. This high retention rate translates directly into financial benefits, reducing marketing and renovation costs.

- Retention rates decrease costs.

- Consistent occupancy leads to financial stability.

- Superior customer experience is key.

- UDR reported 55% resident retention in 2024.

UDR's cash cows, like established properties, bring reliable cash flow, supported by stable occupancy. Streamlined operations and focused capital allocation enhance profitability. Their diversified portfolio across urban and suburban markets ensures consistent income. In 2024, UDR saw solid revenue growth and high resident retention.

| Metric | Details | 2024 Data |

|---|---|---|

| Same-Store Revenue Growth | Increase from existing properties | 3.7% |

| Same-Store NOI Growth | Net Operating Income Increase | 6.1% |

| Resident Retention Rate | Percentage of retained residents | ~55% |

Dogs

UDR's joint venture at 1300 Fairmount in Philadelphia, PA, is categorized as a 'dog' within the BCG Matrix. The company had to establish a non-cash loan reserve of $37.3 million. Income from this investment is projected to decrease by around $8.0 million in 2025.

In challenging markets, like Austin and Nashville, UDR's properties face headwinds. These areas, with increasing supply or economic shifts, can underperform. UDR's Q3 2023 earnings highlighted concerns in specific markets. Occupancy rates and revenue growth are crucial indicators of property health in stressed locations.

Properties marked for disposition, like Leonard Pointe and One William, fit the 'dogs' category in UDR's BCG matrix. These assets, slated for sale, aren't core to future growth. UDR sold properties worth approximately $1.1 billion in 2024, signaling a shift in focus.

Retail Components of Developments

The retail component of a Washington, D.C., development, sold by UDR in January 2023, aligns with the 'dog' quadrant of the BCG matrix, representing underperforming assets. UDR's strategic focus on multifamily properties suggests this retail element was a non-core asset. Non-core assets can divert resources, impacting overall financial performance.

- UDR's 2023 total revenue was approximately $2.3 billion.

- The sale of non-core assets helps streamline operations.

- Focusing on core competencies improves efficiency.

- Underperforming assets can lower profitability.

High-Maintenance Properties

In UDR's context, "dogs" signify properties demanding high upkeep yet yielding poor returns. These properties often suffer from structural deficiencies or obsolete features, hindering profitability. For instance, older buildings needing extensive renovations might fall into this category. Such properties can drag down overall portfolio performance. Identifying and addressing these underperforming assets is crucial for UDR's financial health.

- Properties with significant maintenance costs.

- Outdated amenities affecting marketability.

- Limited profitability due to various issues.

- Potential for negative impact on overall portfolio.

UDR's "dogs" are underperforming properties with high upkeep and low returns, like the 1300 Fairmount joint venture, facing a projected $8.0 million income decrease in 2025. These assets, including those in challenging markets, often require significant renovations. The company sold approximately $1.1 billion in properties in 2024, reflecting a strategic shift away from these.

| Category | Characteristics | Financial Impact (2024 est.) |

|---|---|---|

| "Dogs" Definition | High maintenance, low return properties. | Reduced profitability, asset sales approx. $1.1B |

| Examples | Older buildings, underperforming markets like Austin & Nashville. | Potential negative impact on portfolio performance |

| Strategic Action | Disposition of non-core assets. | Streamlined operations, improved focus on core assets |

Question Marks

UDR's new developments, like the 415 apartment homes recently finished, are 'question marks' in the BCG matrix. They need substantial investment, and their profitability is uncertain. Market conditions and efficient operations are key to their success. In 2024, UDR's total revenue was $1.6 billion.

UDR's tech investments are 'question marks'. Their impact on NOI growth is still being assessed. Despite cost savings, the full ROI of ACE™ is pending. In 2024, UDR spent $35 million on technology and innovation. Prospect conversion rates have increased by 10%.

UDR's foray into new markets is a 'question mark' in the BCG matrix. They must evaluate market demand, competition, and regulations. Success hinges on local adaptation and property management. In 2024, UDR's expansion strategy included exploring opportunities in high-growth areas, focusing on diversification. This approach aims to increase revenue streams.

Debt and Preferred Equity Program (DPE) Investments

UDR's Debt and Preferred Equity Program (DPE) investments are considered 'question marks' within their BCG matrix. Their success hinges on the underlying projects' performance and borrowers' repayment capabilities. These investments involve inherent risks, potentially not delivering anticipated returns. For instance, in 2023, UDR had $683 million in DPE investments.

- High Risk: DPE investments are inherently risky due to their dependence on project success.

- Variable Returns: Returns can fluctuate based on borrower repayment and project performance.

- Market Sensitivity: Economic downturns can negatively impact DPE investments.

- Portfolio Diversification: UDR uses DPE to diversify its investment portfolio.

Sustainability Initiatives

UDR's sustainability initiatives, while boosting its image, are 'question marks' in the BCG Matrix. The financial returns and ROI from these ESG efforts are currently under evaluation. Such commitments require continuous investment, which may not immediately reflect in revenue or profit. This highlights the need to closely monitor the financial impact of these sustainability projects. For instance, in 2024, the ESG investment market is projected to reach $30 trillion.

- ESG investments are growing rapidly, but ROI is still being measured.

- Ongoing investments in sustainability may not directly increase revenue.

- Financial impact of sustainability projects requires close monitoring.

- The ESG investment market is expected to be worth $30 trillion by the end of 2024.

UDR's new ventures like completed apartments, are 'question marks', demanding investment. Their uncertain profitability relies on market conditions and efficiency. UDR's tech investments, including ACE™, are 'question marks', impacting NOI growth. Evaluating their ROI is ongoing; UDR spent $35M in 2024 on tech.

Expanding into new markets poses 'question marks', necessitating evaluation of demand, competition, and regulations. Success depends on local adaptation and property management. UDR’s DPE investments are 'question marks', success depending on project performance, and repayments. Sustainability initiatives also are "question marks" requiring evaluations.

| Aspect | Description | 2024 Data |

|---|---|---|

| New Developments | New apartments; profitability uncertain. | $1.6B total revenue |

| Tech Investments | ACE™ ROI pending. | $35M spent; 10% prospect conversion |

| Market Expansion | Focus on diversification. | Exploring high-growth areas |

BCG Matrix Data Sources

Our BCG Matrix uses verified data, combining financial reports, market research, and analyst evaluations to drive actionable insights.