UDR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UDR Bundle

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the specific company.

Quickly analyze market threats with a dynamic, color-coded chart.

What You See Is What You Get

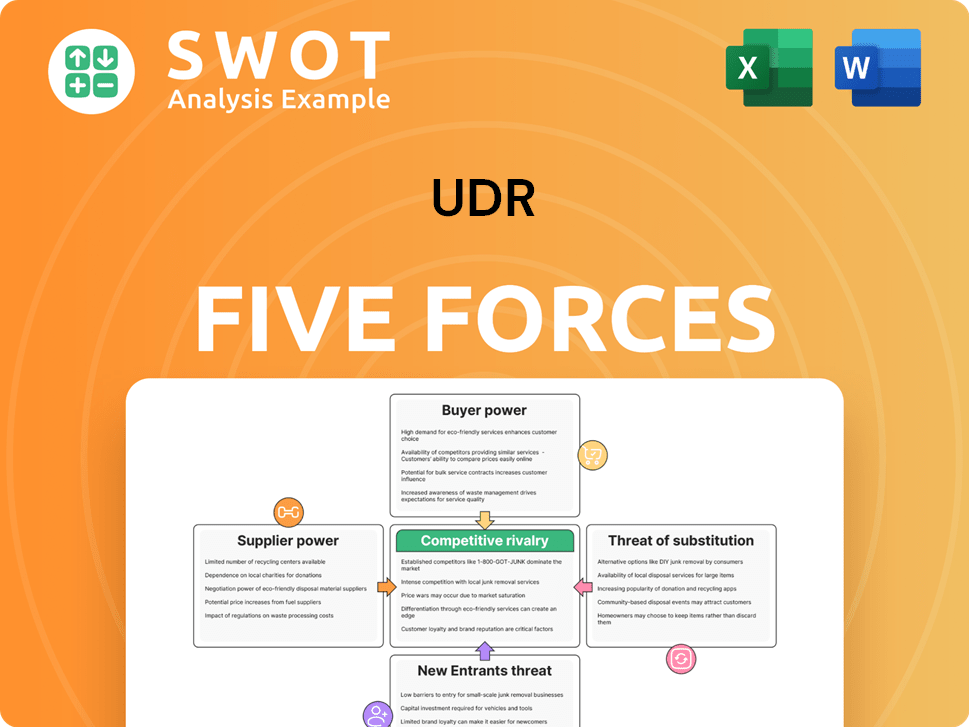

UDR Porter's Five Forces Analysis

This preview presents the UDR Porter's Five Forces Analysis, which comprehensively examines industry dynamics. This is the exact, fully-formatted document you'll receive immediately after purchase. It offers a detailed breakdown of competitive forces, providing valuable insights. The analysis is ready for download and use as soon as your order is complete. You’re getting the complete, ready-to-use analysis file.

Porter's Five Forces Analysis Template

Understanding UDR through Porter's Five Forces reveals its competitive landscape. Analyzing supplier power, buyer power, and the threat of substitutes gives crucial insights. Examining the threat of new entrants and industry rivalry helps gauge market dynamics. This framework identifies strengths, weaknesses, opportunities, and threats within UDR's ecosystem.

The complete report reveals the real forces shaping UDR’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Construction material suppliers significantly influence UDR's expenses. Limited suppliers for essential materials such as concrete, steel, and lumber can lead to increased costs. In 2024, the Producer Price Index (PPI) for construction materials saw fluctuations, potentially impacting UDR's profitability. UDR might offset this by securing long-term contracts to stabilize expenditures. In 2023, the cost of materials increased by 3.2%.

UDR's project costs are significantly influenced by the availability and expense of skilled labor. Labor shortages can inflate wages and delay project completion. In 2024, construction labor costs rose by approximately 5% nationwide, impacting real estate developers. UDR's proficiency in labor relations and efficient project scheduling is essential to mitigate these risks. For instance, effective project management can reduce labor-related cost overruns by up to 10%.

Land acquisition significantly influences UDR's operations. The cost and availability of land are crucial for development, with competition driving up prices. In 2024, UDR's focus on high-growth markets like the Sun Belt made land a key strategic concern. For example, in 2023, UDR's total assets were $16.3 billion.

Regulatory Compliance

Regulatory compliance significantly impacts UDR's costs, especially concerning building codes and environmental regulations. Unexpected expenses can arise from changes in these regulations, potentially affecting project budgets. UDR actively monitors and adapts to regulatory shifts, mitigating financial risks and ensuring compliance. This proactive stance helps manage costs effectively, ensuring projects meet all necessary standards.

- In 2024, UDR spent approximately $120 million on property improvements, including compliance upgrades.

- UDR's focus on sustainable building practices helps in managing environmental regulation costs.

- Regulatory changes, such as those related to energy efficiency, often necessitate capital expenditures.

- UDR's compliance team ensures adherence to thousands of local and federal regulations.

Financing Terms

Financing terms significantly influence project feasibility. Rising interest rates can increase the cost of capital, potentially impacting UDR's profitability. UDR's flexible balance sheet and strategic use of joint ventures help to mitigate these financing risks. In 2024, the Federal Reserve maintained a high federal funds rate, between 5.25% and 5.50%, affecting borrowing costs. UDR's ability to secure favorable terms is crucial.

- Interest rate fluctuations directly affect project costs.

- UDR's financial strategies help manage risks.

- High interest rates can decrease profitability.

- The Federal Reserve's policy influences financing.

Suppliers of materials and labor significantly influence UDR's costs. Rising material prices and labor shortages can squeeze profit margins. In 2024, the construction industry faced higher input costs, impacting projects.

| Factor | Impact on UDR | 2024 Data |

|---|---|---|

| Material Costs | Increased expenses | PPI for construction materials rose by 2.8% |

| Labor Costs | Higher project costs | Construction labor costs increased by 5% |

| Land Costs | Development cost | Land prices in Sun Belt increased by 7% |

Customers Bargaining Power

Tenants' sensitivity to rental rates is a key factor, particularly where new apartment supply is abundant. Increased supply can constrain UDR's ability to raise prices. In 2024, UDR's occupancy rate was 95.6%, reflecting their focus on quality and service. UDR strives to offer appealing homes and excellent service to retain tenants and maintain pricing power, despite market pressures.

Tenants' location choices significantly affect UDR. They seek areas with job prospects, amenities, and transport, impacting rent and occupancy. UDR targets high-growth urban areas to draw tenants. In 2024, UDR's occupancy rate was around 96%, with average effective monthly rent at $2,800, reflecting location demand.

Economic conditions significantly shape customer bargaining power. Downturns like the 2023-2024 period, with rising interest rates, can strain tenants, potentially affecting UDR's occupancy rates. Strong job and income growth, as seen in some metro areas, supports higher demand for housing. UDR capitalizes on the sustained tenant preference for core metro areas, which in 2024, showed relatively stable occupancy.

Tenant Turnover

Tenant turnover significantly impacts UDR's operational costs and financial performance. High turnover rates lead to increased expenses for marketing vacant units and maintaining properties. Reducing turnover is crucial for improving UDR's cash flow and profitability. UDR's strategic initiatives aim to decrease resident turnover, contributing to enhanced financial outcomes. In 2024, UDR reported a decrease in turnover rates, reflecting improved resident satisfaction and retention efforts.

- Increased costs associated with marketing and property maintenance due to high tenant turnover.

- Improved cash flow and profitability by reducing tenant turnover rates.

- UDR's strategic initiatives to decrease resident turnover.

- In 2024, UDR reported a decrease in turnover rates.

Alternative Housing Options

Tenants possess bargaining power due to alternative housing options, including single-family homes and condos. Affordability and lifestyle preferences heavily influence these choices. UDR's apartments compete with homeownership; in 2024, the median existing-home sales price was around $389,800. UDR benefits from the relative affordability of apartments. Data from 2024 showed that apartment rents increased, but at a slower rate than home prices, maintaining their appeal.

- Alternative housing options like single-family homes and condos give tenants choices.

- Affordability and lifestyle are key factors in tenant decisions.

- UDR's apartments compete with homeownership, which is more expensive.

- In 2024, home prices were significantly higher than apartment rents.

Customer bargaining power affects UDR through rent sensitivity, location choices, and economic conditions.

Tenants consider various housing alternatives, influencing UDR's competitiveness, with affordability being key. UDR’s occupancy remained stable in 2024, around 96% despite economic challenges.

UDR reduces turnover through resident satisfaction efforts, as seen by decreased 2024 turnover rates. This enhances financial performance by lowering marketing and maintenance costs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Tenant Choices | Influence on Rent | Avg. rent $2,800/month |

| Economic Conditions | Affect Occupancy | 96% Occupancy |

| Turnover | Operational Costs | Decreased Turnover |

Rivalry Among Competitors

Highly competitive markets, like the multifamily real estate sector, can trigger price wars. In 2024, UDR faced this as established REITs and new players increased competition. This environment could force UDR to offer rent concessions. They compete with entities offering similar properties. UDR's net operating income decreased by 4.1% in Q1 2024.

UDR faces intense competition, with rivals employing varied strategies. These include aggressive marketing and unique amenities, directly affecting UDR's market share. The real estate sector is highly competitive, necessitating continuous innovation. In 2024, UDR's occupancy rate was around 96.1%, reflecting the competitive environment.

Brand differentiation is crucial for UDR. Strong brand recognition gives a competitive edge. UDR attracts and retains tenants through its reputation. In 2024, UDR's technology-enabled property management enhanced its competitive position. This tech focus has helped UDR maintain a high occupancy rate, around 96% in Q3 2024.

Geographic Overlap

Competing in the same geographic areas intensifies rivalry among real estate companies like UDR. UDR and its competitors often focus on similar high-growth markets, such as those along the coasts. This overlap increases the intensity of competition for tenants and properties. UDR's concentration in these coastal, high-rent markets exposes it to greater economic and regulatory risks compared to companies with more diverse geographic footprints.

- UDR's portfolio is heavily weighted in coastal markets, with about 70% of its revenue coming from these areas as of late 2024.

- Competitors like Equity Residential also have significant coastal exposure, increasing direct competition.

- High-rent markets are subject to stricter regulations and economic fluctuations, potentially impacting UDR's profitability.

- Economic downturns could disproportionately affect UDR's occupancy rates and rental income due to the concentration in high-cost areas.

Technological Innovation

Technological innovation significantly shapes competitive dynamics. Adopting new technologies offers UDR a crucial competitive edge in the market. Improved operating efficiencies and enhanced resident experiences are direct benefits. UDR's partnership with Funnel, impacting nearly 60,000 units, exemplifies this strategy. This focus on technology helps UDR stay ahead.

- Funnel partnership covers nearly 60,000 units.

- Technology enhances operational efficiency.

- Innovation improves resident experiences.

- Competitive advantage is gained through technology.

Competitive rivalry in UDR's market is high, especially in coastal areas. UDR faces competition from established REITs and new entrants. In 2024, UDR's occupancy rate was approximately 96%, reflecting this intense competition.

| Metric | Details |

|---|---|

| Occupancy Rate (Q3 2024) | Approx. 96% |

| Geographic Revenue (Late 2024) | 70% from coastal markets |

| Q1 2024 NOI Decrease | 4.1% |

SSubstitutes Threaten

The threat of substitutes for UDR, such as homeownership, is influenced by affordability. Declining homeownership affordability boosts apartment demand. In 2024, rising interest rates and tighter financing conditions may increase UDR's capital costs. However, UDR's prime urban locations offer strong pricing power. They also provide demand resilience, with occupancy rates at 95.6% as of Q3 2024.

Other rental choices, like single-family homes or co-living, draw tenants away from UDR. UDR competes with entities that may offer similar or better properties. For instance, in 2024, the single-family rental market grew, presenting a significant alternative. UDR needs to innovate and differentiate its properties to remain competitive. In 2023, UDR's occupancy rate was around 96%, showing the importance of maintaining high demand.

Tenants always have the option to seek out cheaper housing elsewhere, posing a threat to UDR. Economic downturns and job market changes directly affect people's decisions to move. UDR's presence in high-growth markets helps lessen the impact of tenants relocating. In 2024, UDR's occupancy rate remained high despite economic shifts, indicating its ability to retain residents. The company's diversified portfolio showed resilience.

Extended Stays

Extended-stay hotels and corporate housing present a threat as temporary substitutes. These options meet short-term housing needs, differing from UDR's long-term lease focus. In 2024, the extended-stay hotel sector saw a RevPAR (Revenue Per Available Room) of approximately $85, indicating a competitive environment. UDR's strategy aims to maintain stable occupancy, which is critical for financial performance.

- Extended-stay options offer flexibility.

- UDR targets long-term residents.

- RevPAR in extended-stay hotels is a key metric.

- Stable occupancy is crucial for UDR.

Suburban Living

Suburban living poses a threat to UDR by offering an alternative to urban apartments. The shift towards suburban areas is fueled by lifestyle choices and the rise of remote work. This trend could lead to a decrease in demand for UDR's urban properties. UDR's strategy of targeting high-growth urban areas attempts to mitigate this threat by attracting tenants with desirable locations and amenities.

- In 2024, the suburban population grew, while urban areas saw slower growth.

- Remote work continues to be a significant factor in the suburban shift.

- UDR's focus on premium urban locations is designed to counter the suburban appeal.

UDR faces substitute threats, including homeownership, single-family rentals, and extended-stay hotels. Suburban living and co-living also compete for tenants. In 2024, the single-family rental market grew. UDR's ability to maintain high occupancy rates is critical to counter these alternatives.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Homeownership | Alternative to renting | Affordability challenges |

| Single-Family Rentals | Direct competition | Market growth |

| Extended Stay | Short-term housing | RevPAR ~ $85 |

Entrants Threaten

High capital requirements present a significant barrier to entry in the real estate industry. Building or purchasing apartment communities demands substantial financial resources. UDR, for example, reported a total market capitalization of approximately $18.8 billion as of Q4 2024. UDR's strong balance sheet and strategic use of joint ventures allow it to pursue growth opportunities. UDR's 2024 acquisitions totaled over $300 million, showcasing its ability to expand its portfolio.

Zoning laws and building codes pose significant barriers for new entrants in real estate. These regulations limit where and how development can occur, increasing costs. For instance, in 2024, compliance with evolving environmental regulations added 5-10% to construction budgets. UDR's established presence and expertise in managing these regulatory complexities give it an advantage. This experience allows UDR to navigate permitting processes more efficiently.

Established REITs, like UDR, hold an advantage due to economies of scale. Their extensive portfolios lead to cost efficiencies in property management and operations. For instance, UDR's size enables it to negotiate better rates with vendors. In 2024, UDR's operating expenses were about 30% of its revenue, showcasing scale benefits. This leverage supports higher profitability and competitive pricing.

Brand Recognition

New entrants in the real estate market often struggle with brand recognition, a significant barrier to entry. Establishing trust and attracting tenants is a time-consuming process. UDR, with its decades-long history, benefits from a well-established brand reputation, giving it a competitive edge over newcomers. This advantage helps UDR secure leases and maintain occupancy rates. Strong brand recognition can lead to higher property values and increased investor confidence.

- UDR's brand recognition helps it achieve higher occupancy rates compared to newer competitors.

- Established brands often command premium rental prices.

- UDR's brand reduces marketing costs compared to new entrants.

- The company's reputation minimizes tenant turnover.

Market Expertise

New entrants face significant hurdles in the real estate market, particularly concerning market expertise. Understanding local market dynamics is crucial for success; this includes navigating regulations and tenant preferences. Gaining expertise in property management and tenant relations is a steep learning curve for new players. UDR's established market knowledge and operational capabilities, developed over many years, are key strengths that protect its market position.

- Local Market Knowledge: Crucial for navigating regulations and understanding tenant preferences.

- Operational Capabilities: UDR's established systems offer a significant advantage.

- Learning Curve: New entrants need time to build expertise in property management.

- Competitive Advantage: UDR's deep market understanding is a key barrier to entry.

The threat of new entrants in the real estate market is moderated by high barriers. These include substantial capital needs, regulatory hurdles, and the necessity for economies of scale. Brand recognition and market expertise also create significant challenges for newcomers.

UDR's established position, for example, with a market cap around $18.8B in Q4 2024, offers robust defense. New entrants often struggle with the initial investment.

| Barrier | Impact | Example (UDR) |

|---|---|---|

| Capital | High cost | $300M+ acquisitions in 2024 |

| Regulations | Compliance cost | 5-10% budget increase |

| Brand | Trust issues | High occupancy rates |

Porter's Five Forces Analysis Data Sources

The UDR analysis leverages company filings, competitor data, and market reports to assess industry forces accurately.