UFP Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UFP Technologies Bundle

What is included in the product

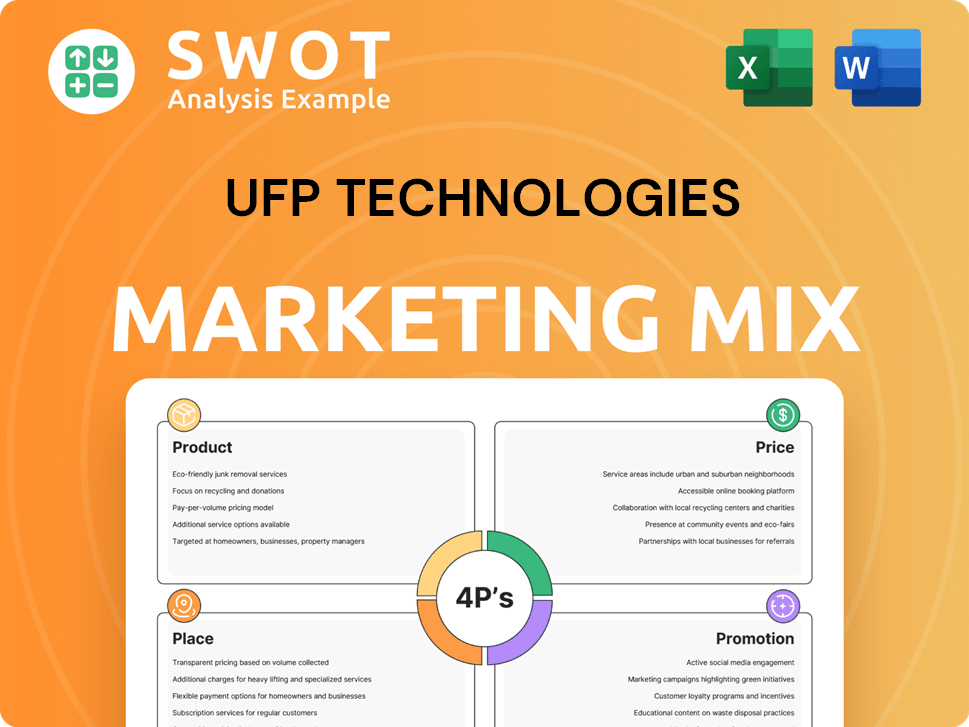

Deep dives into UFP Technologies's Product, Price, Place, and Promotion. A great starting point for market strategy.

Summarizes complex marketing strategies into an easy-to-read format for concise internal review and presentations.

What You See Is What You Get

UFP Technologies 4P's Marketing Mix Analysis

The preview displays the actual UFP Technologies 4Ps Marketing Mix Analysis. There are no changes to this ready-to-use document after purchase.

4P's Marketing Mix Analysis Template

UFP Technologies utilizes a focused 4Ps marketing mix. Their product strategy centers on engineered solutions. Pricing reflects value, targeting diverse markets. Distribution relies on direct and indirect channels. Promotions highlight innovation and performance. Get an editable Marketing Mix Analysis to learn from their tactics!

Product

UFP Technologies excels in creating custom components, products, and packaging. They utilize diverse materials, including foams and plastics. Customization addresses specific customer needs across various markets. In Q1 2024, UFP Technologies reported net sales of $436.7 million. This highlights their ability to tailor solutions.

UFP Technologies heavily focuses on the medical device market, a key segment for its product portfolio. This includes single-use devices, components, and sterile packaging. The company serves applications like minimally invasive surgery and wound care. In 2024, the medical sector accounted for a significant portion of UFP Technologies' revenue. The medical packaging market is projected to reach $60.2 billion by 2029.

UFP Technologies offers engineered products for aerospace and defense. These include specialized materials and manufacturing processes. In Q1 2024, the company's net sales in the Aerospace and Defense segment were $42.6 million. This reflects the demand for high-performance components. The segment's gross profit was $11.9 million.

Industrial and Consumer Applications

UFP Technologies extends its reach beyond medical and aerospace/defense, offering custom-engineered solutions for industrial and consumer markets. These applications include protective packaging and technical components for diverse products. In 2024, the industrial and consumer segments accounted for a significant portion of UFP Technologies' revenue. Specifically, the company reported approximately $280 million in sales from these sectors.

- Protective Packaging: UFP Technologies provides packaging solutions for various industries.

- Technical Components: The company manufactures components used in consumer goods.

- Market Diversification: This segment contributes to revenue diversification.

- Revenue Contribution: Industrial and consumer markets are key revenue drivers.

Design and Prototyping Services

UFP Technologies' design and prototyping services are crucial for product development. They provide engineering support and rapid prototyping. This helps customers create and improve products. In Q1 2024, UFP Technologies saw a 5% increase in design services revenue.

- Design and prototyping services support product development.

- They offer engineering support and rapid prototyping.

- Customers use these services to create and optimize products.

- Q1 2024 saw a 5% revenue increase in this area.

UFP Technologies focuses on custom component and packaging solutions, using diverse materials for varied markets. They offer products for the medical device sector, aiming at single-use devices and sterile packaging. The industrial and consumer segments make a large part of their revenue stream, with $280 million reported in 2024. Moreover, design and prototyping services show growth, with a 5% rise in Q1 2024 revenue.

| Product Segment | Key Offerings | 2024 Sales |

|---|---|---|

| Medical | Single-use devices, sterile packaging | Significant |

| Aerospace/Defense | Specialized materials, components | $42.6M (Q1 2024) |

| Industrial/Consumer | Protective packaging, components | ~$280M (2024) |

Place

UFP Technologies strategically operates multiple manufacturing facilities across the U.S. and Mexico. These facilities enhance production capabilities, providing tailored solutions. In 2024, this geographic spread supported $772.3 million in net sales. This network ensures efficient delivery and localized service to customers.

UFP Technologies focuses on direct sales, especially in medical and industrial sectors. This approach fosters strong customer relationships. For 2024, direct sales accounted for 75% of revenues. This strategy enables customized solutions, boosting customer satisfaction. It's a key factor in maintaining a strong market position.

UFP Technologies utilizes a distribution network to ensure product availability. This network primarily serves its North American operations, supporting timely delivery. Specific details about the network's structure are not widely available. In 2024, UFP Technologies reported $780 million in sales within North America, highlighting the importance of its distribution capabilities.

Strategic Partnerships

UFP Technologies strategically partners to boost global distribution, a key part of its marketing strategy. These alliances extend its market reach beyond its main manufacturing spots. This approach allows UFP Technologies to effectively serve a worldwide customer base. In 2024, UFP Technologies' international sales accounted for about 25% of its total revenue, showing the success of these partnerships.

- International sales contributed to roughly 25% of total revenue in 2024.

- Partnerships are vital for reaching customers in various global markets.

Investor Relations Presence

Investor relations at UFP Technologies, though not a physical distribution point, is crucial for engaging with financial stakeholders. They use their website and investor events to provide information. This helps in transparency and market access. In 2024, UFP Technologies' stock performance and investor sentiment have been closely watched.

- UFP Technologies' investor relations efforts aim to build trust.

- The company provides updates on financial performance and strategic initiatives.

- These initiatives support the company's value and market perception.

UFP Technologies uses diverse places to boost its market reach, leveraging its widespread network. They use many manufacturing sites and direct sales teams. This increases product availability and sales figures.

| Place Strategy | Details | 2024 Impact |

|---|---|---|

| Manufacturing Facilities | Operates facilities in the U.S. and Mexico. | $772.3M in net sales |

| Direct Sales | Focus on sales in the medical and industrial sectors. | 75% of revenue |

| Distribution Network | Primarily in North America. | $780M in North American sales |

| Partnerships | Global distribution alliances. | 25% of total revenue from international sales |

Promotion

UFP Technologies uses targeted marketing, like paid search and account-based marketing (ABM). This approach helps them focus on key decision-makers. In 2024, ABM spending is projected to reach $2.8 billion. This targeted strategy boosts promotional impact, increasing the chance of reaching potential customers.

UFP Technologies' website is central for promotion, highlighting their offerings and markets. Online B2B ordering capabilities are also available. In 2024, web traffic saw a 15% increase, reflecting its importance. Digital marketing spend grew by 10% in 2024, targeting online presence.

UFP Technologies fosters investor relations via press releases and earnings calls. They engage in investor conferences to boost transparency. In Q1 2024, UFP Technologies reported net sales of $208 million, showcasing ongoing financial disclosures. This strategy keeps the financial community informed.

Public Relations and News

UFP Technologies utilizes public relations to boost brand visibility. They issue press releases for financial results and acquisitions. This informs stakeholders and increases market awareness. In Q1 2024, UFP Technologies reported net sales of $238.1 million. This type of communication is crucial for investor relations.

- Press releases announce key company updates.

- This builds brand recognition.

- They communicate financial performance.

- Stakeholders stay informed.

Industry Events and Forums

UFP Technologies actively promotes itself through participation in industry events and forums. This strategy allows direct engagement with potential customers, partners, and investors. For example, they attend the KeyBanc Capital Healthcare Forum, facilitating networking and relationship-building. These events offer platforms to showcase innovations and gather market insights. This approach supports brand visibility and strengthens market positioning.

- KeyBanc Capital Healthcare Forum: UFP Technologies participates to network.

- These events boost brand visibility and market position.

UFP Technologies' promotional efforts span digital and traditional channels, enhancing visibility and market reach. Targeted marketing strategies like ABM are key, with ABM spending expected to hit $2.8 billion in 2024. Press releases and financial disclosures keep stakeholders informed.

| Promotion Strategy | Details | Impact |

|---|---|---|

| Digital Marketing | Websites and online presence | 15% website traffic growth |

| Investor Relations | Press releases and earnings calls | Q1 2024 net sales: $208M, $238.1M |

| Industry Events | Networking and showcases | Builds brand and relationships |

Price

UFP Technologies employs value-based pricing, aligning with its custom, engineered products. This strategy reflects the value of specialized materials and design expertise. In 2024, gross profit was $293.8 million, indicating effective pricing. This approach supports their strong gross margins.

UFP Technologies faces competition in its custom solutions market. Pricing must reflect competitor strategies and market demand to stay competitive. For instance, average industry profit margins in 2024 were around 10-15%, influencing UFP's pricing decisions. They must balance profitability with market share, especially given the expected growth in their target sectors by 2025.

Material and manufacturing costs are pivotal for UFP Technologies' pricing strategies. The expenses for raw materials such as foams, plastics, and composites directly impact product costs. In Q1 2024, material costs for UFP Technologies were approximately $125 million. Manufacturing complexity, including specialized processes, also influences pricing.

Customer-Specific Pricing

UFP Technologies' customer-specific pricing reflects its custom manufacturing approach. Prices are adjusted based on factors like project intricacy and order size. This strategy allows for flexibility, appealing to diverse customer needs. In Q1 2024, customized solutions drove a 12% revenue increase.

- Tailored pricing based on project complexity.

- Volume discounts to encourage larger orders.

- Pricing flexibility to meet various customer budgets.

- Customization is key for UFP Technologies.

Financial Performance and Margins

UFP Technologies' financial health, including revenue and gross margins, is crucial for understanding their pricing tactics and profitability. In Q1 2024, UFP Technologies reported net sales of $434.7 million, a decrease compared to $470.1 million in Q1 2023. Gross profit for Q1 2024 was $110.8 million, with a gross margin of 25.5%. These figures help assess how effectively they manage costs and set prices.

- Revenue Changes: Reflects market demand and pricing effectiveness.

- Gross Margin: Indicates pricing power and cost control.

- Q1 2024 Net Sales: $434.7 million.

- Q1 2024 Gross Margin: 25.5%.

UFP Technologies uses value-based pricing, emphasizing the worth of their specialized offerings. Pricing strategy is shaped by competitor moves and market demand. Their financials, including net sales and gross margin, highlight pricing effectiveness and profitability.

| Metric | Q1 2024 | Comment |

|---|---|---|

| Net Sales | $434.7M | Reflects market demand |

| Gross Margin | 25.5% | Indicates pricing power |

| Material Costs (Q1 2024) | ~$125M | Impacts product costs |

4P's Marketing Mix Analysis Data Sources

We leverage UFP Technologies' official reports, SEC filings, and press releases to understand product, price, distribution, and promotion strategies. Market data, competitor analysis, and industry reports inform the research as well.