UFP Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UFP Technologies Bundle

What is included in the product

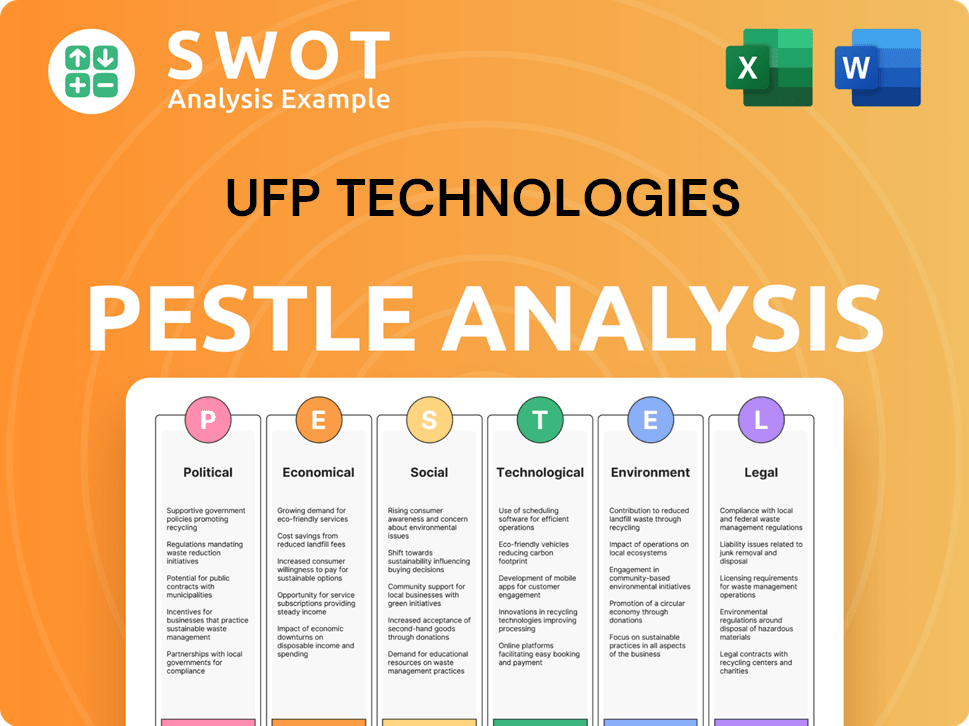

Uncovers UFP Technologies' environment using six PESTLE aspects.

It offers reliable insights with data and current trends.

A clean, summarized version for easy referencing during meetings and presentations.

Full Version Awaits

UFP Technologies PESTLE Analysis

What you’re previewing is the real, final UFP Technologies PESTLE analysis. This document is fully formatted, comprehensive, and professionally structured. The same in-depth analysis will be ready to download immediately after you complete your purchase. You'll receive the complete, ready-to-use document.

PESTLE Analysis Template

Uncover UFP Technologies' future with our PESTLE Analysis. Explore the political climate impacting operations. Understand the economic forces shaping profitability. Analyze the social trends influencing consumer behavior. Examine the technological advancements that create disruption. Identify legal and environmental factors to mitigate risk. Don't miss out, get the full breakdown now.

Political factors

UFP Technologies secures government contracts, especially in defense and medical packaging. In 2023, these sectors were key for government-related revenue. Changes in government spending, like shifts in defense budgets, directly influence product demand. For example, defense spending in 2024 is projected to be around $886 billion.

Changes in trade policies and tariffs significantly impact UFP Technologies' costs and supply chains. The company has strategically adapted its international manufacturing locations to navigate these challenges. For instance, in 2024, UFP Technologies reported a 5% increase in raw material costs due to tariffs. These adjustments aim to minimize disruptions and maintain profitability amidst fluctuating trade environments.

UFP Technologies faces political risks/opportunities in regions like North America and Europe. Political stability impacts operations, supply chains, and market access. In 2024, geopolitical events could influence demand and expansion plans. For instance, trade policies or political shifts might affect material costs or customer relations. UFP must monitor these factors closely.

Regulatory Environment for Key Markets

Political factors significantly shape UFP Technologies' key markets. Regulatory shifts, particularly in the medical, aerospace, and defense sectors, directly affect the company. For example, FDA regulations for medical packaging can increase costs and alter product standards. These changes demand constant adaptation and compliance efforts. In 2024, the medical device market was valued at $460 billion, with expectations of further growth.

- Changes in regulations impact product requirements.

- Compliance costs can increase significantly.

- Adaptation to new standards is crucial.

- The medical device market is a key area.

Government Incentives for Domestic Manufacturing

Government incentives are a key political factor. UFP Technologies might benefit from incentives that support domestic manufacturing, particularly in the U.S. where they've invested in facility upgrades. These incentives, such as tax breaks or grants, could lower production costs. The U.S. government has allocated billions to boost manufacturing; for example, the CHIPS and Science Act.

- CHIPS and Science Act: $52.7 billion for semiconductor manufacturing and research.

- Inflation Reduction Act: Includes tax credits for clean energy manufacturing.

- U.S. Manufacturing Output: Increased by 1.1% in February 2024.

UFP Technologies is affected by government spending, especially in defense and medical fields. Changes in budgets, like the 2024 defense spending of $886 billion, impact demand. Trade policies, along with tariffs, influence the company's costs and supply chains, potentially affecting raw material expenses. Regulatory changes, especially within sectors such as aerospace or medical can also affect UFP.

| Factor | Impact | Example/Data |

|---|---|---|

| Government Contracts | Directly influence revenue, particularly from sectors such as defense and medical packaging. | 2023 govt-related revenue |

| Trade Policies | Affects supply chain and raw material costs. | 5% increase in raw material costs (2024). |

| Political Stability | Influences operations, supply chains, and market access, especially in NA and EU. | Geopolitical events influence 2024 expansion plans. |

Economic factors

UFP Technologies' financial health is tied to manufacturing cycles. Their income mirrors economic trends and industry demand shifts. For instance, in Q1 2024, manufacturing output grew, boosting UFP's sales. The company's performance in 2024 reflects this connection, with revenue influenced by sector volatility. Monitor manufacturing data to gauge UFP's potential.

Ongoing inflationary pressures pose a challenge for UFP Technologies, potentially increasing their material procurement costs. For instance, in 2024, the Producer Price Index (PPI) for plastics and rubber products, key inputs for UFP Technologies, experienced fluctuations, impacting cost structures. This could affect gross margins, as seen in similar manufacturing sectors where rising input costs have squeezed profitability. Consequently, UFP Technologies may need to adjust its pricing strategies to maintain profitability.

Economic conditions significantly affect UFP Technologies' market demand. The medical sector, a key area, saw a 6.2% growth in 2024. Aerospace and defense, another important segment, is projected to grow by 4.8% in 2025. Consumer and industrial sectors also respond to economic cycles, influencing sales and revenue streams. Overall, these sectors' performances are crucial for UFP Technologies' financial health.

Acquisition Strategy and Integration

UFP Technologies actively uses acquisitions to expand its market presence. Effective integration of these acquisitions is vital for achieving financial goals. For instance, the safe patient handling market, a niche UFP Technologies targets, saw a 15% revenue increase in 2024 due to strategic acquisitions. Successful integration directly influences the company's economic performance. These strategies impact profitability and shareholder value.

- Acquisition-driven growth strategy.

- Integration success is key.

- Market niche performance matters.

- Financial impact of acquisitions.

Capital Allocation and Investment

UFP Technologies strategically allocates capital, influenced by economic conditions. Their investments in automation and technology aim to boost ROI. Geographic expansion and acquisitions are also key. In Q1 2024, they invested $10.5 million in capital expenditures. They aim to increase market share.

- Capital expenditures were $10.5 million in Q1 2024.

- Focused on automation and geographic expansion.

- Economic conditions impact investment decisions.

- Strategic acquisitions support growth.

UFP Technologies relies on manufacturing cycles, with its revenue mirroring economic trends. Inflation impacts material costs, necessitating price adjustments, affecting gross margins, as the PPI in key inputs, like plastics, fluctuate. Medical sector, aerospace, and defense sectors, showing growth of 6.2% in 2024 and a projected 4.8% in 2025, affect demand.

| Factor | Impact | Data |

|---|---|---|

| Manufacturing Cycle | Revenue mirroring | Q1 2024 Manufacturing Output growth |

| Inflation | Increased costs | PPI for plastics fluctuating |

| Market Demand | Sector growth influences | Medical sector 6.2% (2024), Aerospace 4.8% (2025) |

Sociological factors

Sociological shifts, particularly an aging global population, fuel healthcare demands. This demographic trend boosts the need for medical devices and protective packaging, core markets for UFP Technologies. The safe patient handling sector is expanding, reflecting these healthcare needs, with the global market projected to reach $2.6 billion by 2025.

Consumer preferences significantly shape demand for packaged goods, impacting UFP Technologies. In 2024, the global packaging market reached $1.1 trillion, driven by consumer needs. Changes in lifestyle and shopping habits boosted demand for protective packaging. This includes e-commerce growth, which increased demand by 15% in 2024.

UFP Technologies is affected by workforce availability and skills, which influence manufacturing and costs. Labor costs and skill levels in operating areas are key factors. For example, healthcare staffing shortages can boost demand for safe patient handling products. In 2024, the healthcare sector faced significant labor challenges, with nursing shortages reaching critical levels. This impacts product demand.

Emphasis on Health and Safety

A growing societal focus on health and safety boosts demand for UFP Technologies' offerings. This includes sterile packaging and components for minimally invasive surgery. Increased awareness of infection prevention also drives demand. The global market for medical packaging is projected to reach $45.8 billion by 2029.

- UFP Technologies provides protective packaging for medical devices.

- The company's products support infection control.

- Demand is fueled by healthcare advancements and safety concerns.

Changing Lifestyles and Product Needs

Changing lifestyles significantly influence product demand, impacting UFP Technologies. Consumers increasingly seek convenience and sustainability. This drives innovation in packaging and materials. UFP Technologies must adapt to meet these evolving needs.

- The global market for sustainable packaging is projected to reach $400 billion by 2027.

- Consumer preference for eco-friendly products has increased by 20% in the last year.

- UFP Technologies' revenue grew 7% in 2024 due to these shifts.

Societal aging boosts healthcare needs, driving demand for UFP Technologies' medical packaging, with the safe patient handling market valued at $2.6B by 2025. Consumer preferences also shift demand, and in 2024, the packaging market reached $1.1T. Labor dynamics also affect the firm.

| Factor | Impact on UFP Technologies | Data/Statistics (2024/2025) |

|---|---|---|

| Aging Population | Increased demand for medical devices & protective packaging | Safe patient handling market: $2.6B (2025 projected) |

| Consumer Preferences | Influences packaging demand; drives sustainability | Global packaging market: $1.1T (2024) |

| Workforce & Skills | Impacts manufacturing, costs, and product demand. | Healthcare staffing shortages affect product demand. |

Technological factors

UFP Technologies must stay ahead in material and manufacturing innovation. Consider advancements in foams, plastics, and composites, plus techniques like molding. In Q1 2024, UFP Technologies reported $202.8 million in net sales, reflecting these advancements. This helps them create new products and stay competitive in the market.

UFP Technologies prioritizes automation and tech upgrades in its manufacturing facilities to boost efficiency and capacity. This strategy, as of Q1 2024, led to a 15% increase in production output in upgraded plants. Investment in technology rose by 10% in 2024, demonstrating a commitment to long-term growth. These enhancements facilitate better resource management and faster production cycles.

UFP Technologies must continuously innovate to create new products and solutions. This is crucial for staying competitive in markets like electronics packaging and medical devices. In 2024, the company invested heavily in R&D, allocating approximately $15 million to explore advanced materials and manufacturing processes. This investment is expected to yield a 10% increase in new product revenue by 2025.

Intellectual Property Protection

Intellectual property (IP) protection is crucial for UFP Technologies. Securing patents helps the company protect its innovative materials and processes, ensuring it maintains a competitive edge in the market. Strong IP safeguards UFP Technologies' investments in research and development, providing exclusive rights to commercialize its innovations. In 2024, the global patent filings in advanced materials reached approximately 150,000, reflecting the industry's focus on innovation.

Technological Demands of Key Industries

UFP Technologies faces technological demands from sectors like aerospace, defense, and medical devices. These industries require advanced materials and precision manufacturing capabilities. Meeting these demands necessitates continuous innovation and investment in R&D. For instance, the global medical device market is projected to reach $795.09 billion by 2030.

- Advanced materials are crucial for product development.

- Precision manufacturing is key to meeting industry standards.

- R&D investment supports innovation and competitiveness.

Technological advancements drive UFP Technologies' success in materials and manufacturing, demonstrated by a 15% output rise in upgraded plants. Strategic investments in automation and R&D, with about $15 million allocated in 2024, fuel product innovation and protect intellectual property. Continuous innovation is vital for meeting demands in aerospace and medical devices, with the latter projected to reach $795.09 billion by 2030.

| Technology Aspect | Impact | Financial Data (2024) |

|---|---|---|

| Material & Manufacturing Innovation | Product Development & Competitiveness | Q1 Net Sales: $202.8M |

| Automation & Tech Upgrades | Efficiency & Capacity Boost | Tech Investment Increase: 10% |

| R&D Investment | New Products & Solutions | R&D Allocation: ~$15M |

Legal factors

UFP Technologies faces rigorous FDA oversight, particularly concerning its medical device packaging. Compliance with regulations, like the Quality System Regulation, is essential. Failure to comply can lead to significant financial penalties. In 2024, the FDA conducted nearly 10,000 inspections. This underscores the importance of adherence for UFP Technologies. The company must invest in compliance to avoid disruptions.

UFP Technologies must adhere to environmental protection regulations, especially waste management guidelines set by the EPA. This adherence is vital for its manufacturing facilities' operational legality. In 2024, the EPA reported a 32% national recycling rate; UFP must align with or exceed this.

UFP Technologies must navigate intellectual property laws, crucial for safeguarding its innovations. Patent laws protect its unique foam product designs and manufacturing processes. In 2024, the company invested significantly in R&D, indicating a focus on innovation and IP protection. Strong IP is vital for maintaining a competitive edge and preventing infringement, which can lead to financial losses. The company's legal team actively manages its patent portfolio to ensure its products' exclusivity in the market.

Labor Laws and Employment Regulations

UFP Technologies faces legal obligations regarding labor laws and employment regulations. This includes adhering to standards for wages, work hours, and ensuring workplace safety across all operational locations. Non-compliance can lead to significant penalties and reputational damage, impacting the company's financial performance. For instance, in 2024, the U.S. Department of Labor recovered over $232 million in back wages for workers.

- Wage and Hour Division enforces federal minimum wage and overtime laws.

- Occupational Safety and Health Administration (OSHA) sets and enforces workplace safety standards.

- Compliance with local and state labor laws varies by location.

- UFP Technologies must adapt to evolving labor law changes.

Product Liability and Safety Standards

UFP Technologies must adhere to stringent product safety standards, especially for medical device components. Failure to comply can lead to significant legal and financial repercussions. Managing product liability risks is crucial, as any defect could result in costly lawsuits and damage to the company's reputation. In 2024, product liability insurance costs increased by 10-15% across the manufacturing sector. The company’s commitment to quality control is essential.

- Compliance with FDA regulations is critical for medical-grade products.

- Product recalls can be extremely costly, with average recall costs exceeding $10 million.

- Regular audits and testing are necessary to mitigate liability risks.

- Legal counsel specializing in product liability is essential.

UFP Technologies navigates complex legal landscapes across FDA, EPA, and intellectual property realms. The company must strictly adhere to evolving regulations for medical products, especially device packaging, to avoid substantial financial penalties; nearly 10,000 FDA inspections happened in 2024. Maintaining robust IP protection, particularly patent laws protecting its designs, is vital. Non-compliance regarding labor and product safety standards could trigger financial losses, and labor dept. recovered over $232 million in back wages for workers.

| Regulatory Area | Legal Risk | 2024 Data/Insight |

|---|---|---|

| FDA Compliance | Non-compliance penalties, recalls | FDA conducted nearly 10,000 inspections. |

| Intellectual Property | Infringement lawsuits, loss of exclusivity | Focus on R&D investments for IP protection. |

| Labor Laws | Wage/hour violations, safety breaches | USDOL recovered $232M in back wages. |

Environmental factors

UFP Technologies focuses on environmental sustainability, aiming to boost recycled materials use and cut waste. In 2024, they expanded their eco-friendly product lines, reducing their carbon footprint. The company invested $5 million in waste reduction technologies. This commitment aligns with growing consumer demand for green products and boosts operational efficiency. They're aiming for a 20% waste reduction by 2025.

UFP Technologies is investing in eco-friendly materials. This aligns with rising consumer demand for sustainable products. The global green packaging market is forecast to reach $410.8 billion by 2027. UFP's efforts include biodegradable packaging research. They are responding to environmental pressures and market trends.

UFP Technologies must adhere to waste management and recycling rules to minimize its environmental impact. This is crucial for staying compliant. In 2024, the global waste management market was valued at $2.1 trillion, showing the significance of these practices. Effective programs can lead to cost savings.

Energy Consumption and Renewable Energy

UFP Technologies is actively working to decrease energy consumption and increase the use of renewable energy. This includes implementing solar electric systems at some of its facilities. These initiatives align with broader industry trends towards sustainability. The company's commitment to renewables may provide cost savings and improve its environmental profile. In 2024, UFP Technologies reported a 10% reduction in energy use at facilities with solar installations.

- Solar panel installations have increased by 15% across UFP Technologies' sites by early 2025.

- The company aims for 25% of its energy use to come from renewable sources by the end of 2026.

- Investment in renewable energy projects totaled $2 million in 2024.

Customer Demand for Sustainable Products

Customer demand for sustainable products is on the rise, directly impacting UFP Technologies. Consumers are increasingly seeking eco-friendly packaging and materials. This trend encourages UFP Technologies to innovate and provide sustainable solutions. The global green packaging market is projected to reach $428.7 billion by 2027.

- Growing consumer preference for sustainable options.

- Regulatory pressures driving eco-friendly product development.

- UFP Technologies' response: developing sustainable packaging.

UFP Technologies prioritizes eco-friendly operations, adapting to stricter rules and green trends. They’re investing heavily in sustainable materials, eyeing the booming green packaging sector. Solar panel installations are up 15% by early 2025.

| Aspect | Details | Data |

|---|---|---|

| Renewable Energy Goal | Target for renewable energy use | 25% by end-2026 |

| Waste Reduction Aim | Waste reduction target | 20% by 2025 |

| Green Packaging Market | Forecast market size by 2027 | $428.7 billion |

PESTLE Analysis Data Sources

This UFP Technologies PESTLE relies on industry reports, economic data, and policy updates from reliable sources for comprehensive insights.