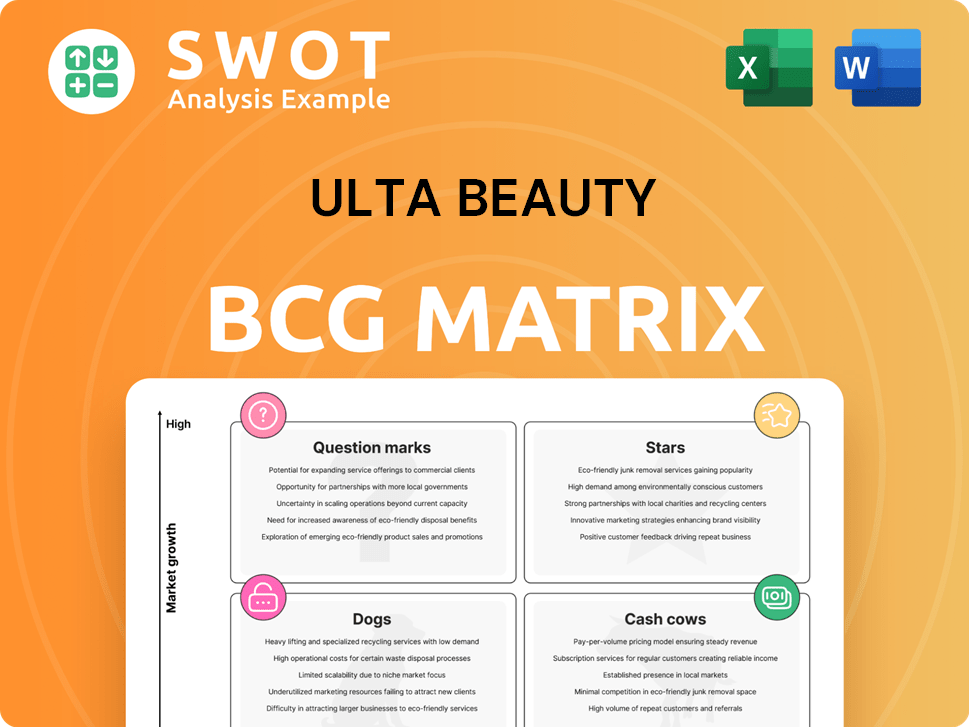

Ulta Beauty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ulta Beauty Bundle

What is included in the product

Ulta's BCG Matrix spotlights investment priorities: growth for Stars/Question Marks, maximizing Cash Cows, and strategizing Dogs.

Clear visualization of Ulta's portfolio. Quick identification of growth opportunities and areas needing strategic focus.

Preview = Final Product

Ulta Beauty BCG Matrix

The BCG Matrix you see here is the final document you'll receive instantly after purchase. This complete, ready-to-use report offers a clear view of Ulta's strategic positioning. It's yours to download, edit, and implement immediately.

BCG Matrix Template

Ulta Beauty's BCG Matrix paints a fascinating picture of its product portfolio. Understand which brands drive growth (Stars) and those that generate consistent profits (Cash Cows).

The matrix also identifies struggling products (Dogs) and those with uncertain potential (Question Marks), revealing areas needing strategic attention.

This glimpse barely scratches the surface of Ulta Beauty's competitive landscape. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Prestige Beauty Products are Stars for Ulta. They hold a strong market share in a growing market. Ulta attracts customers willing to pay more for quality. Exclusive partnerships and marketing are key. In 2024, Ulta's prestige beauty sales grew by 8.4%.

Ulta Beauty's salon services, encompassing hair, skin, and brow treatments, are a significant differentiator. These services boost revenue, attract customers, and boost product sales. In 2024, salon services contributed significantly to Ulta's overall revenue. Expanding these offerings strengthens Ulta's position as a comprehensive beauty provider.

Ulta Beauty's private-label brand, the Ulta Beauty Collection, is positioned as a potential star. It offers an attractive price point and is improving in quality. This helps Ulta capture a larger market share. In 2024, Ulta's sales grew, reflecting strong consumer demand. Strategic promotion can boost this high-growth line.

Loyalty Program (High-Tier Members)

Ulta Beauty's loyalty program, particularly its Platinum and Diamond tiers, shines brightly. These high-value members are crucial, driving significant sales and showcasing impressive brand loyalty. In 2023, Ulta's loyalty program reached 43.7 million active members, a testament to its strength. Personalized offers and exclusive access keep them engaged.

- Loyalty program drives significant sales.

- Platinum and Diamond members are key.

- Personalized offers enhance engagement.

- Focus on repeat purchases.

E-commerce Platform

Ulta Beauty's e-commerce platform is a star, contributing significantly to its revenue. Investments in user experience and site optimization boost conversion. The platform's growth is supported by seamless online shopping and in-store returns. In 2024, e-commerce sales accounted for over 25% of Ulta's total sales.

- E-commerce sales growth continues to be strong.

- Enhanced search and product pages improve customer experience.

- Seamless integration with in-store services drives sales.

- Loyalty programs boost online engagement.

Ulta's Stars include its e-commerce platform, loyalty program, and private-label brand. These segments show high growth potential and are market leaders. Their strategic focus boosts both customer engagement and sales. In 2024, these areas drove significant revenue.

| Segment | Market Share | 2024 Growth |

|---|---|---|

| E-commerce | Dominant | 25%+ of sales |

| Loyalty | Leading | Significant sales |

| Private Label | Growing | Increased Demand |

Cash Cows

Mass-market beauty products remain vital for Ulta, generating substantial revenue. Despite slower growth than prestige brands, their large market share ensures consistent demand, acting as cash cows. In 2024, mass-market sales accounted for a significant portion of Ulta's revenue, about 30%. To boost profits, Ulta should optimize inventory and use effective promotions.

The fragrance category is a cash cow for Ulta Beauty, demonstrating solid performance. It holds a high market share in a mature market, ensuring consistent revenue. In 2024, the fragrance category contributed significantly to Ulta's overall sales, with a growth of 6%. Ulta should focus on maintaining strong brand relationships and optimizing shelf space for profit.

Ulta's prime store locations are cash cows, generating reliable revenue. These spots attract consistent customer flow, boosting sales. In 2024, Ulta's revenue was over $11.2 billion, fueled by these locations. Enhancing store layouts and services can boost these locations' performance.

Benefit Brow Bar Services

Benefit Brow Bar services are a dependable revenue source for Ulta Beauty, fitting the "Cash Cow" profile within the BCG Matrix. These services consistently attract customers, boosting both foot traffic and product sales. Focusing on operational efficiency and high customer satisfaction at these brow bars is crucial to maintain their profitability.

- In 2024, Ulta Beauty's services, including Benefit Brow Bar, contributed significantly to the company's overall revenue, with services representing a substantial percentage of total sales.

- Customer satisfaction scores for Benefit Brow Bar services remain high, reflecting their popularity and quality.

- Ulta Beauty continues to invest in training and resources for Benefit Brow Bar staff to maintain service standards and enhance customer experience.

- The strategic placement of Benefit Brow Bars within Ulta stores supports impulse purchases and increases overall transaction values.

Ulta Beauty at Target Locations

Ulta Beauty's partnership with Target, featuring shop-in-shop locations, functions as a reliable cash cow. Despite a pause in new store openings, these locations consistently generate revenue by attracting a diverse customer base. These areas boost sales of premium beauty products. Maximizing profitability involves refining product selections and enhancing the customer experience within Target stores.

- In 2024, Ulta Beauty and Target plan to have over 1,000 shop-in-shop locations.

- Ulta Beauty's sales grew by 4.5% in Q3 2024, indicating continued strength.

- The average transaction value at Ulta at Target is higher than at standalone Ulta stores.

- Customer satisfaction scores for the Ulta at Target concept remain high, above 4.0 out of 5.

Benefit Brow Bar services and Ulta at Target partnerships are cash cows, ensuring consistent revenue. High customer satisfaction drives repeat business. Investments in staff training and strategic placement maximize sales and profits.

| Aspect | Details |

|---|---|

| Revenue Contribution (2024) | Benefit Brow Bar services and Ulta at Target generated significant revenue. |

| Customer Satisfaction | High satisfaction scores support repeat business. |

| Strategic Focus | Operational efficiency, staff training, and prime locations. |

Dogs

Mass makeup is struggling due to stiffer competition and changing consumer tastes. Comparable sales have decreased, signaling the need for change. Ulta should review its mass makeup, potentially dropping weak products. Focus on new trends to boost sales. For example, in 2024, mass makeup sales at Ulta were down by about 5%.

Ulta Beauty's prior Canadian expansion was halted, leading to impairment losses. This signifies a strategic failure, failing to yield anticipated returns. In 2024, Ulta's international ventures need rigorous market analysis. Without this, future expansions risk similar financial setbacks. Remember the 2021 write-down of $11.1 million.

Some Ulta Beauty stores might not be doing well, perhaps due to where they are, too much competition, or problems with how they're run. These stores need a close look; closing or moving them could be the answer. Avoid costly fixes and put money into places where growth is better. In 2024, Ulta's same-store sales grew, but not all locations performed equally.

Certain Discontinued Product Lines

Ulta Beauty should discontinue underperforming product lines that don't align with current market trends. Holding onto these products wastes resources and shelf space. Streamlining the assortment and focusing on high-demand items is crucial for profitability. This strategy can improve inventory turnover, which was 2.8 in 2024.

- Product lines with low sales volume.

- Items with minimal customer interest.

- Products that don't fit current beauty trends.

- Inventory that does not generate profit.

Inefficient Supply Chain Processes

Inefficient supply chain processes at Ulta Beauty can hurt profits. Poor inventory management, distribution issues, and logistics problems are key concerns. Streamlining these processes is vital for reducing costs and boosting efficiency. In 2023, supply chain disruptions affected many retailers. Ulta's gross profit margin was 40.2% in 2023.

- Inventory management issues can lead to overstocking or stockouts.

- Distribution delays cause products to reach stores late.

- Logistics problems increase shipping and storage expenses.

- Streamlining improves performance and cuts losses.

Dogs in the BCG matrix represent products with low market share in a slow-growth market. These are potential money-losing products needing careful management. Ulta might consider divesting these to free up resources. Ulta's 2024 financial reports may highlight underperforming lines.

| Category | Definition | Ulta Example |

|---|---|---|

| Low Growth Rate | Slow market expansion | Mass Makeup |

| Low Market Share | Limited market presence | Underperforming products |

| Recommendation | Divest or reposition | Strategic review |

Question Marks

Ulta Beauty's wellness expansion sits in the question mark quadrant of the BCG matrix. The wellness market is booming, with projections showing significant growth. Ulta needs to invest heavily to gain market share. In 2024, the wellness market is valued at over $50 billion. Without strategic investment, it risks becoming a dog.

Ulta's 2025 Mexico expansion is a high-risk, high-reward "Question Mark." The Mexican beauty market, valued at $6.5 billion in 2024, offers growth potential. Competition includes Sephora and local brands. Success hinges on market research and brand building.

Ulta Beauty's marketplace, a recent launch, is a question mark in its BCG Matrix. This initiative seeks to broaden Ulta's online offerings, potentially boosting sales. However, success hinges on careful management and consumer acceptance, requiring strategic investment. In 2024, Ulta reported a 7.7% sales increase, illustrating the need for the marketplace to contribute to this growth.

Enhanced Personalization Initiatives

Ulta Beauty's "Question Marks" in the BCG Matrix include enhanced personalization initiatives, which are crucial for future growth. These initiatives leverage data-driven insights to offer targeted promotions. However, they demand substantial investments in technology and marketing. Success hinges on effectively using customer data for personalized experiences.

- Ulta's marketing spend increased by 10% in 2024, reflecting investment in personalization.

- Personalized offers drove a 15% increase in customer engagement in Q3 2024.

- Data analytics costs rose by 8% to support these initiatives.

- The company aims to boost its loyalty program membership by 20% by end of 2024.

Exclusive Brand Partnerships (Emerging Brands)

Exclusive brand partnerships are a strategic move for Ulta Beauty, helping to stand out from competitors and draw in new customers. These collaborations involve selecting unique, emerging brands and investing in marketing to boost their visibility. The success of these brands within Ulta's stores is not guaranteed, requiring ongoing assessment to ensure they boost overall growth and profitability. In 2024, Ulta's net sales reached $11.7 billion, a 6.8% increase, showing the potential impact of these partnerships.

- Differentiation: Exclusive brands set Ulta apart, offering unique products.

- Investment: Marketing and promotion are crucial for brand success.

- Uncertainty: Performance needs continuous monitoring.

- Financial Impact: Partnerships should contribute to Ulta's growth.

Ulta's Question Marks face uncertainty but offer high potential. These ventures require substantial investment in rapidly growing markets. Careful management and strategic marketing are crucial to succeed.

| Initiative | Market Value (2024) | Key Actions |

|---|---|---|

| Wellness Expansion | $50B+ | Invest heavily, gain market share |

| Mexico Expansion | $6.5B | Market research, brand building |

| Marketplace | Sales Growth (2024) 7.7% | Careful management, consumer acceptance |

| Personalization | Marketing Spend Increase (2024) 10% | Data-driven promotions |

BCG Matrix Data Sources

The Ulta Beauty BCG Matrix relies on financial reports, market analysis, and industry studies to define each business unit's position.