Unifi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Unifi Bundle

What is included in the product

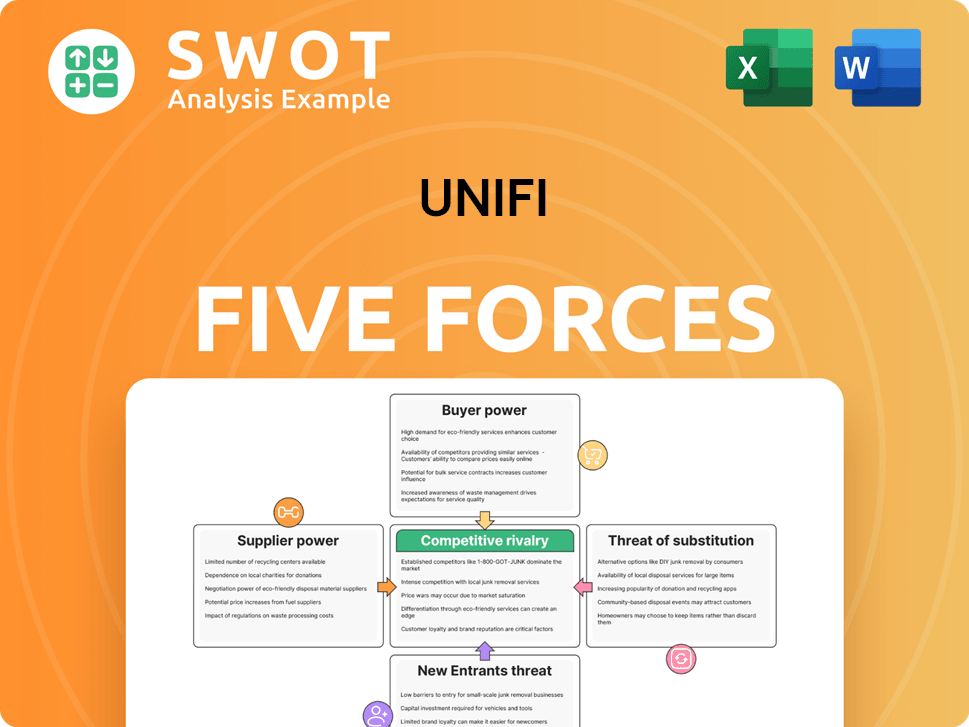

Assesses Unifi's competitive environment by analyzing suppliers, buyers, new entrants, substitutes, and rivals.

Instantly visualize competitive forces with a vibrant, easy-to-read color-coded chart.

Full Version Awaits

Unifi Porter's Five Forces Analysis

This Unifi Porter's Five Forces Analysis preview is the complete document. You're seeing the final version—the same in-depth, professionally crafted analysis you'll receive.

Porter's Five Forces Analysis Template

Unifi faces a complex competitive landscape shaped by five key forces. Buyer power stems from concentrated customers, impacting pricing. Supplier influence is moderate due to diverse input sources. The threat of new entrants is limited by barriers. Competitive rivalry is intense, especially among established players. Substitute products pose a moderate threat.

Ready to move beyond the basics? Get a full strategic breakdown of Unifi’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Unifi benefits from a fragmented supplier base in the textile industry, which limits supplier power. For instance, Unifi sources from multiple suppliers, including NanYa and Reliance Industries, which helps to diversify and reduce reliance. This strategy is crucial as in 2024, Unifi's raw material costs significantly impact its overall profitability. Having multiple suppliers lessens the risk associated with depending on a single source.

Unifi's bargaining power of suppliers is affected by raw material availability, especially recycled plastics. The company's REPREVE line depends on a steady supply chain. They have recycled over 42 billion plastic bottles, aiming for 50 billion by December 2025. This focus strengthens their control over suppliers, ensuring material access.

Unifi's joint venture, UNFA, provides nylon raw materials, indicating vertical integration and supply control. Strong supplier relationships are crucial for a stable supply chain. In 2024, the nylon market faced price fluctuations, emphasizing the importance of these relationships. These relationships help mitigate price volatility and supply disruptions, which in 2024 impacted several manufacturers.

Impact of Geopolitical Factors

Geopolitical factors significantly impact supplier power, as trade disputes and tensions can disrupt supply chains and raise raw material costs. Unifi addresses these challenges by diversifying its sourcing and closely monitoring global events. Effective management of these factors is essential for cost-effectiveness and operational stability. For example, in 2024, disruptions in shipping due to geopolitical events increased transportation costs by 15% for many textile companies.

- Trade wars can lead to increased tariffs, raising the cost of imported raw materials.

- Political instability in key supplier regions can disrupt production and delivery schedules.

- Diversification of suppliers mitigates risks associated with geopolitical events.

- Monitoring global events helps in anticipating and responding to supply chain disruptions.

Sustainability Demands

Sustainability is reshaping the textile industry, influencing supplier dynamics. Suppliers providing eco-friendly materials gain leverage. Unifi's REPREVE and circular solutions strategy supports this shift. This could strengthen its position with environmentally focused suppliers.

- In 2024, the global market for sustainable textiles is estimated to be worth over $40 billion.

- REPREVE sales accounted for a significant portion of Unifi's revenue in 2024.

- Unifi's partnerships with sustainable material providers are growing annually.

Unifi benefits from a fragmented supplier base, reducing supplier power. Vertical integration and strong relationships with suppliers, such as through UNFA, also enhance its control. Geopolitical and sustainability factors further shape supplier dynamics.

| Factor | Impact | 2024 Data/Example |

|---|---|---|

| Supplier Base | Fragmented; reduces supplier power | Multiple suppliers, including NanYa and Reliance Industries |

| Vertical Integration | Enhances supply control | UNFA joint venture for nylon raw materials |

| Geopolitical Factors | Disrupt supply chains and raise costs | Shipping cost increase by 15% due to disruptions |

Customers Bargaining Power

Unifi's customer base, while not overly reliant on one entity, shows concentration. In fiscal 2024, the top 10 direct customers represented around 24% of total net sales. This concentration gives these major customers more leverage in negotiations. They can potentially demand lower prices or better terms.

Unifi faces strong customer bargaining power, particularly from major brand partners. Nike, Target, and Walmart, with large order volumes, can dictate pricing and product specifications. This influences Unifi's profit margins and operational strategies. Unifi acknowledges these key relationships through its Champions of Sustainability awards. In 2024, Walmart's revenue was over $600 billion, highlighting their significant market influence.

Switching costs for Unifi's customers can vary. Customers might switch to competitors, particularly for standard yarns, where alternatives are readily available. However, Unifi's unique offerings, like specialty and recycled yarns, create differentiation. In 2024, Unifi reported $578.8 million in net sales, indicating a strong customer base.

Demand for Sustainable Products

Growing consumer awareness of environmental issues boosts customer bargaining power, especially for sustainable clothing. Unifi's REPREVE brand addresses this demand, potentially fostering stronger customer relationships. This trend aligns with the textile industry's sustainability shift. In 2024, the global market for sustainable textiles is estimated at $40 billion.

- Increased customer demand for sustainable and ethically produced clothing.

- Unifi's REPREVE brand meets this demand.

- Alignment with the broader shift towards sustainability in textiles.

- The global market for sustainable textiles is estimated at $40 billion in 2024.

Price Sensitivity

Unifi faces significant price sensitivity from customers, especially in fast fashion. This can lead to decreased prices and compressed margins. Maintaining profitability requires a careful balance between cost-effectiveness and the value of sustainable and performance fibers. The textile industry saw price volatility in 2024, with cotton prices fluctuating significantly. Unifi's ability to navigate these fluctuations is vital.

- Fast fashion brands often demand low prices, impacting suppliers like Unifi.

- The cost of raw materials, such as recycled PET, directly affects pricing strategies.

- Unifi must differentiate its products to justify premium pricing.

- Negotiating contracts and managing supply chain costs are key to maintaining profitability.

Unifi's customers have significant bargaining power. Key customers like Nike and Walmart influence pricing and product specs. The trend toward sustainability increases this power. Fast fashion demands low prices, affecting Unifi's margins.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | Higher bargaining power | Top 10 customers = 24% of sales |

| Sustainability Demand | Increased leverage | $40B sustainable textiles market |

| Price Sensitivity | Margin pressure | Cotton price volatility |

Rivalry Among Competitors

The textile industry is fiercely competitive, with many global yarn producers. Unifi faces competition in global and regional supply chains. The company competes with foreign and domestic polyester and nylon yarn producers.

Competitors are moving to specialty products, increasing competition where Unifi had better margins. This change requires constant innovation to stay ahead. Unifi's net sales in fiscal year 2023 were $638.9 million, down from $729.2 million the prior year, signaling challenges. The company must differentiate to maintain its market position. This shift impacts profitability and market share.

Unifi faces intense competition in the Americas. Major rivals for polyester yarns include Aquafil O'Mara and NanYa Plastics Corp. In the U.S., Sapona Manufacturing and McMichael Mills compete in nylon yarn sales. Globally, REPREVE battles brands like Far Eastern New Century. In 2024, the global textile market was valued at approximately $993 billion.

Market Share Dynamics

Unifi's competitive landscape shifted in fiscal 2024. The closure of a major competitor's polyester manufacturing facility in Mexico and a halt in textured yarn production in Brazil created opportunities for Unifi. Capitalizing on these shifts is critical for market share growth. These changes influence pricing and product availability. Success depends on responsiveness and strategic positioning.

- Market share gains were possible due to competitor closures in Mexico and Brazil.

- Unifi needed to actively exploit these market shifts.

- The impacts affected pricing and product availability.

- Responsiveness was key to capitalizing on the shifts.

Focus on Innovation and Sustainability

Competitive rivalry at Unifi is significantly influenced by innovation and sustainability efforts. Unifi's strong emphasis on recycled fibers and sustainable practices provides a competitive edge. To maintain this advantage, continuous investment in R&D and eco-friendly initiatives is crucial. The company's dedication to textile-to-textile recycling and reducing its environmental impact highlights this strategic direction.

- Unifi's REPREVE® fiber sales increased, reflecting market demand for sustainable products.

- The company invested in new recycling technologies to enhance its sustainability offerings.

- Competition includes other major textile manufacturers that are also investing in sustainable practices.

- Unifi's strategies involve expanding its sustainable product lines and reducing its carbon footprint.

Unifi navigates a competitive textile market, facing rivals like Aquafil O'Mara and NanYa. Shifts in the market, like competitor closures in Mexico and Brazil, create opportunities, as responsiveness is key to success. Innovation and sustainability efforts, including REPREVE fiber, are crucial for competitive advantage.

| Metric | Data (2024) | Notes |

|---|---|---|

| Global Textile Market Value | $993B | Approximate market size |

| Unifi's FY2023 Net Sales | $638.9M | Reflects market challenges |

| REPREVE Fiber Sales | Increased | Driven by sustainability |

SSubstitutes Threaten

The threat of substitutes for Unifi's fibers is moderate. Consumers can choose from various options, including natural fibers like cotton and wool, alongside other synthetic alternatives. For example, in 2024, the global cotton market was valued at approximately $25 billion. The selection hinges on factors like the intended use, performance needs, and overall cost. There's a growing trend toward sustainable materials; the eco-friendly textile market is expected to reach $9.8 billion by 2025.

Technological advancements pose a threat by potentially introducing new substitutes for existing fibers. Monitoring technological developments and investing in innovation are essential. Automation, AI, and 3D printing are changing textile manufacturing, enhancing efficiency. For example, in 2024, investments in textile tech increased by 15%. These innovations can lead to new materials.

Changing consumer preferences pose a threat to Unifi. Shifting demand towards slow fashion and customization affects mass-produced synthetic fiber demand. Adapting by offering customized, sustainable options is crucial. Consumers seek personalized, ethically-produced clothing, impacting traditional textile companies. In 2024, the sustainable fashion market is valued at $9.8 billion.

Cost Considerations

The cost-effectiveness of substitutes significantly impacts Unifi's competitive landscape. If alternative materials provide similar performance at a lower cost, the threat of substitution rises. For example, the price of virgin carbon fiber in 2024 averaged around $25 per pound, while recycled carbon fiber was available for approximately $10-$15 per pound. Balancing cost and performance is crucial for maintaining competitiveness. Recycled carbon fiber, like that used in some automotive components, offers a more eco-friendly and cost-effective solution.

- Cost Savings: Recycled carbon fiber can reduce material costs by up to 50%.

- Market Impact: The global recycled carbon fiber market was valued at $120 million in 2023.

- Performance: Recycled fiber retains 70-80% of the strength of virgin fiber.

- Sustainability: Reduces carbon footprint by up to 80% compared to virgin fiber.

Sustainability Initiatives

Growing environmental awareness fuels demand for sustainable alternatives, posing a threat to traditional synthetic fibers. Eco-friendly options are gaining popularity, creating substitutes for materials like those UNIFI produces. UNIFI's REPREVE and similar offerings aim to meet this demand, but they must compete with other sustainable materials. This shift impacts UNIFI's market position.

- Global recycled fiber market size was valued at USD 12.3 billion in 2023.

- The market is projected to reach USD 16.8 billion by 2028.

- REPREVE sales grew 11% in fiscal year 2024.

- Consumer preference for sustainable textiles is increasing.

The threat of substitutes to Unifi comes from a broad range of materials, including natural and synthetic options. Consumers' choices are affected by cost, performance, and growing eco-awareness. In 2024, sustainable textiles became a $9.8 billion market, pushing companies to adapt and offer eco-friendly alternatives.

| Factor | Impact on Unifi | Data (2024) |

|---|---|---|

| Cost of Alternatives | Lower costs increase substitution | Recycled carbon fiber at $10-$15/lb |

| Sustainability Trends | Demand for eco-friendly options | Global recycled fiber market: $12.3B (2023) |

| Technological Advancements | Emergence of new materials | Textile tech investments rose by 15% |

Entrants Threaten

The textile industry's high capital needs pose a significant threat. New entrants face substantial costs for factories, supply chains, and research. UNIFI, for instance, plans $10-12 million in capital projects for fiscal 2025. This financial barrier makes it difficult for new firms to compete effectively. These investments are essential for staying competitive.

Existing players like UNIFI benefit from economies of scale, posing a challenge for new entrants to compete on cost. UNIFI's vertically integrated model and strong market position offer a significant advantage. The company has direct operations in the United States, Colombia, El Salvador, and Brazil. In 2024, UNIFI's net sales were approximately $637 million.

Established brands like REPREVE, a significant player in UNIFI's portfolio, enjoy strong recognition and loyalty. New entrants face an uphill battle to capture market share against such established names. Building brand awareness and trust requires substantial marketing investments and time. REPREVE contributed 32% of UNIFI's 2024 revenue.

Technological Expertise

The textile industry demands significant technological expertise, especially in creating high-performance and sustainable fibers. New entrants face substantial R&D investments and the need for specialized knowledge to compete effectively. UNIFI, a leader in this space, has pioneered scaling the conversion of waste into sustainable products. This gives UNIFI a strong competitive advantage, making it difficult for newcomers to replicate their capabilities quickly.

- R&D spending in the textile industry is projected to increase, with a focus on sustainable materials.

- UNIFI's sustainable product sales have grown, indicating their market leadership.

- New entrants may struggle with the initial capital investment in specialized equipment.

- Intellectual property and patents are crucial in protecting technological advantages.

Regulatory and Trade Barriers

Regulatory and trade barriers can significantly deter new entrants in the market. Compliance with environmental regulations, for example, can be intricate and expensive, increasing the financial burden on new businesses. Trade policies also present challenges; the EU's Carbon Border Adjustment Mechanism (CBAM), which began its transition phase in October 2023, will enforce tariffs on imported goods based on their carbon content, potentially reshaping market dynamics. This could particularly impact industries with high carbon footprints, raising the bar for new competitors. These factors collectively raise the cost of entry and create hurdles for new businesses.

- CBAM transition phase started in October 2023.

- Environmental compliance costs can be substantial.

- Trade policies add complexity.

- These barriers increase the cost of entry.

New textile businesses face high capital requirements and established brand loyalty, hindering market entry. Economies of scale and technological expertise, like UNIFI's sustainable fibers, create further barriers. Regulatory compliance and trade policies, such as the EU's CBAM, increase costs.

| Factor | Impact | Example |

|---|---|---|

| High Capital Costs | Difficult entry | UNIFI's $10-12M capital projects |

| Brand Loyalty | Market share challenges | REPREVE’s 32% revenue share (2024) |

| Regulatory & Trade | Increased expenses | CBAM affecting carbon-intensive goods |

Porter's Five Forces Analysis Data Sources

The analysis uses financial statements, market reports, and competitor assessments, drawing from SEC filings and industry publications. It incorporates sales data, market trends.