Unifi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Unifi Bundle

What is included in the product

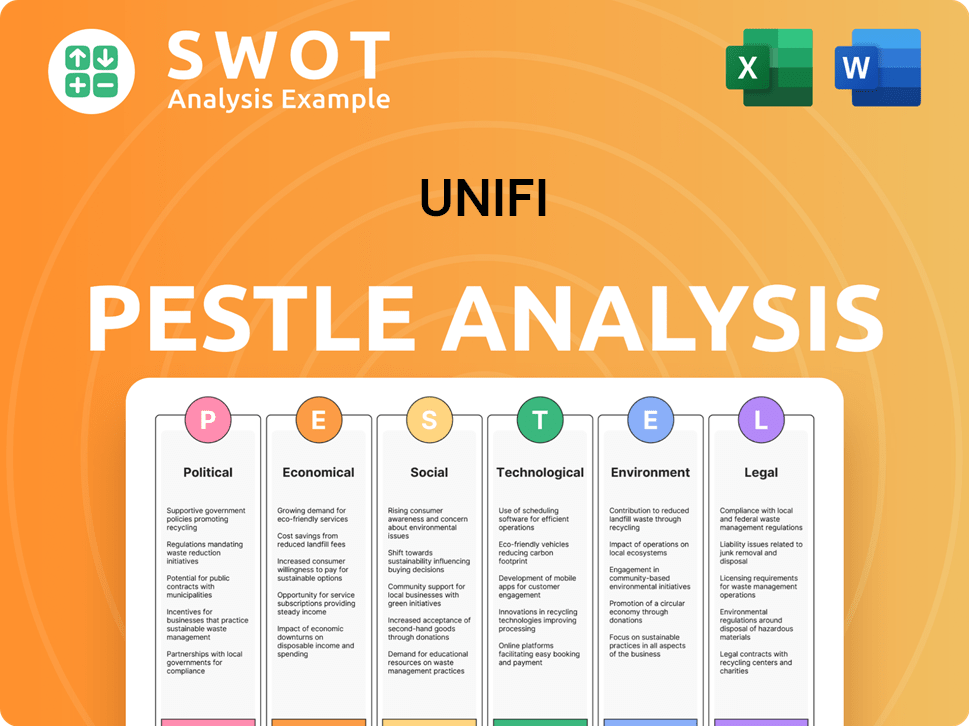

Unifi's PESTLE analyzes macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise version, easily used for quick review and accessible alignment for all stakeholders.

Full Version Awaits

Unifi PESTLE Analysis

The content of this Unifi PESTLE analysis preview mirrors the complete document you'll receive. Expect no differences; this is the finished product. Everything here, from formatting to the data, will be available immediately upon purchase.

PESTLE Analysis Template

Navigate Unifi's market landscape with our expertly crafted PESTLE Analysis. Uncover crucial political, economic, social, technological, legal, and environmental factors impacting the company. Grasp the complex external forces shaping Unifi's future and strategize effectively. Understand potential risks and discover new growth opportunities within the industry. Download the full report for in-depth insights and actionable recommendations to boost your business decisions.

Political factors

Changes in trade policies and tariffs directly affect Unifi's operational costs and market competitiveness. The company, with its presence in the U.S., Colombia, El Salvador, and Brazil, faces diverse trade landscapes. For example, the U.S. imposed tariffs on certain textile imports, potentially raising Unifi's raw material costs. Evolving tariff and trade talks significantly influence Unifi's business and financial projections. In 2024, global trade uncertainty continues to affect supply chains.

Unifi faces governmental rules across regions, impacting operations. Environmental, labor, and product safety laws demand compliance. These can alter production and costs. Tax regulations and their interpretations also present challenges. For instance, in 2024, changes in environmental standards in the EU increased compliance spending by 7%.

Political stability is crucial for Unifi's operations across the US, Colombia, El Salvador, Brazil, and Asia. Unrest or government changes may affect Unifi's facilities. For example, in 2024, political risk scores varied widely across these regions. Brazil's score was around 60, while El Salvador's was about 40, reflecting differing stability levels.

Government Support for Recycling and Sustainability

Government backing for recycling and sustainability directly affects Unifi. Initiatives like tax credits for recycled materials boost REPREVE®. Policies favoring eco-friendly manufacturing can improve Unifi's position and profits. For example, the US Inflation Reduction Act includes incentives for sustainable practices. These measures increase demand for recycled products.

- US Inflation Reduction Act provides tax credits.

- EU's Green Deal promotes circular economy.

- China's policies support green manufacturing.

International Relations and Geopolitical Events

International relations and geopolitical events significantly impact Unifi. Uncertainties stemming from global political dynamics can disrupt supply chains and shift market demand for textiles. Unifi, with its global presence, is exposed to these risks. For example, trade tensions between the U.S. and China, which is a major textile market, could affect Unifi's sales.

- Increased geopolitical instability can lead to higher raw material costs, impacting profitability.

- Changes in trade policies, like tariffs, directly influence Unifi's ability to operate in different regions.

- Political unrest in key markets can disrupt production and distribution.

- Geopolitical events can create currency fluctuations, affecting financial results.

Political factors, including trade policies and tariffs, substantially impact Unifi’s operations, costs, and market competitiveness. Government regulations, such as environmental and labor laws, also affect Unifi's compliance expenses, which in 2024 rose 7% in the EU. The US Inflation Reduction Act and the EU's Green Deal offer incentives for sustainable practices, enhancing Unifi's market position.

| Factor | Impact | Example (2024) |

|---|---|---|

| Trade Policies | Affects costs and market access. | US tariffs on textiles. |

| Regulations | Compliance costs and operational changes. | EU environmental standards. |

| Political Stability | Influences facility security and production. | Political risk scores vary (Brazil ~60, El Salvador ~40). |

Economic factors

Global economic conditions are crucial for Unifi. Domestic and international economic health directly affects textile demand. Recessions or shifts in consumer spending can curb sales. For instance, in 2023, global textile exports faced headwinds. Consumer spending is projected to grow modestly in 2024-2025.

Raw material costs, like plastic bottles and virgin polyester, are key for Unifi. Price swings directly affect their production costs. In Q1 2024, raw material costs rose, impacting margins. Limited sources for materials pose a supply risk. Fluctuations require careful financial planning.

Unifi faces currency exchange risks due to its global presence, influencing costs and revenues. For example, in 2024, the USD/EUR exchange rate varied significantly. High inflation rates can elevate Unifi's operational expenses. The U.S. inflation rate was around 3.1% in January 2024, impacting consumer spending. These factors require careful financial planning.

Competition and Pricing Pressures

The textile industry is fiercely competitive, involving both domestic and international players. Unifi encounters pricing and volume pressures due to this competition, which impacts profitability and market share. Low-cost producers present a significant challenge, affecting Unifi's ability to maintain margins. The global textile market was valued at $993.6 billion in 2023 and is projected to reach $1.2 trillion by 2029.

- Competition from low-cost producers can erode Unifi's profit margins.

- Price wars can decrease sales revenue, impacting Unifi's financial performance.

- Unifi must innovate to differentiate and maintain market share.

Financial Condition of Customers

The financial well-being of Unifi's customers significantly influences its economic standing. These customers, including yarn manufacturers and major brands, drive demand for Unifi's products. Customer financial instability can curtail purchases, impacting Unifi's sales and profitability. For example, a downturn in the apparel industry could reduce demand.

- In 2024, the global textile market was valued at approximately $1.08 trillion.

- Unifi's revenue for fiscal year 2024 was $628.3 million.

- A decrease in consumer spending could negatively affect Unifi's customer's ability to purchase.

Unifi's performance hinges on global economics, which affects demand. Textile exports faced challenges in 2023, yet consumer spending is modestly growing in 2024-2025. Fluctuating raw material costs like those for polyester (with prices fluctuating since Q1 2024), and exchange rates add financial risks.

| Factor | Impact | Data |

|---|---|---|

| Global Economy | Impacts Textile Demand | Global textile market projected to $1.2T by 2029 |

| Raw Materials | Cost Swings | Polyester costs impacted margins in Q1 2024. |

| Currency | Exchange Risk | USD/EUR volatility in 2024. |

Sociological factors

Consumer preferences and fashion trends significantly impact Unifi. There's a shift towards sustainable products. Unifi's REPREVE® brand meets this demand. For example, the global market for sustainable textiles is projected to reach $34.8 billion by 2025. This offers Unifi major growth opportunities.

Growing consumer and brand focus on environmental sustainability boosts demand for Unifi's REPREVE® recycled products. A 2024 study revealed that 65% of consumers favor sustainable brands. This preference drives market opportunity for Unifi. In 2024, the sustainable apparel market reached $30 billion, showing significant growth.

Unifi's workforce well-being, safety, and engagement are key sociological factors. Positive employee relations, a safe work environment, and development opportunities boost productivity. Recent restructuring, including facility closures, has impacted employees. In 2024, Unifi's employee count was approximately 2,000, reflecting changes. Employee satisfaction scores and safety metrics are crucial for operational efficiency and brand perception.

Community Engagement and Social Responsibility

Unifi's community engagement is crucial. Their social responsibility initiatives boost reputation, aligning with ESG goals. A 2024 report showed Unifi invested $10M in local community projects. These efforts build goodwill, supporting sustainable development.

- Investment in community projects reached $10M in 2024.

- ESG commitments are a key driver of Unifi's community engagement.

Public Perception and Brand Reputation

Unifi's brand reputation and public perception are crucial for success. The perception of its brands, like REPREVE®, significantly impacts consumer choices. Positive brand associations, especially with sustainability, drive sales and customer loyalty. Negative publicity, however, can erode trust and negatively affect sales figures. In 2024, the global market for sustainable textiles, which includes REPREVE®, was valued at approximately $8.5 billion, demonstrating the importance of a strong brand image.

- Consumer trust is vital for brand success.

- Sustainability efforts are increasingly important to consumers.

- Negative publicity quickly erodes brand value and trust.

- Positive brand image drives purchasing decisions.

Unifi faces impacts from societal trends, like a strong focus on brand reputation and consumer trust. Sustainability is a major factor, reflected in initiatives like investing $10M in community projects in 2024. Unifi’s workforce well-being, including safety, drives efficiency, underscored by its approximately 2,000 employees in 2024.

| Factor | Impact | Data (2024) |

|---|---|---|

| Brand Perception | Influences consumer decisions | Global sustainable textiles market: $8.5B |

| Sustainability | Boosts demand for REPREVE® | Community investment: $10M |

| Workforce | Affects productivity | Approx. 2,000 employees |

Technological factors

Unifi's success depends on its proprietary recycling tech, converting waste into fibers. Investing in advanced methods, like textile-to-textile recycling, is key. This boosts efficiency and expands product lines. In Q1 2024, Unifi reported a 10% increase in sales of recycled products. This helps maintain a competitive advantage.

Technological improvements in manufacturing are vital for Unifi. Advanced texturing boosts production, cuts costs, and raises yarn quality. New tech investments can save energy. In 2024, Unifi's capital expenditures were $36.6 million, focusing on efficiency.

Unifi's product innovation in performance fibers is crucial. They create fibers with features like moisture control and stretch. Ongoing R&D helps meet changing consumer demands. In Q1 2024, Unifi reported a 6.3% increase in sales volume for value-added products. This growth highlights the importance of technological advancements.

Traceability and Verification Technologies

Traceability and verification technologies are critical for Unifi's sustainability efforts. FiberPrint® and U-TRUST® systems enhance transparency. These technologies ensure the authenticity of recycled content, building consumer trust. This is vital as the market demands verifiable sustainability. In 2024, the global market for traceability solutions was valued at $18.5 billion, projected to reach $38.2 billion by 2029.

Digitalization and Automation

Digitalization and automation are transforming Unifi's operations. Implementing these technologies can streamline manufacturing and supply chains. This leads to reduced errors and more efficient processes. Staying updated with tech trends is key to Unifi's operational success.

- In 2024, automation spending in manufacturing is projected to reach $178 billion.

- Supply chain automation is expected to grow by 12% annually through 2025.

- Companies using automation report up to 30% increase in efficiency.

Technological factors greatly influence Unifi. Their proprietary tech, like recycling processes, directly impacts efficiency. Innovation in fibers and digital automation are vital, ensuring competitiveness.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| Recycling Tech | Efficiency & Product Expansion | Q1 2024: 10% sales increase for recycled products |

| Manufacturing | Cost Reduction & Quality | 2024 CapEx: $36.6M on efficiency |

| Digitalization/Automation | Streamlined operations | 2024 Automation spending in manufacturing projected at $178B. |

Legal factors

Unifi faces legal obligations to adhere to environmental regulations concerning emissions, water discharge, waste, and hazardous substances across its operational sites. Compliance with these laws, including goals like zero non-compliant water discharges, is a legal mandate. For example, companies failing to comply with environmental regulations can face significant fines. In 2024, penalties for environmental violations averaged $75,000 per instance.

Unifi must comply with product safety and labeling laws to ensure consumer safety and accurate product representation. These laws cover the materials used in their products, including recycled content claims. For example, the U.S. Federal Trade Commission (FTC) requires accurate labeling of textile fiber content. In 2024, there were 1,200+ FTC investigations related to product labeling. This is crucial for maintaining consumer trust and avoiding legal issues.

Unifi must adhere to labor laws and employment regulations across its global operations. In 2024, labor law compliance costs increased by 7% due to updated regulations in key markets. Failure to comply could lead to significant financial penalties and reputational damage. Ongoing monitoring and adaptation to changing labor standards are critical for Unifi's legal and operational success.

Intellectual Property Protection

Intellectual property protection is vital for Unifi. Securing patents and trademarks safeguards its innovations, including REPREVE® and recycling methods. This legal shield helps Unifi maintain its market edge by deterring imitators. In 2024, Unifi spent $2.5 million on IP protection. This investment is crucial for long-term competitiveness.

- Patents: Protects specific inventions and processes.

- Trademarks: Shields brand names and logos.

- Copyrights: Covers original works of authorship.

- Trade Secrets: Confidential information providing a competitive edge.

International Trade Laws and Agreements

Unifi, as a global entity, must adhere to international trade laws and agreements to facilitate its import and export operations. Compliance with customs regulations is crucial for smooth cross-border transactions. Changes in these laws, such as tariffs or trade sanctions, can significantly affect Unifi's supply chains and profitability. The World Trade Organization (WTO) reports that global trade grew by 2.6% in 2024, indicating the dynamic nature of international trade.

- Tariff rates on textiles and apparel, key sectors for Unifi, vary significantly depending on the trade agreements in place.

- Changes in trade policies, such as the US-China trade war, have caused volatility in global supply chains.

- The enforcement of environmental and labor standards in trade agreements is becoming increasingly important.

Unifi must strictly follow environmental, product safety, labor, intellectual property, and international trade laws. Non-compliance risks penalties, for example, with average environmental violation fines at $75,000 in 2024. IP protection spending was $2.5M in 2024. Adaptations to evolving global trade rules are essential.

| Legal Factor | Compliance Area | Impact |

|---|---|---|

| Environmental Regulations | Emissions, waste | Fines, operational disruptions |

| Product Safety | Labeling, materials | Legal issues, consumer trust |

| Labor Laws | Employment standards | Penalties, reputational harm |

Environmental factors

Unifi's use of recycled feedstock hinges on the availability of materials like post-consumer plastic bottles and textile waste. The efficiency of collection and sorting systems directly affects their supply chain. In 2024, the global recycling rate for plastics remained low, around 9%, highlighting a key challenge. Unifi's success is closely tied to improving these rates.

Unifi's manufacturing heavily relies on energy and water. Reducing consumption is key for their environmental impact and costs. They've set goals for cutting greenhouse gas emissions and water use. In 2024, Unifi reported progress on these targets, with specific reductions. For example, they aim to lower water usage by a certain percentage by 2025.

Waste management is a key environmental factor for Unifi. The company actively reduces waste in its manufacturing processes. They're expanding textile-to-textile recycling to promote a circular economy. In 2024, Unifi reported a 10% reduction in waste sent to landfills. This initiative aligns with sustainability goals.

Greenhouse Gas Emissions and Climate Change

Unifi faces environmental scrutiny due to its greenhouse gas emissions, a key environmental factor. The company's operations contribute to these emissions, prompting reduction targets. Climate change impacts Unifi's facilities and supply chains. Extreme weather events pose risks.

- Unifi reported Scope 1 and 2 emissions.

- Climate change impacts include supply chain disruptions.

- The company aims for emissions reductions.

- Extreme weather can affect production.

Environmental Certifications and Standards

Unifi's commitment to environmental sustainability is demonstrated through adherence to certifications and standards. This includes following guidelines from organizations like GRI and SASB. Life cycle assessments help validate the environmental benefits of products such as REPREVE®. These efforts provide credible data to stakeholders, showcasing Unifi's dedication to eco-friendly practices.

- GRI Standards: Unifi likely uses GRI Standards for sustainability reporting.

- SASB Standards: SASB standards are also probable for industry-specific environmental disclosures.

- REPREVE®: Its use helps Unifi meet environmental goals.

- Lifecycle Assessments: Used to quantify environmental impacts.

Environmental factors for Unifi include resource use like energy and water. Emissions reductions are critical; they set targets and report progress. Their efforts align with industry standards.

| Environmental Aspect | Details | 2024/2025 Data |

|---|---|---|

| Recycling | Reliance on recycled feedstocks; includes bottles and textile waste. | Global plastic recycling rates stayed around 9% (2024), Unifi aims to increase its use of recycled materials. |

| Energy & Water | Significant use in manufacturing and the environmental and financial benefits of reduced usage | Unifi aims to decrease greenhouse gas emissions, and water usage, by specific percentages by the end of 2025, reporting progress in 2024. |

| Waste Management | Strategies to minimize waste and boost circularity. | In 2024, Unifi reported a 10% waste reduction to landfills and aims to expand textile recycling by 2025. |

PESTLE Analysis Data Sources

Our Unifi PESTLE Analysis integrates data from government agencies, financial institutions, and tech industry reports.