Union Pacific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Union Pacific Bundle

What is included in the product

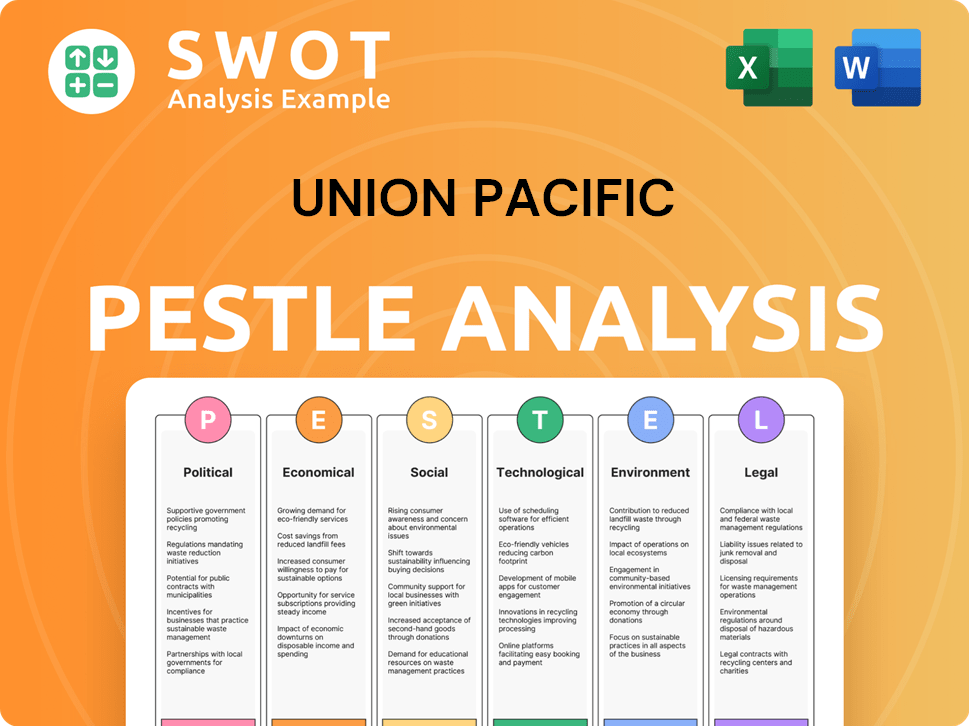

Examines the macro-environmental factors impacting Union Pacific using a PESTLE framework across six areas.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Union Pacific PESTLE Analysis

What you're previewing here is the exact Union Pacific PESTLE analysis document. The file you see contains detailed political, economic, social, technological, legal, and environmental factors. It's fully formatted, structured, and ready for immediate use. You'll get this file instantly after purchase. There are no hidden surprises!

PESTLE Analysis Template

Discover the external forces shaping Union Pacific's trajectory. Our detailed PESTLE analysis uncovers political, economic, social, technological, legal, and environmental factors. Understand the challenges and opportunities ahead, from regulatory shifts to market dynamics. This concise overview is perfect for quick insights, but the full analysis offers a deeper dive. Download the complete PESTLE report now to empower your strategic decisions!

Political factors

Government regulations are crucial for Union Pacific, affecting safety, environment, and labor. The company engages in policy discussions, keeping tabs on changes. For example, in 2024, the Surface Transportation Board (STB) continued to oversee the industry. Union Pacific spent $1.7 billion on capital expenditures in Q1 2024.

Union Pacific closely monitors trade policies and tariffs, as these can significantly affect its business. For example, in 2024, changes in tariffs on steel impacted the types of goods they transported. The company continually assesses potential shifts in trade regulations to anticipate impacts on freight volumes. In Q1 2024, UP reported a 4% decrease in revenue due to lower volumes, partly influenced by trade dynamics.

Political stability is vital for Union Pacific's operations. Political instability can disrupt supply chains and increase operational costs. For example, regulatory changes in 2024 impacted rail transport. These changes necessitate robust risk management strategies. Union Pacific must navigate these challenges for sustained performance.

Infrastructure Investment

Government infrastructure investments, including rail lines and intermodal facilities, can significantly boost Union Pacific's operational efficiency and network capacity. These investments often align with and enhance Union Pacific's own capital expenditure strategies, creating a synergistic effect. For example, in 2024, the U.S. government allocated billions to improve rail infrastructure through various programs. These improvements directly benefit Union Pacific’s ability to handle increased freight volumes and reduce transportation costs.

- Increased Freight Volumes: Government spending enables higher capacity.

- Cost Reduction: Better infrastructure lowers operational expenses.

- Strategic Alignment: Capital expenditures complement federal initiatives.

Lobbying and Political Engagement

Union Pacific actively lobbies to shape policies affecting the rail industry. In 2023, the company spent $2.66 million on lobbying efforts. They comply with all political participation regulations, as evidenced by their adherence to federal and state laws. This engagement aims to advocate for favorable legislation and regulations.

- 2023 Lobbying Spending: $2.66 million.

- Compliance: Adheres to all relevant regulations.

Political factors are critical for Union Pacific, impacting regulations, trade, and stability. Infrastructure investments enhance operational efficiency, aligning with the company's strategies. Union Pacific actively lobbies to influence industry-related policies.

| Aspect | Details | Impact |

|---|---|---|

| Regulations | STB oversight, safety, environment, labor | Compliance costs, operational constraints |

| Trade | Tariffs, policy shifts affecting volumes | Revenue fluctuations (Q1 2024 -4%) |

| Lobbying | $2.66M in 2023, policy influence | Favorable legislation, regulation shaping |

Economic factors

Union Pacific's performance is closely linked to economic growth. In 2024, U.S. GDP growth was around 2.5%, influencing freight volumes. A recession, like the 2020 downturn, can significantly decrease demand and revenue. During economic expansions, like the period from 2021-2023, Union Pacific often sees increased shipping activity. Economic forecasts for 2025 suggest moderate growth, which could positively affect the company.

Inflation directly influences Union Pacific's operational expenses, specifically fuel and labor costs. Rising interest rates can elevate borrowing costs for capital expenditures, impacting investment decisions. In Q1 2024, Union Pacific reported a 2.3% increase in operating expenses. The company is actively managing these financial uncertainties.

Fuel prices are a critical economic factor for Union Pacific. Rising fuel costs increase operating expenses, impacting profitability. In Q1 2024, fuel expenses were $742 million. Lower fuel prices can reduce fuel surcharge revenue. While productivity gains can offset some effects, price volatility remains a key concern.

Industry-Specific Demand

Union Pacific's performance is heavily tied to the demand for goods it transports. For example, in 2024, automotive shipments increased, reflecting strong consumer demand and production. However, coal transport decreased due to a shift towards cleaner energy sources. The company's intermodal business also showed growth, driven by e-commerce and international trade. These shifts demonstrate how industry-specific demands directly impact Union Pacific's revenue streams.

- Automotive sector saw growth in 2024.

- Coal transport has declined due to energy transition.

- Intermodal business is expanding.

Competitive Landscape

Union Pacific faces competition within the transportation sector, primarily from other railroads and the trucking industry. Trucking companies often exert pricing pressure, especially in intermodal transport, potentially delaying recovery in this area. In 2024, the company's operating ratio was 60.9%, reflecting efficiency amid competition. The trucking industry's revenue in 2024 reached approximately $800 billion.

- Operating Ratio (2024): 60.9%

- Trucking Industry Revenue (2024): ~$800 billion

Economic factors profoundly influence Union Pacific's performance. GDP growth and forecasts directly affect freight volumes. Inflation impacts operating costs and capital expenditures.

Fuel prices are a significant economic variable. The demand for goods, such as automotive shipments, and intermodal business growth in 2024 shows how key these dynamics are.

The trucking industry also remains a considerable source of competition. These economic influences are pivotal for Union Pacific's financial outcomes.

| Economic Factor | Impact on Union Pacific | 2024/2025 Data/Forecast |

|---|---|---|

| GDP Growth | Affects freight volumes | 2024: ~2.5% growth, 2025: Moderate growth forecast |

| Inflation | Increases operating expenses | Q1 2024: Operating expenses up 2.3% |

| Fuel Prices | Affects profitability | Q1 2024: Fuel expenses $742M |

Sociological factors

Union Pacific's success hinges on its workforce and labor relations. Recent labor agreements include wage increases and enhanced benefits, impacting operational costs. As of Q1 2024, UP's labor costs were a significant portion of operating expenses. The company employs roughly 34,000 people. Employee satisfaction and productivity are crucial for efficient operations.

Union Pacific prioritizes safety, impacting employees and communities. The company invests in training and tech to improve safety metrics. In 2024, UP's train accident rate was 0.98 per million train miles. This demonstrates a commitment to safety. UP's safety culture is crucial for its reputation and operational efficiency.

Union Pacific's activities affect communities along its rail lines. The company aims to be a responsible corporate citizen. They support local projects and address environmental issues. For example, in 2024, UP invested $18 million in community programs. This included safety and education initiatives.

Diversity and Inclusion

Union Pacific emphasizes diversity and inclusion, aiming for an environment where all employees feel valued and have opportunities to thrive. The company's commitment to a diverse workforce is reflected in its initiatives and programs. In 2023, Union Pacific's workforce comprised 33.8% racial and ethnic minorities, with women making up 25.4% of the workforce. These efforts support a more inclusive workplace.

- 33.8% of Union Pacific's workforce was comprised of racial and ethnic minorities in 2023.

- 25.4% of Union Pacific's workforce was comprised of women in 2023.

Public Perception and Reputation

Public perception significantly impacts Union Pacific. The railroad industry faces scrutiny regarding environmental impact and safety. Union Pacific aims to improve its image through sustainability initiatives and safety records. Positive perception helps attract customers and reduces regulatory burdens. In 2024, Union Pacific invested $1.9 billion in infrastructure, enhancing safety and operational efficiency.

- Customer satisfaction scores improved by 5% in 2024.

- Union Pacific reduced its carbon emissions by 15% from 2018 to 2024.

- The company's safety record shows a 10% decrease in reportable incidents year-over-year.

Sociological factors influence Union Pacific's labor force, community relations, and public perception. The company prioritizes diversity, reporting 33.8% racial/ethnic minorities and 25.4% women in its 2023 workforce. Public scrutiny of environmental impact and safety necessitates ongoing sustainability efforts, like reducing emissions by 15% from 2018-2024.

| Aspect | Detail |

|---|---|

| Workforce Diversity | 33.8% racial/ethnic minorities, 25.4% women (2023) |

| Emissions Reduction | 15% reduction from 2018 to 2024 |

| Community Investment | $18 million in community programs (2024) |

Technological factors

Union Pacific is actively embracing technology to enhance its operations. They are modernizing their systems and integrating advanced technologies. This includes AI and digital twins to boost efficiency. In Q1 2024, UP's operating ratio was 60.9%, improved by tech investments.

Automation is transforming Union Pacific's operations, particularly in signal systems and train management, boosting efficiency and safety. For instance, the company is actively seeking regulatory approvals to implement advanced signal system modifications. In 2024, Union Pacific invested $3.7 billion in infrastructure, including automation technologies. These investments aim to modernize operations and improve safety protocols.

Union Pacific leverages data analytics and AI to enhance decision-making. This includes predicting shipping trends and optimizing network efficiency. AI applications span safety protocols, operational improvements, and strategic planning. In 2024, Union Pacific invested $2.3 billion in technology. The company uses predictive maintenance to reduce delays.

Precision Scheduled Railroading (PSR)

Precision Scheduled Railroading (PSR) at Union Pacific leverages technology and data to boost efficiency in network operations, asset use, and labor productivity. The company has been actively using and improving its PSR system. This technological shift is crucial for managing its extensive rail network. The focus is on optimizing operations through data-driven decisions.

- Union Pacific's operating ratio improved to 60.8% in 2023, indicating efficiency gains.

- Capital expenditures in 2023 were $3.74 billion, which includes tech upgrades for PSR.

- PSR aims to reduce train dwell time and improve overall network velocity.

Locomotive Technology

Union Pacific's technological landscape is significantly shaped by locomotive advancements. The company is actively involved in developing and testing both battery-electric and hybrid locomotives to boost fuel efficiency and cut emissions. These initiatives are a key part of Union Pacific's sustainability goals. As of 2024, Union Pacific has invested heavily in fuel efficiency.

- Union Pacific aims to reduce its Scope 1 and 2 greenhouse gas emissions by 26% by 2030 from a 2018 baseline.

- In 2024, Union Pacific's fuel efficiency improved, consuming less fuel per gross ton-mile.

- Testing of alternative fuel technologies, including biofuels, is ongoing.

Union Pacific heavily invests in technology, with $2.3 billion in 2024 alone, boosting efficiency and safety via automation and AI. Digitalization helps optimize network operations, including PSR. They are also advancing with locomotive technology, including hybrid models.

| Technological Aspect | Details | Data (2024/2025) |

|---|---|---|

| Automation | Signal systems, train management | $3.7B infrastructure investment, focus on regulatory approvals. |

| Data Analytics/AI | Predictive maintenance, shipping trends | $2.3B tech investment in 2024, with operating ratio improvement. |

| Locomotive Advancements | Hybrid and battery-electric | Ongoing tests and development focused on sustainability goals. |

Legal factors

Union Pacific faces extensive regulatory compliance across multiple levels of government. This compliance covers safety, environmental protection, and labor practices. In 2024, the company spent approximately $1.1 billion on safety and compliance initiatives. These regulations can significantly impact operational costs and strategic decisions.

Union Pacific faces legal constraints due to labor laws and agreements with unions. The company finalized a five-year labor agreement, impacting workforce management. In 2024, labor costs represented a significant portion of operating expenses. The new agreement likely influences long-term financial planning and operational strategies.

Union Pacific faces environmental regulations concerning emissions, waste, and habitat. Compliance demands substantial investment in cleaner technologies. In 2024, the company allocated $1.2 billion for environmental initiatives. They aim to reduce greenhouse gas emissions by 26% by 2030 compared to 2018 levels.

Legal Disputes and Litigation

Union Pacific, like other major companies, faces legal challenges that can affect its finances and image. These can range from environmental issues to contract disputes. For instance, in 2024, the company might have faced lawsuits related to train derailments or labor practices. Such legal battles can lead to significant expenses and reputational damage.

- Environmental lawsuits can result in substantial fines and remediation costs.

- Contract disputes with suppliers or customers can lead to financial losses.

- Litigation related to safety incidents can impact insurance premiums and legal expenses.

- Regulatory changes can trigger legal challenges to compliance.

Antitrust and Competition Law

Antitrust laws are crucial for Union Pacific, influencing its operations and any mergers. The Surface Transportation Board (STB) plays a key role in regulating competition within the rail industry. Recent legal actions and regulatory changes continue to shape the competitive landscape. These factors impact Union Pacific's strategic decisions and market positioning.

- STB has been reviewing rail merger rules, potentially affecting Union Pacific's growth strategies.

- Antitrust scrutiny may impact pricing strategies and service offerings.

Legal factors significantly shape Union Pacific's operations. Compliance with regulations cost $1.1B in 2024. Labor agreements impact workforce and expenses. Antitrust laws and litigation influence strategies and financial outcomes.

| Legal Aspect | Impact | Financial Implication (2024) |

|---|---|---|

| Regulatory Compliance | Safety, Environment, Labor | $1.1B spent on compliance initiatives |

| Labor Laws & Agreements | Workforce Management, Costs | Significant portion of operating expenses |

| Environmental Regulations | Emissions, Waste | $1.2B allocated for environmental initiatives |

Environmental factors

Climate change is a key environmental factor for Union Pacific. The company aims to cut greenhouse gas emissions. Union Pacific has science-based emission reduction goals. In 2023, the company reduced Scope 1 and 2 GHG emissions by 10.8% from 2019. It invests in low-carbon fuels.

Union Pacific prioritizes fuel efficiency for environmental and economic reasons. The company invests in technologies and strategies to cut fuel consumption. In 2024, they aimed to reduce fuel consumption intensity. This helps lower emissions and operating costs. These efforts are crucial for sustainable operations.

Union Pacific actively enhances its environmental management systems, aiming to reduce its impact. In 2024, the company invested $188 million in environmental projects. This includes initiatives to cut emissions and manage waste effectively. These efforts align with stricter environmental regulations.

Natural Disasters and Extreme Weather

Union Pacific faces operational disruptions from natural disasters and extreme weather, which climate change may worsen. The company includes climate change's physical risks in its risk management strategies. Severe weather events, such as floods and wildfires, can damage infrastructure and halt operations. These events can lead to increased maintenance costs and service delays.

- In 2023, Union Pacific experienced significant service disruptions due to extreme weather events.

- The company invested $1.6 billion in infrastructure maintenance in 2024.

- Union Pacific is assessing climate-related risks to its assets and operations through 2025.

Biodiversity and Land Use

Union Pacific's vast rail network spans diverse ecosystems, requiring careful consideration of biodiversity and land use. The company must assess how its operations and any expansion projects affect these sensitive areas. In 2024, the U.S. freight railroads, including Union Pacific, handled over 20 million carloads, highlighting the scale of their environmental footprint. Environmental regulations add to the costs.

- Railroads face scrutiny for habitat disruption.

- Land use planning is crucial for new infrastructure.

- Compliance with environmental regulations is essential.

- Union Pacific invests in sustainable land management.

Union Pacific actively combats climate change by targeting greenhouse gas emissions. In 2023, it cut Scope 1 and 2 GHG emissions by 10.8% from 2019. The company focuses on fuel efficiency and environmental projects, investing $188 million in 2024. Extreme weather and biodiversity impacts are significant concerns.

| Environmental Aspect | Union Pacific Initiatives | Data/Statistics |

|---|---|---|

| Emission Reduction | Low-carbon fuels, fuel efficiency | 10.8% reduction in Scope 1&2 GHG by 2023 from 2019 base year |

| Fuel Efficiency | Investment in technologies & strategies | Targeted reduction in fuel consumption intensity in 2024 |

| Environmental Investments | Cutting emissions, waste management | $188 million invested in environmental projects in 2024 |

PESTLE Analysis Data Sources

Union Pacific's PESTLE relies on governmental stats, financial reports, and industry publications. Analysis includes regulatory updates, economic indicators, and environmental impact studies.