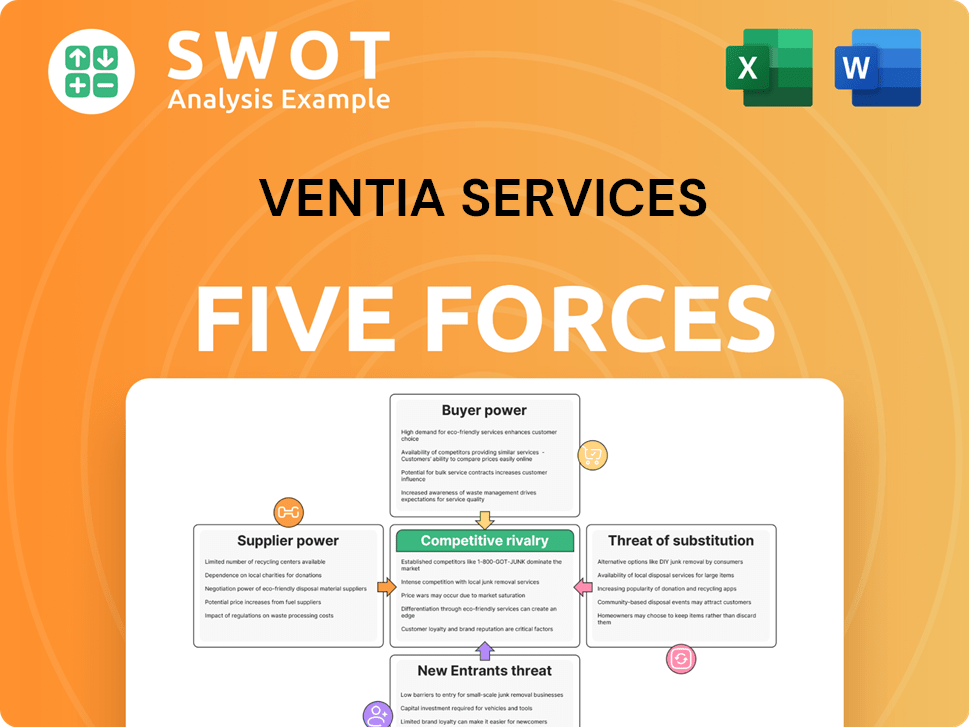

Ventia Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ventia Services Bundle

What is included in the product

Tailored exclusively for Ventia Services, analyzing its position within its competitive landscape.

Customize pressure levels based on new data or evolving market trends.

Same Document Delivered

Ventia Services Porter's Five Forces Analysis

This preview illustrates Ventia Services' Porter's Five Forces analysis you'll instantly receive post-purchase. It examines industry rivalry, supplier power, and buyer power. We also delve into the threats of new entrants and substitutes within the industry. The document provides a complete, ready-to-use assessment, exactly as shown.

Porter's Five Forces Analysis Template

Ventia Services faces moderate buyer power due to concentrated customer segments. Supplier power is relatively low, with diverse service providers. The threat of new entrants is moderate, requiring significant capital and expertise. Substitute threats are limited, focusing on niche alternatives. Competitive rivalry is intense, driven by established players.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ventia Services’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ventia's reliance on few key suppliers for specialized gear or services boosts supplier power. These suppliers, controlling critical inputs, can set prices and terms. In 2024, supply chain disruptions impacted many firms. Ventia may need to diversify its supply chain, as 2023 showed a 10% rise in input costs.

Ventia's specialized projects demand unique supplier capabilities, potentially increasing supplier power. Limited alternatives give suppliers more control. For example, in 2024, Ventia's infrastructure projects in Australia showed how critical specialized suppliers are. Ventia may need to develop alternative supplier relationships to mitigate risks.

Supplier costs significantly influence Ventia's profitability. Rising costs from suppliers, like materials, decrease profit margins. Suppliers of essential goods can increase prices if Ventia lacks alternatives. For instance, Ventia's cost of services rose in 2024 due to supply chain issues. Therefore, monitoring supplier costs and negotiating terms are vital for Ventia.

Supplier concentration in specific regions

If Ventia's suppliers are clustered geographically, their bargaining power increases. Disruptions, like those from the 2024 Australian floods impacting infrastructure, can limit supply. To mitigate this, Ventia should diversify its supplier base across regions. This reduces vulnerability to localized issues.

- Geographic concentration boosts supplier influence.

- Regional disruptions, as seen in 2024, impact supply.

- Ventia needs a diverse supplier network.

- Mitigation reduces vulnerability to localized events.

Potential for forward integration by suppliers

Suppliers possess the potential to integrate forward, directly competing with Ventia in the infrastructure services market. This poses a threat if suppliers have the capabilities to offer services themselves, potentially cutting out Ventia. Ventia must focus on building strong supplier relationships and providing unique value. For example, in 2024, the construction industry saw a 6% increase in materials costs, highlighting supplier leverage.

- Forward integration by suppliers can increase competition.

- Suppliers may bypass Ventia if they have the resources.

- Ventia must offer unique value to maintain relationships.

- Rising materials costs in 2024 show supplier power.

Ventia faces supplier power challenges from specialized or geographically clustered suppliers. Supply chain issues and rising costs, like the 6% increase in construction materials in 2024, impact margins. Diversifying and building strong supplier relationships are key for Ventia's profitability and market position.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | Higher bargaining power | Australian floods impacted infrastructure projects |

| Cost Influence | Reduced profit margins | 6% rise in materials costs in construction |

| Strategic Response | Diversification & Strong relationships | Focus on unique value |

Customers Bargaining Power

Ventia Services benefits from a large and diverse client base across sectors like transport and defense, which limits the bargaining power of any single client. In 2024, no single client accounted for a significant portion of Ventia's revenue, reducing its vulnerability to client demands. This strategy is essential for Ventia. A diversified portfolio, as of late 2024, includes contracts in multiple geographic regions, enhancing stability.

Ventia's long-term contracts offer stability, reducing immediate customer negotiation pressure. These contracts often have pre-agreed terms, limiting frequent renegotiations. For example, in 2023, approximately 70% of Ventia's revenue came from long-term contracts. Renewal periods are crucial, as they allow customers to reassess and potentially seek better terms.

Ventia's clients face high switching costs due to complex infrastructure projects. Changing providers is disruptive and expensive, providing Ventia with leverage. Consistent performance and reliability strengthen client relationships. In 2024, Ventia reported a revenue of $7.2 billion, reflecting its strong client base. These factors help maintain client relationships.

Client dependence on essential services

Ventia's clients, including government and utility companies, are highly dependent on its essential services like water and energy infrastructure. This dependency significantly reduces their bargaining power. Switching providers is complex and costly, especially for critical services. Ventia's 2024 revenue reached $6.6 billion, demonstrating strong client reliance.

- Critical services: Ventia's services are vital for daily operations.

- Switching costs: High costs and complexities limit client alternatives.

- Revenue: Reflects strong client dependence on Ventia.

Government and regulatory influence

Government entities, a significant customer base for Ventia Services, are subject to regulatory oversight, which influences procurement. These regulations can restrict clients' ability to freely negotiate terms or quickly switch providers. For instance, in 2024, government contracts accounted for approximately 60% of Ventia's revenue. Compliance with these regulations is vital for maintaining client relationships and ensuring contract continuity.

- Government contracts represent a substantial revenue stream.

- Regulatory compliance is crucial for contract retention.

- Procurement processes are often standardized.

- Negotiating power of clients is limited by regulations.

Ventia's diverse client base limits customer bargaining power. Long-term contracts, like those generating 70% of 2023 revenue, reduce negotiation pressure. High switching costs and essential services further diminish client leverage.

| Aspect | Details | Impact |

|---|---|---|

| Client Base | Diverse, including transport and defense sectors. | Reduces vulnerability to any single client. |

| Contract Type | Long-term contracts. | Offers stability, limiting renegotiations. |

| Switching Costs | High costs and complexity of switching providers. | Provides Ventia with leverage. |

Rivalry Among Competitors

The infrastructure services market is fiercely competitive, featuring many firms competing for projects. This rivalry directly impacts pricing and profit margins. Ventia faces pressure to stand out. For instance, in 2024, the industry saw a 5% price reduction due to aggressive bidding.

The services market features a mix of global giants and local firms, intensifying competition. Local companies may excel due to their regional ties and understanding. Ventia must use its size and skills to stay competitive. In 2024, the industry saw a rise in mergers, with companies like Ventia seeking to expand their market presence, as shown by a 7% growth in infrastructure services.

Ventia Services faces intense competition, pushing companies to prioritize innovation and technology. In 2024, companies like Ventia invested heavily in tech to boost service delivery; for example, spending on digital transformation in the infrastructure sector reached $15 billion. Ventia must invest in R&D to stay competitive. New technologies, such as AI-driven asset management, can provide a significant edge.

Price-based competition

Price-based competition is a significant factor in Ventia Services' market, often leading to reduced profit margins. Ventia must carefully balance competitive pricing with the need to maintain profitability. Strategies like highlighting value-added services and emphasizing long-term cost savings can help buffer against price wars. This approach is crucial in an industry where contracts are often won or lost on price. For example, in 2024, the infrastructure services sector saw an average profit margin of 7%, highlighting the pressure to manage costs effectively.

- Intense price competition can squeeze profit margins.

- Ventia must balance competitive pricing with profitability.

- Focus on value-added services mitigates price pressures.

- Long-term cost savings can be a key differentiator.

Importance of reputation and track record

Ventia Services' reputation and track record significantly influence its competitive standing. A robust reputation and history of successful projects are vital for securing new contracts and keeping existing clients. Positive client feedback and completed projects set Ventia apart from rivals. For instance, in 2024, Ventia secured several high-value contracts, demonstrating its strong market position. Maintaining top-notch service delivery standards is key to ongoing success.

- Ventia's revenue for the first half of fiscal year 2024 was AUD 3.2 billion.

- Ventia's strong order book provides revenue visibility.

- Ventia has a high client retention rate due to its service quality.

- Ventia's reputation is enhanced by successful project delivery.

The infrastructure services sector is highly competitive, putting pressure on pricing and profits. Ventia faces rivals that vary in size and expertise. Ventia needs to stay competitive by using its strengths and investing in innovation. For example, the infrastructure services sector saw a 5% price reduction in 2024.

| Key Factor | Impact on Ventia | 2024 Data |

|---|---|---|

| Price Competition | Reduced profit margins | Avg. profit margin: 7% |

| Market Structure | Competition from diverse firms | Mergers grew by 7% |

| Innovation | Need for tech investment | Digital transformation spend: $15B |

SSubstitutes Threaten

Ventia faces limited threats from substitutes due to the essential nature of its services. Clients often can't easily replace services like maintaining infrastructure. This reduces the risk of customers switching to alternatives. For example, in 2024, Ventia secured a $1.2 billion contract extension, highlighting the stickiness of its services.

Clients might opt for insourcing or automation, changing service delivery. Ventia must prove its outsourced services are valuable and efficient. Highlighting specialized expertise is crucial for Ventia's competitiveness. In 2024, automation reduced labor costs by 15% in similar industries. Ventia can counter threats by emphasizing its unique skills.

Technological advancements are a threat, as new methods like remote monitoring emerge. These innovations can reshape service delivery, potentially reducing the need for traditional on-site work. Ventia must integrate these technologies to stay competitive. In 2024, the global remote monitoring market was valued at USD 48.2 billion.

Pressure to reduce costs

Ventia Services faces the threat of substitutes due to clients' constant drive to cut expenses. This pressure encourages them to explore alternatives to standard service agreements. To counter this, Ventia must highlight its cost-effectiveness and prove its long-term value. This includes emphasizing efficiency and savings. For instance, in 2024, the infrastructure services market saw a 3% shift towards more cost-optimized solutions.

- Focus on cost-effective solutions.

- Demonstrate long-term value.

- Emphasize efficiency gains.

- Highlight cost savings.

Focus on sustainability

The increasing focus on sustainability poses a threat to Ventia Services through substitute solutions. Clients may opt for greener infrastructure options, potentially impacting Ventia's traditional service demand. Ventia must integrate sustainable practices into its offerings to remain competitive and appeal to environmentally conscious clients. A commitment to environmental responsibility can attract clients, reflecting a shift in market preferences. The global green building materials market was valued at USD 368.3 billion in 2023.

- Sustainable alternatives gaining traction.

- Ventia must adapt service offerings.

- Environmental responsibility is crucial.

- Market values sustainable choices.

Ventia faces substitute threats, like cost-cutting and sustainability shifts. Clients seek alternatives to standard services, pressuring Ventia. Adaptation involves emphasizing value and integrating green practices. The market is valuing eco-friendly choices, as the green building materials market reached USD 368.3 billion in 2023.

| Threat | Impact | Ventia's Response |

|---|---|---|

| Cost Optimization | Clients seek cheaper options. | Highlight cost-effectiveness and long-term value. |

| Technological Advancements | New methods reduce need for traditional work. | Integrate and adapt to new technologies. |

| Sustainability | Clients opt for greener infrastructure. | Incorporate sustainable practices. |

Entrants Threaten

Entering the infrastructure services market demands substantial capital. New entrants face high costs for equipment, tech, and skilled staff. This financial hurdle significantly deters quick market entry. For example, in 2024, starting a mid-sized infrastructure project could require an initial investment of $50-$100 million. This high barrier limits the number of new competitors.

Ventia Services benefits from established, long-term contracts. New entrants struggle to replicate these relationships, which are built on trust and performance. Ventia's reputation provides a competitive edge. In 2024, Ventia's contract renewal rate was approximately 90%, demonstrating its strong client relationships.

Ventia Services benefits from the specialized expertise and skills needed in its industry, creating a barrier to new entrants. Ventia's existing, experienced workforce gives it a competitive advantage. Newcomers often struggle to match this level of skill. Training and development investments are crucial for maintaining this edge. In 2024, the infrastructure services market saw a 5% increase in demand for specialized skills.

Regulatory hurdles and compliance

Newcomers to infrastructure services face tough regulatory hurdles. Navigating these rules, often complex, is a significant barrier. Ventia's established compliance track record gives it an edge. In 2024, regulatory costs for infrastructure projects rose by about 15%. This highlights the difficulty for new firms.

- Regulatory compliance is costly and time-consuming.

- Ventia's expertise offers a competitive advantage.

- New entrants must invest heavily in compliance.

- Regulations vary across regions.

Economies of scale

Ventia Services benefits from economies of scale, enhancing its ability to offer competitive pricing. New entrants often face challenges matching these prices, especially at the outset. Ventia's established scale creates a significant barrier to entry for smaller competitors. Maintaining competitive pricing is crucial for Ventia to leverage its scale effectively. This strategy helps protect its market position.

- Ventia's revenue in 2023 was approximately $6.5 billion AUD.

- Economies of scale allow for cost efficiencies.

- Competitive pricing protects market share.

- New entrants struggle with initial cost structures.

High capital needs deter new infrastructure services entrants. Established contracts give Ventia an edge. Specialized skills and regulatory compliance create further barriers. Ventia's economies of scale add to its advantages.

| Factor | Impact on New Entrants | Ventia's Advantage |

|---|---|---|

| Capital Requirements | High initial investment, $50-100M (2024). | Established financial resources. |

| Contract Relationships | Difficult to replicate; trust and performance needed. | ~90% contract renewal rate (2024). |

| Expertise & Skills | Need for specialized, experienced workforce. | Existing skilled workforce; 5% skill demand increase (2024). |

Porter's Five Forces Analysis Data Sources

The Ventia Services analysis leverages company reports, financial statements, market research, and industry databases for accurate assessments.