Ventia Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ventia Services Bundle

What is included in the product

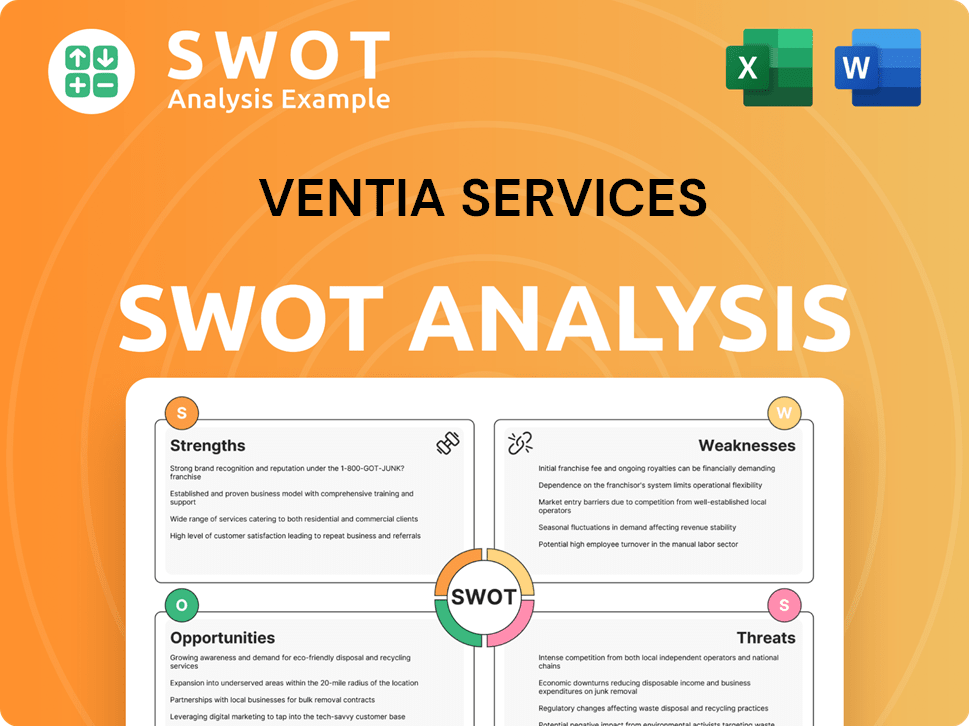

Outlines Ventia Services's strengths, weaknesses, opportunities, and threats.

Provides a simple, high-level SWOT template for fast decision-making.

Preview Before You Purchase

Ventia Services SWOT Analysis

What you see here is the full Ventia Services SWOT analysis report preview.

This exact document, in its entirety, is what you’ll receive after purchase.

No changes or alterations; the same professional analysis is yours.

Access all the details immediately after completing your order.

SWOT Analysis Template

Ventia Services navigates a complex market with diverse strengths and potential vulnerabilities. Our analysis uncovers how Ventia leverages its resources and faces competitive pressures. Understanding the external opportunities and internal challenges is crucial. We provide a detailed overview of Ventia's strategic landscape. The snapshot you've seen scratches the surface.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Ventia holds a leading position in Australia and New Zealand's infrastructure services market. They have a substantial market share across sectors like defense, telecommunications, and transport. In 2024, Ventia's revenue in Australia and New Zealand was approximately $6.6 billion, demonstrating their strong market presence. This dominance allows Ventia to secure major contracts and influence industry standards.

Ventia Services' strength lies in its diverse portfolio spanning defense, social infrastructure, and more. This diversification is a key advantage. The company's long-term contracts, especially with government clients, ensure stable revenue. Approximately 75% of Ventia's revenue comes from these contracts, reducing financial risk. This strategic approach supports consistent performance.

Ventia showcases robust financial performance, marked by rising revenue and profits. In its recent financial reports, Ventia revealed substantial growth in NPATA, reflecting solid earnings. The company's strong cash conversion rate further underscores its effective financial management capabilities. For instance, in the first half of fiscal year 2024, Ventia Services Group reported a 10.3% increase in revenue to $3.2 billion.

High Contract Renewal Rates and Work in Hand

Ventia's impressive contract renewal rates, hovering around 90%, are a major strength, ensuring a steady revenue stream. This high rate offers investors considerable predictability in future earnings and cash flow. The substantial work in hand further solidifies its financial stability and growth prospects. This provides a robust base for sustained performance.

- 90% contract renewal rate.

- Significant work in hand.

- Future revenue visibility.

Capital-Light Business Model and Strong Capital Position

Ventia's capital-light model keeps capital expenditure low, usually under 3% of revenue. This strength is backed by its robust financial health. Ventia's strong free cash flow and a healthy debt-to-EBITDA ratio enhance its financial flexibility. This allows for potential capital management actions.

- Capital expenditure typically under 3% of revenue.

- Strong free cash flow generation.

- Healthy debt-to-EBITDA ratio.

Ventia Services' strengths include market leadership in Australia and New Zealand, with 2024 revenue around $6.6 billion. A diverse portfolio, with 75% revenue from long-term contracts, ensures stability. Furthermore, high contract renewal rates near 90% and a capital-light model bolster financial performance.

| Strength | Details | Data Point |

|---|---|---|

| Market Position | Leading infrastructure services provider | $6.6B (2024 revenue in AUS/NZ) |

| Revenue Stability | Long-term contracts with clients | 75% revenue from contracts |

| Financial Efficiency | Low capital expenditure, strong cash flow | Capex <3% of revenue |

Weaknesses

The Infrastructure Services division faced revenue and EBITDA declines. This indicates issues in adapting from resource projects to renewables and water. This segment's performance is a hurdle for Ventia's growth. Specifically, in 2024, this division reported a 7% drop in revenue. Profit margins also decreased by approximately 4%.

Ventia Services faces operational risks due to its involvement in high-hazard sectors. A significant safety incident occurred in FY2024, impacting the company. This incident underscores the potential for disruptions and reputational damage. Such events can negatively affect financial performance and stakeholder trust.

Ventia's Scope 3 emissions, driven by fleet operations and procurement, are a growing concern. This expansion increases environmental impact, potentially harming Ventia's reputation. Addressing this requires focused initiatives, given rising stakeholder demands for sustainability. In 2024, companies faced tougher scrutiny regarding Scope 3 emissions.

Market Skepticism Despite Solid Results

Ventia Services' share price has declined, even with solid financial performance, signaling market skepticism. Investors might doubt Ventia's ability to maintain growth amid current challenges. This negative sentiment can hinder future investments and strategic initiatives. The stock's performance reflects concerns over long-term sustainability.

- Share Price Drop: Ventia's stock has decreased despite positive financial results.

- Growth Concerns: Investors worry about sustained growth in the face of market pressures.

- Investor Sentiment: Negative sentiment may impact future investments and strategies.

Potential Delays in Public-Sector Procurement

Ventia's reliance on public-sector contracts exposes it to potential delays in procurement processes. These delays, especially in defense and large infrastructure projects, can slow down the progress of the company's project pipeline. Such delays can cause uncertainty in securing new contracts and completing existing ones on schedule. This can lead to financial instability. The Australian government's infrastructure spending in 2024 was $24.5 billion, with potential for delays.

- Procurement delays can impact project timelines.

- Delays create uncertainty in securing new projects.

- Public sector reliance introduces risk.

- Financial instability caused by delays.

The Infrastructure Services division experienced both revenue and EBITDA declines. Ventia's involvement in high-hazard sectors introduces operational risks. Scope 3 emissions pose rising environmental and reputational risks. The share price decline signals investor skepticism regarding long-term growth. Reliance on public-sector contracts exposes Ventia to procurement delays and associated financial risks.

| Weaknesses | Impact | Financial Data |

|---|---|---|

| Infrastructure Decline | Revenue/EBITDA drops. | Revenue down 7%, profit margins -4% in 2024. |

| Operational Risks | Disruptions, reputational damage. | Safety incident in FY2024 affected the company. |

| Scope 3 Emissions | Reputational and environmental risk. | Rising stakeholder demands, increased scrutiny in 2024. |

Opportunities

Ventia benefits from a growing addressable market. The maintenance services market in Australia and New Zealand is projected to expand. This growth is fueled by population increases and infrastructure development. Investment in telecommunications, like 5G and NBN upgrades, boosts opportunities. The energy transition also creates market expansion for Ventia.

Ventia's revenue heavily relies on government partnerships. Increased government spending, especially in infrastructure and defence, presents significant growth opportunities. In 2024, the Australian government allocated $120 billion to infrastructure. This provides a robust pipeline of potential contracts. The defence sector also offers substantial opportunities for Ventia.

Ventia is strategically expanding into renewables and water infrastructure, capitalizing on growing demand. This shift could significantly boost revenue, with the global water and wastewater treatment market projected to reach $400 billion by 2025. This move aligns with sustainability trends, potentially improving Ventia's margins. It also opens doors for long-term growth and market share gains.

Potential for Bolt-on Acquisitions

Ventia Services' robust financial standing and proven track record in acquisitions create opportunities for bolt-on acquisitions. This strategy could target niche sectors like digital infrastructure, enhancing capabilities and market reach. In the fiscal year 2024, Ventia's revenue reached $6.8 billion, reflecting strong financial health. These acquisitions can lead to growth.

- Bolt-on acquisitions in digital infrastructure.

- Expansion of capabilities and market share.

- Ventia's revenue in 2024 was $6.8 billion.

- Strong financial position enables strategic deals.

Leveraging Technology and Innovation

Ventia's strategic focus on data infrastructure and its enterprise-wide platform offers significant opportunities. By integrating AI and IoT in facility management, Ventia can enhance operational efficiency and service quality. This approach can lead to cost savings and improved client satisfaction. For example, the global smart facilities market is projected to reach $97.7 billion by 2024, showing strong growth potential.

- Data analytics can optimize resource allocation.

- IoT integration enables predictive maintenance.

- AI enhances decision-making processes.

- Platform provides scalability.

Ventia's opportunities stem from market growth and government spending. Strategic expansions into renewables and infrastructure further enhance their potential, supported by acquisitions and platform development. These moves align with broader trends.

| Area | Details | 2024 Data |

|---|---|---|

| Market Growth | Expansion in maintenance services. | Australian infrastructure spending: $120B |

| Strategic Expansion | Focus on renewables & water. | Smart facilities market: $97.7B |

| Financial | Revenue & acquisitions. | Ventia's 2024 revenue: $6.8B |

Threats

Ventia faces ACCC civil proceedings for alleged competition law breaches. These proceedings could lead to legal expenses, potentially impacting profitability. The ACCC has a strong enforcement record, with penalties reaching millions of dollars. Reputational damage from these actions could also affect future contracts and investor confidence. In 2024, the ACCC secured over $150 million in penalties.

Ventia faces execution risks in its shift to renewables and water infrastructure. Successfully transitioning and improving margins in these areas is challenging. For instance, the renewables sector saw project delays in 2024, impacting profitability. These delays highlight the need for robust project management. Ventia's ability to effectively manage these risks will determine its success.

Ventia Services faces fierce competition in the infrastructure services market across Australia and New Zealand. This competitive landscape includes significant players, increasing the pressure on Ventia's profit margins. Securing new contracts becomes more challenging due to rival bids. For instance, in 2024, the infrastructure sector saw several large projects where multiple firms competed aggressively. This environment may affect Ventia's financial performance.

Delays in Contract Awards

Delays in contract awards pose a threat to Ventia Services. Such delays, especially in public sector projects, can hurt Ventia's backlog and revenue forecasts. For example, in 2024, delayed infrastructure projects in Australia affected several service providers. This uncertainty can lead to financial planning challenges.

- Reduced Workload: Delays decrease the immediate volume of work.

- Revenue Impact: Postponed projects push back revenue recognition.

- Resource Allocation: Delays can disrupt workforce planning.

- Competitive Risk: Competitors may benefit from the uncertainty.

Economic Headwinds and Market Skepticism

Economic challenges and market doubts pose risks. Ventia's growth sustainability is questioned, potentially hitting share prices. Investors may lose confidence, affecting capital access. The company's stock price saw a 15% drop in Q4 2024 due to market uncertainty. These factors could limit Ventia's expansion.

- Market skepticism about growth can lower investor confidence.

- Economic downturns may reduce project spending.

- Share price volatility could increase financing costs.

- Access to capital might become more difficult.

Ventia faces legal and financial threats, including ACCC proceedings that can impact its profits. Its transition to new sectors like renewables comes with execution risks. These include project delays and competitive pressures that can squeeze profit margins, as demonstrated by 2024 market trends. Also, delays in contract awards may further hurt revenue.

| Threat | Description | Impact |

|---|---|---|

| Legal/Compliance | ACCC investigations | Financial penalties ($150M+ in 2024), reputational damage |

| Operational | Renewables transition, contract delays | Reduced profit margins, planning uncertainty |

| Market | Competition, Economic challenges | Squeezed margins, investor doubts (15% share price drop in Q4 2024) |

SWOT Analysis Data Sources

This SWOT analysis uses financial reports, market data, industry publications, and expert analysis to build a reliable strategic overview.