Veolia Environnement Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Veolia Environnement Bundle

What is included in the product

Tailored analysis for Veolia's business units across the BCG Matrix.

Clean, distraction-free view optimized for C-level presentation.

What You See Is What You Get

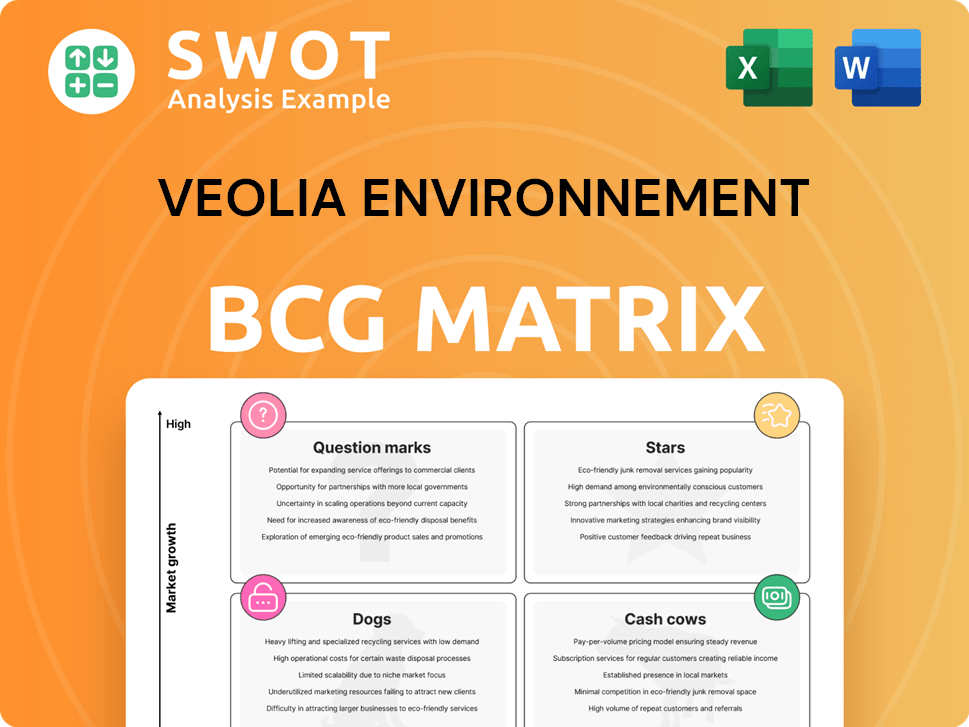

Veolia Environnement BCG Matrix

The BCG Matrix preview you see is the final, complete document you will receive. No hidden content, the ready-to-use, fully formatted BCG Matrix is immediately accessible post-purchase. The document provides comprehensive Veolia Environnement insights.

BCG Matrix Template

The Veolia Environnement BCG Matrix analyzes the company's diverse portfolio, categorizing its business units into Stars, Cash Cows, Dogs, and Question Marks. This framework helps understand resource allocation effectiveness and market positioning. Early insights reveal strategic implications for investments. We've simplified complex data for quick understanding. Ready to make informed decisions? Purchase the full BCG Matrix report for detailed quadrant breakdowns and actionable strategies!

Stars

Veolia's Water Technologies & New Solutions is a "Star" within its BCG Matrix, focusing on future water services. The company leverages advanced tech for wastewater reuse, pollutant treatment, and drinking water production. In 2024, the sector generated €18 billion in sales. Veolia targets a +50% growth by 2030, fueled by these innovative solutions.

Veolia's hazardous waste treatment is a "Star" in its BCG Matrix. The company leverages its expertise in this sector. Veolia is constructing five new plants, slated for commissioning between 2025 and 2027. As of December 2024, the net debt/EBITDA was 2.6x, indicating financial stability.

Veolia's bioenergy, flexibility, and energy efficiency initiatives are a 'Star' in its BCG matrix. The company is targeting 8 GW of bioenergy production by 2030. In 2024, sales reached €12 billion, showing strong growth. This focus helps customers optimize their energy mix.

Digital Water Services

Veolia's "Digital Water Services" are a "Stars" segment within its BCG Matrix, showcasing strong growth potential. Veolia leverages digital tools and generative AI, like its partnership with Mistral AI, to enhance efficiency in water management. These services include Hubgrade Wastewater Plant Performance and savings calculators, driving innovation in a sector benefiting from positive macroeconomic trends. This focus aligns with the company's strategy to expand its digital offerings.

- 2024 Revenue: Veolia's revenue reached €46.3 billion.

- Digital Solutions Growth: Continued expansion in digital water solutions.

- AI Partnerships: Collaboration with AI firms like Mistral AI.

- Hubgrade: Improved efficiency and performance.

Decarbonization Initiatives

Veolia's decarbonization initiatives are a strong point. They've cut scope 1 and 2 emissions by approximately 15%. Scope 4 avoided emissions increased by 13%, reaching 15.2 million tonnes of CO₂.

Investments in phasing out coal in Europe were substantial. In 2024, €133.5 million was invested, with a total of €656 million since the plan began. The company's goal is a 30% reduction by 2025.

- 15% reduction in scope 1 and 2 emissions

- 13% increase in scope 4 avoided emissions

- €133.5 million invested in 2024 for coal phase-out

- Aiming for a 30% reduction by 2025

Veolia's hazardous waste treatment is a "Star," leveraging its expertise. Five new plants are set for commissioning between 2025-2027. Net debt/EBITDA was 2.6x in December 2024.

| Key Metric | Value |

|---|---|

| Hazardous Waste Sales | €7.2 Billion (2024) |

| Plants Commissioning | 5 (2025-2027) |

| Net Debt/EBITDA (Dec 2024) | 2.6x |

Cash Cows

Veolia's water management is a cash cow, offering essential services. They manage water and wastewater for municipalities and businesses. Their contracts have a high renewal rate, around 90%, ensuring stable revenue. Veolia has improved water access for 90+ million people. They aim to cut water waste by 25% by 2025.

Veolia, a waste management leader, handles liquid, solid, and hazardous waste, focusing on collection, treatment, and recycling. In 2023, Veolia processed around 46 million tons of waste, converting it into reusable materials. The company strategically invests in higher-value activities, despite the low barriers to entry in nonhazardous waste collection and disposal. Veolia's robust waste management operations generate consistent revenue, solidifying its cash cow status. This strategic approach supports steady financial performance.

Veolia's Energy Services in Europe, a cash cow, leads in delegated management of urban heating and air conditioning networks. This segment, focused on thermal and multi-technique services, contributes significantly to Veolia's revenue. The company's strategy emphasizes optimizing energy sources and boosting renewable energy use. In 2024, Veolia's revenue was approximately €45 billion.

Municipal Water Operations

Municipal water operations are a cash cow for Veolia, with consistent revenue from essential services. In 2024, Veolia's water purification and distribution services continued to generate stable cash flows. The company's focus on efficiency, aiming to cut water waste by 25% by 2025, supports its profitability. Veolia aims for balanced revenue distribution, indicating strategic management of its diverse business segments.

- Revenue generated from water services in 2024: approximately €10 billion.

- Number of people with improved water access: over 90 million.

- Target water waste reduction by 2025: 25%.

- Goal: balanced revenue distribution.

Long-Term Contracts

Veolia's "Cash Cows" within its BCG matrix are its long-term contracts, offering stable revenue. These contracts span years, including low-risk public sector and shorter-term commercial agreements. Contract types range from capital-intensive to operation-focused, minimizing investment needs. The company boasts a typical renewal rate of roughly 75%, ensuring revenue predictability.

- Revenue Stability: Long-term contracts provide predictable cash flow.

- Contract Variety: Catering to diverse needs, from public to commercial sectors.

- Renewal Rate: A 75% renewal rate ensures recurring revenue.

- Capital Efficiency: Contracts can be structured to require minimal investment.

Veolia's cash cows, including water and waste management, ensure stable revenue streams. Municipal water services generated around €10 billion in 2024. The company targets a 25% water waste reduction by 2025. These segments benefit from long-term contracts and high renewal rates.

| Cash Cow Segment | 2024 Revenue (approx.) | Key Feature |

|---|---|---|

| Municipal Water Services | €10 billion | Stable, essential services with high renewal rate. |

| Waste Management | Significant | Consistent revenue from processing and recycling. |

| Energy Services (Europe) | €45 billion | Delegated management of urban heating and cooling. |

Dogs

Veolia's energy services in Central and Eastern Europe, a "dog" in its BCG Matrix, faced headwinds. Despite 1.9% energy growth, declining prices hurt profitability. Increased EBITDA from waste-to-energy could amplify exposure to price volatility. In 2024, Veolia focused on efficiency and strategic adjustments in the region.

Veolia's non-hazardous waste segment faces tough competition due to low entry barriers. The company strategically invests in high-value areas like hazardous waste sorting. In 2024, Veolia aimed to increase its revenue from specialized waste treatment. This aligns with its core expertise. Veolia's focus is on higher-margin activities.

Veolia struggles in certain areas due to local problems. In 2024, the company showed good progress in its four-year strategic plan. The plan emphasizes growth in sectors needing expertise. Veolia reported €45.6 billion in revenue for 2024. This plan focuses on accelerating growth in sectors that require specific expertise and will benefit from strong macroeconomic trends.

Water Activities in Mature Economies

In mature economies, water demand faces a slow decline, particularly in Europe, due to increased resource awareness among the population. Veolia benefits from its low-risk water business, offering essential services under long-term agreements. Unfavorable weather can impact water consumption. Veolia's water revenue was approximately €12.7 billion in 2023.

- Demand decline in Europe due to resource awareness.

- Veolia offers essential water services.

- Weather conditions influence consumption.

- 2023 Water revenue: €12.7 billion.

Short-Term Contracts with Industrial Clients

Veolia's shift toward short-term contracts with industrial clients, which were projected to account for 65% of investment spending, makes it sensitive to economic fluctuations. This strategic move has been evident in recent years. The company's operating performance since 2022 demonstrates its ability to withstand market volatility.

- Industrial clients’ share in Veolia's revenue mix is increasing.

- Veolia's exposure to macroeconomic cycles is rising.

- 65% of investment spending was projected for industrial clients.

- Operating performance since 2022 shows portfolio resilience.

Veolia's Dogs include struggling energy services and non-hazardous waste segments. Energy services in Central and Eastern Europe faced declining prices despite 1.9% energy growth. The company strategically invests in high-value areas to boost specialized waste treatment revenue. Veolia reported €45.6 billion in revenue for 2024.

| Segment | Status (BCG) | Key Issue |

|---|---|---|

| Energy Services (CEE) | Dog | Declining prices, low profitability. |

| Non-Hazardous Waste | Dog | Low entry barriers, competition. |

| Overall Strategy | - | Focus on efficiency, high-value areas. |

Question Marks

Veolia's expansion into emerging markets is a key growth driver. Sales in these regions grew by 15% in 2024, especially in Asia and Africa. The company is investing in tech for efficiency and sustainability. Half of Veolia's revenue is targeted to come from outside Europe.

Veolia is focusing on lithium battery recycling, a "Question Mark" in its BCG matrix. The company aims to boost circular economy solutions and innovation in this area. Veolia's goal aligns with the growing demand for sustainable battery recycling. Notably, the global lithium-ion battery recycling market was valued at $6.6 billion in 2023, and is projected to reach $35.1 billion by 2032.

Veolia is at the forefront of innovation, focusing on water, waste, and energy. They invest around €100 million annually in R&D. A recent breakthrough is a water purification tech. It cuts energy use by 30% versus older methods. This positions Veolia for growth.

PFAS and Microplastics Treatment

Veolia's BCG Matrix includes PFAS and microplastics treatment, reflecting its commitment to water and pollutant solutions. The company is investing in innovative technologies like generative AI and carbon capture. A 2024 report indicated a 15% increase in demand for water treatment solutions. This aligns with the growing need for environmental sustainability.

- Focus on treating pollutants like PFAS and microplastics.

- Utilizing generative AI and carbon capture tech.

- Water treatment solutions see a 15% rise in demand.

- Emphasis on environmental sustainability is key.

Generative AI and Digital Initiatives

Veolia is actively venturing into generative AI to boost operational efficiency and drive innovation. A key development is the recent partnership with Mistral AI, reflecting its commitment to leveraging cutting-edge technology. This strategic move aims to refine processes and enhance performance across various sectors. The company constantly seeks to integrate new technologies to improve operations and gain a competitive advantage. These initiatives are designed to support future growth and maintain market leadership.

- Partnership with Mistral AI: Aims to improve efficiency.

- Focus on innovation: Utilizing new technologies to enhance operations.

- Strategic goal: Support long-term growth and maintain a competitive edge.

- Data-driven approach: Implementing AI to refine processes.

Veolia’s "Question Marks" include lithium battery recycling and pollutant treatment. The company targets circular economy solutions and innovative tech applications. The global lithium-ion battery recycling market was $6.6B in 2023, expected to hit $35.1B by 2032.

| Initiative | Focus | Market Data (2023) |

|---|---|---|

| Lithium Battery Recycling | Circular Economy | $6.6B (Global Market) |

| Pollutant Treatment | PFAS, Microplastics | 15% Rise in Demand |

| Tech Integration | Generative AI, Carbon Capture | Partnership with Mistral AI |

BCG Matrix Data Sources

The Veolia BCG Matrix leverages financial reports, market analyses, and competitor data for strategic evaluations.