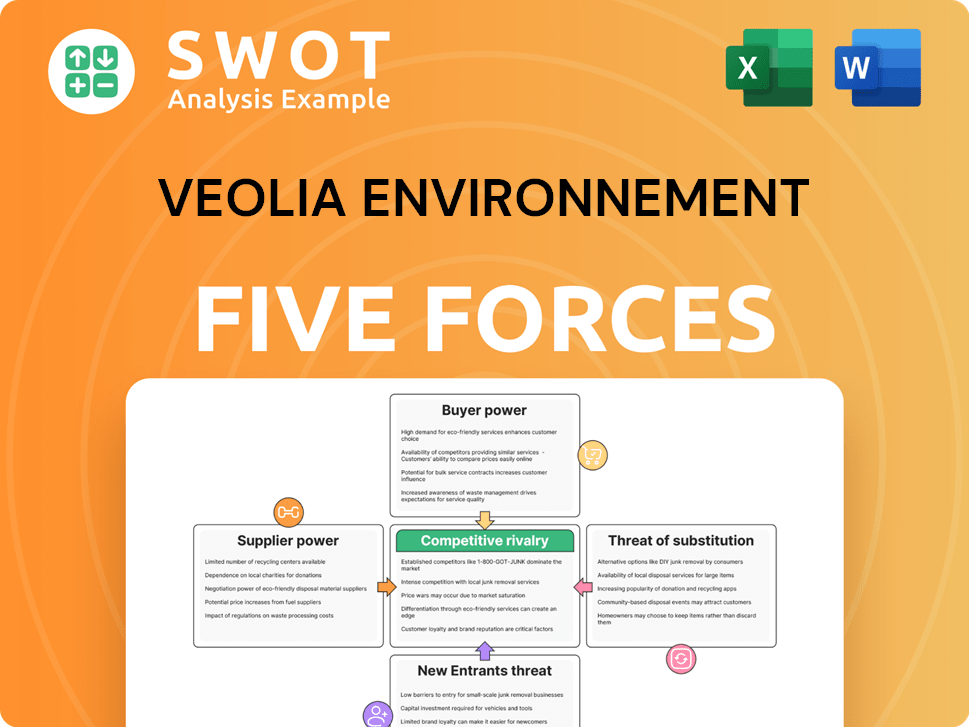

Veolia Environnement Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Veolia Environnement Bundle

What is included in the product

Tailored exclusively for Veolia Environnement, analyzing its position within its competitive landscape.

Quickly identify competitive risks with a customizable and intuitive dashboard.

Same Document Delivered

Veolia Environnement Porter's Five Forces Analysis

This is the complete Veolia Environnement Porter's Five Forces analysis. The preview you see details the competitive landscape, exactly what you'll download immediately after purchasing.

Porter's Five Forces Analysis Template

Veolia Environnement faces moderate rivalry, influenced by competitors in water and waste management. Buyer power is somewhat concentrated, with municipalities and large industrial clients having leverage. Supplier power is relatively balanced, though specialized equipment suppliers hold some sway. The threat of new entrants is low due to high capital requirements and regulatory hurdles. Substitute threats are moderate, with alternative solutions like water conservation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Veolia Environnement’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Veolia's suppliers include equipment makers, chemical providers, and energy firms. Supplier power fluctuates, but Veolia's size gives it leverage. For commodity products, switching is an option. Moderate concentration means Veolia isn't overly reliant on one supplier. Veolia's 2024 revenue was €45.3 billion, showing its financial strength in negotiations.

Switching costs for Veolia can be low when it comes to commodity chemicals or standard equipment, diminishing supplier power. In 2024, Veolia sourced a significant portion of its materials from various suppliers. Conversely, specialized equipment or proprietary technologies may have higher switching costs. This increases supplier power in these areas. Veolia's agility in supplier selection directly influences its negotiation leverage.

Suppliers with strong brand reputations or specialized tech have more power. Veolia might pay a premium for trusted brands or cutting-edge solutions. Reliability and performance are critical in water treatment and energy-efficient equipment. In 2023, Veolia's revenue was €45.2 billion. Brand value influences supplier dynamics.

Input costs are significant

Input costs, including chemicals, energy, and specialized equipment, are a significant part of Veolia Environnement's operational expenses. These costs can fluctuate, directly affecting Veolia's profitability. Suppliers with control over essential inputs wield considerable bargaining power. Veolia must mitigate these risks through strategies like long-term contracts or supplier diversification. In 2024, energy costs have notably impacted operational expenses.

- Energy costs are a major factor, influencing Veolia's operational expenses.

- Supplier bargaining power is high when they control crucial resources.

- Long-term contracts help stabilize costs and reduce risk.

- Diversifying suppliers is a key strategy to manage input costs.

Forward integration threat is limited

The threat of suppliers integrating forward into Veolia's markets is low. Suppliers like equipment manufacturers and chemical providers are unlikely to enter the complex environmental services market. This reduces their bargaining power, as they won't become direct competitors. Veolia's market presence and expertise act as barriers. In 2024, Veolia's revenue was around EUR 45.3 billion, showcasing its strong position.

- Limited forward integration threat from suppliers.

- Suppliers unlikely to compete directly.

- Reduced supplier bargaining power.

- Veolia's market dominance acts as a barrier.

Veolia's supplier power is moderate due to its size and ability to switch suppliers. The 2024 revenue was €45.3B. Specialized suppliers have more power because of higher switching costs. Energy costs significantly impact operational expenses.

| Factor | Impact on Supplier Power | 2024 Data/Context |

|---|---|---|

| Switching Costs | Low for commodities, high for specialized items | Veolia's diverse sourcing strategy |

| Input Costs | Significant impact on profitability | Energy costs a major operational expense |

| Supplier Integration | Low threat of forward integration | Veolia's market dominance |

Customers Bargaining Power

Veolia's customer base is diversified, encompassing municipalities, industrial firms, and commercial entities. This fragmentation means no single customer heavily impacts revenue. In 2024, Veolia's revenue was around €45 billion, spread across numerous clients. This distribution bolsters pricing power.

Switching costs for Veolia's customers fluctuate. Municipalities face high costs due to infrastructure investments and regulatory hurdles. Industrial clients may find lower costs if competitors offer better pricing. In 2024, Veolia's revenue was approximately €45.3 billion, showing the impact of customer contracts. Balancing long-term contracts with customer needs is crucial.

Veolia's service differentiation, marked by its comprehensive environmental solutions and expertise, offers some protection from customer price pressures. Clients value the integrated approach to water, waste, and energy management, reducing the ease of switching to single-service providers. In 2024, Veolia's revenue was approximately €45.3 billion, showcasing its market presence. This integrated strategy helps maintain customer loyalty. The company's innovation and reliability also strengthen its position.

Customers are price-sensitive

Customers, particularly municipalities and industrial clients, are often highly price-sensitive, which can pressure Veolia to offer competitive pricing. In 2024, Veolia's revenue was around €45.3 billion, demonstrating the scale of its operations and the importance of managing costs effectively. However, the growing emphasis on sustainability and environmental compliance could allow Veolia to charge a premium for its specialized services. Balancing cost-effectiveness with value-added services is crucial for maintaining a strong market position.

- Price Sensitivity: Municipalities and industrial clients are often cost-conscious, affecting pricing.

- Revenue: Veolia's 2024 revenue was approximately €45.3 billion.

- Sustainability Premium: Demand for environmental solutions allows for premium pricing.

- Value Proposition: Balancing cost and service quality is key to success.

Backward integration threat is low

The threat of customers integrating backward and providing environmental services themselves is low, as the industry demands specialized skills and large capital investments. Veolia's customers, such as municipalities and industrial clients, typically find it more economical to outsource these complex services. This outsourcing approach allows clients to focus on their core business, taking advantage of Veolia's expertise. This dynamic strengthens Veolia's market position.

- Veolia's revenue in 2024 was approximately €45.3 billion.

- Veolia's operating margin in 2024 was around 7.5%.

- The global environmental services market is estimated to be worth over $1 trillion.

- Outsourcing rates for environmental services are consistently high.

Veolia faces moderate customer bargaining power due to diversified clientele and high switching costs for some. The firm's 2024 revenue of about €45.3 billion reflects this balance. Integrated services and specialized expertise enhance pricing flexibility, but cost sensitivity remains a factor.

| Aspect | Details | Impact |

|---|---|---|

| Customer Base | Diversified (municipalities, industries) | Reduces individual customer influence |

| Switching Costs | Variable: high for municipalities | Impacts customer price sensitivity |

| Differentiation | Integrated environmental solutions | Supports premium pricing, enhances loyalty |

Rivalry Among Competitors

Veolia faces intense competition in mature markets. Key rivals include Suez and Waste Management. This rivalry impacts pricing and service quality. Veolia needs to innovate to stay competitive. In 2024, Veolia's revenue was around €45.3 billion.

Competitive rivalry drives Veolia to focus on innovation and technology. Developing new solutions for water treatment, waste management, and energy efficiency is crucial for differentiating itself. In 2024, Veolia invested €450 million in R&D. Investing in digital technologies helps offer more efficient services. Innovation is key to winning contracts and retaining customers.

The environmental services industry is consolidating. Larger firms acquire smaller ones, expanding services and reach. This raises competition, as the remaining firms grow stronger. Veolia, for example, saw revenues of EUR 45.1 billion in 2023. Strategic moves are vital for Veolia to stay competitive against bigger rivals.

Bidding processes are competitive

Veolia faces intense competition in bidding for contracts, a core aspect of its operations. Companies compete by submitting proposals, which can spark price wars, squeezing profit margins. Veolia must carefully balance its bids, emphasizing value and its strong track record to win contracts profitably. This competitive landscape is critical for Veolia's financial success.

- In 2024, the global water and waste management market, where Veolia operates, saw numerous competitive bids, with margins often pressured by aggressive pricing strategies.

- Veolia's 2023 annual report highlighted a strategic focus on value-added services to differentiate bids and maintain profitability in competitive scenarios.

- The company’s success in securing contracts depends heavily on its ability to demonstrate expertise, as seen in its win rates across various regions.

- Veolia's financial performance in 2024 will likely reflect its ability to navigate these competitive pressures effectively.

Regulatory environment is complex

The environmental services sector faces intricate regulations, demanding substantial investment in compliance. Veolia must allocate resources to navigate evolving environmental laws. Companies excelling in compliance and sustainability gain a competitive edge. Adapting to regulatory shifts is crucial for sustained market success. Regulatory compliance costs can significantly impact profitability; in 2024, companies allocated an average of 12% of their operational budget to regulatory compliance.

- Compliance Costs: In 2024, the average compliance cost for environmental services companies was 12% of their operational budget.

- Regulatory Changes: The EPA finalized 15 major regulations in 2024 impacting waste management and water treatment.

- Sustainability Reporting: The EU's Corporate Sustainability Reporting Directive (CSRD) came into effect in January 2024, increasing reporting requirements.

- Legal Challenges: There were over 500 legal challenges related to environmental regulations in 2024.

Veolia battles rivals like Suez and Waste Management. Competition impacts pricing and spurs innovation. In 2024, R&D investment reached €450 million. Consolidation and bidding wars shape the market. Regulatory compliance also plays a role.

| Aspect | Detail |

|---|---|

| Market Share | Veolia held approx. 11% of global water market in 2024. |

| R&D Spend | Veolia invested €450M in R&D in 2024. |

| Compliance Cost | Average of 12% of operational budget in 2024. |

SSubstitutes Threaten

Companies and municipalities might opt for in-house environmental solutions, acting as a substitute for Veolia's services. Basic waste management or water treatment are prime examples. Veolia must highlight outsourcing's cost-effectiveness and expertise. In 2024, the global waste management market was valued at approximately $2.1 trillion. Offering specialized services and advanced tech enhances outsourcing appeal.

The emergence of alternative technologies poses a significant threat to Veolia. Decentralized water treatment systems and waste-to-energy technologies are potential substitutes. These innovations could diminish the demand for Veolia's centralized services. Veolia needs to monitor these developments closely. In 2024, the global waste-to-energy market was valued at $38.7 billion.

Efforts to reduce consumption and waste pose a threat to Veolia. Water conservation programs and waste reduction strategies can diminish the need for Veolia's services. In 2024, global water stress affected billions. Veolia can adapt by promoting resource efficiency. Embracing sustainability turns this threat into an opportunity.

Other service providers offer alternatives

The threat of substitute services arises from competitors offering similar environmental solutions. These alternatives could come from specialized firms or companies with diverse service portfolios. Veolia must differentiate itself to stay competitive.

In 2024, the environmental services market saw increased competition, with smaller firms gaining ground. Veolia needs to highlight its comprehensive services to stand out.

Customer loyalty and providing superior value are key strategies to mitigate this threat. Superiority can involve innovative tech.

This ensures clients remain with Veolia.

- Market competition increased in 2024, with smaller firms gaining ground.

- Differentiation through comprehensive services is vital.

- Customer loyalty and superior value are key.

- Innovative technologies help Veolia stand out.

Limited substitutes for complex solutions

The threat of substitutes for Veolia is relatively low, especially for complex environmental solutions. Veolia's integrated services in water, waste, and energy management offer a unique value proposition. This makes it challenging for competitors to replicate its comprehensive offerings. Focusing on these specialized solutions strengthens Veolia's market position.

- Veolia's revenue in 2023 was €45.3 billion, highlighting its significant market presence.

- The company's integrated model reduces the likelihood of customers switching to fragmented solutions.

- Veolia's expertise in hazardous waste management and water treatment provides a competitive edge.

- Ongoing investments in innovation, such as digital solutions for water management, further differentiate Veolia.

Veolia faces substitute threats from in-house solutions and alternative technologies. Water conservation efforts also pose a challenge. The company mitigates risks through differentiation and innovation. Customer loyalty and integrated services are also key.

| Substitute Type | Description | 2024 Data |

|---|---|---|

| In-House Solutions | Municipalities or companies handling own services | Global waste management market: ~$2.1T |

| Alternative Tech | Decentralized systems, waste-to-energy | Waste-to-energy market: ~$38.7B |

| Resource Reduction | Conservation and waste reduction | Global water stress: billions affected |

Entrants Threaten

The environmental services sector demands hefty upfront investments in specialized equipment, facilities, and cutting-edge technology, creating a substantial financial hurdle for newcomers. This high initial capital outlay serves as a significant barrier, making it tough for new players to enter. Veolia, with its well-established infrastructure and vast operational scale, holds a competitive edge. For example, in 2024, Veolia's capital expenditure reached €2.8 billion, highlighting the scale of investment needed. New entrants would need similar substantial resources to compete.

The environmental services industry faces strict regulations, including environmental and permitting requirements. This complex landscape demands specialized expertise. Veolia's established compliance record offers a key advantage. New entrants struggle to secure permits and meet regulations. In 2024, Veolia spent approximately €1 billion on compliance and environmental protection.

Veolia's established brand and reputation provide a significant barrier to new entrants. Veolia's brand recognition is a key competitive advantage. Building trust and credibility requires substantial investment. Veolia's 2023 revenue was €45.2 billion, reflecting its strong market position. A strong reputation helps secure contracts.

Access to technology is crucial

Access to cutting-edge technology and specialized knowledge is essential in environmental services. Veolia significantly invests in R&D to stay ahead, with a 2023 R&D expenditure of EUR 203 million. New companies face the challenge of matching this technological prowess to compete. Technological innovation is a key factor that differentiates companies in this sector.

- Veolia's R&D spending in 2023 was EUR 203 million.

- Advanced tech is a barrier to entry.

- Innovation is a key market differentiator.

Economies of scale are significant

Veolia Environnement benefits from significant economies of scale, making it tough for new entrants. This allows Veolia to offer services at lower costs than smaller companies. Replicating this scale is a major hurdle for potential competitors. Veolia's size gives it an edge in pricing and how it delivers its services. New entrants face the challenge of rapidly achieving substantial scale to compete effectively on cost.

- Veolia operates in numerous countries, enhancing its scale.

- The company's size allows for optimized resource allocation.

- New entrants struggle to match Veolia's established infrastructure.

- Veolia's revenue in 2024 is expected to be around €45 billion.

New entrants face high barriers due to the capital-intensive nature of environmental services. Veolia’s substantial investments, like €2.8B in capex in 2024, create a significant hurdle.

Stringent regulations and compliance costs, with Veolia spending around €1B in 2024, further limit new entries.

Veolia's strong brand and R&D, (€203M in 2023), combined with economies of scale, pose major competitive challenges.

| Factor | Description | Impact |

|---|---|---|

| Capital Requirements | High initial investment in equipment and facilities. | Limits new entries due to financial barriers. |

| Regulatory Hurdles | Strict environmental and permitting requirements. | Requires specialized expertise and compliance costs. |

| Brand & Scale | Veolia's established brand & large operational scale. | Creates a competitive advantage, hard for new entrants to replicate. |

Porter's Five Forces Analysis Data Sources

We use annual reports, industry journals, financial news, and regulatory filings for a comprehensive market view.