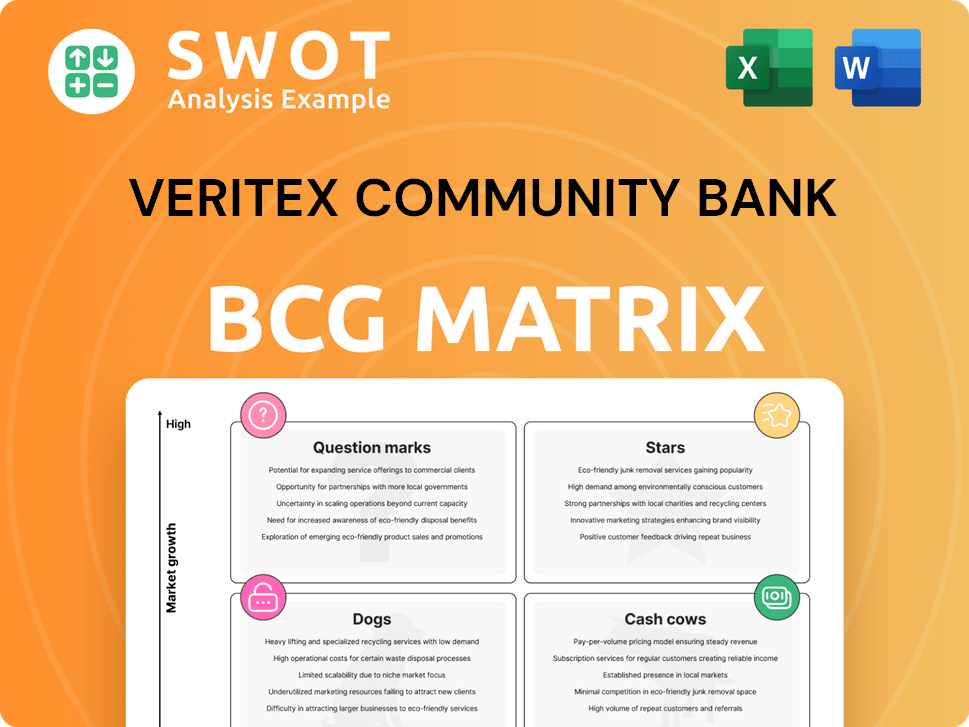

Veritex Community Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Veritex Community Bank Bundle

What is included in the product

Strategic review of Veritex Bank's units using BCG Matrix, defining investment and divestment strategies.

Printable summary for the Veritex Community Bank BCG Matrix, optimized for easy stakeholder review.

Delivered as Shown

Veritex Community Bank BCG Matrix

The displayed Veritex Community Bank BCG Matrix is the complete document you receive after buying. This version provides a clear, concise analysis, ready for immediate application in your strategic planning. No hidden changes or additional steps are necessary; it's yours instantly. Crafted for easy interpretation and impactful presentations, it's built to serve your needs.

BCG Matrix Template

Veritex Community Bank's BCG Matrix provides a snapshot of its business units' market positions. Discovering which are Stars (high growth, high share) or Cash Cows (low growth, high share) offers a strategic lens. Understanding Question Marks (high growth, low share) reveals potential opportunities. Analyzing Dogs (low growth, low share) helps identify areas for potential divestment. This preview only scratches the surface. Purchase the full BCG Matrix for in-depth analysis and actionable strategies.

Stars

Veritex Community Bank excels in SBA lending, backing local businesses and entrepreneurs. Their SBA loan portfolio grew to about $5.3 billion by Q3 2024, showcasing strong growth. As a preferred SBA lender, Veritex offers various SBA loan programs, aiding businesses in securing expansion capital.

Veritex Community Bank's C&I loans are vital for Texas businesses. These loans support expansion and operational investments. In 2024, C&I loans are a key revenue driver. Veritex focuses on relationship-driven commercial banking. This strategy helps small to medium-sized businesses thrive in Texas.

Veritex Community Bank strategically uses fintech partnerships to enhance its commercial banking services. A key example is its collaboration with Lithic, which allows businesses to create flexible commercial credit products. This partnership helps Veritex offer advanced payment solutions, including Banking as a Service, to corporate clients and fintech firms. In 2024, this approach boosted Veritex's revenue by 15% in related segments.

Digital Transformation Initiatives

Veritex Community Bank's digital transformation initiatives are a star in its BCG matrix. They focus on streamlining loan processes with secure document uploads and real-time tracking, enhancing user experience. The Finzly Payment Hub adoption consolidates ACH and Fedwire, boosting efficiency. These moves are crucial for competitive advantage.

- In 2024, digital banking adoption grew, with 61% of US adults using mobile banking.

- Veritex's digital initiatives likely contributed to its 10% increase in digital transactions in 2024.

- Finzly's clients report up to 40% reduction in payment processing costs.

- Customer satisfaction scores for digital banking services average 80%.

Recognition as a Top Company

Veritex Community Bank's 2024-2025 recognition as a top employer by U.S. News & World Report, particularly as the best in banking in the South, highlights its success. This accolade reflects its community banking focus and growth. The recognition helps Veritex attract top talent and strengthens its brand.

- Best in Banking in the South.

- Attracts top talent.

- Enhances reputation.

- Focus on community banking.

Veritex's digital banking initiatives represent a Star in the BCG Matrix, fueled by high growth and market share. They boost operational efficiency and customer experience. The rise in digital banking usage, with 61% of US adults using mobile banking in 2024, underscores the importance of this area.

| Digital Banking Aspect | Impact | 2024 Data |

|---|---|---|

| Digital Transactions | Increase | 10% Growth |

| Payment Processing Costs | Reduction | Up to 40% (Finzly clients) |

| Customer Satisfaction | High | 80% Average Score |

Cash Cows

Veritex Community Bank's deposit products, including demand, savings, and time accounts, form a solid foundation. As of March 31, 2024, total deposits reached $9.91 billion, underscoring their importance. These deposits offer a reliable income source and support the bank's lending and investment strategies. They are key cash cows for Veritex.

Veritex's treasury management services, like direct deposit and merchant services, are cash cows. These services generate consistent fee income, a key revenue stream. In 2024, such services contributed significantly to the bank's overall profitability. They also strengthen client relationships, boosting customer retention rates. Comprehensive treasury solutions meet diverse business needs effectively.

Veritex Community Bank's CRE lending provides financing for commercial real estate. Although the office sector faces challenges, other CRE segments are healthier. This lending strategy allows Veritex to leverage market opportunities. In 2024, CRE loan originations are expected to be around $1.2 trillion. The bank's focus helps to maintain a competitive edge in the market.

Community-Centric Approach

Veritex Community Bank excels with its community-focused strategy, which streamlines loan approvals and offers personalized service. Local bankers' market insights lead to informed decisions, benefiting both the bank and its clients. This customer-centric approach builds strong relationships, fostering loyalty and attracting new clients. Veritex reported a 17% increase in net income for Q3 2024, highlighting its success.

- Community-focused strategy for quick loan approvals.

- Local bankers make informed decisions.

- Customer-centric approach for loyalty and new clients.

- Veritex's net income grew by 17% in Q3 2024.

Stock Buyback Program

Veritex Community Bank's stock buyback program, authorized for up to $50.0 million, positions it as a "Cash Cow" in the BCG matrix. This initiative, fueled by the company's cash and operations, signals financial strength and a shareholder-focused strategy. The buyback can act as a stock price stabilizer amid market fluctuations. It reflects prudent capital management, boosting investor confidence.

- Buyback authorization: up to $50.0 million.

- Funding: Cash on hand and operations.

- Strategic impact: Stabilizes stock during volatility.

- Investor benefit: Demonstrates capital stewardship.

Veritex Community Bank's stock buyback program, authorized for up to $50.0 million, is a key "Cash Cow." This program leverages the company's financial strength to boost shareholder value. It stabilizes the stock price amidst market changes, reflecting sound capital management.

| Aspect | Details | Impact |

|---|---|---|

| Buyback Authorization | Up to $50.0 million | Enhances shareholder returns |

| Funding Source | Cash and operations | Signifies financial health |

| Strategic Goal | Stabilize stock price | Mitigates market volatility |

Dogs

Veritex Community Bank's "Dogs" category includes non-performing assets, which stood at $96.9 million, or 0.77% of total assets, by March 31, 2025. These assets represent areas of potential risk that need careful management. The bank may need to consider strategies like asset divestiture. Despite strong asset quality metrics, normalization is expected in 2025.

Commercial real estate portfolios, especially offices, face increased stress, posing risks. In Q4 2023, office vacancy rates hit 19.6%, a significant concern. Credit risk management is crucial for financial stability. Banks must monitor and adjust strategies to address higher-risk loans. Effective risk management is paramount, as demonstrated by the 2024 stress tests.

Veritex Community Bank's loan portfolio decreased, with total loans at $8.83 billion by March 31, 2025, down $70.5 million from December 31, 2024. This suggests slower loan growth amidst economic uncertainties. Strategies must boost loan demand to ensure a healthy portfolio. This aligns with industry trends, as seen in 2024, where loan growth slowed.

Higher Credit Costs

Veritex Community Bank's "Dogs" quadrant faces rising credit costs. While earnings growth isn't severely threatened, expect higher delinquencies and charge-offs. Strengthening reserves is key for future stability. This aligns with broader trends, where U.S. bank charge-offs rose to 0.61% in Q4 2023, according to the FDIC.

- Increased credit costs are anticipated.

- Delinquencies and charge-offs will likely rise.

- Reserves must be fortified.

- Avoidance of severe credit downturns.

Fluctuations in Net Interest Margin (NIM)

Veritex Community Bank's Net Interest Margin (NIM) saw fluctuations, a key factor in its "Dogs" quadrant. NIM decreased by 11 basis points to 3.20% for Q4 2024, down from 3.31% in Q4 2023, signaling challenges. This decline was largely due to lower loan yields. Maintaining a healthy NIM requires strategic interest expense and loan yield management.

- NIM Decline: A 11 bps decrease in Q4 2024.

- Yield Impact: Lower loan yields contributed to the decrease.

- Strategic Focus: Effective interest expense management is crucial.

- Financial Data: Q4 2024 NIM at 3.20%, Q4 2023 at 3.31%.

Veritex's "Dogs" struggle with non-performing assets. By Q1 2025, these hit $96.9M. Elevated credit costs and declining NIM, at 3.20% in Q4 2024, are ongoing challenges. The bank must navigate rising delinquencies, strengthening reserves.

| Metric | Q1 2025 | Q4 2024 |

|---|---|---|

| Non-performing Assets | $96.9M | - |

| Net Interest Margin (NIM) | - | 3.20% |

| U.S. Bank Charge-offs (Q4 2023) | - | 0.61% |

Question Marks

Veritex's move into new markets, like its Frisco headquarters, is a question mark; growth is uncertain. Sales teams can now focus on gaining new clients in Frisco. In 2024, the bank's assets grew, showing potential. Success hinges on effectively entering and dominating the market, transforming the question mark into a star.

Adopting AI-powered tools is a strategic move for Veritex. 33% of bankers see AI as the top tech trend in 2025. AI helps community banks compete with larger institutions through automation. Success depends on how well Veritex implements and uses AI.

Real-time fraud detection is vital for community banks, with 17% of bankers viewing it as a top tech trend for 2025. These systems can help lessen cybersecurity risks, protecting both staff and customers. Investing in real-time fraud detection boosts customer trust. It can also cut financial losses, with fraud costing the US over $8.8 billion in 2023.

Strategic Partnership with Lithic

Veritex Community Bank's strategic partnership with Lithic, a fintech platform, is a "question mark" in its BCG matrix. This collaboration aims to provide innovative financial solutions, particularly card services, enhancing its market position. Sales teams can offer tailored card solutions and efficient money movement, targeting tech-focused clients. Success hinges on effective marketing and integrating these services.

- Lithic saw a 300% increase in transaction volume in 2024, showcasing rapid growth.

- Veritex's card services revenue grew by 15% in Q3 2024, indicating early success.

- The fintech sector is projected to reach $200 billion by 2025, highlighting market potential.

- Customer acquisition costs through fintech partnerships can be 20% lower.

Focus on Commercial Clients

Veritex Community Bank's strategic focus on commercial clients, particularly small to mid-sized businesses, is a key aspect of its business model. This approach requires a proactive stance toward market dynamics, especially concerning credit risk. Industries like retail, including motor vehicle dealers and power equipment, are currently facing elevated credit risk profiles. Adapting risk management strategies is essential for success.

- Veritex focuses on small to mid-sized businesses.

- Industries like retail face higher credit risk.

- Adapting to market changes is vital.

- Risk management strategies are crucial.

Veritex's Lithic partnership is a "question mark," aiming to provide innovative card services. Lithic's transaction volume surged 300% in 2024, while Veritex's card revenue rose 15% in Q3 2024, suggesting potential. Success depends on marketing and service integration as the fintech sector eyes a $200 billion market by 2025.

| Metric | 2024 Data | Significance |

|---|---|---|

| Lithic Transaction Volume Growth | 300% | Rapid expansion |

| Veritex Card Services Revenue Growth (Q3) | 15% | Early success |

| Fintech Market Size (Projected 2025) | $200 Billion | Market opportunity |

BCG Matrix Data Sources

The Veritex BCG Matrix uses financial statements, industry data, and competitor analysis, complemented by market growth figures and expert opinions.