Vital Farms Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vital Farms Bundle

What is included in the product

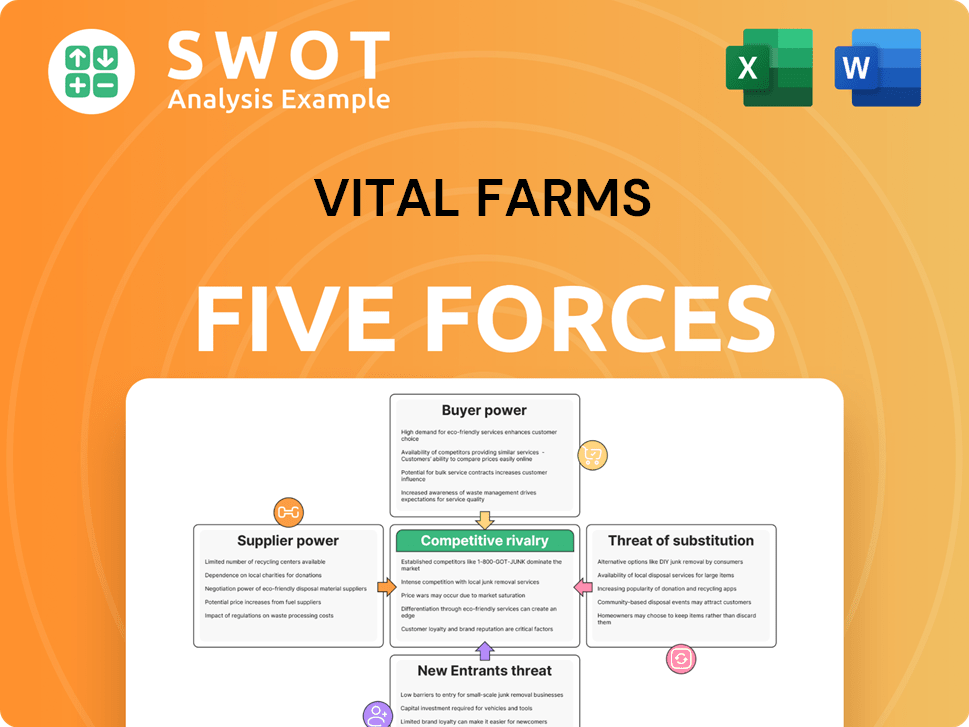

Analyzes Vital Farms' competitive landscape, focusing on forces like rivalry, supplier/buyer power, threats, and entry barriers.

Swap data and labels—perfect for reflecting business conditions.

Full Version Awaits

Vital Farms Porter's Five Forces Analysis

This preview showcases the complete Vital Farms Porter's Five Forces analysis you'll receive upon purchase. It details competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants.

Porter's Five Forces Analysis Template

Vital Farms faces moderate buyer power due to consumer preference for ethical sourcing and brand loyalty. Supplier power is somewhat high, influenced by the specific requirements of pasture-raised farming. The threat of new entrants is moderate, limited by high capital costs and established brand presence. Substitute products pose a mild threat, with plant-based alternatives available. Competitive rivalry is also moderate, with several established players in the market.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Vital Farms's real business risks and market opportunities.

Suppliers Bargaining Power

Vital Farms sources eggs from over 425 family farms, creating supplier dependency. The company's ethical sourcing and partnerships reduce supplier power. In 2024, Vital Farms added 125+ new farms, increasing egg sourcing capacity by over 40%. This proactive approach mitigates risks.

Switching costs for Vital Farms' suppliers are generally low, as they can sell to other buyers. However, Vital Farms' focus on pasture-raised eggs and long-term partnerships, which represented 90% of the company's revenue in 2024, creates loyalty. This strategy reduces the risk of suppliers switching based purely on price. The company's commitment to quality helps in retaining suppliers.

Vital Farms faces moderate supplier power. The egg industry is fragmented, but ethical and pasture-raised suppliers are a smaller group. Vital Farms' network of family farms mitigates risk. No single farm accounts for a large production share. In 2024, Vital Farms sourced from over 300 family farms.

Input cost sensitivity

Vital Farms' suppliers, primarily egg and dairy farmers, are greatly impacted by input costs, especially feed prices. These costs can swing wildly, affecting farmers' profitability. To counter this, Vital Farms utilizes fair and steady pricing agreements, helping farmers manage their finances more predictably. They also support their farmers with resources to adopt sustainable practices, which can help control costs.

- Feed costs, a major expense for farmers, can vary significantly due to factors like weather and global market conditions.

- Vital Farms' contracts provide price stability, which is crucial for farmers' financial planning.

- Offering support for sustainable farming reduces operational costs and increases efficiency.

- In 2024, Vital Farms reported a gross profit margin of 32.5%, showing the impact of managing input costs effectively.

Differentiation of inputs

Vital Farms sources pasture-raised eggs, a differentiated input, granting suppliers some power. The company's focus on ethical treatment and quality builds a strong brand. This differentiation supports premium pricing, which can benefit suppliers. In 2024, Vital Farms' revenue was $412.8 million, showing strong consumer demand for its products.

- Ethical sourcing differentiates products.

- Premium pricing supports supplier profitability.

- 2024 revenue: $412.8 million.

- Brand strength influences supplier relationships.

Vital Farms manages moderate supplier power, sourcing eggs from a diverse network of family farms, which numbered over 425 in 2024. Although input costs, like feed, fluctuate, the company uses stable pricing agreements to help suppliers. Their focus on pasture-raised eggs supports brand strength and premium pricing.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Network | Diversifies sourcing | 425+ farms |

| Pricing Agreements | Offers stability | Steady prices |

| Revenue | Shows strong demand | $412.8M |

Customers Bargaining Power

Consumer price sensitivity is a key factor, yet Vital Farms operates in a segment valuing ethics and quality. The company doesn't focus on price as a primary sales driver in 2024. Although egg prices rose by 12% in 2023, Vital Farms customers often prioritize ethical sourcing. This customer base shows less price-driven switching behavior. In Q3 2024, Vital Farms' revenue was $103.3 million.

Customers wield considerable power due to the availability of substitutes. They can easily opt for conventional eggs, cage-free eggs, or even egg substitutes. In 2024, the market for alternative eggs and egg products expanded, with a 15% increase in sales. This highlights the competitive landscape. Vital Farms, however, offers pasture-raised eggs, a differentiation that appeals to consumers seeking higher-welfare options. This positions them favorably against cheaper alternatives.

Vital Farms exhibits moderate customer power due to diverse distribution. The company's products are available in roughly 24,000 stores across the U.S., mitigating reliance on a single buyer. This wide reach includes shell eggs, butter, and liquid whole eggs. Furthermore, a growing foodservice presence strengthens customer power in 2024.

Brand loyalty

Vital Farms benefits from strong brand loyalty, particularly among consumers prioritizing ethical and sustainable practices. Aided brand awareness reached 26% in 2024, demonstrating growing consumer recognition. This loyalty diminishes individual customer bargaining power, as consumers are often prepared to pay a premium for Vital Farms products. This allows Vital Farms to maintain pricing power and protect margins.

- Aided brand awareness increased to 26% in 2024, up from 23% at the end of 2023.

- Brand awareness is nine percentage points higher than in 2020.

Information availability

Consumers' access to information about farming and ethical sourcing significantly influences their purchasing decisions, particularly for products like Vital Farms' eggs. The rise of transparency, with 40% of organic egg brands offering detailed traceability, empowers consumers. This trend aligns with a growing preference for clean-label products, reflecting heightened awareness of animal welfare issues within the poultry industry. This shift gives customers more leverage.

- 40% of organic egg brands provide traceability information.

- Consumers increasingly seek clean-label products.

- Demand is driven by ethical sourcing awareness.

Customer bargaining power for Vital Farms is moderate. The availability of egg substitutes and conventional eggs influences customer choices, but brand loyalty to ethical sourcing mitigates this. Wide distribution across 24,000 stores also reduces customer power. However, rising consumer transparency and ethical awareness increase customer leverage.

| Factor | Impact | Data |

|---|---|---|

| Substitutes | High | 15% increase in alt. egg sales (2024) |

| Brand Loyalty | Moderate | Aided brand awareness 26% (2024) |

| Distribution | Moderate | 24,000 stores in the U.S. |

Rivalry Among Competitors

The egg market is intensely competitive, featuring major players like Cal-Maine Foods and Eggland's Best, along with numerous smaller brands. In 2024, Cal-Maine Foods held about 20% of the U.S. market share. Vital Farms, as the leading pasture-raised egg brand, competes directly with these established companies. Vital Farms' focus on ethical sourcing and product differentiation helps it carve a niche in this crowded sector, with around $350 million in revenue in 2024.

The ethical and pasture-raised egg market, where Vital Farms operates, is experiencing significant expansion. The global egg market, estimated at USD 150.83 billion in 2024, is expected to reach USD 222.86 billion by 2032. This growth is driven by rising consumer demand for organic and free-range options. This rapid expansion creates opportunities for companies like Vital Farms.

Vital Farms distinguishes itself by focusing on pasture-raised eggs and ethical farming. It challenges the traditional factory food model. This allows them to sell products from family farms nationally. In 2024, their revenue reached $410.2 million, reflecting this strategy.

Switching costs

Switching costs for consumers are generally low in the egg market, making it easy for them to choose different brands. Vital Farms works to build brand loyalty to counter this, highlighting the benefits of its pasture-raised eggs. The company's focus on its brand is working. This is evidenced by the increasing distribution and sales velocity of its Shellac product.

- Vital Farms' revenue for Q1 2024 was $108.7 million, a 15.7% increase year-over-year.

- The company's gross profit increased to $43.2 million in Q1 2024, up from $34.1 million the previous year.

- Vital Farms' distribution has expanded, with its products available in over 21,000 stores across the United States.

Competitive pricing

Vital Farms operates in a market where pricing is a key competitive factor. While the company positions its products as premium, it contends with rivals that offer eggs at lower prices. Vital Farms is not planning to make price a major contributor to egg sales this year. To justify its higher prices, the company emphasizes the value and benefits of its products. This strategy aims to differentiate its offerings in a price-sensitive market.

- Vital Farms' revenue increased by 14.3% to $359.7 million in 2023.

- The company's gross profit rose to $131.1 million in 2023, a 23.7% increase.

- Vital Farms' focus is on brand building and premium positioning.

- The company is committed to its pricing strategy.

Competitive rivalry in the egg market is fierce, with numerous players vying for market share. In 2024, Cal-Maine Foods held about 20% of the U.S. market. Vital Farms differentiates itself through ethical sourcing and branding.

The low switching costs for consumers increase the pressure on companies. Pricing is a key factor in the competitive landscape, with Vital Farms emphasizing premium value. Vital Farms reported a 15.7% year-over-year revenue increase in Q1 2024.

| Metric | 2023 | Q1 2024 |

|---|---|---|

| Revenue (millions) | $359.7 | $108.7 |

| Gross Profit (millions) | $131.1 | $43.2 |

| Distribution | Over 18,000 stores | Over 21,000 stores |

SSubstitutes Threaten

Vegan egg alternatives present a substitute threat, especially with rising environmental awareness. The market for plant-based eggs is expanding; in 2024, it was valued at approximately $200 million. Consumers increasingly favor alternatives like barn or free-range eggs, even with a higher price point. Vital Farms can emphasize its pasture-raised eggs' quality and nutritional advantages to counter this threat.

Consumers have several options for protein, including meat, dairy, and plant-based alternatives, posing a threat to Vital Farms. Eggs are often more affordable and offer great nutritional value, which boosts global consumption. In 2024, the average price of a dozen eggs was around $2.50, making them budget-friendly. Vital Farms can highlight eggs' versatility and cost-effectiveness to compete effectively.

Processed egg products, like liquid eggs and powders, are substitutes for fresh eggs, especially in food manufacturing, creating a threat. The B2B sector's demand for processed eggs is growing, driven by cost control and efficiency. In 2024, the processed egg market was valued at approximately $8 billion globally. Vital Farms could innovate by offering its own ethically sourced processed egg products to compete.

Price of substitutes

The price of substitutes significantly impacts consumer choices. For Vital Farms, this means closely monitoring the pricing of conventional eggs and other protein sources. Competitive pricing is crucial for retaining customers, especially given the premium associated with ethical and sustainable practices. Escalating egg costs are driven by multiple factors, including HPAI, higher production costs, and supply chain challenges.

- Conventional eggs often serve as a direct substitute, with prices varying widely.

- Plant-based egg alternatives are gaining traction, posing another competitive pressure.

- In 2024, egg prices surged due to HPAI outbreaks and increased production costs.

- Vital Farms' ability to justify its premium pricing through its brand and values is critical.

Consumer perception

Consumer perception significantly shapes the adoption of egg substitutes, impacting Vital Farms. They can highlight the advantages of pasture-raised eggs to counter negative perceptions. There's a growing consumer preference for clean-label products, driven by awareness of animal welfare. This shift influences the demand for Vital Farms' offerings.

- In 2024, the market for plant-based eggs is valued at approximately $200 million.

- Vital Farms' revenue in 2024 is projected to be around $400 million.

- Consumer interest in ethical sourcing is up 15% in 2024.

Substitutes like conventional eggs and plant-based options challenge Vital Farms. The plant-based egg market hit $200M in 2024, pressuring market share. In 2024, egg prices surged due to HPAI and production costs.

| Substitute | Market Data (2024) | Impact on Vital Farms |

|---|---|---|

| Conventional Eggs | Avg. price: $2.50/dozen | Price competition |

| Plant-Based Eggs | Market Value: $200M | Erosion of market share |

| Processed Eggs | Global Market: $8B | B2B sector challenge |

Entrants Threaten

Entering the egg industry demands substantial capital for infrastructure, including farming setups and processing tech. The Egg Central Station's new equipment, increasing capacity by 30%, showcases scalability. Vital Farms' supply chain investments raise entry barriers for rivals. In 2024, the egg industry's capital needs remain significant, affecting new ventures.

The egg industry faces regulatory hurdles concerning food safety, animal welfare, and environmental standards. State laws, such as those in Colorado, California, and Massachusetts, mandate cage-free egg production. Compliance costs can be significant for new entrants. The U.S. egg market was valued at approximately $12.8 billion in 2024. These regulations increase the barriers to entry.

Building brand recognition and consumer trust is a lengthy process. Vital Farms benefits from a strong brand reputation and a loyal customer base. New entrants struggle to quickly replicate this established trust. In 2024, Vital Farms led in the U.S. for pasture-raised eggs and was the second-largest egg brand by retail sales. This brand strength poses a significant barrier.

Access to distribution channels

New entrants face significant hurdles in accessing distribution channels, like securing shelf space and building relationships. Vital Farms benefits from its established network and strong ties with major retailers. The company's ability to enhance distribution and boost sales velocity highlights its brand strength and consumer connection. In 2024, Vital Farms' distribution expanded, increasing product availability nationwide.

- Shelf space is crucial for consumer product visibility.

- Vital Farms leverages existing retailer partnerships effectively.

- Distribution expansion directly boosts revenue and market reach.

- Strong brand recognition helps secure and maintain distribution.

Economies of scale

Established egg producers often have a significant advantage due to economies of scale in both production and distribution, making it difficult for new entrants to compete. Vital Farms is actively working to enhance its efficiency and competitiveness through investments in new facilities and technologies. The company's strategic investments, like the planned second facility in Seymour, Indiana, aim to boost its revenue capacity. This new facility is projected to generate an additional $350 million in revenue by 2027, indicating a strong focus on scaling operations.

- Economies of scale favor established players.

- Vital Farms invests in new facilities.

- Seymour, Indiana facility projected to add $350M revenue by 2027.

New egg industry entrants face high capital costs, including infrastructure and tech investments, hindering easy market entry. Regulatory compliance, such as food safety and animal welfare standards, adds complexity and expense. Building brand recognition and securing distribution are lengthy processes, giving established players a competitive edge.

| Factor | Impact on New Entrants | 2024 Data Highlight |

|---|---|---|

| Capital Requirements | High investment needed for farms & processing. | U.S. egg market valued ~$12.8B. |

| Regulatory Hurdles | Compliance costs and requirements. | State laws mandate cage-free eggs. |

| Brand & Distribution | Difficult to build brand and secure shelf space. | Vital Farms leads in pasture-raised eggs. |

Porter's Five Forces Analysis Data Sources

This analysis draws from Vital Farms' financial reports, competitor assessments, and industry-specific market research for insights.