Vitesco Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vitesco Technologies Bundle

What is included in the product

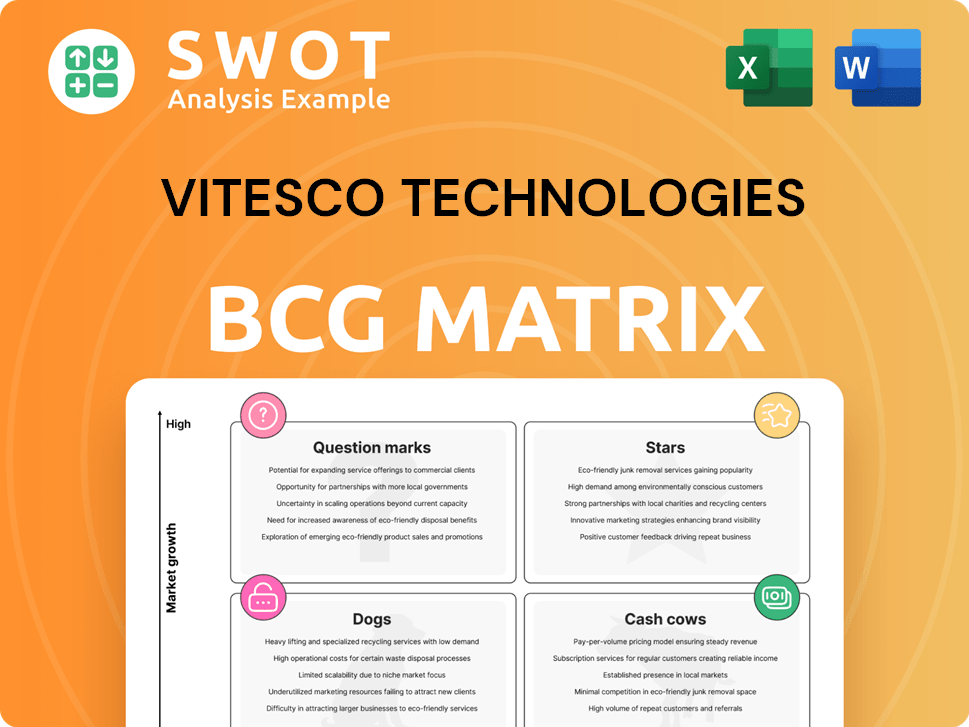

BCG Matrix assessment of Vitesco's portfolio, categorizing its business units for strategic decisions.

Printable summary optimized for A4 and mobile PDFs, allowing quick and concise communication of Vitesco's portfolio.

What You’re Viewing Is Included

Vitesco Technologies BCG Matrix

The displayed Vitesco Technologies BCG Matrix preview is the same report you'll receive after purchase. It's a complete, fully functional analysis ready for strategic planning. No changes, just the professional BCG Matrix document for your use. The download will be available immediately.

BCG Matrix Template

Vitesco Technologies navigates the automotive landscape with a diverse portfolio. Understanding their product strategy is key to grasping future potential. Which products are booming Stars, and which are Dogs needing attention? The BCG Matrix offers strategic insights into market share and growth. See the complete picture: product placements, tailored strategies, and data-driven decisions.

Stars

Vitesco Technologies' electric drive systems, crucial for EVs, thrive in a high-growth market. Securing major eMobility orders, like the recent €1.5 billion contract, signals strong market leadership potential. The increasing EV demand positions these components for substantial growth. In 2024, the e-mobility order intake reached €11.6 billion, reflecting robust market position.

Vitesco Technologies excels in power electronics, vital for the EV sector. Their 800V silicon carbide modules and high-voltage inverters boost EV efficiency and range. This aligns perfectly with the growing EV market. In 2024, global EV sales are projected to increase significantly, driving demand for Vitesco's tech.

Battery Management Systems (BMS) are vital for electric vehicle safety and performance. Vitesco's China BMS production launch highlights its focus on this expanding sector. In 2024, the global BMS market was valued at approximately $8.5 billion. As battery tech evolves, the need for advanced management systems will grow, with projections showing the market reaching over $15 billion by 2030.

Integrated Thermal Management

Integrated Thermal Management is a star within Vitesco Technologies' BCG matrix, highlighting its strong market growth and high market share. Thermal management is critical for EV batteries, enhancing performance and longevity. Vitesco's ITMM offers flexible heating and efficiency improvements, crucial in colder regions. This technology aligns with the increasing demand for efficient EV solutions.

- Market growth for EV thermal management is projected to reach $15.6 billion by 2027.

- Vitesco reported a 10.7% increase in order intake in Q1 2024, reflecting strong demand.

- ITMM can improve EV range by up to 20% in cold weather conditions.

- Vitesco's sales in the Electrification Solutions division grew by 34.5% in 2023.

Electronic Controls, Sensors, and Actuators

Electronic Controls, Sensors, and Actuators are critical for electric and hybrid vehicles' performance. Vitesco excels in these areas, offering solutions for sustainable mobility. As the automotive industry electrifies, the demand for these components will surge. This segment is a "Star" due to its growth potential and Vitesco's strong market position.

- Revenue growth in the Electrification Solutions segment reached 32.3% in 2023.

- Order intake for electrification components reached €12.2 billion in 2023.

- Vitesco aims to achieve over €20 billion in sales by 2028, driven by electrification.

- The market for electric vehicle components is projected to grow significantly by 2030.

Stars in Vitesco's BCG matrix include Integrated Thermal Management and Electronic Controls. These segments experience high market growth and strong market share. Revenue growth in Electrification Solutions was 32.3% in 2023.

| Segment | 2023 Revenue Growth | Market Position |

|---|---|---|

| ITMM | N/A | Strong |

| Electronic Controls | 32.3% | Strong |

| eMobility Orders (2024) | €11.6B | High Growth |

Cash Cows

Vitesco Technologies' combustion engine components face a declining market, yet remain significant. Components for commercial vehicles and aftermarket sales offer stable cash flow. In 2024, Vitesco generated €9.2 billion in sales, focusing on efficient management to boost profitability. This segment requires careful optimization to maximize returns amidst market shifts.

Vitesco's legacy sensors and actuators, crucial for older powertrains, still bring in steady revenue. These products, backed by solid market share and customer loyalty, are cash cows. Careful investment management is key, as the market for these items is gradually shrinking.

Hydraulic components and pumps, vital for traditional powertrains, represent a Cash Cow for Vitesco Technologies. These products, though facing a limited long-term future, offer a steady income stream. In 2024, such components likely still generated significant revenue, supporting overall financial health. Vitesco should prioritize efficient production and distribution to maximize profits from this segment.

Turbochargers (Legacy)

Turbochargers, a legacy product, face decline due to electric boosting. Vitesco can still exploit its expertise in niche markets, but investments should be limited. The market shift is evident, with electric boosting gaining traction. In 2024, turbocharger sales are expected to decrease by 5% globally.

- Demand for turbochargers is shrinking.

- Vitesco's expertise provides niche opportunities.

- Investments must be carefully managed.

- Electric boosting is the future.

Exhaust Gas Treatment Solutions (Selected)

Exhaust gas treatment solutions remain relevant for hybrid and combustion engine vehicles, even with the rise of EVs. Vitesco can still generate revenue by focusing on efficiency and cost reduction in this area. It's crucial to adapt the product portfolio based on regulatory changes. These solutions serve as a cash cow, providing a steady income stream.

- Revenue from exhaust gas treatment in 2024: Approximately €1.5 billion.

- Projected market size for exhaust gas treatment systems by 2027: $18 billion.

- Vitesco's R&D spending on exhaust gas treatment in 2024: €100 million.

- Key focus: Improving catalytic converter efficiency to meet Euro 7 standards.

Cash Cows provide stable revenue with limited growth, like legacy sensors and actuators for Vitesco Technologies. These products, backed by strong market positions, generate consistent cash flow. Efficient management is key to maximizing profits as these markets contract.

| Product Category | 2024 Revenue (approx.) | Market Trend |

|---|---|---|

| Legacy Sensors/Actuators | €1.8B | Declining |

| Hydraulic Components | €0.9B | Declining |

| Exhaust Gas Treatment | €1.5B | Stable |

Dogs

The phase-out of contract manufacturing for Continental signifies a declining product line, no longer a strategic priority for Vitesco Technologies. This shift likely involves low-margin activities, consuming resources better allocated to core areas. In 2024, Vitesco's focus should be on a swift and efficient completion of this phase-out, optimizing resource allocation. According to recent reports, Vitesco's margins are under pressure, making this move crucial for profitability.

The catalysts and filters product line's divestment suggests poor performance and strategic misalignment. This likely involved low growth and resource drain. Vitesco shifted focus, a move reflecting 2024's strategic realignment. The divestment aligns with the core electrification business, aiming for improved financials.

Diesel engine components face obsolescence amid declining production. These parts offer restricted growth and potentially low margins. Vitesco needs to reduce its involvement in this area. In 2024, diesel car sales declined further, impacting component demand. Focus should shift to more promising segments.

Legacy Powertrain Components with low Market Share

Legacy powertrain components with low market share represent Dogs in Vitesco Technologies' BCG Matrix. These products struggle to generate significant revenue or growth. Vitesco should consider divestiture or discontinuation to free up resources. In 2024, Vitesco's focus has been on electrification and electronic control systems, which are likely to be prioritized over legacy components.

- Low market share indicates limited profitability.

- Limited growth prospects suggest a declining market.

- Divesting or discontinuing can improve resource allocation.

- Focus on electrification is a strategic priority.

Non-Core Technologies with Negative Cash Conversion

Non-core technologies with negative cash conversion are "Dogs" in the BCG Matrix. These technologies consume resources without generating profits, directly impacting Vitesco's financial health. In 2024, Vitesco's strategic focus is on streamlining operations, which includes addressing underperforming segments. This is crucial for improving overall profitability and competitiveness.

- Vitesco's 2023 revenue was approximately EUR 9.26 billion.

- The company is actively divesting non-core businesses to concentrate on electrification.

- Negative cash conversion indicates a need for strategic reassessment and potential divestiture.

- Resource reallocation is critical to support growth in core areas.

Dogs in Vitesco’s portfolio include legacy components, often with low market share and limited growth prospects, as of 2024. These segments underperform in revenue generation, requiring strategic actions like divestiture. Focusing on electrification and electronic control systems aligns with Vitesco's shift.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Low Market Share Components | Limited revenue, low growth. | Divest or discontinue. |

| Non-Core Technologies | Negative cash conversion. | Streamline or divest. |

| Diesel Components | Obsolescence, declining demand. | Reduce involvement. |

Question Marks

Vitesco Technologies' SiC power module investments target the booming EV sector. SiC boosts power electronics efficiency, essential for EVs. This demands substantial investment and tech development. Success hinges on capturing market share and cost efficiency. In 2024, the global SiC market was valued at around $1.2 billion.

800V motor stators and rotors are critical for fast-charging EVs. Vitesco's development targets this growing segment. In 2024, the EV motor market is valued at billions. Success hinges on tech innovation and cost competitiveness. Demand is up, but competition is fierce.

EMR3 systems integrate motor, inverter, and transmission, boosting EV efficiency. Vitesco's EMR3 could capture a substantial market share in the evolving EV landscape. Success hinges on proving EMR3's top-tier performance and dependability. In 2024, the global EV market is projected to reach $300 billion.

Next-Generation Wide-Bandgap Semiconductors

Vitesco Technologies' investment in next-generation wide-bandgap semiconductors, like those beyond silicon carbide (SiC), could be a strategic move for its future. These advanced materials have the potential to boost efficiency and performance significantly. The market for SiC power semiconductors is projected to reach $6.4 billion by 2028, according to Yole Développement. However, this technology is still developing, requiring substantial R&D investments.

- SiC market projected to $6.4B by 2028.

- Higher efficiency and performance are potential benefits.

- Requires substantial R&D investment.

Fuel Cell Components

Fuel cell components represent a potential avenue for Vitesco Technologies, although electric vehicles remain the primary focus. Vitesco's existing expertise in electric drive systems could facilitate the development of components for fuel cell vehicles. However, the fuel cell vehicle market faces uncertainty, and substantial investment is necessary. This area is considered a question mark within the BCG matrix, given the high investment needs and uncertain future.

- Market for fuel cell vehicles is still developing, representing a high-growth, low-share scenario.

- Vitesco's investment in this area is significant, but the returns are uncertain.

- The company needs to carefully assess market trends and potential before committing heavily to fuel cell technology.

- Partnerships and strategic alliances could help mitigate risks.

Fuel cell components represent a question mark in Vitesco's BCG matrix. The market is still developing, with high investment needs and uncertain returns. Vitesco's expertise in electric drive systems could be leveraged here. The fuel cell vehicle market size in 2024 is expected to be $500 million.

| Feature | Details | Implications |

|---|---|---|

| Market Growth | High potential | Requires significant investment |

| Market Share | Low, developing | Uncertain future |

| Vitesco's Role | Component development | Leverage existing expertise |

BCG Matrix Data Sources

The BCG Matrix for Vitesco Technologies uses financial data, market research, and expert opinions. Data is also drawn from industry reports for comprehensive analysis.