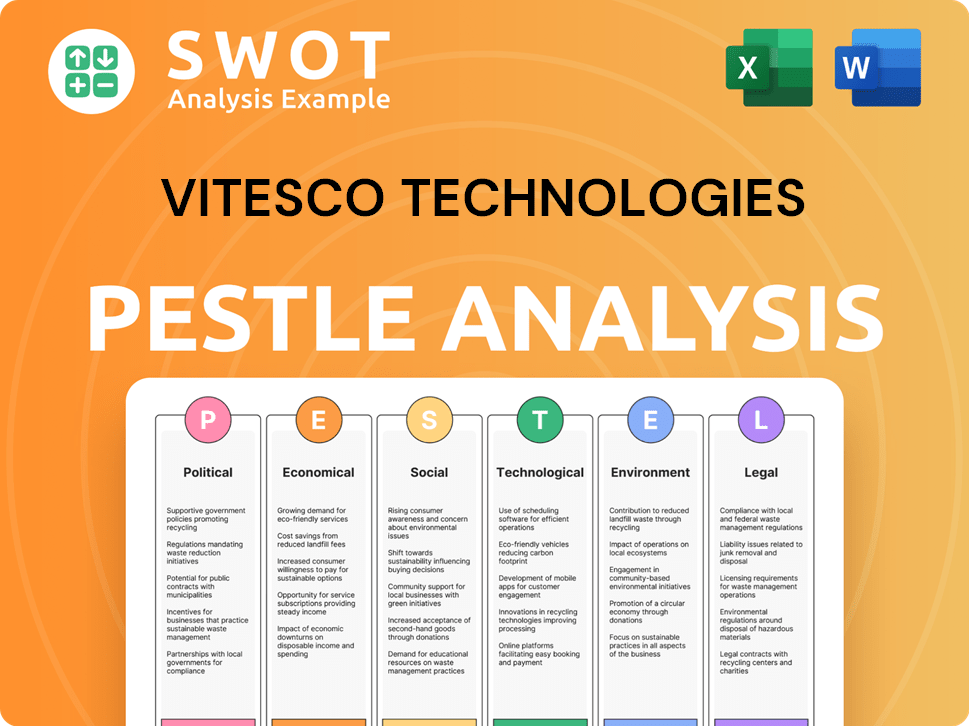

Vitesco Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vitesco Technologies Bundle

What is included in the product

Analyzes macro-environmental factors influencing Vitesco Technologies, covering Political, Economic, Social, etc.

A distilled version for swift analysis of market forces and its implications for Vitesco Technologies.

What You See Is What You Get

Vitesco Technologies PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured, showing a PESTLE analysis for Vitesco Technologies. This in-depth analysis examines political, economic, social, technological, legal, and environmental factors. Each element is thoroughly researched and clearly presented for your use. Upon purchase, you'll download this exact document.

PESTLE Analysis Template

Navigate Vitesco Technologies's future with our PESTLE analysis.

Understand how global events impact their strategy and market position.

Our analysis covers crucial political, economic, and social factors.

Plus, environmental, legal, and technological influences are detailed.

Perfect for strategic planning, investment decisions, and market research.

Gain essential insights to strengthen your own strategies today!

Download the full report and make informed choices now!

Political factors

Government regulations play a crucial role in shaping the automotive industry. Stricter emissions standards are pushing the sector towards electrification. For instance, the EU's CO2 targets have led to significant changes. In 2024, the EU's average CO2 emissions for new cars were 106.7 g/km. Governments provide incentives for EVs, like tax credits.

Trade policies and tariffs significantly influence Vitesco Technologies' operations. Changes in import duties can raise the prices of components. For example, in 2024, tariffs on specific electronic parts increased costs by up to 5%. This impacts manufacturing costs and profit margins.

Vitesco Technologies faces political risks due to its global operations. Instability and geopolitical tensions can disrupt production and supply chains. For instance, the Russia-Ukraine war significantly impacted supply chains in 2022-2023. These factors create market uncertainty, affecting demand and financial performance. In 2024, geopolitical risks remain a key concern for the automotive industry.

Government Investment in Infrastructure

Government investments in infrastructure, like EV charging stations, significantly boost the e-mobility market, directly benefiting companies like Vitesco Technologies. These investments create a supportive ecosystem for electrification solutions, encouraging wider adoption of EVs. For example, the U.S. government plans to invest $7.5 billion in EV charging infrastructure by 2027, potentially creating numerous opportunities for Vitesco. Such policies can accelerate market growth and increase demand for Vitesco's products.

- U.S. aims to install 500,000 EV chargers by 2030.

- EU targets 3.5 million public charging points by 2030.

- China leads in EV charger deployment, with over 2.6 million chargers as of late 2024.

Industrial Policies and Support for the Automotive Sector

Government policies significantly shape the automotive industry. Industrial policies, such as those promoting electric vehicle (EV) adoption, directly impact Vitesco Technologies. Support programs, including R&D funding, offer Vitesco opportunities for innovation. For example, the U.S. government allocated $7.5 billion for EV charging infrastructure in 2021, influencing market trends.

- Policy Focus: EV incentives, emission standards.

- R&D Funding: Grants for powertrain tech.

- Market Impact: Increased EV adoption rates.

Political factors heavily influence Vitesco Technologies. Government regulations on emissions and trade policies like tariffs impact costs. Incentives for EVs, and infrastructure investments such as the U.S. aiming for 500,000 EV chargers by 2030, boost e-mobility.

| Aspect | Details | Impact on Vitesco |

|---|---|---|

| Emissions Standards | EU: 106.7 g/km CO2 for new cars in 2024. | Drives EV tech adoption |

| Trade Policies | Tariffs increased electronic part costs up to 5% in 2024. | Affects manufacturing costs. |

| Government Investments | U.S. $7.5B for EV chargers by 2027. | Boosts market for EV components. |

Economic factors

Global economic health directly affects Vitesco. Strong growth boosts car sales, benefiting the company. For example, the World Bank forecasts global GDP growth of 2.6% in 2024 and 2.7% in 2025. Recessions decrease demand, impacting revenue and profits.

Inflation significantly impacts Vitesco Technologies by driving up raw material and component expenses. For instance, in 2024, the prices of key materials like semiconductors and certain metals have seen increases. This directly affects production costs. Vitesco must actively manage these costs, possibly through hedging or supply chain adjustments, to protect profit margins. This is vital in a market where competition is fierce.

Vitesco Technologies faces currency exchange rate risks due to its global operations. Currency fluctuations affect the cost of raw materials and components sourced internationally. For instance, the Euro's movement against the USD directly impacts profitability. In 2024, Vitesco's financial reports will reflect these currency impacts. The company actively uses hedging strategies to mitigate these risks.

Consumer Purchasing Power and Confidence

Consumer purchasing power and confidence are crucial for Vitesco Technologies, as they significantly affect the demand for new vehicles. Economic downturns or low consumer confidence can lead to reduced vehicle sales, directly impacting the sales of Vitesco's components. For instance, in 2024, consumer spending on durable goods, which includes vehicles, saw fluctuations due to inflation and interest rate hikes. These shifts influence Vitesco's revenue projections and strategic planning.

- Consumer spending on durable goods in the US saw a 0.7% decrease in March 2024, reflecting economic uncertainty.

- Consumer confidence in the Eurozone improved slightly to -14.9 in April 2024, but remains fragile.

- Interest rate hikes by central banks continue to affect consumer borrowing costs for vehicle purchases.

Interest Rates and Access to Financing

Interest rates play a critical role in Vitesco Technologies' financial performance. Elevated rates increase borrowing costs for both consumers and the company. This can dampen demand for new vehicles and raise Vitesco's expenses. These factors influence investment decisions and operational profitability.

- The European Central Bank (ECB) held its key interest rate steady at 4.5% in April 2024.

- The US Federal Reserve maintained its target range at 5.25%-5.5% in early 2024.

- Higher rates could impact Vitesco's plans for R&D and expansion.

- Consumer financing costs can rise, affecting vehicle sales.

Vitesco Technologies is heavily influenced by global economic conditions. Strong GDP growth, forecasted at 2.7% in 2025, supports higher car sales, increasing demand for Vitesco's products. Inflation, impacting raw material costs, necessitates strategic cost management. Currency fluctuations, like the Euro's movement, create financial risks.

Consumer spending trends and interest rates also play pivotal roles. Decreased consumer confidence, coupled with interest rate hikes, can curtail vehicle sales. Interest rate decisions, such as the ECB maintaining a 4.5% rate in April 2024, affect borrowing costs for both consumers and Vitesco.

| Economic Factor | Impact on Vitesco | 2024-2025 Data |

|---|---|---|

| GDP Growth | Affects car sales demand | Global GDP growth: 2.6% (2024), 2.7% (2025) |

| Inflation | Increases production costs | Raw material prices increased, particularly semiconductors |

| Interest Rates | Impact borrowing costs & sales | ECB held rate at 4.5% in April 2024, US Fed at 5.25-5.5% |

Sociological factors

Consumer preference increasingly favors sustainable mobility. Awareness of environmental issues fuels demand for electric vehicles (EVs). This boosts companies like Vitesco Technologies, specializing in electrification. Global EV sales reached 13.8 million in 2023, a 33% increase from 2022.

Changing lifestyles and urbanization are reshaping transportation. This shift drives demand for efficient vehicles. In 2024, urban populations globally grew, influencing car preferences. Compact EVs are gaining traction, reflecting lifestyle changes. Vitesco must adapt to this evolving market, which is projected to reach $2.5 trillion by 2025.

Public views on electric vehicles (EVs) and driver-assistance systems greatly impact market uptake. Vitesco must address concerns and build confidence in its innovations. In 2024, 30% of consumers cited range anxiety as a barrier to EV adoption. Building trust is essential for Vitesco's success.

Demographic Shifts and Aging Population

Changing demographics, like an aging population in Europe and North America, significantly influence the automotive industry. This shift impacts vehicle design, with increased demand for features like enhanced safety systems and user-friendly interfaces, which Vitesco Technologies must address. These demographic changes also affect market demand for specific vehicle types, such as electric vehicles (EVs) favored by younger demographics. Vitesco's product development needs to align with these trends.

- By 2030, the over-65 population in Europe is projected to reach over 25%.

- The global EV market is expected to grow to $823.75 billion by 2030.

- Older drivers are more likely to prefer vehicles with advanced driver-assistance systems (ADAS).

Labor market trends and availability of skilled workforce

Vitesco Technologies relies heavily on a skilled workforce, especially in electrical engineering and software development, crucial for its operations. The labor market trends and the ability to secure talent are key sociological factors. In 2024, the demand for software developers increased by 22% globally. Attracting and retaining talent is vital. The company's success is tied to its ability to adapt to evolving labor dynamics.

- Demand for software developers increased by 22% globally in 2024.

- Vitesco needs electrical engineers and software developers.

- Labor market trends directly impact its operations.

Societal shifts are key. Preference for EVs grows, with sales up 33% in 2023. Urbanization and lifestyles influence car choices, boosting compact EVs, which should be worth $2.5 trillion by 2025. Vitesco must navigate public views and build trust, crucial for its success.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| EV Adoption | Consumer behavior | 30% cite range anxiety |

| Demographics | Aging impacts design | Europe's over-65s will exceed 25% by 2030 |

| Labor Market | Talent acquisition | 22% rise in software dev demand |

Technological factors

Advancements in battery tech, like energy density, charging speed, and cost reduction, are crucial for EVs. These improvements directly affect Vitesco's electrification solutions. Battery costs have fallen significantly; in 2024, they were around $139/kWh. Faster charging times and increased range enhance EV appeal, boosting demand for Vitesco's products.

Ongoing advancements in power electronics and electric motor technology are vital for enhancing electric powertrains. Vitesco's proficiency here is crucial for its success. The global electric motor market is projected to reach $108.8 billion by 2025. These innovations directly impact the efficiency and cost of EVs.

Software and connectivity are crucial in cars. This means features like over-the-air updates and advanced vehicle systems. Vitesco must use advanced software in its products. The global automotive software market is projected to reach $57.7 billion by 2025.

Research and Development in Alternative Fuels and Powertrains

Vitesco Technologies faces significant technological shifts due to research and development in alternative fuels and powertrains. Hydrogen fuel cells and advanced electric vehicle technologies are areas of intense innovation, potentially disrupting the market for traditional combustion engines. The company must closely monitor these developments to adjust its strategic focus. In 2024, the global hydrogen fuel cell market was valued at $12.3 billion, and is projected to reach $49.9 billion by 2029.

- Hydrogen fuel cell market growth.

- Impact on combustion engines.

- Adaptation of strategic focus.

- Electric vehicle tech advancements.

Automation and Manufacturing Technologies

Vitesco Technologies can significantly benefit from advancements in automation and manufacturing technologies. These technologies can improve production efficiency and reduce costs. They also enhance the quality of products, which is vital for competitiveness. Investing in these technologies is critical for maintaining a strong market position. In 2024, the global industrial automation market was valued at approximately $200 billion, with expected growth of 8% annually through 2028.

- Robotics and automation can reduce production costs by up to 20%.

- Implementation of advanced manufacturing systems can increase production output by 15%.

- Quality control systems powered by AI can reduce defect rates by 10%.

Vitesco must embrace rapid technological advancements. Battery tech improvements drove EV adoption, with costs around $139/kWh in 2024. The electric motor market is forecast at $108.8B by 2025, crucial for electric powertrains. Software and alternative fuels also drive change, with automotive software projected at $57.7B in 2025.

| Technology Area | Impact on Vitesco | 2024/2025 Data |

|---|---|---|

| Battery Tech | Enhances EV solutions | Battery costs: $139/kWh (2024) |

| Electric Motors | Drives powertrain efficiency | Market: $108.8B (2025 projection) |

| Automotive Software | Enhances vehicle systems | Market: $57.7B (2025 projection) |

Legal factors

Vitesco Technologies must adhere to strict vehicle safety standards mandated by governments globally. These regulations, crucial for consumer protection, directly affect product design and manufacturing processes. Compliance is non-negotiable, influencing costs and timelines. For instance, in 2024, the EU's General Safety Regulation (GSR) requires advanced safety features, impacting Vitesco's product development.

Environmental regulations and emissions standards are pivotal, pushing the automotive industry towards electrification. Vitesco Technologies, specializing in electric mobility components, directly responds to these legal pressures. Globally, governments are tightening emissions rules; for example, the EU's Euro 7 standards. In 2024, the electric vehicle (EV) market is projected to grow significantly, influenced by these regulations.

Product liability laws are critical for Vitesco Technologies, holding them accountable for product defects. They must follow strict quality control to reduce claims. In 2024, the automotive industry faced $1.5 billion in product liability settlements. Vitesco's compliance is crucial to avoid financial and reputational damage.

Intellectual Property Laws and Patents

Intellectual property (IP) protection is vital for Vitesco Technologies. Patents secure its innovations, ensuring a competitive edge in the automotive tech sector. Securing and defending patents is key, as R&D spending reached €676.3 million in 2024. This investment fuels innovation, making IP protection essential. In 2024, Vitesco filed 298 patent applications.

- Patent applications safeguard Vitesco's innovations.

- R&D investments totaled €676.3 million in 2024.

- 298 patent applications were filed in 2024.

International Trade Laws and Compliance

Vitesco Technologies operates globally, necessitating strict adherence to international trade laws. Compliance with export controls and sanctions is critical for seamless international operations. Non-compliance can lead to significant penalties and operational disruptions. The company's commitment to legal and regulatory compliance is essential for its global footprint. Vitesco's recent annual report highlights the importance of these measures.

- Export Controls: Vitesco must adhere to export regulations, such as those from the U.S. Department of Commerce, to ensure that the transfer of goods and technology complies with international standards.

- Sanctions Compliance: The company must comply with economic sanctions imposed by various governments, including those from the U.S., EU, and UN, to avoid financial and legal repercussions.

- Trade Agreements: Understanding and leveraging trade agreements, such as those within the EU or with specific countries, can impact tariffs and market access.

- Recent Data: In 2024, the U.S. Department of Commerce increased enforcement actions related to export control violations, underscoring the need for robust compliance programs.

Legal factors heavily shape Vitesco Technologies' operations, with vehicle safety standards like the EU's GSR impacting product design. Compliance is critical, influencing both costs and timelines. Product liability and IP protection are also paramount, as seen in the €676.3 million R&D spend and 298 patent filings in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Safety Regulations | Compliance with global standards | EU's GSR impacts product development |

| R&D Investment | Funding innovation and IP | €676.3 million |

| Patent Filings | Protecting innovations | 298 applications |

Environmental factors

Growing climate change concerns are pushing the automotive industry to cut emissions. Vitesco Technologies focuses on sustainable drive tech, especially for EVs. In 2024, global EV sales rose, reflecting this shift. Vitesco's solutions help reduce carbon footprints, aligning with stricter environmental regulations.

The availability and sustainability of raw materials are crucial for Vitesco Technologies. Battery and electric motor components, like rare earth elements, are under scrutiny. Vitesco is actively seeking sustainable sourcing methods. They are also researching material alternatives. In 2024, Vitesco's sustainability report highlighted progress in this area.

Regulations on waste management and recycling, especially for automotive components like batteries, are crucial. Vitesco Technologies must address the end-of-life cycle of its products. The EU's Battery Regulation (2023/1542) sets recycling targets; by 2025, 45% of portable batteries must be collected. Vitesco needs recycling solutions to comply and minimize environmental impact.

Energy Consumption and Efficiency

Energy consumption and efficiency are crucial environmental factors for Vitesco Technologies. The company focuses on creating energy-efficient powertrains and improving operational sustainability. This includes optimizing manufacturing processes to reduce energy use and waste. Vitesco's efforts align with global trends towards greener technologies and regulations.

- Vitesco aims to reduce its Scope 1 and 2 emissions by 60% by 2030, compared to the 2019 baseline.

- In 2023, Vitesco reported a 19% reduction in CO2 emissions from its production sites.

Water Usage and Pollution Control

Water usage and pollution control are key environmental aspects for Vitesco Technologies. Manufacturing processes require careful water management to minimize environmental impact. Sustainable practices and pollution control ensure regulatory compliance and corporate responsibility.

- Vitesco Technologies aims to reduce water consumption by 15% by 2025.

- The company invests in water treatment technologies to minimize pollution.

- Compliance with water quality standards is a priority.

Vitesco Technologies faces increasing environmental demands, especially concerning emissions and sustainability. The company focuses on reducing its carbon footprint, aligning with regulations like the EU's Battery Regulation. Water management and sustainable sourcing are also key. Vitesco's goals include cutting emissions and water usage.

| Factor | Initiative | Goal |

|---|---|---|

| Emissions | Reduce Scope 1 & 2 | 60% reduction by 2030 (vs. 2019) |

| Water Usage | Improve Efficiency | 15% reduction by 2025 |

| Recycling | EU Battery Reg compliance | Meet recycling targets |

PESTLE Analysis Data Sources

Our PESTLE Analysis sources official governmental, financial and technological data alongside specialized industry publications.