Vornado Realty Trust Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vornado Realty Trust Bundle

What is included in the product

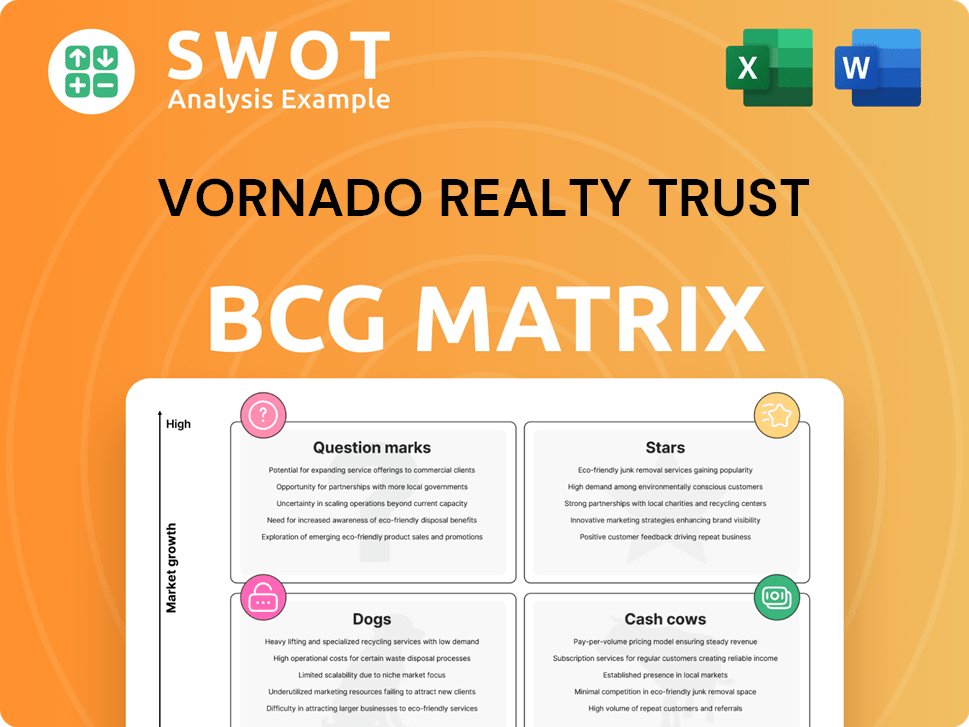

BCG Matrix analysis reveals Vornado's real estate portfolio performance, identifying investment opportunities.

Clean, distraction-free view optimized for C-level presentation of Vornado's diverse real estate portfolio.

What You’re Viewing Is Included

Vornado Realty Trust BCG Matrix

The preview showcases the complete Vornado Realty Trust BCG Matrix you'll receive. This is the final, fully formatted document, ready for immediate application in your strategic planning and investment analysis.

BCG Matrix Template

Vornado Realty Trust's BCG Matrix offers a glimpse into its portfolio's strategic landscape. Identifying "Stars" like prime NYC properties vs. "Dogs" needing restructuring is key. This analysis informs capital allocation and risk management decisions. Understanding market share and growth rates guides strategic planning. This preview hints at critical insights, but the full BCG Matrix provides detailed quadrant analysis and actionable strategies. Uncover Vornado's true potential—purchase now for a competitive edge!

Stars

Vornado's Penn District redevelopment is a star in its portfolio. Penn 1 and Penn 2, are nearing completion, with high occupancy rates. This project is expected to boost revenue. In 2024, Vornado's net operating income increased by 1.6% to $1.67 billion.

555 California Street, a key asset for Vornado with a 70% stake, shines brightly. Despite market shifts, top-tier offices in areas like San Francisco, with its tech focus, remain in demand. High occupancy rates are key. In 2024, San Francisco's office market showed resilience.

Vornado's "Stars" status, fueled by sustainability, shines. Achieving 100% LEED certification across its portfolio is a key differentiator. This attracts tenants and reduces environmental impact. In 2024, Vornado's efforts were likely recognized by awards like Energy Star, boosting its reputation. These initiatives contribute to long-term financial success.

Strategic Leasing Activity in NYC

Vornado Realty Trust shines as a "Star" in the BCG Matrix due to its robust leasing performance in NYC. Securing large deals at premium rents underscores its market leadership. This drives revenue and boosts its NYC portfolio's value. The firm's ability to attract tenants highlights its prime office space demand.

- Q1 2024: Vornado leased 300,000 sq. ft. in NYC.

- Average rent in Q1 2024: $75 per sq. ft.

- Occupancy rate: 85% in NYC.

- Revenue growth: 5% from leasing.

350 Park Avenue Development

The 350 Park Avenue development is a key project for Vornado Realty Trust. This 1.8 million-square-foot office tower is anchored by Citadel. Securing a major tenant like Citadel early on reduces risk and ensures income. The project is positioned as a "star" within Vornado's portfolio.

- Projected cost: approximately $3 billion.

- Citadel's lease: covers a significant portion of the building.

- Completion target: likely by 2028.

- Market impact: strengthens Vornado's NYC presence.

Vornado's "Stars" include high-value assets and key projects. Strong leasing in NYC at premium rents boosted revenue. These stars drive portfolio value.

| Key Metric | 2024 Data | Impact |

|---|---|---|

| NYC Leasing | 300,000 sq. ft. leased in Q1 | Increased revenue |

| Average Rent | $75 per sq. ft. | Boosts profitability |

| Occupancy Rate | 85% in NYC | Ensures income |

Cash Cows

Vornado's Manhattan office portfolio, a cash cow, provides steady revenue. Despite remote work, prime locations and long leases offer stability. Upgrades and amenities boost appeal and occupancy. In Q3 2024, Manhattan occupancy was 85.6%, with $300M+ in revenue.

Manhattan street retail, a cash cow for Vornado, thrives on high foot traffic. Prime locations ensure strong rental income despite retail sector shifts. In Q3 2023, Vornado's Manhattan portfolio saw occupancy rates at 83.6%. Active management and tenant selection are crucial for consistent cash flow.

THE MART in Chicago is a reliable cash cow for Vornado, providing consistent income through long-term leases. This commercial hub thrives due to its prime location and varied tenants. High occupancy rates and new tenant attraction are key. In 2024, its net operating income was $170 million.

Long-Term Leases

Vornado Realty Trust's long-term leases function as cash cows, generating consistent income. These leases, securing steady cash flow, are vital for stability. Actively managing and renewing these leases is key to maintaining their value. In 2024, Vornado's focus includes lease renewals.

- Predictable Revenue: Long-term leases offer a reliable income source.

- Market Stability: They provide stability during economic shifts.

- Active Management: Renewal at favorable terms is crucial.

- 2024 Strategy: Focus on lease renewals and management.

Operational Efficiencies

Vornado Realty Trust focuses on operational efficiencies to boost profitability and cash flow within its portfolio. Cost-saving measures and technology adoption help to maximize income from existing properties. These improvements directly benefit their cash cow assets, enhancing their performance. In 2024, Vornado reported a net operating income (NOI) of $593.7 million. This reflects effective management of its properties.

- Operational efficiencies drive increased profitability.

- Cost-saving measures and tech leverage boost income.

- These efficiencies enhance cash cow asset performance.

- 2024 NOI was $593.7 million.

Vornado’s cash cows—Manhattan office, retail, and THE MART—deliver consistent revenue, with long-term leases ensuring stability. Prime locations and active management are key to high occupancy rates and cash flow. In 2024, these assets boosted Vornado’s NOI.

| Asset | 2024 Revenue/NOI | Key Feature |

|---|---|---|

| Manhattan Office | $300M+ | High Occupancy |

| Manhattan Retail | Stable Rental Income | Prime Locations |

| THE MART | $170M NOI | Long-term Leases |

Dogs

Vornado Realty Trust faces challenges with underperforming retail properties. Changing consumer habits and e-commerce have hit these assets hard. They may struggle to find tenants, hurting revenue. In 2024, Vornado's retail segment saw occupancy rates around 90%, signaling pressure. Divesting or repurposing could boost returns.

Properties outside Vornado's core markets, like those in Washington, D.C., could be "dogs" if they underperform. These assets might need substantial investment to stay competitive, potentially straining resources. Selling these non-core assets, such as the 2024 sale of 2200 Pennsylvania Avenue in D.C., could boost Vornado's financial health. This aligns with strategies to improve overall portfolio performance.

Properties with high vacancy rates are a significant financial burden for Vornado. These underperforming assets often face challenges like outdated designs or undesirable locations. To boost occupancy and revenue, renovations or repositioning are essential. Otherwise, they will continue to underperform within the portfolio. In 2024, Vornado's occupancy rate was around 88%, and a focus on improving occupancy rates in underperforming properties is vital.

Defaulted Loans

Defaulted loans, like the $74.1 million mortgage on 606 Broadway, are liabilities for Vornado. These non-performing assets require active management to reduce losses and tie up capital. Minimizing these defaults is essential for portfolio health. The focus is on improving the overall financial standing.

- Non-recourse loans, like the one on 606 Broadway, shift risk.

- Active management is needed to handle the defaulted loans.

- These defaults can affect Vornado's financial performance.

- Reducing defaults is a key part of financial strategy.

Properties Requiring Significant Capital Expenditure

Properties demanding substantial capital without equivalent revenue growth can be "dogs" in Vornado Realty Trust's portfolio. These assets consume resources that could be better allocated elsewhere, potentially hindering overall profitability. Vornado might face challenges with properties like the Hotel Pennsylvania, which required significant investment. Strategic alternatives are crucial, considering the long-term prospects of these properties.

- Hotel Pennsylvania's renovation costs could be considered.

- These properties may have a lower return on investment.

- They could negatively affect Vornado's overall financial performance.

- Alternatives include sale, redevelopment, or repositioning.

In Vornado's portfolio, "dogs" are underperforming assets like certain retail spaces and properties outside core markets. These assets experience low occupancy rates and high capital demands. Such properties drag down overall financial performance.

| Category | Characteristics | Financial Impact |

|---|---|---|

| Retail Properties | Low occupancy, outdated design | Reduced revenue, high costs |

| Non-Core Assets | Poor location, require investment | Strain resources, potential losses |

| Defaulted Loans | Non-performing assets | Tie up capital, negative returns |

Question Marks

Sunset Pier 94 Studios, a Vornado project, is a question mark in the BCG matrix. The project's success hinges on securing tenants at predicted rates. In 2024, the studio market saw fluctuations; thus, careful monitoring is crucial. Strategic marketing is vital to transform this project into a profitable venture. Market analysis shows that studio spaces in New York City had a vacancy rate of about 10% in late 2024.

The Rego Park Mall redevelopment or sale is a question mark for Vornado Realty Trust. Its success hinges on favorable sale terms or a revenue-generating plan. Vornado's Q3 2024 financials show ongoing uncertainty. The project's outcome affects asset value and resource allocation. As of late 2024, specifics remain fluid.

Leasing activity at 315 Montgomery Street in San Francisco is concerning, with negative GAAP and cash mark-to-market rent changes. The initial rent of $67.57 per square foot and a 5.4-year lease term suggest potential market challenges. Strategic repositioning might be needed. Vornado Realty Trust reported a Q3 2023 net loss of $108.6 million.

Expansion into Residential Properties

Vornado's Question Mark status is due to its small residential portfolio. It has 1,330 units across two Manhattan properties. Success hinges on occupancy and efficient management.

- Residential represents a small portion of Vornado's overall portfolio.

- Vornado's total revenue in 2024 was roughly $1.7 billion.

- The future depends on strategic choices and further investments.

Potential Sale of 770 Broadway

The potential sale of 770 Broadway is a question mark in Vornado Realty Trust's portfolio. Its success hinges on securing a high valuation and a high-credit tenant, crucial for maximizing returns. A favorable sale could generate significant capital for reinvestment, bolstering Vornado's financial flexibility and future growth. However, failure could constrain resources and impact strategic initiatives.

- The property's valuation is key, with market conditions playing a vital role in the final sale price.

- Securing a high-credit tenant ensures stable, long-term income for the new owner.

- Successful sales can provide funds for other strategic investment.

- Unsuccessful sales restrict financial resources, affecting growth potential.

Several Vornado projects are "Question Marks" in its BCG matrix. These include Sunset Pier 94 Studios and Rego Park Mall, their success depending on market conditions and strategic execution. A significant factor is the leasing or selling of properties like 770 Broadway or 315 Montgomery Street, which affects the company's financial position.

| Project | Status | Key Considerations |

|---|---|---|

| Sunset Pier 94 Studios | Question Mark | Tenant acquisition, market fluctuations. |

| Rego Park Mall | Question Mark | Sale terms or revenue plan. |

| 770 Broadway | Question Mark | Valuation, securing high-credit tenant. |

BCG Matrix Data Sources

The BCG Matrix uses Vornado's financials, market growth data, and real estate sector reports, all validated for strategic insights.