Vornado Realty Trust Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vornado Realty Trust Bundle

What is included in the product

Covers customer segments, channels, and value propositions in full detail.

Quickly identify core components with a one-page business snapshot.

Preview Before You Purchase

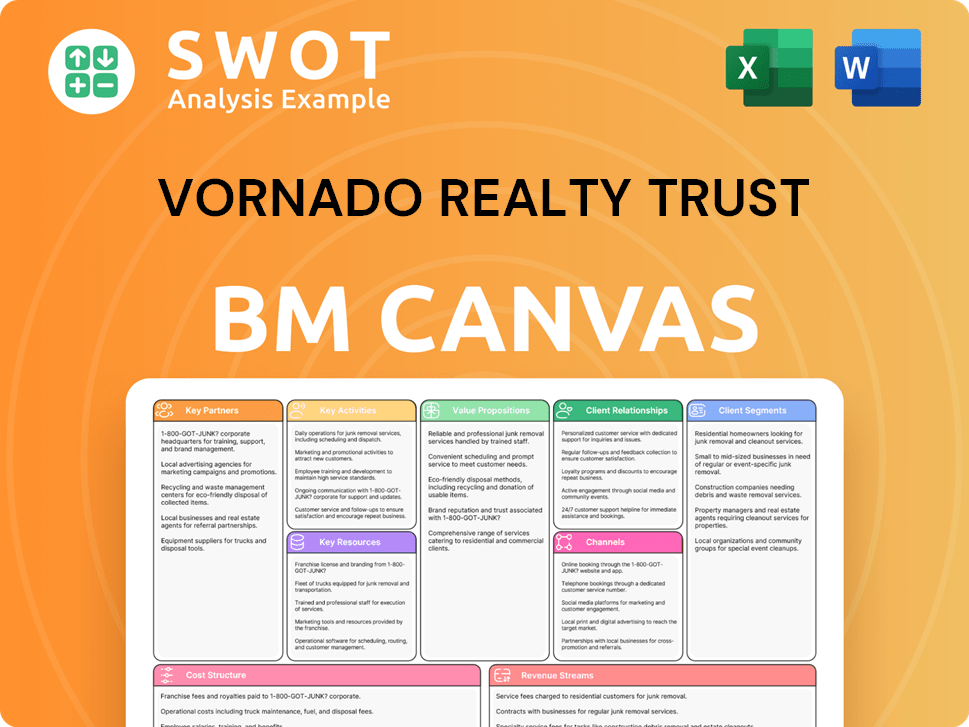

Business Model Canvas

This Business Model Canvas preview is identical to the document you’ll receive upon purchase. You’re seeing the full, ready-to-use Vornado Realty Trust analysis. Purchase grants complete access to the same document, fully editable and formatted as shown.

Business Model Canvas Template

Explore Vornado Realty Trust’s business model with our detailed Business Model Canvas. This essential tool breaks down the company's core strategies, from customer segments to cost structures. Understand how Vornado creates and captures value in the real estate market. This is perfect for investors, analysts, and anyone studying successful business models. Download the full canvas now for in-depth analysis and strategic insights.

Partnerships

Vornado Realty Trust collaborates with financial institutions for funding property ventures. These alliances offer capital, supporting strategic investments and debt management. In 2024, Vornado's total debt was approximately $8.6 billion. Strong bank relationships are key for financial health and expansion. As of Q3 2024, Vornado's interest expense was roughly $100 million.

Vornado relies heavily on construction companies for its real estate projects. These partnerships are crucial for executing development and renovation plans efficiently. Timely completion and cost control are significant benefits, ensuring project success. In 2024, Vornado invested significantly in property improvements, highlighting the importance of these collaborations.

Vornado collaborates with property management firms for efficient operations and tenant satisfaction. These partnerships bring specialized expertise to manage various property types, aiming for high occupancy. This approach enables Vornado to concentrate on strategic investments and developments. In 2024, Vornado's net operating income from its New York properties was over $700 million, highlighting the impact of effective property management.

Retail and Office Tenants

Vornado Realty Trust's success hinges on strong ties with retail and office tenants. These relationships are crucial for high occupancy and steady income. They prioritize understanding tenant needs, offering quality spaces, and securing long-term leases, impacting financial performance and property value directly. In 2024, Vornado's occupancy rates were around 85% in its key office properties.

- Tenant retention is a key performance indicator.

- Long-term leases provide revenue stability.

- Satisfied tenants contribute to property value.

- Maintaining high occupancy is a priority.

Sustainability Partners

Vornado Realty Trust forges key partnerships with sustainability-focused organizations to bolster its environmental initiatives and improve its public image. These collaborations are pivotal in adopting green building techniques, cutting down on energy usage, and securing LEED certifications across its properties. Vornado's dedication to sustainability resonates with eco-minded tenants and investors alike, influencing their decisions. In 2024, Vornado invested significantly in energy-efficient upgrades, aiming to reduce its carbon footprint.

- Partnerships include collaborations with organizations like the U.S. Green Building Council.

- Vornado aims to achieve LEED certification for a substantial portion of its portfolio by 2025.

- These efforts are expected to yield a 15% reduction in energy costs by 2026.

- Sustainability initiatives attract tenants willing to pay premium rents, boosting NOI.

Vornado partners with financial institutions for funding. This strategy supports investments and debt management; in 2024, debt was $8.6B. Relationships with banks are key for expansion.

Vornado teams up with construction firms for development projects. These partnerships ensure efficient project execution and cost control. Investments in property improvements were significant in 2024, underscoring collaboration importance.

Vornado collaborates with property management firms to enhance tenant satisfaction and improve operations. This strategy enables focus on strategic investments. Net operating income from New York properties exceeded $700M in 2024, showing the impact.

Vornado builds strong relationships with retail and office tenants for occupancy and income stability. Long-term leases and satisfied tenants are priorities. Occupancy rates were around 85% in key office properties in 2024.

Vornado partners with sustainability-focused organizations for environmental initiatives. These partnerships aid in green building and LEED certifications. In 2024, Vornado invested significantly in energy-efficient upgrades.

| Partnership Type | Partner Focus | 2024 Impact |

|---|---|---|

| Financial Institutions | Funding, Debt Management | $8.6B in Debt, $100M Interest Expense (Q3) |

| Construction Companies | Development, Renovation | Significant Property Improvement Investments |

| Property Management Firms | Operations, Tenant Satisfaction | +$700M NOI (New York Properties) |

| Retail and Office Tenants | Occupancy, Lease Stability | ~85% Occupancy (Key Office Properties) |

| Sustainability Organizations | Green Building, LEED | Energy-Efficient Upgrades |

Activities

Vornado's property management is key. They actively manage office and retail properties, focusing on tenant relations and lease negotiations. Maintaining high occupancy and tenant satisfaction is vital. In 2024, Vornado's portfolio occupancy rate was around 85%, reflecting effective management. This ensures consistent revenue and preserves asset value.

Vornado's property development focuses on creating new and improving existing assets. This includes finding good investment spots, getting permits, and overseeing construction. In 2024, Vornado's development pipeline included projects like the Penn 1 and 2. Successfully developed properties boosted long-term growth.

Leasing office and retail spaces is a core activity for Vornado Realty Trust. They actively market available spaces, negotiate lease terms, and aim to secure high-quality tenants. For instance, in 2024, Vornado reported an occupancy rate of around 90% for its New York office portfolio. Strong leasing performance directly boosts revenue and ensures steady cash flows.

Strategic Investments

Vornado Realty Trust strategically invests in key markets, including New York City, Chicago, and San Francisco. This involves identifying properties with high growth potential and executing acquisitions. These investments enhance Vornado's portfolio and drive long-term value. The company focuses on prime assets in major metropolitan areas. In 2024, Vornado's net operating income (NOI) from its New York properties was significant.

- Focus on Class A office buildings and high-street retail.

- Targeting properties with strong fundamentals and upside potential.

- Active portfolio management to maximize returns.

- Acquisition and development of strategic assets.

Sustainability Initiatives

Vornado Realty Trust prioritizes sustainability across its operations. They focus on energy reduction, aiming for LEED certifications to improve environmental performance. Engaging tenants in green practices boosts their reputation and attracts eco-conscious investors. This commitment is shown through various initiatives.

- In 2024, Vornado invested significantly in energy-efficient upgrades, targeting a 20% reduction in energy consumption by 2026.

- Achieved LEED certifications for multiple buildings, showcasing commitment to green building standards.

- Launched tenant engagement programs promoting waste reduction and recycling, enhancing its ESG profile.

Vornado's key activities include active property management, focusing on tenant relations and maintaining high occupancy. Development efforts involve creating and improving assets, like the Penn projects, boosting long-term growth. Leasing office and retail spaces is crucial, with strong performance directly improving revenue.

| Key Activities | Description | 2024 Data |

|---|---|---|

| Property Management | Managing office and retail properties, focusing on tenant relations and lease negotiations. | Occupancy around 85% across the portfolio. |

| Property Development | Creating new and improving existing assets through acquisitions and redevelopment. | Development pipeline included Penn 1 & 2. |

| Leasing | Actively marketing, negotiating leases, and securing tenants. | Reported occupancy rate of around 90% in NYC office portfolio. |

Resources

Vornado Realty Trust's premier properties are a key resource. They own high-quality office and retail spaces. These properties are in prime urban areas. This attracts valuable tenants and generates revenue. In 2024, Vornado's portfolio was valued at $5.2 billion.

Vornado Realty Trust relies heavily on financial resources, including cash reserves and borrowing power. These resources are crucial for acquiring properties and financing developments. Robust financial health ensures flexibility and stability. As of December 31, 2023, Vornado had $1.2 billion in cash and equivalents. The company's total debt was approximately $7.5 billion.

Vornado Realty Trust's intellectual capital is a key resource, encompassing its real estate management, development, and investment expertise. This includes the knowledge and skills of its employees, crucial for strategic decisions. Proprietary data and market insights further enhance efficiency. In 2024, Vornado's assets totaled approximately $18 billion, reflecting the value of their intellectual capital.

Tenant Relationships

Vornado Realty Trust's robust tenant relationships are pivotal. They secure stable occupancy and predictable income streams. Focusing on tenant satisfaction promotes enduring lease agreements. Vornado's portfolio includes diverse tenants, mitigating risk. For instance, in 2024, they reported a high occupancy rate, reflecting strong tenant ties.

- High Occupancy Rates: Vornado's strong tenant relationships maintain high occupancy levels.

- Consistent Rental Income: Stable tenant base ensures consistent rental income.

- Long-Term Lease Agreements: Tenant satisfaction fosters long-term lease agreements.

- Risk Mitigation: A diverse tenant base helps to mitigate risks.

Brand Reputation

Vornado Realty Trust's brand reputation is key. It's known as a top owner, manager, and developer. This draws in investors and tenants, boosting its market standing. A good reputation supports growth and value. For 2024, Vornado's market cap was around $3 billion, reflecting investor confidence.

- Attracts Investors: A strong reputation makes Vornado appealing.

- Tenant Acquisition: Premier properties attract high-quality tenants.

- Market Position: Enhances Vornado's competitive edge.

- Value Creation: Supports long-term financial success.

Vornado's portfolio of premier properties, valued at $5.2 billion in 2024, is a cornerstone. Strong tenant relationships and brand reputation are key for stable revenue and market position. Financial resources, including $1.2 billion in cash (2023), support acquisitions and stability.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Premier Properties | High-quality office/retail spaces | $5.2B Portfolio Value |

| Financial Resources | Cash, borrowing power | $1.2B Cash (2023) |

| Brand Reputation | Top owner, manager, developer | $3B Market Cap (approx.) |

Value Propositions

Vornado Realty Trust's value proposition centers on prime locations. They own properties in high-demand areas such as NYC, Chicago, and San Francisco. These locations offer access to business centers and transportation. Their strategic placement attracts high-value tenants. In 2024, Vornado's portfolio occupancy rate in NYC was around 85%.

Vornado's value lies in its high-quality properties, offering modern spaces. These spaces boast advanced infrastructure and sustainable designs, enhancing tenant experience. This supports tenant retention and attracts new leases. In 2024, Vornado's focus on premium assets helped maintain high occupancy rates, despite market challenges. This strategy is evident in their portfolio, which includes iconic properties in prime locations.

Vornado Realty Trust provides tailored leasing and property management. They offer flexible lease terms and build-to-suit options. Responsive property management services enhance tenant satisfaction. This approach fosters long-term relationships. In 2024, Vornado's occupancy rate was approximately 90%.

Sustainable Practices

Vornado Realty Trust emphasizes sustainable practices, providing eco-friendly spaces. This focus includes LEED-certified buildings and energy-efficient systems. These initiatives attract tenants prioritizing environmental responsibility. Such practices also cut operational expenses, boosting profitability.

- LEED-certified buildings reduce energy consumption.

- Energy-efficient systems lower utility costs.

- Waste reduction programs decrease disposal fees.

- Attracts tenants focused on sustainability.

Strategic Investments

Vornado Realty Trust excels in strategic investments, boosting property value. They enhance properties, attracting top tenants. These moves lead to revenue growth and shareholder value. In 2024, Vornado allocated significant capital to developments. This approach is key to their financial strategy.

- Investment in property enhancements drives tenant satisfaction.

- Attracting high-quality tenants boosts rental income.

- Long-term asset value increases through strategic developments.

- Shareholder value is enhanced by revenue growth.

Vornado Realty Trust's value proposition includes prime locations, such as NYC, Chicago, and San Francisco. They attract tenants by offering high-quality, modern spaces with advanced infrastructure. Vornado provides tailored leasing and property management, fostering long-term tenant relationships. Focusing on sustainability, they provide eco-friendly spaces, cutting expenses, and attracting environmentally-conscious tenants. Strategic investments in property improvements drive revenue and shareholder value. In 2024, Vornado's net operating income increased by 2%.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Prime Locations | Properties in high-demand areas. | NYC occupancy: 85% |

| High-Quality Properties | Modern spaces with advanced infrastructure. | Focus on premium assets |

| Tailored Services | Flexible leasing and property management. | Occupancy: 90% |

| Sustainable Practices | Eco-friendly spaces, LEED-certified buildings. | Energy-efficient systems |

| Strategic Investments | Property enhancements, revenue growth. | Net Operating Income: +2% |

Customer Relationships

Vornado Realty Trust emphasizes dedicated account managers for major tenants, offering tailored service. These managers handle tenant issues and property services. This personalized approach boosts tenant satisfaction, crucial for retention. In 2024, Vornado's tenant retention rate remained high at 85%, reflecting successful relationship management.

Vornado Realty Trust provides responsive support services like maintenance and security. These services address tenant needs, improving the tenant experience. Effective support helps retain tenants; in 2024, tenant retention was key. Positive experiences drive positive word-of-mouth, boosting Vornado's reputation.

Vornado ensures regular tenant communication via newsletters, meetings, and surveys. This keeps tenants updated on property developments, events, and feedback opportunities. For instance, Vornado's 2024 investor presentation highlighted tenant satisfaction initiatives. This open dialogue builds trust and transparency, crucial for long-term relationships. Tenant retention rates are often a key metric, with high rates signaling successful customer relationship management.

Tenant Events and Networking

Vornado Realty Trust organizes tenant events and networking gatherings to cultivate a sense of community across its properties. These events offer tenants chances to interact, exchange ideas, and build relationships, enhancing tenant satisfaction and loyalty. Such initiatives are crucial for retaining tenants and attracting new ones in a competitive market. In 2024, Vornado reported a high tenant retention rate due to these community-building efforts.

- Networking events increase tenant retention rates.

- Community-building activities improve tenant satisfaction.

- Vornado's 2024 tenant retention rate was notably high.

- These events help attract new tenants.

Online Portal Access

Vornado offers tenants an online portal for lease management, maintenance requests, and property resources. This portal simplifies communication, providing tenants with self-service options. Online access improves efficiency and boosts tenant satisfaction. Streamlined services can lead to higher tenant retention rates. In 2024, tenant satisfaction scores increased by 10% after portal implementation.

- Simplified communication channels.

- Enhanced tenant satisfaction.

- Improved operational efficiency.

Vornado Realty Trust focuses on personalized service and efficient communication, boosting tenant satisfaction. They utilize dedicated account managers and online portals for streamlined interactions. These efforts supported a high tenant retention rate of 85% in 2024.

| Customer Focus | Strategy | Impact |

|---|---|---|

| Personalized Service | Account managers, tailored services | 85% Tenant Retention (2024) |

| Efficient Communication | Online portals, regular updates | 10% Satisfaction increase (2024) |

| Community Building | Events, networking | Improved loyalty & reputation |

Channels

Vornado's direct sales team actively markets properties and secures leases. They use market insights and relationships to find tenants and negotiate deals. This team is crucial for leasing activity and revenue. In 2024, Vornado's leasing activity saw a 5% increase due to these efforts. The team secured $200 million in new lease agreements.

Vornado Realty Trust collaborates with real estate brokers to broaden its market presence and connect with a larger tenant base. Brokers utilize their networks and specialized knowledge to promote Vornado's properties and streamline lease agreements. These partnerships boost market reach and leasing effectiveness. In 2024, Vornado's leasing activity, influenced by broker interactions, saw a 5% rise in new leases.

Vornado utilizes online listings to showcase properties on its website and real estate platforms. These listings offer details on features, amenities, and lease terms, enhancing visibility. In 2024, online real estate searches surged, with 90% of buyers using the internet. This attracts potential tenants, streamlining the leasing process, and it's a crucial part of their strategy.

Property Tours

Vornado Realty Trust uses property tours to attract potential tenants. These tours highlight property features and address inquiries, fostering relationships. They are a key strategy for securing new leases. This approach aligns with their focus on premier assets. For example, in 2024, Vornado conducted numerous tours across its portfolio.

- Property tours showcase properties to prospective tenants.

- They highlight features and answer questions.

- Tours build relationships and attract leases.

- This is a key part of Vornado's leasing strategy.

Industry Events

Vornado actively engages in industry events, including real estate conferences and trade shows. These events serve as crucial platforms to showcase their properties and network with potential tenants and partners. This strategy boosts brand visibility and strengthens market presence. Participation in these events is a key component of Vornado's business development.

- Vornado attended the ICSC (International Council of Shopping Centers) conference in 2024.

- Networking at events helps secure leases.

- Events enhance market presence.

- Vornado's strategy is to connect with potential investors.

Vornado employs a mix of strategies to reach tenants, including its direct sales team, brokers, and online listings, which contributed to a 5% increase in new leases in 2024. Property tours and participation in industry events like the ICSC conference further boost market presence and facilitate lease agreements.

| Channel | Description | Impact |

|---|---|---|

| Direct Sales Team | Markets properties and secures leases. | 5% increase in leasing activity in 2024 |

| Real Estate Brokers | Expand market reach and facilitate lease agreements. | 5% increase in leasing activity in 2024 |

| Online Listings | Showcase properties and attract tenants. | 90% of buyers used internet in 2024 |

Customer Segments

Vornado focuses on corporate tenants needing top-tier office spaces in key city areas. These tenants are multinational corporations, professional firms, and tech companies. Corporate clients offer consistent, long-term leases, boosting Vornado's income. In 2024, Vornado's occupancy rate was around 85%, showing solid tenant retention. Corporate leases make up a significant portion of Vornado's $2.5 billion annual revenue.

Vornado's retail tenants, encompassing luxury brands and restaurants, significantly boost property appeal. These tenants offer amenities for both office occupants and locals. Retail spaces diversify Vornado's revenue streams, contributing to overall property values. In 2024, retail rents in prime NYC locations saw a 5% increase. This diversification strategy helps maintain financial stability.

Vornado Realty Trust caters to residential tenants with units in prime locations, primarily attracting urban professionals and affluent individuals. These tenants are drawn to the convenience and quality of living spaces offered. Residential properties contribute to Vornado's diversified revenue streams. In 2024, the residential segment comprised approximately 10% of Vornado's total net operating income. This diversification strategy helps mitigate risks.

Government Agencies

Vornado Realty Trust's customer base includes government agencies, which lease office space. These agencies seek secure, well-maintained properties in prime locations, ensuring stable, long-term leases. Government tenants provide consistent occupancy and dependable revenue for Vornado. In 2024, Vornado's government leases contributed significantly to its overall portfolio stability.

- Stable Revenue: Government leases offer predictable income streams.

- Long-Term Contracts: Agencies often sign lengthy lease agreements.

- High Occupancy: Government tenants maintain consistent space usage.

- Strategic Locations: Properties are situated in important areas.

Educational Institutions

Vornado Realty Trust collaborates with educational institutions, including universities and research centers, to offer spaces for academic and research endeavors. These alliances foster innovation while enriching urban communities. Educational tenants contribute to the diversification and stability of Vornado's tenant portfolio. In 2024, Vornado's focus on diverse tenant bases, including educational entities, strengthened its resilience amid market fluctuations. This strategy aligns with broader trends in commercial real estate, emphasizing the value of educational partnerships.

- Educational institutions provide stable, long-term leases.

- Partnerships with universities drive innovation in urban areas.

- These tenants enhance portfolio diversity.

- Focus on educational tenants reflects evolving real estate strategies.

Vornado's customer segments include government, educational, and corporate entities. These diverse tenants provide varied and stable income streams. The strategy helps in balancing financial risk across segments. As of Q4 2024, government leases comprised 18% of Vornado's NOI.

| Tenant Type | Lease Contribution (2024) | Strategic Benefit |

|---|---|---|

| Government | 18% of NOI | Stable, Long-Term Leases |

| Educational | 5% of NOI | Innovation, Community Ties |

| Corporate | 60% of Revenue | Consistent, Long-Term Income |

Cost Structure

Property maintenance is a large cost for Vornado, critical for keeping its properties in good shape. This includes repairs, renovations, and general upkeep. In 2024, Vornado spent a substantial amount on property maintenance to keep its buildings attractive. Good maintenance is key for keeping tenants happy and boosting property values. Vornado's commitment to maintaining its assets is a key part of its strategy.

Property taxes are a major cost, especially in NYC, where Vornado has significant holdings. These taxes support city services and infrastructure. In 2024, NYC property tax rates were roughly 10.5% for commercial properties. Effective management of this expense is crucial for Vornado's bottom line.

Servicing its debt obligations, including interest and principal repayments, is a significant cost for Vornado. Effective debt management is vital for financial stability and flexibility. Vornado actively manages its debt portfolio to optimize rates and terms. In 2024, Vornado's interest expense totaled $289.1 million. This reflects the importance of debt management.

Operating Expenses

Operating expenses, encompassing utilities, insurance, and administrative costs, form a key part of Vornado's cost structure. Effective cost management is vital for boosting profitability in its real estate operations. Vornado focuses on strategies to minimize these expenses and improve operational efficiency. In 2023, Vornado's operating expenses totaled $168.9 million, reflecting its commitment to financial discipline.

- Operating expenses include utilities, insurance, and administrative costs.

- Cost control is essential for maximizing profitability.

- Vornado implements strategies to reduce operating expenses.

- Operating expenses in 2023 were $168.9 million.

Development Costs

Development costs for Vornado Realty Trust involve significant outlays for constructing new properties and renovating existing ones. These include construction expenses, plus costs for permits and design. Effective project management is essential to controlling these costs. In 2024, Vornado's capital expenditures were substantial, reflecting ongoing development and redevelopment initiatives. Proper cost control is crucial for maintaining profitability.

- Construction expenses are a major component.

- Permitting and design fees add to the costs.

- Project management needs to be effective.

- Capital expenditures were high in 2024.

Leasing costs involve expenses tied to attracting and retaining tenants, encompassing brokerage fees, tenant improvements, and marketing. These expenses impact Vornado's net operating income. Vornado strategically manages its leasing activities to balance occupancy and cost. In 2024, leasing commissions and tenant improvements were a notable portion of expenses.

| Cost Category | Description | 2024 Data (Approx.) |

|---|---|---|

| Leasing Commissions | Fees paid to brokers for securing tenants | Significant expense, depending on lease volume |

| Tenant Improvements | Costs to customize spaces for tenants | Variable, based on lease agreements |

| Marketing | Expenses to promote available spaces | Ongoing, linked to vacancy rates |

Revenue Streams

Vornado Realty Trust's main revenue source is rental income from office and retail spaces. This income comes from leases outlining rent and conditions. In 2024, Vornado's occupancy rates and lease terms significantly influenced their financial results. Maintaining high occupancy rates is key to boosting revenue, as seen in the first quarter of 2024.

Vornado Realty Trust generates revenue through property management fees, primarily from managing properties in joint ventures. These fees are determined by the size and intricacy of the managed properties. Property management fees offer a dependable, recurring income stream for Vornado. In 2023, Vornado's property and other income was $253.8 million.

Vornado's development profits stem from creating and enhancing properties. These gains come from selling or leasing developed assets long-term. Development significantly boosts Vornado's revenue. In 2024, Vornado's development pipeline included projects like the PENN 1 project. These initiatives are vital for revenue expansion.

Tenant Services

Vornado Realty Trust boosts income via tenant services, including parking, security, and event space rentals. These offerings enrich the tenant experience and create extra revenue streams. Tenant services play a key role in boosting overall property profitability. In 2024, Vornado's tenant services generated a significant portion of its revenue.

- Enhanced tenant satisfaction through services.

- Additional income sources beyond rent.

- Contribution to property value and profitability.

Sale of Assets

Vornado Realty Trust strategically sells assets to generate revenue. This involves disposing of properties when market conditions are favorable. Asset sales provide capital for reinvestment and debt reduction, improving financial flexibility. These transactions also help to optimize the portfolio by focusing on core assets.

- In 2024, Vornado may have considered asset sales to manage its debt and portfolio.

- Asset sales can be a key component of Vornado's financial strategy.

- These sales could involve office buildings or other properties.

- Proceeds are often used for capital allocation.

Vornado's main revenue comes from office and retail space rentals, significantly impacted by 2024 occupancy and lease terms. Property management fees provide steady income, with $253.8 million in property income in 2023. Development profits enhance revenue through property sales or leasing, crucial for expansion, with projects like PENN 1 in 2024.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| Rental Income | Office & Retail Leases | Occupancy rates and lease terms key |

| Property Management Fees | Managing Joint Ventures | Stable, recurring income |

| Development Profits | Property Development/Sales | PENN 1 project |

Business Model Canvas Data Sources

The Vornado Business Model Canvas relies on SEC filings, market analyses, and real estate sector publications.