Voestalpine Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Voestalpine Bundle

What is included in the product

Analysis of Voestalpine's product portfolio across BCG Matrix quadrants for strategic decisions.

Clean, distraction-free view optimized for C-level presentation, helping Voestalpine leaders grasp portfolio performance quickly.

Preview = Final Product

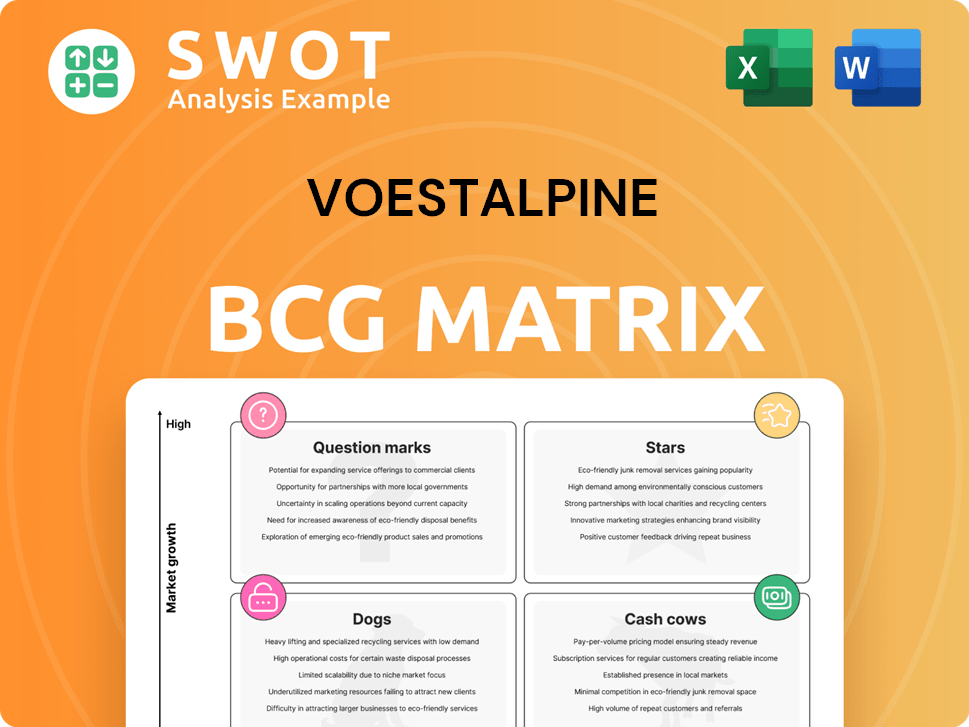

Voestalpine BCG Matrix

The Voestalpine BCG Matrix you see here is the complete document you receive upon purchase. This is not a demo; it's a fully functional analysis tool ready to be integrated into your strategic planning—no hidden content.

BCG Matrix Template

Explore Voestalpine's product portfolio through the insightful lens of the BCG Matrix. See how its diverse offerings are categorized: Stars, Cash Cows, Dogs, and Question Marks. This overview gives you a glimpse of their strategic positioning. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Voestalpine's railway systems are a Star due to its global leadership, especially in turnout technology. Its high market share benefits from growing demand and international projects. For instance, the high-speed rail line in Egypt boosts growth. Continuous innovation and customer adaptation in railway infrastructure solidify its Star status.

Voestalpine excels in aerospace components, offering high-quality materials. The aerospace industry's growth fuels strong demand for their products. Voestalpine's market share is high due to innovation and partnerships. This segment profits from long-term contracts; in 2024, this sector saw a 15% revenue increase.

Voestalpine's high-tech steel products, like tool steel, are crucial for tech-heavy sectors. The company's R&D investments and greentec program boost its market position. In fiscal year 2023/24, the High-Performance Metals Division saw a 15% revenue share. This strategic focus on innovation and sustainability is key.

Warehouse & Rack Solutions

Voestalpine's Warehouse & Rack Solutions, utilizing advanced steel profiles, are seeing robust demand. This growth is fueled by the expansion in warehouse technology and e-commerce. The company is executing projects for key retail and manufacturing clients, including expansions in North America. In 2024, the segment's revenue is projected to increase by 8%.

- Revenue growth of 8% in 2024.

- Focus on high-bay warehousing systems.

- Projects for major retail and manufacturing clients.

- Expansion of production capacities in North America.

Greentec Steel Initiative

Voestalpine's greentec steel initiative is a "Star" in its BCG matrix, focusing on climate-neutral steel production by 2050. This sustainability drive includes significant investments in electric arc furnaces and hydrogen-based steelmaking, catering to the rising demand for eco-friendly steel. The strategy aligns with growing customer and investor interest in sustainable practices. In 2024, Voestalpine allocated over €1 billion towards green steel projects.

- Climate-neutral steel by 2050.

- Investments in electric arc furnaces and hydrogen-based steel.

- Attracts environmentally conscious customers and investors.

- €1 billion allocated towards green steel projects in 2024.

Voestalpine's greentec initiative is a "Star," aiming for climate-neutral steel by 2050. It leverages investments in electric arc furnaces and hydrogen-based steel, meeting the rising demand for eco-friendly steel. This strategy attracts environmentally conscious customers and investors. In 2024, over €1 billion was allocated to green steel projects.

| Key Aspect | Details | 2024 Data |

|---|---|---|

| Goal | Climate-neutral steel production | By 2050 |

| Investments | Electric arc furnaces, hydrogen-based steel | Over €1 Billion |

| Market | Eco-friendly steel demand | Growing |

Cash Cows

Voestalpine's automotive components segment, a cash cow, benefits from strong market positions, particularly in Europe, where it holds a significant share. This segment focuses on specialized, high-value components, which shields it from the price pressures of standardized products. Restructuring in Germany aims to boost efficiency; in 2024, the automotive sector contributed significantly to Voestalpine's revenue. The company's strategy prioritizes profitability in this mature market.

Voestalpine's tool steel business is a cash cow. It's a mature market, generating steady cash flow. In 2024, the High Performance Metals Division, which includes tool steel, reported strong revenue. This division benefits from consistent demand. Voestalpine focuses on innovation to stay competitive.

Voestalpine's special sections boast a strong market position. These sections provide customized solutions across various industries. Their growth is steady, supported by a solid customer base, ensuring reliable revenue. The company prioritizes efficiency, focusing on optimizing production to boost cash flow. In fiscal year 2023/24, the Metal Forming Division, which includes Special Sections, generated €3.7 billion in revenue.

Metal Forming Division (Selected Products)

Certain products within Voestalpine's Metal Forming Division function as cash cows. These products hold established market positions, especially those serving mature industries with steady demand. The division concentrates on optimizing production and distribution to maximize profitability. For example, in fiscal year 2023/24, the Metal Forming Division reported a revenue of EUR 4.2 billion.

- Steady revenue streams from established products.

- Focus on production and distribution efficiency.

- Revenue of EUR 4.2 billion in fiscal year 2023/24.

- Products often serve mature industries.

Oil and Gas Industry Solutions

Voestalpine strategically positions itself within the oil and gas sector, a key area for its cash cow status. The company supplies specialized steel products and solutions crucial for this industry. Despite the volatile nature of energy markets, Voestalpine's established presence ensures a dependable revenue flow. The focus is on solidifying client relationships and boosting operational effectiveness.

- In 2024, the global oil and gas market was valued at approximately $3.7 trillion.

- Voestalpine's revenue from its High Performance Metals division, which serves the oil and gas industry, was about €3.8 billion in the 2023/2024 fiscal year.

- The company aims to increase its efficiency in this segment by 5% by 2025.

Voestalpine's cash cows show steady revenue from established products. They emphasize production and distribution efficiency. The Metal Forming Division reported EUR 4.2 billion in 2023/24.

| Segment | Revenue (EUR Billion, 2023/24) | Key Strategy |

|---|---|---|

| Automotive Components | Significant contribution | Prioritize profitability |

| Tool Steel | Strong, from High Performance Metals | Innovation for competitiveness |

| Special Sections | 3.7 (Metal Forming) | Optimize production |

| Metal Forming Division (Other) | 4.2 | Maximize profitability |

| Oil and Gas (High Performance Metals) | 3.8 | Solidify client relations |

Dogs

Voestalpine's Camtec business at the Linz site is classified as a "Dog" in the BCG Matrix. This decision stems from rising costs and fierce competition, alongside weak demand. Specifically, the European machinery sector's downturn severely impacted Camtec. The business unit's phase-out is planned by March 2026, due to its lack of economic viability.

Voestalpine divested Buderus Edelstahl to Mutares SE & Co. KGaA. This strategic move suggests Buderus was a "Dog" in Voestalpine's BCG matrix. In 2024, Voestalpine focused on core businesses. The sale likely aimed to improve Voestalpine's overall financial performance.

Voestalpine's automotive components in Europe face headwinds. Economic weakness and competition are significant challenges. Reorganization of German locations addresses structural shifts. Standardized components' profitability may be squeezed. In fiscal year 2023/24, the Metal Forming Division saw a revenue decrease.

Commodity Steel Products

Voestalpine is strategically reducing its focus on commodity steel. This segment struggles with profitability due to tough competition and fluctuating prices. The company is directing investments toward high-tech and specialized steel products. This shift aims at higher margins and enhanced value creation. In 2024, Voestalpine's revenue from high-grade steel increased by 8%.

- Focusing on high-tech steel.

- Dealing with price volatility.

- Aiming for higher profit margins.

- Redirecting investments.

Certain Construction Sector Products (Europe)

Voestalpine faces challenges in Europe's construction sector, classified as a "Dog" in its BCG matrix. Weak economic conditions in 2024 have decreased demand for its construction-related products. This sector may see low growth and profitability due to these headwinds. Voestalpine is actively diversifying its portfolio and expanding into growth markets beyond Europe to mitigate risks.

- European construction output decreased by 1.2% in 2024.

- Voestalpine's revenue from construction-related products declined by 3% in 2024.

- The company aims to increase sales in North America by 10% in 2025.

- Profit margins in this segment were down by 2% in 2024.

Several Voestalpine business segments are categorized as "Dogs" within its BCG matrix, reflecting poor market position and low growth. These include Camtec, facing phase-out by March 2026, and parts of automotive components. The construction sector also struggles in Europe, impacting the company's overall performance. Voestalpine actively divests these "Dogs" to focus on high-tech and specialized steel.

| Segment | Status | Actions |

|---|---|---|

| Camtec | Dog | Phase-out by March 2026 |

| Buderus Edelstahl | Dog | Divested |

| Construction (Europe) | Dog | Diversification, expansion |

Question Marks

Voestalpine actively invests in metal additive manufacturing, or 3D printing, for customized products. This technology is in a high-growth phase, yet Voestalpine's market share is still emerging. They utilize powder metallurgy expertise to grow in this innovative area. In fiscal year 2023/24, the company invested EUR 148 million in research and development, supporting such initiatives.

Voestalpine is exploring hydrogen-based steel production to cut CO2 emissions, a high-growth area. Demand for green steel is rising, with a projected market value of $100 billion by 2030. The tech is nascent, so Voestalpine's market share is still developing. In 2024, the company invested €100 million in green steel initiatives.

Voestalpine is focusing on energy efficiency in Brazil, Poland, and Romania, backed by IFC's green bond. These initiatives aim to cut emissions in steel production, aligning with global sustainability goals. The global market for green building materials is projected to reach $477.4 billion by 2028. Success hinges on efficient execution and customer uptake.

Specialty Steel Plant (Kapfenberg)

Voestalpine's Kapfenberg specialty steel plant, with a 205 kt annual capacity, is positioned as a "question mark" in its BCG matrix. This plant expansion directly addresses the rising global demand for high-grade steel products, particularly within sectors like aerospace and automotive. However, its profitability and classification hinge on successfully capturing market share and maximizing production efficiency. The competitive dynamics of the specialty steel market, including factors like pricing pressures and technological advancements, will significantly influence its future trajectory.

- 2024 capacity utilization rates are crucial for determining profitability.

- Market share gains are essential amid competition from rivals like ArcelorMittal.

- Technological integration, like Industry 4.0, will influence production.

- Economic cycles and sector-specific demand affect performance.

High-Performance Turnouts (Cairo, Egypt)

Voestalpine's joint venture in Cairo, Egypt, focuses on high-performance turnouts. This initiative supports Egypt's high-speed rail project, capitalizing on a growing railway infrastructure market. The venture's success hinges on securing contracts and competing effectively.

- Market growth is supported by the Egyptian government's infrastructure investments.

- Competition includes established European and Asian manufacturers.

- Securing contracts is essential for revenue generation.

- The project aims to supply turnouts for the new high-speed rail line.

Voestalpine's Kapfenberg plant's "question mark" status hinges on market share and efficiency. 2024 capacity rates and competition with ArcelorMittal are critical. Tech integration and economic cycles will also sway the plant's performance.

| Aspect | Challenge | Data (2024) |

|---|---|---|

| Market Share | Competition | ArcelorMittal's revenue: $68.3B. |

| Efficiency | Capacity | Utilization rates: Variable. |

| Technology | Integration | Industry 4.0 adoption: Ongoing. |

BCG Matrix Data Sources

This BCG Matrix is built with comprehensive financial data, market analysis, company reports, and industry expert assessments.