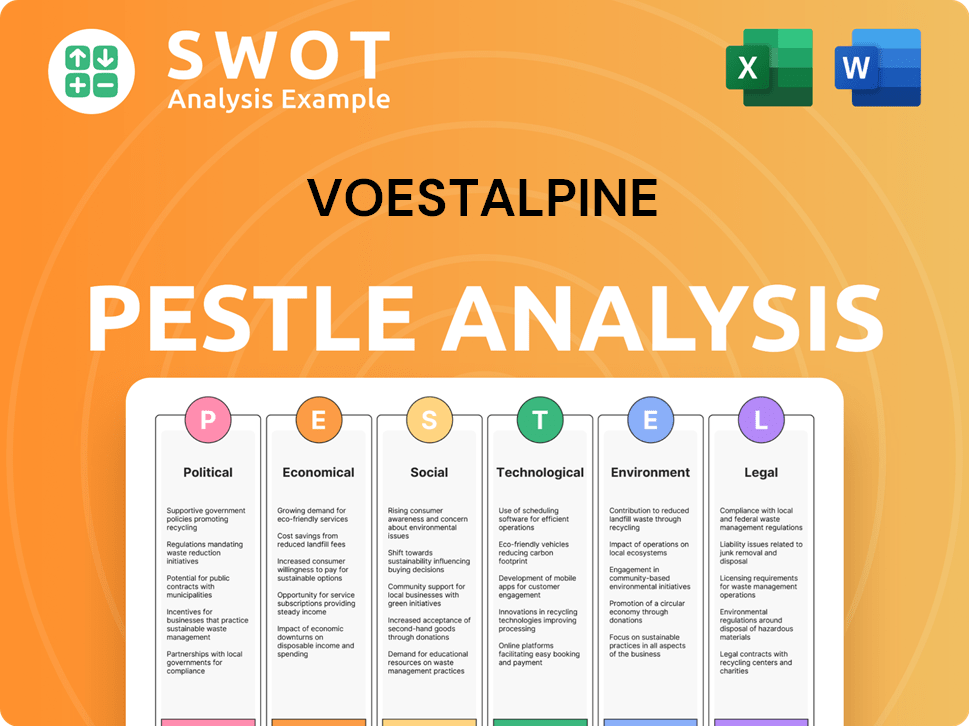

Voestalpine PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Voestalpine Bundle

What is included in the product

Unpacks external factors impacting Voestalpine using PESTLE framework. Includes insights for strategic planning.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

What You See Is What You Get

Voestalpine PESTLE Analysis

This preview presents the complete Voestalpine PESTLE Analysis. The content and formatting you see now will be included. There are no changes; after purchase, you'll instantly access this document. Everything displayed is included. Get the finished analysis.

PESTLE Analysis Template

Navigate the complexities shaping Voestalpine with our PESTLE analysis. We explore political factors like trade policies and economic trends impacting its steel production. Uncover social shifts, technological advances, environmental concerns and legal regulations influencing the company. Purchase now for a comprehensive overview!

Political factors

Political backing and incentives are key for voestalpine's green steel program. Government aid, like loans and subsidies, fuels the shift to low-emission steel. The European Investment Bank's €300 million loan for green steel R&D showcases this. Such support boosts competitiveness and investment in sustainable methods.

Changes in trade policies, like tariffs, directly impact voestalpine. For example, the EU's safeguard measures on steel could affect its exports. In 2024, the company faced challenges in some markets due to protectionist measures. The company's global presence helps, but regional issues still pose risks to revenue and profit.

Political instability, geopolitical tensions, and policy shifts in voestalpine's operating and sourcing regions can disrupt operations and supply chains. Consistent business activities depend on a stable political environment, which is also crucial for investment security. For example, in 2023, voestalpine saw impacts from geopolitical events, with potential supply chain disruptions. The company's risk management continually assesses these political factors.

Regulatory environment and compliance

Voestalpine must navigate a complex regulatory landscape. Adherence to environmental, labor, and competition regulations is vital. For instance, in 2024, environmental compliance costs increased by 7% due to stricter EU directives. Changes in these regulations can affect operational costs.

- EU's Green Deal impacts: Increased compliance costs.

- Labor laws: Affects workforce management.

- Competition regulations: Influence market strategies.

- Compliance costs: Increased by 7% in 2024.

Government procurement policies

Government procurement policies significantly affect voestalpine. Infrastructure projects, like railway systems, boost demand for its products. Policies favoring high-quality or sustainable steel benefit the company. In 2024, global infrastructure spending reached $4.5 trillion, influencing steel demand. Favorable policies in the EU, prioritizing sustainable materials, are particularly advantageous.

- Infrastructure spending significantly impacts demand for steel products.

- Favorable procurement policies boost voestalpine's market position.

- EU policies promote sustainable steel, benefiting the company.

Voestalpine benefits from political support, like EU loans for green initiatives and favorable infrastructure spending, exemplified by the European Investment Bank's €300 million loan. Conversely, trade policies and protectionist measures pose challenges. Political instability and regulatory shifts, such as the EU’s Green Deal increasing compliance costs, also affect operations.

| Factor | Impact | 2024 Data |

|---|---|---|

| Green Steel Support | Enhanced Competitiveness | €300M Loan |

| Trade Policies | Exports Affected | Challenges in Some Markets |

| Regulatory Changes | Increased Costs | 7% Rise in Compliance |

Economic factors

Global economic growth directly influences steel demand, crucial for sectors like automotive and construction. Slowdowns, especially in Europe, can slash sales volumes and prices, hitting revenue. In 2024, the Eurozone's GDP growth is projected at around 0.8%, potentially impacting Voestalpine's sales. Decreased demand can lower profits.

Voestalpine faces raw material price volatility, impacting production costs. Iron ore and scrap metal price swings are key concerns. In 2024, iron ore prices fluctuated significantly. Voestalpine employs hedging strategies to mitigate risks, as raw material costs account for a substantial portion of its expenses.

Voestalpine's steel production is significantly impacted by energy costs. In 2023, energy expenses were a notable part of the company's operational costs. The shift to green steel hinges on affordable renewable energy. The EU's carbon border tax, effective from October 2023, further influences energy strategy.

Currency exchange rates

Voestalpine, as a global entity, faces currency exchange rate risks, affecting import costs and export earnings. Currency fluctuations can significantly impact profitability, especially in regions with volatile currencies. The company actively manages these risks through hedging strategies and financial instruments. For example, in 2024, the EUR/USD exchange rate saw fluctuations, influencing Voestalpine's financial performance.

- Currency hedging strategies are essential.

- EUR/USD rate fluctuations impact earnings.

- Global operations require careful monitoring.

- Financial instruments are used to mitigate risks.

Interest rates and access to financing

Interest rates are a critical economic factor for Voestalpine, impacting borrowing costs for investments and operations. In 2024, the European Central Bank (ECB) maintained relatively high interest rates to combat inflation, affecting the company's financing strategies. Access to financing, including green bonds, is crucial for sustainability projects. For instance, in 2024, Voestalpine issued green bonds to fund eco-friendly initiatives.

- ECB interest rate decisions directly affect Voestalpine's financing costs.

- Green bonds and sustainable financing are key for strategic projects.

- Inflation and economic stability influence financial planning.

Economic factors heavily influence Voestalpine's performance, particularly in the volatile steel industry.

Global economic growth rates, especially in key markets like the Eurozone, directly affect demand and pricing.

Interest rates and currency exchange rates introduce significant financial risks managed through strategic hedging.

| Factor | Impact | 2024/2025 Data Point |

|---|---|---|

| GDP Growth (Eurozone) | Demand and pricing | 0.8% (Projected, 2024) |

| Interest Rates (ECB) | Financing costs | 4.5% (Peak, 2023) |

| EUR/USD | Profitability (hedging) | 1.06-1.10 (Fluctuations, 2024) |

Sociological factors

Voestalpine's success hinges on strong workforce relations. The company actively engages with labor unions to maintain operational efficiency. Recent workforce reductions and social plan negotiations are crucial, impacting employee morale and public perception. In 2024, Voestalpine's workforce was approximately 50,000 employees globally, and labor costs represented a significant portion of operational expenses. Ensuring a skilled workforce is vital for Voestalpine's competitive edge.

Customer preferences are shifting towards sustainable, high-quality steel. Voestalpine responds by focusing on high-tech and niche markets. In 2024, the demand for sustainable steel solutions grew by 15% globally. This shift impacts product development and market strategies. Voestalpine's strategic moves reflect these changing demands.

Voestalpine's reputation hinges on environmental responsibility, ethical conduct, and social impact. Accounting scandals and environmental concerns significantly impact stakeholder trust. For example, in 2023, Voestalpine faced scrutiny regarding its CO2 emissions and sustainability practices. Maintaining a positive public image is crucial, as seen in the fluctuation of its stock price in response to reputational hits. Addressing these issues is vital for sustained success.

Demographic trends and consumer behavior

Shifting demographics and evolving consumer habits significantly influence steel demand, especially in sectors like automotive and consumer goods. For instance, an aging population might reduce demand for new cars, while increased urbanization could boost infrastructure projects. The automotive industry, a major steel consumer, saw sales of around 14.6 million vehicles in the US in 2024, a slight increase from 2023. These trends necessitate Voestalpine's adaptability.

- US vehicle sales in 2024 were approximately 14.6 million.

- Urbanization trends can boost infrastructure projects.

- Aging populations may decrease new car demand.

Health and safety standards

Voestalpine prioritizes health and safety, crucial for employee well-being and a positive corporate image. Their commitment includes robust safety programs and regular audits to minimize workplace hazards. This adherence is integral to their corporate responsibility strategy. Strong health and safety practices also contribute to operational efficiency by reducing incidents and downtime. In 2024, Voestalpine invested €15 million in safety measures.

- €15 million investment in safety (2024)

- Reduction in accidents by 10% (2023)

- Compliance with ISO 45001 standards

Voestalpine's success depends on maintaining positive labor relations and adapting to evolving workforce dynamics. The company focuses on upskilling its workforce to meet the demands of high-tech markets and sustain its competitiveness. A strong safety record, illustrated by a 10% reduction in accidents in 2023, is integral to a positive corporate image.

| Aspect | Impact | Data |

|---|---|---|

| Workforce | Labor costs; Skills | 50,000 employees (2024) |

| Safety | Employee well-being; Reputation | €15M invested (2024) |

| Market | Consumer Demands; Growth | Sustainable steel grew by 15% (2024) |

Technological factors

Voestalpine is investing in electric arc furnaces and hydrogen-based steel production. These advancements aim to cut carbon emissions and boost efficiency. For instance, the company plans to lower CO2 emissions by 30% by 2030. This strategy is key for long-term sustainability.

Voestalpine benefits from continuous advancements in steel technology. Ongoing R&D focuses on high-strength and specialized steels. These innovations enhance product properties, like corrosion resistance. This supports premium product offerings, crucial for automotive and aerospace. For instance, in 2024, Voestalpine invested €200 million in R&D.

Automation and digitalization are key for Voestalpine. Industry 4.0 technologies, including robotics, enhance efficiency and precision. For example, in 2024, Voestalpine invested €400 million in digitalization. This investment aims to optimize welding and production management, and reduce costs. These advancements are expected to boost productivity by 10-15% by 2025.

Innovations in materials science

Innovations in materials science are reshaping the landscape for companies like Voestalpine. New materials could substitute steel or demand novel steel alloys, altering market dynamics. For instance, the global market for advanced materials is projected to reach $80.7 billion by 2025. This affects Voestalpine's product development and strategic planning, necessitating adaptability.

- The global advanced materials market is forecast to reach $80.7 billion by 2025.

- Research and development spending on new materials is increasing.

Energy efficiency technologies

Voestalpine is actively investing in energy-efficient technologies to minimize its carbon footprint and operational expenses. This includes upgrading equipment and optimizing processes across its steel production facilities. In 2024, the company allocated significant capital towards projects aimed at enhancing energy efficiency. These efforts are critical for compliance with increasingly stringent environmental regulations and maintaining a competitive edge.

- In 2024, Voestalpine invested €100 million in environmental protection and energy efficiency.

- The Group aims to reduce its CO2 emissions by 12% by 2025 compared to the 2019 baseline.

- Implementing energy-efficient technologies is expected to reduce energy consumption by 5% by 2026.

Voestalpine prioritizes tech via electric arc furnaces and hydrogen-based steel. Digitalization boosts efficiency, aiming for a 10-15% productivity rise by 2025. Investment in Industry 4.0 tech reached €400 million in 2024. Advanced materials market projected to hit $80.7B by 2025.

| Technology Aspect | Investment/Focus | Impact/Goal |

|---|---|---|

| Electric Arc Furnaces | Investment in new technologies | Reduce CO2 emissions by 30% by 2030. |

| Digitalization | €400 million in 2024 | Boost productivity by 10-15% by 2025. |

| R&D | €200 million in 2024 | Improve product properties (corrosion resistance) |

Legal factors

Voestalpine must adhere to strict environmental laws, like emissions limits and waste management rules. Environmental Impact Assessments (EIAs) are crucial for new facilities. In 2024, environmental compliance costs for steelmakers rose by 10-15% due to stricter regulations. This impacts operational expenses and investment decisions.

Voestalpine must adhere to labor laws, including working hours, wages, and workplace safety. Compliance with Austrian labor laws is crucial for operational legality. In 2024, Austria's minimum wage stood at around EUR 1,700 per month. Any restructuring must follow legal procedures.

Voestalpine must comply with competition laws to avoid anti-competitive practices. These laws oversee mergers, acquisitions, and market behavior. In 2024, the EU fined companies billions for antitrust violations. Legal adherence is crucial for market integrity and avoiding penalties.

Product liability and safety standards

Voestalpine must adhere to stringent product liability and safety standards when manufacturing steel products. These legal requirements are crucial, especially for high-stakes industries such as automotive and aerospace, where the quality and safety of materials are paramount. Failure to comply can lead to significant financial and reputational damage. For example, in 2024, the automotive industry faced recalls due to defective steel components, highlighting the importance of these standards.

- Compliance with product liability laws is essential to avoid lawsuits.

- Strict adherence to safety standards minimizes risks and ensures product integrity.

- Failure to meet these standards can result in significant financial penalties and reputational damage.

Financial reporting regulations and corporate governance

Voestalpine, as a publicly listed entity, must adhere to stringent financial reporting standards and corporate governance regulations, as mandated by law. Failure to comply can lead to severe legal repercussions, including hefty fines and potential lawsuits. Accounting irregularities, if discovered, can trigger investigations by regulatory bodies, damaging the company's reputation and financial stability. The company's commitment to transparency and ethical conduct is crucial. In 2023, the EU's Corporate Sustainability Reporting Directive (CSRD) came into effect, increasing reporting obligations.

- Compliance is mandatory for listed companies.

- Accounting issues can lead to legal penalties.

- Transparency and ethical practices are essential.

- CSRD enhances reporting demands.

Voestalpine faces stringent legal requirements across environmental, labor, and competition domains, affecting operations and costs. Product liability and safety standards demand utmost adherence to avoid recalls and lawsuits, especially in critical industries like automotive. Publicly listed, the company must follow stringent financial reporting and corporate governance regulations, with non-compliance leading to penalties. For instance, in 2024, Austria's minimum wage was approximately EUR 1,700 monthly, influencing labor expenses.

| Regulation Area | Requirement | Impact |

|---|---|---|

| Environmental | Emissions limits, waste management, EIAs | Increased compliance costs (10-15% rise in 2024) |

| Labor | Working hours, wages, workplace safety | Compliance with Austrian labor laws is essential |

| Competition | Anti-competitive practice avoidance | Risk of antitrust fines, EU fined billions in 2024 |

| Product Liability | Product safety standards | Potential recalls, reputational damage, financial penalties |

| Financial Reporting | Adherence to standards like CSRD | Hefty fines, lawsuits, reputational damage if not followed. |

Environmental factors

The steel industry faces pressure to cut emissions. Voestalpine aims for carbon neutrality by 2050 via "greentec steel". In 2024, they invested in green technologies. This strategic shift impacts investments and operational strategies.

Voestalpine faces environmental shifts. Resource scarcity drives circular economy adoption. Recycling and efficient resource use gain importance. Steel production evolves to meet these demands. In 2024, the EU steel industry aimed for 80% recycled steel by 2030.

Voestalpine faces stringent regulations on air and water emissions from its steel plants. This requires ongoing investment in pollution control technologies. For example, in 2024, the company allocated €150 million for environmental protection measures. Public expectations for environmental responsibility also drive these investments. These measures are crucial for sustainable operations.

Waste management and by-product utilization

Voestalpine must effectively manage industrial waste and find uses for steel production by-products. This minimizes environmental impact and can create economic opportunities. In 2024, the company invested heavily in sustainable waste management technologies. They are focused on circular economy principles to reduce waste sent to landfills.

- In 2024, Voestalpine reported recycling over 90% of its steel scrap.

- The company aims to increase its by-product utilization rate to 85% by 2025.

- Voestalpine is exploring partnerships to convert by-products into construction materials.

Biodiversity and land use impact

Voestalpine faces increasing scrutiny regarding the environmental impact of its operations. Mining activities for raw materials and the footprint of production facilities significantly affect biodiversity and land use, drawing attention from environmental regulators. The company must navigate stringent regulations and public pressure to minimize its environmental footprint. A 2024 report showed a 10% increase in environmental compliance costs.

- The EU's Biodiversity Strategy for 2030 sets ambitious targets for land use and protection.

- Voestalpine's steel production processes are energy-intensive, indirectly impacting land use through energy sourcing.

- The company's supply chain is also under examination regarding deforestation and sustainable sourcing practices.

Voestalpine's focus on sustainability intensifies. The company strives for carbon neutrality by 2050. Environmental compliance costs rose by 10% in 2024.

| Factor | Impact | 2024 Data/Target |

|---|---|---|

| Carbon Emissions | Regulatory Pressure | "greentec steel" investment |

| Resource Use | Circular Economy | Recycled steel over 90% |

| Waste Management | Efficiency Gains | 85% by-product utilization (2025) |

PESTLE Analysis Data Sources

The analysis integrates insights from economic reports, industry publications, and governmental databases. This ensures relevance and reliability of information.