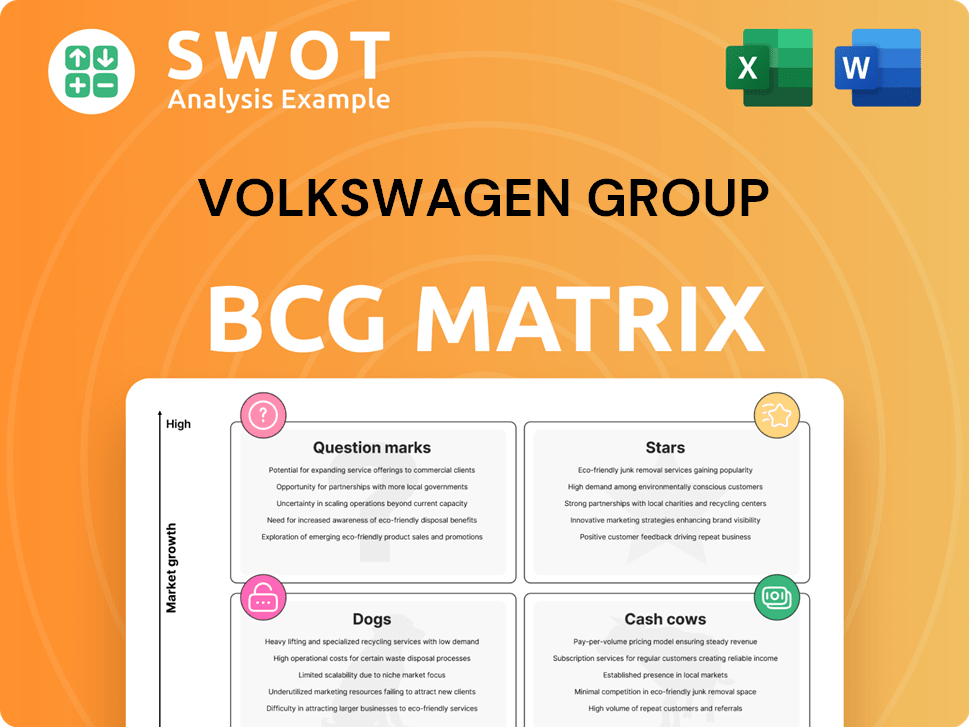

Volkswagen Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volkswagen Group Bundle

What is included in the product

The Volkswagen Group BCG Matrix analyzes its diverse portfolio across Stars, Cash Cows, Question Marks, and Dogs.

Export-ready design for quick drag-and-drop into PowerPoint, enabling swift updates to presentations.

Preview = Final Product

Volkswagen Group BCG Matrix

This is the complete Volkswagen Group BCG Matrix you'll get after purchase. No hidden content or watermarks—it's ready to inform your strategic decisions. Download and analyze the full document right away for immediate business insights.

BCG Matrix Template

Volkswagen Group's BCG Matrix reveals its product portfolio's dynamics. Some models shine as Stars, driving growth and market share. Others are Cash Cows, generating profits. Dogs may require restructuring. Question Marks demand strategic decisions.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Volkswagen's ID. series, including the ID.4 and ID.7, is classified as a Star due to its high growth potential in the expanding EV market. Order intake for all-electric vehicles in Western Europe increased by 88% in FY 2024, supporting this classification. This series represents a key investment area. The ID.4 saw significant sales growth, with deliveries up 10.4% in the first quarter of 2024.

Porsche and Audi, as premium brands within the Volkswagen Group, remain strong cash cows. They boast high revenue and profitability, driven by brand recognition and innovation. Despite Porsche’s slight revenue dip in 2024, both brands maintain healthy operating margins. In 2024, Porsche's operating margin was around 18%, showcasing their continued financial strength.

Volkswagen's China-specific models could be stars, given the market's growth and unique demands. The company is ramping up local R&D to better serve Chinese customers. By 2027, over 30 new models, including EVs, will launch in China. In Q1 2024, VW delivered 691,000 vehicles in China.

Financial Services

Volkswagen Group's Financial Services, a 'Star' in its BCG Matrix, shows strong performance. This division actively supports the company's e-mobility expansion and consistently achieves high contract portfolios and new contracts. Vehicle Lifetime Management further enhances the automotive value chain's efficiency. In 2024, the financial services sector saw over €40 billion in new business volume.

- New business volume in 2024 exceeded €40 billion.

- Supports the market ramp-up of e-mobility.

- Achieves record levels in contract portfolios.

- Focus on Vehicle Lifetime Management.

Advanced Driver Assistance Systems (ADAS)

Volkswagen's focus on Advanced Driver Assistance Systems (ADAS) highlights a promising area within its BCG matrix. The company is leveraging AI to boost ADAS, particularly in the Chinese market, which is a high-growth sector. Collaborations with Valeo and Mobileye improve driver assistance technology, solidifying Volkswagen's innovative position. The China Electrical Architecture (CEA) supports digital service and autonomous driving expansion.

- Volkswagen invested €7 billion in its China strategy, including ADAS tech.

- Sales of vehicles with ADAS are expected to rise, with the Chinese market leading.

- Mobileye partnership boosts Volkswagen's autonomous driving capabilities.

Volkswagen Financial Services is a 'Star', driven by strong performance metrics in 2024. It supports the e-mobility expansion with over €40 billion in new business volume. The division's focus is on Vehicle Lifetime Management, improving efficiency.

| Metric | Description | 2024 Data |

|---|---|---|

| New Business Volume | Total financial services contracts | Exceeded €40 billion |

| E-Mobility Support | Supporting the EV market ramp-up | Active in e-mobility expansion |

| Vehicle Lifetime Mgmt. | Focus | Enhanced automotive value chain efficiency |

Cash Cows

The Volkswagen Golf, a decades-long staple, consistently delivers solid sales and steady profits. It demands little new investment, offering significant returns, making it a classic cash cow. Although facing competition and the EV transition, the Golf's revenue remains robust, especially in key markets. In 2024, the Golf's sales figures continue to be strong.

The Volkswagen Tiguan, a steady performer, is a cash cow for the company. Its global popularity ensures consistent sales and profits, making it a reliable asset. The Tiguan is a top seller in Germany, frequently appearing among the most popular vehicles. In 2024, the Tiguan's sales in Germany reached 50,000 units.

The Volkswagen Passat, much like the Golf and Tiguan, is a cash cow for the Volkswagen Group. It generates steady revenue thanks to its established customer base and reputation for reliability. In 2024, the Passat's sales figures remained robust in key markets. The Passat's strong market position means it needs minimal investment.

Volkswagen Commercial Vehicles

Volkswagen Commercial Vehicles, a cash cow for the Volkswagen Group, consistently generates substantial revenue. Despite delivery fluctuations, its diverse product range and market presence ensure robust cash flow. Optimizing processes and leveraging synergies are key to maintaining profitability. In 2024, the division's revenue reached €14.6 billion.

- Revenue in 2024: €14.6 billion

- Focus: Process optimization and synergy benefits

- Market Presence: Strong across various markets

- Product Range: Diverse, supporting revenue streams

Skoda (Certain Models)

Skoda, especially in Europe, is a solid cash cow for Volkswagen Group. The brand's financial strength comes from its focus on value and practicality. Skoda saw its best financial year ever in 2024, with an improved operating margin. This solidifies its position as a reliable, profitable segment.

- 2024 operating profit reached €2.5 billion.

- Sales revenue increased to €26.5 billion.

- Skoda delivered over 866,000 vehicles globally in 2024.

- The brand's operating margin improved to 9.4% in 2024.

Volkswagen Group's cash cows, including Golf, Tiguan, and Passat, generate consistent revenue with minimal investment. The Volkswagen Commercial Vehicles segment brought in €14.6 billion in 2024, optimizing processes for profits. Skoda, another cash cow, had a record year in 2024, with sales revenue reaching €26.5 billion.

| Cash Cow | 2024 Revenue/Sales | Key Feature |

|---|---|---|

| Volkswagen Commercial Vehicles | €14.6 billion | Process Optimization |

| Skoda | €26.5 billion | Improved Operating Margin of 9.4% |

| Volkswagen Golf | Strong Sales | Established model, high return |

Dogs

The Volkswagen Phaeton, a luxury sedan discontinued in 2016, fits the "Dogs" category. It had low market share and minimal growth prospects. Despite VW's investment, the Phaeton didn't compete effectively, with sales figures significantly below targets. This failure resulted in substantial financial losses for Volkswagen, highlighting its status as a resource drain.

Bugatti, under Volkswagen Group, is a "Niche" brand. Its ultra-luxury status leads to low sales volume. In 2024, Bugatti's sales were around 80 cars. This results in a small market share and limited cash flow contribution.

Bentley's classification within the Volkswagen Group's BCG matrix is complex, potentially aligning with 'Dog' or 'Question Mark' categories. In 2024, Bentley's sales volume, while representing a luxury segment, remains comparatively low. The brand's financial performance necessitates strategic reassessment. Bentley's future hinges on effective market repositioning.

Certain Niche Models

Dogs in Volkswagen's BCG matrix include niche models or those at the end of their cycle. These models typically show low sales and limited growth prospects. For instance, in 2024, some niche EVs faced slow adoption. Volkswagen must assess their profitability and strategic alignment. The goal is to decide whether to phase them out or revamp them for better performance.

- Low sales volume.

- Limited growth potential.

- Need for profitability evaluation.

- Strategic fit assessment.

Legacy Internal Combustion Engine (ICE) Vehicles (in some markets)

Legacy ICE vehicles, a part of Volkswagen's BCG Matrix, are facing challenges. Demand is decreasing due to the rise of EVs. These models may become "dogs" as competition intensifies. Volkswagen needs to strategize its shift to EVs effectively. For example, in 2024, ICE sales decreased by 10% in Europe.

- Declining Demand: ICE vehicle sales are dropping.

- Competition: EVs offer better efficiency.

- Strategic Shift: Volkswagen must manage the EV transition.

- 2024 Data: ICE sales declined by 10% in Europe.

Dogs in Volkswagen’s BCG matrix represent underperforming assets with low market share and growth. These are typically legacy models or niche vehicles. Strategic decisions include potential phase-out or restructuring. In 2024, this category faced declining sales and profitability challenges.

| Category | Characteristics | Example (2024) |

|---|---|---|

| Dogs | Low market share, limited growth. | Some legacy ICE models. |

| Challenges | Declining sales, low profitability. | ICE vehicle sales decrease by 10% in Europe. |

| Actions | Potential phase-out or restructuring. | Evaluate strategic alignment with EVs. |

Question Marks

Volkswagen's autonomous driving tech is a Question Mark. The market's huge, but tech's still new. Volkswagen invests heavily in R&D. In 2024, VW invested €2 billion in self-driving tech. Success is uncertain, but the payoff could be massive.

New EV models in emerging markets are question marks for Volkswagen. These markets show high growth potential, but adoption rates are uncertain. Limited charging and consumer awareness pose challenges. Volkswagen's 2024 sales in China showed growth, but EV infrastructure lags. Tailoring offerings to local needs is key.

CARIAD, Volkswagen's software division, represents a high-growth, high-risk venture within the BCG matrix. The automotive industry's shift towards software makes CARIAD crucial for Volkswagen's future. However, the division has encountered setbacks in delivering software solutions. Volkswagen's success hinges on CARIAD's ability to execute its strategy effectively. In 2024, Volkswagen invested heavily to address CARIAD's challenges.

Battery Cell Production

Volkswagen's battery cell production, a crucial component of its BCG Matrix, is a question mark. The company's substantial investments in gigafactories across Europe are a high-risk, high-reward endeavor. These factories are pivotal for its EV ambitions, but face technological, supply chain, and cost hurdles. Securing a leading EV market position hinges on the success of these ventures.

- Volkswagen aims to produce 240 GWh of battery cells annually by 2030.

- The first gigafactory in Salzgitter, Germany, started production in 2023.

- Total investment in battery production exceeds €20 billion.

- Volkswagen's EV sales increased by 21.1% in 2024.

Mobility Solutions (New Business Models)

Volkswagen's foray into mobility solutions, like ride-hailing and car-sharing, places them in the question mark quadrant of the BCG matrix. These ventures target high-growth markets but carry uncertain profitability due to stiff competition and evolving regulations. For instance, the global ride-hailing market, valued at $100 billion in 2024, is projected to reach $200 billion by 2030. VW must carefully assess the scalability and financial viability of these services to avoid significant losses.

- High Growth Potential: The mobility market is expanding rapidly, offering significant opportunities.

- Uncertain Returns: Profitability is not guaranteed due to intense competition and regulatory hurdles.

- Strategic Evaluation: VW needs to rigorously assess the viability and scalability of its mobility solutions.

- Market Dynamics: The ride-hailing sector's growth is noteworthy, yet success isn't assured.

Volkswagen's question marks are areas with high growth potential but uncertain outcomes. Autonomous driving, new EV models, CARIAD, battery cell production, and mobility solutions fit here. These ventures require massive investment, but success is not guaranteed. VW must carefully manage risk and adapt to market dynamics.

| Category | Description | 2024 Data Point |

|---|---|---|

| R&D Investment | Investment in self-driving tech | €2 billion |

| EV Sales Growth | Increase in VW's EV sales | 21.1% |

| Battery Production | Planned annual battery cell capacity by 2030 | 240 GWh |

BCG Matrix Data Sources

The Volkswagen Group's BCG Matrix uses financial statements, market research, competitor data, and expert analysis.